Many Canadian shareholder investors (“investor”) own foreign securities. Occasionally a foreign corporation (“original corporation”) will spin-off a subsidiary or business line to its shareholders, so the subsidiary becomes a separate, publicly traded corporation (“spin-off corporation”). In this situation, the investor now owns two separate foreign securities.

By default, the receipt of the new spun-off securities is reflected as a taxable foreign dividend for Canadian tax purposes by the investor. However, in some cases, the investor can make an election so that no foreign dividend is reported, and therefore no Canadian tax applies in respect of the spin-off for the year.

The original and spin-off corporations can collectively apply to the Canada Revenue Agency (CRA) to have the spin-off transaction treated as an approved, eligible foreign spin-off if it meets certain conditions. The conditions to be approved as an eligible foreign spin-off are beyond the scope of this communication.

Where CRA has approved the foreign spin-off, section 86.1 “Foreign spin-offs” (S.86.1) in Canada’s Income Tax Act allows a Canadian resident investor to make a special election. This election allows the investor to exclude the taxable foreign dividend from income and recalculate the adjusted cost base (ACB) of the original corporation shares and the spin-off corporation shares held as a result of the spin-off. In effect, with the election, no tax is payable for the spin-off, but the future sale of the original and spun-off foreign securities may result in greater capital gains, owing to a lower cost basis.

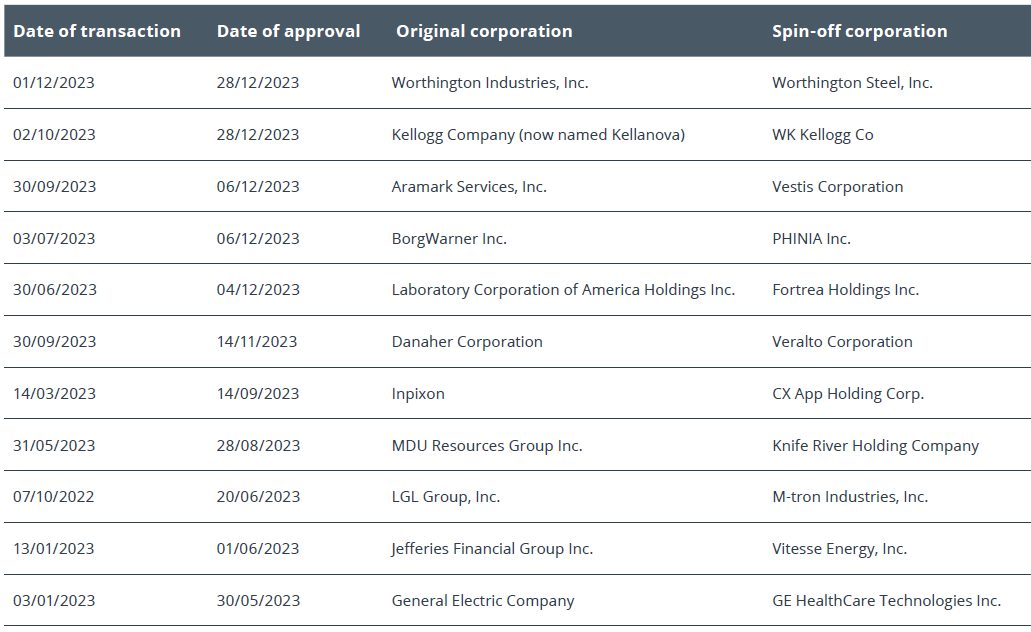

For 2023, the following foreign spin-offs were approved as eligible for S.86.1 election purposes, as of February 20, 2024:

Here is an example:

Let’s assume there are 8,000,000 shares of Kellogg Company, now Kellanova (“Kellanova”) issued and outstanding. Kellanova owns all 2,000,000 shares of its subsidiary WK Kellogg Co (“WK Kellogg”). WK Kellogg has a FMV of $20,000,000 ($10/share).

In October 2023, Kellanova spun-off all 2,000,000 shares of WK Kellogg to its investors. For every 4 shares an investor owned of Kellanova, the investor received 1 share of WK Kellogg in the spin-off. The FMV of Kellanova post spin-off of WK Kellogg is $160,000,000 ($20/share).

Mr. Black, a Canadian resident taxpayer, owned 800 shares of Kellanova with an ACB of $12,000 CDN ($15/share) in his non-registered account at the time of the spin-off.

In October 2023, Mr. Black received 200 shares of WK Kellogg worth $10 per share, resulting in a foreign taxable dividend of $2,000.

For 2023 personal tax purposes, Mr. Black has two options. He can:

A. Report the $2,000 foreign dividend as income. This will become his ACB of his WK Kellogg shares; or

B. Elect under S.86.1 not to report the $2,000 foreign dividend as income, and recalculate the ACB of his Kellanova and WK Kellogg shares instead.

If Mr. Black wanted to utilize the S.86.1 foreign spin-off election, what would the recalculated ACB of his Kellanova and WK Kellogg shares now be?

First, the ACB of his Kellanova shares will be reduced. The formula to calculate the ACB reduction is:

A * (B / C)

A = ACB of Kellanova share prior to distribution: $15

B = FMV of the fraction of WK Kellogg share received for each share of Kellanova: 1/4 * $10 = $2.50

C = FMV of Kellanova share post spin-off plus FMV of the fraction of WK Kellogg share received (B): $20 + $2.50 = $22.50

- A * (B / C) = $15 * ($2.50/$22.50) = $1.67 per share, or $1,336 is the reduction.

Thus, the ACB of his 800 Kellanova shares is now $10,664 (800 * ($15 – $1.67))

- Next, the ACB of his WK Kellogg shares will be calculated: $1.67 * 1/ (1/4) * 200 = $1,336 This is the ACB reduction to his Kellanova shares.

Note: $10,664 (new Kellanova ACB) + $1,336 (new WK Kellogg ACB) = $12,000 (original Kellanova ACB).

As a result of utilizing the S.86.1 election, Mr. Black does not have to report the $2,000 foreign dividend, which is taxed as regular income. As well, when he eventually sells the Kellanova or WK Kellogg shares, he will likely generate greater capital gains and there is a good chance the capital gains will attract a lower tax rate.

For more information on foreign spin-offs, please see:

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/foreign-spin-offs.html