Canada Disability Benefit

Download this PDF here. What is the Canada Disability Benefit? Launched in June 2025, the

The holiday season is a time for giving, and at the Baun & Pate Investment Group (BPIG), we’re excited to bring back our 12 Days of Giving for 2024.

In place of sending Christmas cards, we are continuing a tradition that aligns with our core values as active members of the Calgary community. Over the course of 12 days, we will highlight a charity selected by a member of our team—one that holds personal significance to them and truly embodies the spirit of Calgary and the essence of giving back. Thanks to the generosity of Michael Pate and Craig Baun, each of these organizations will receive a $1,000 donation to support the meaningful work they do in our community.

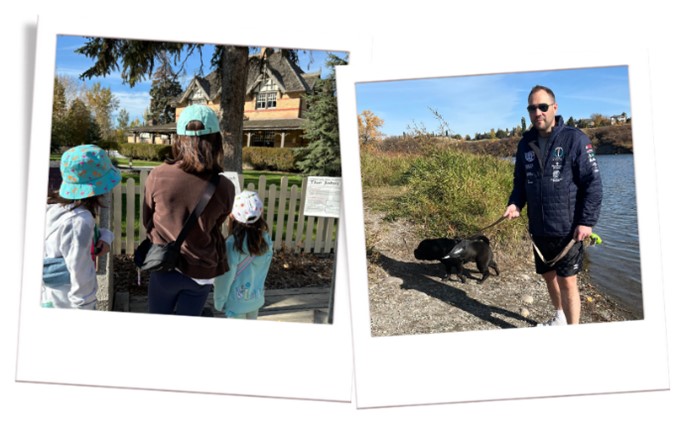

On the first day of giving, Paul Duff, our Senior Investment Advisor, nominated the Friends of Fish Creek Provincial Park Society.

Why? “I again have chosen the Friends of Fish Creek Provincial Park Society as my charity of choice to support this holiday season,” said Paul. “Having spent many of my own childhood summers in the park, and now being given the opportunity to share that same experience with my own daughters, its driven home the importance of preserving this amazing asset we have in our community.”

Since 1992, the Friends of Fish Creek Provincial Park Society has been engaging the public and cultivating “informed park users” so that Fish Creek Provincial Park can continue to offer a place of refuge and improve quality of life for generations to come.

With a small staff team and a dedicated community of volunteers, partners and supporters, they offer events, recreational, educational and wellness programs, as well as a wide diversity of volunteer opportunities.

Their work is possible through in-kind and financial support from a mosaic of different organizations.

“Through first-hand experience of working in the Park for several summers, to being able to now enjoy it with my family, I’m proud to continue my support for this cause,” said Paul.

Please follow along on our LinkedIn page and our website as we highlight a new charity every business day until December 24th.

From the entire team at the Baun & Pate Investment Group, we wish you and your family a very happy holiday season and a prosperous New Year.

Download this PDF here. What is the Canada Disability Benefit? Launched in June 2025, the

Today, that battle rages anew, with the U.S. Federal Reserve at its heart. Martin’s metaphor of the Federal Reserve as a chaperone—removing the punch bowl to curb excess—once defined an era of restraint: intervene only to prevent instability, never to orchestrate outcomes. That era is dead.

As the dust settles from a bumpy first two quarters of the year, portfolios have traded higher even with the U.S. policy adjustments we have experienced. Even though it may feel like risks are high, as we often say, it’s time in the market, not timing the market, that is key.

For decades, the American establishment clung to the gospel of globalization, open markets, cheap goods, and the promise of shared prosperity. Yet beneath the surface, this grand experiment hollowed out the nation’s industrial heartland, eroded economic security, and fuelled a populist backlash that upended politics from Ohio to Washington. The opioid crisis, the decay of small towns, and the anger of those left behind are not mysterious—they are the predictable fallout of an economic order designed by and for elites, insulated from the consequences of their own policies.

In an era of unprecedented geopolitical and economic shifts, the Mar-a-Lago Accord signals a decisive, disruptive strategy by the U.S. to redefine its global influence and economic stability. Moving beyond unipolar dominance, the U.S. aims to reshape the international order through strategic tariffs, security realignments, financial innovations, and institutional reforms—guided by historical lessons and Keynesian principles. This approach seeks to address systemic imbalances—notably the overvaluation of the dollar and unsustainable debt levels—by fostering growth, innovation, reindustrialization, and regional resilience.

The opinions contained herein are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Wellington-Altus Private Wealth. Assumptions, opinions and information constitute the author’s judgement as of the date this material and subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. All third party products and services referred to or advertised in this presentation are sold by the company or organization named. While these products or services may serve as valuable aids to the independent investor, WAPW does not specifically endorse any of these products or services. The third party products and services referred to, or advertised in this presentation, are available as a convenience to its customers only, and WAPW is not liable for any claims, losses or damages however arising out of any purchase or use of third party products or services. All insurance products and services are offered by life licensed advisors of Wellington-Altus. Wellington-Altus Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. All trademarks are the property of their respective owners.