Covid’s Lasting Economic Scar & A Goldilocks 2022?

Download this article as a PDF.

“This porridge is just right.” – Goldilocks and the Three Bears

As the delta variant exerts its strength, the world is coming to terms with the sobering reality that Covid-19 is not going away anytime soon. Since the pandemic began, influential researchers in economic circles have warned that “the ongoing crisis will have large, persistent adverse effects on the U.S. economy, far greater than the immediate consequences.”1 These “scarring effects” can leave a lasting blemish on financial markets. As policymakers begin to acknowledge the long-term scarring effects of the pandemic, we suggest that certain existing forces have the potential to support a good year for equity markets in 2022, whereby inflationary and deflationary forces will counterbalance each other, policymakers will continue to tread lightly and economic growth will be supported by fiscal policy. Recounting a childhood classic, the goldilocks scenario – not too hot, and not too cold – may be on the horizon for investors, culminating in an estimate S&P 500 forecast of 5,300 by the end of 2022.2

What Are “Scarring Effects”?

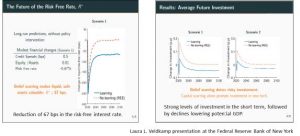

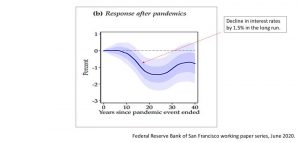

Our investment forecast is predicated on research that suggests that rare catastrophes, or low-probability “tail events”3 such as pandemics, have the potential to exert scarring effects. The scarring as a result of the Great Depression and WWII affected interest rates, and thus equity prices, for decades. Research presented at the Kansas City Fed Jackson-Hole Symposium last year by Laura Veldkamp4 of Columbia University as well as research contained in a San Francisco Federal Reserve working paper5 have studied the effects: a long shadow dampening economic output and asset prices. This scarring has been categorized in two ways:

Belief Scarring: A persistent change in beliefs based on a tail event. We will likely now operate with a perceived non-zero chance of having the consequences of a sudden and unexpected pandemic. These changes in beliefs force decision makers to adapt, whereas they wouldn’t under normal circumstances.

Capital Scarring: Capital may be maladapted to a new reality as we change the way we operate due to the pandemic. Some of these changes will stick and some will revert. The pandemic has accelerated the digitization of the global economy, amplifying the obsolescence of much of the capital stock that existed pre pandemic. This is no different than what happened in the 1920s, when investments in new manufacturing platforms and the electrification of cities and homes supported growth. How will capital be deployed in the post-pandemic world and how will this affect the investing world?

Research suggests that the long-term scarring effects after tail events include the decline of the risk-free interest rate, increased demand for safe, liquid assets, reduced risk taking, increasing investment in new technologies and a reduction in potential GDP.6

Long-Term Effects of Covid-19 on the Risk-Free Rate and Investment

Long-Run Economic Consequences of Pandemics on Interest Rates

We suggest that markets, investors and policymakers have not yet considered and priced in the ramifications of potential long-term Covid-19 scarring effects on the global economy. However, in 2022 this is expected to change. Looking forward, as the delta variant is unlikely to be the last in the evolution of Covid-19, investors need to consider the potential implications.

The Impetus for Goldilocks in 2022

Our base case investment thesis holds that the post- pandemic world will resemble a post-WWII reconstruction period. In 2022, economic growth and earnings could be very strong, as Covid-19 scarring effects – reduced interest rates and potential GDP – will increase the need for fiscal policy response. Fiscal policy will take centre stage – what central banks have been begging for decades! – but, this time, due to disparaging income inequality, it will be financed predominately by deficits and not taxes. While many pundits have indicated that the Fed will commence tapering in late summer or early fall, we continue to believe that tapering will begin in late 2021 at the earliest and rate hikes will likely get pushed to 2023 as inflation cools and the Fed targets income inequality. Real U.S. interest rates are likely to remain negative, further supporting risk assets. As such, in 2022, the markets appear to have all the ingredients for a goldilocks year: counterbalancing inflationary and deflationary forces, tempered actions by policymakers and the potential for significant fiscal policy measures.

Inflation & Deflation: A Balance

As suggested in our August commentary, we continue to assert that the majority of inflation is transitory. As economies reopened in 2021, in many areas demand was pulled forward. As supply chains begin to normalize, this will help to temper elevated temporary price pressures. We must not overlook the very strong secular deflationary forces existing today – debt, technology, and demographics – that will put downward pressure on interest rates and trend growth rates, even before we consider the scarring effects of Covid-19. We expect the forces of transitional inflation and secular deflation to counterbalance, providing a comfortable environment for risk assets to continue to appreciate.

Actions by the Fed: Likely to be Tame

In the words of Gandhi, “to lose patience is to lose the battle.” We believe that the actions of the Fed in 2022 will be tame and dictated by patience. During a virtual Q&A session last month, Chairman Powell stated that “Covid is still with us…and that is likely to continue to be the case for a while,”7 echoing this sentiment. Furthermore, his recent speech given at the Jackson Hole Symposium8 reinforces our view that the Federal Reserve implicitly acknowledges that until the scaring effects of Covid-19 are known, patience is warranted.

How soon we forget the desire for central bankers to reach the magical 2% inflation target. The battle is not yet won and can easily be lost, with deflationary forces lurking. Just as in the post-WWII era, investors should expect inflationary expectations to be controlled through communication.9 Central Bankers have fought long and hard to get inflation to reach a 2% target and give us little reason to believe they will concede this hard-fought battle by tightening too quickly. The irony? Critics who warned of secular stagnation and the Fed’s inability to reach a 2% inflation target are now proclaiming inflation to be permanent and suggesting that it’s not the Fed’s job to focus on climate change and income inequality.

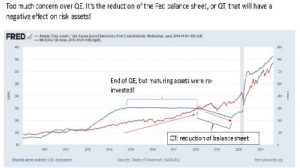

While the media has been busy promulgating concerns over the Fed’s recent signaling that tapering is set to begin in the near future, we suggest that these worries are misguided. The Fed will be reducing the pace of its bond purchases under quantitative easing (QE) – this is simply slowing the expansion of the Fed’s balance sheet. Rather, what should be of concern to investors is the contraction of the Fed balance sheet, whereby the central banks retire balance sheet assets when they mature, engaging in quantitative tightening (QT). QT is not expected anytime soon. Even after the expansion has stopped, the Fed will still need to reinvest the capital received from maturing investments that it holds, so it will continue to be a major participant suppressing interest rates within fixed income markets.

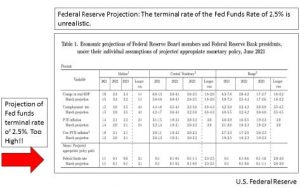

Wrong Focus? Quantitative Tightening’s Effect on Risk Assets

It’s also folly to assume that the Fed Funds rate will increase to 2.5% over this cycle, as Fed officials suggested in June. Alas, too few remember the conundrum that Alan Greenspan10 referred to in 2005 with respect to the relationship between the Fed Funds rate and the slope of the yield curve. Eventually this relationship will be reset, but just not in 2022. Even in recent years, the Fed has admitted: “We do not, at present, have a working theory of inflation dynamics that works sufficiently well to be of use for the business of real-time monetary policy making.”11 Without a reliable framework, we suggest that the Fed will take a light-touch approach until the true scarring effects of the pandemic are clearly known. Of course, with the excessive amount of existing debt, raising interest rates to 2.5% would likely be devastating in the face of rising income inequality.

U.S. Fed’s Projected Appropriate Monetary Policy: June 2021

Investors must also consider that Chairman Powell – a Trump appointee – will end his term in early 2022, perhaps providing the opportunity for the Biden administration to shape the Federal Reserve to be more concerned with Main Street than Wall Street.

Fiscal Policy: Reinvigorated

Given the scarring effects of Covid-19, including reducing interest rates and reduced investment putting downward pressure on GDP, the resulting void must be filled by fiscal policy. This is just beginning, with the recent passing of the $1 trillion infrastructure bill, the largest infrastructure bill since the building of the Interstate Highway, and the American economy is now focused on investing in human capital much like the GI bill did after WWII. A second $3.5 trillion package focuses on the green economy and income inequality.

One of the important foundations of our secular bullish investment thesis is that we are entering an era in which fiscal policy plays a more dominant role in contributing to economic growth. In the reconstruction phase after WWII, public sector contribution-to-GDP peaked at close to 40%. This has declined to only 16% today, and needed a catalyst to warrant its expansion. Over the next decade, we should expect public sector contribution to trend toward the long-term average of 26%.

Historical Government Contribution-to-Real-GDP: Set to Increase

How this will be financed is key: through deficits, also known as modern monetary theory (MMT), or taxes? A more progressive Fed and government has now allowed for the embracing of MMT. At least in the short term, with midterm elections upcoming in late 2022, coupled with strong left and right populist forces, policymakers who wish to aggressively raise taxes will be held at bay, implying that MMT will be begrudgingly accepted. Thus, we are entering an era akin to the post-WWII reconstruction period, in which increases in GDP will be driven by public sector contribution.

Where to for Investors?

Today, the long-term effects of Covid-19 on our economy are underappreciated, and not yet priced into risk assets, and may take years to manifest. To be clear, more support for the global economy will be needed and as the scarring effects continue to become more apparent, they will culminate in the need for a strong fiscal policy response to support economic growth.

Current research suggests that interest rates could be between 67 bps to 1.50% lower than they were before the pandemic hit. Why so much focus on interest rates? Simply put, interest rates are one of the key drivers in building portfolios and asset allocation. Contrary to popular belief, interest rates in the medium and long term are not determined by noisy, high-frequency macro-economic data, but instead by assumptions of potential GDP, the terminal rate of the Fed Funds rate and the speed and the magnitude of changes in monetary policy. So, while many are focused on tapering this fall, the next big risk event for assets will likely occur when the Fed begins to contract the balance sheet. When will the Fed raise rates and how fast? We suggest that this is a 2023 event at the earliest.

In 2022, we expect to see solid growth on the back of the re-opening of the global economy, a synchronized global recovery, predicated on the belief that we are going back to normal. We expect central bankers to keep interest rates at levels that will not be detrimental to risk asset appreciation, and, through their communications strategy, continue to temper concerns that inflation will get out of hand. Strong investment in old and new capital stock, coupled with inventory stocking and pent-up consumer demand, as well as companies using the pandemic to increase productivity and efficiency of their platforms, all suggest that earnings growth will surprise to the upside. The opportunity for productivity gains and margin expansion is underappreciated by the street. Most management teams never let crises go to waste and use recessions or tail events to rationalize and increase the productivity of their business model. This time is no different. As such, our S&P 500 forecast12 has the potential to reach 5,300 for 2022. This is based on an S&P earnings estimate of $240 by the end of 2022.

At the same time, we acknowledge that policymakers are not omnipotent and can make policy errors from time to time. Let’s not forget that in 2018 Chairman Powell proclaimed that the natural rate of interest was much higher than the market believed, suggesting that interest rates were going to be raised higher and faster than expected, which led to a severe market correction. During the global financial crisis of 2008, the European Central Bank proclaimed that the crisis was isolated to the U.S. banking system and proceeded to raise interest rates. If policymakers ignore the longer-term scarring effects of Covid-19, lose patience and reverse policy measures too quickly, raise taxes too high and too fast or abandon their desire to attack the existential threats of income inequality and climate change and revert back to the old playbook, the economic and investment landscape will drastically change.

Just as the Great Depression and WWII had lasting generational effects, so, too, will the Covid-19 pandemic. We don’t foresee the global economy returning to its pre-Covid-19 ways. We suggest that scarring will become most apparent after the midterm elections, likely in early 2023. In fact, strong demand for Treasury auctions suggest scarring effects are starting to take hold as we speak. As the effects of scarring manifest themselves, policymakers will more overtly acknowledge the reality that we will never again return to a pre-pandemic world. Learning takes time – it always has.

James E. Thorne, Ph.D.

References:

[1] “Scarring Body and Mind: The Long-Term Belief-Scarring Effects of Covid-19,” Kozlowski, Veldkamp, Venkateswaran, Working Paper 27439, National Bureau of Economic Research, June 2020.

[2] Based off the equity premium puzzle and the Gordon growth model. E/P-Rf=ERP, using a yield on the five-year Treasury as the risk-free rate of return and assuming an equity risk premium of 3.4%.

[3] Tail events are low-probability events that arise at both ends of a normal distribution curve.

[4] “Why are Interest Rates so Low?” Jackson Hole Symposium. https://www.youtube.com/watch?v=Xn1_r0mG9ww

[5] “Longer-Run Economic Consequences of Pandemics,” Jorda, Singh, Taylor, Federal Reserve Bank of San Francisco, June 2020.

[6] Kozlowski, Veldkamp, Venkateswaran.

[7] Powell: Delta variant’s impact on economy ‘not yet clear,’ The Hill, August 17, 2021.

[8] Monetary Policy in the Time of COVID. August 27, 2021.

[9] Remarks by Governor Ben S. Bernanke before the National Economists Club, Washington, D.C., November 21, 2002. https://www.federalreserve.gov/boarddocs/Speeches/2002/20021121/default.htm

[10] “Greenspan’s Conundrum and the Fed’s Ability to Affect Long-Term Yields.” Daniel Thornton, Federal Reserve of St. Louis working paper, September 2012.

[11] “Monetary Policy Without a Working Theory of Inflation,” Daniel K. Tarullo, Brookings, October 4, 2017.

[12] Based off the equity premium puzzle and the Gordon growth model. E/P-Rf=ERP. We use the yield on the five-year Treasury as the risk-free rate of return, and assume the equity risk premium is 3.4%.