“The secret of change is to focus all of your energy, not on fighting the old, but on building the new.”

— Dan Millman, Author

We are living through a period of extreme change because the context that defines our lives has forever changed. Context — the circumstances that form the setting of an event and upon which informed decisions are made — should not be overlooked by investors. Significant financial and economic regime changes tend to begin during major economic crises, their drivers sometimes inconspicuously lurking behind the scenes. Today is no exception.

We suggest that three major contextual changes are quietly reshaping the financial landscape: i) China’s aging demographics; ii) policymakers’ implementation of helicopter money1 or MMT-Lite;2 and iii) the domination of passive investing, which has altered capital market dynamics. These changes will usher in a new long-term secular regime in which demographics and economic policies point to inflation, with an investing backdrop where capital flows are driven by passive investment vehicles and groupthink.

Global Demographics Are Now Inflationary

We are now just exiting a deflationary cycle that started in the 1980s. At that time, then-U.S. Federal Reserve Chairman Paul Volker had the courage to attack many of the inflationary forces that created a perfect storm within the economy: the Vietnam war, President Lyndon Johnson’s “Great Society” programs (ambitious policy spending intended to abolish inequality), the oil price shock with its effects on manufacturing competitiveness, the rise of Japan as an economic powerhouse, and the significant influx of female participation in the labor force. These events, some evolving under the radar in the late 1970s, set the stage for a secular change that many never saw coming.

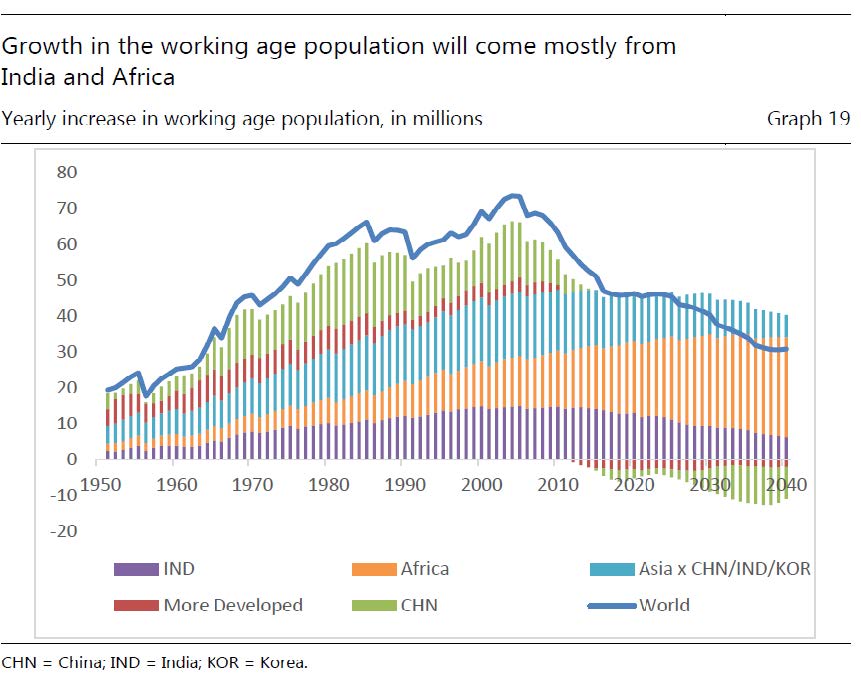

Today, a similarly silent change is in the works: China’s looming population crisis. Expected to peak within this decade, the population will experience a declining workforce that will put pressure on an already aging global work force. It will slowly introduce inflationary pressures into the global economy. This theme is starting to play out in China as we speak (chart below).

Annual Increase in Working Population (MMs) by Region

Source: UN World Population Database

Beginning in the 1980s, the inclusion of China into the world economy, and its eventual inclusion in the World Trade Organization, was the driving force to support the long-term structural deflationary regime that lasted for four decades. The introduction of over a billion citizens into the global work force — the largest labour shock in modern history — put downward pressure on wages (add in the fall of the Soviet Union by 1991, which brought cheap Eastern European labour into the mix). The lack of a Chinese social safety net coupled with the one-child policy created an extremely high savings rate. With closed capital markets and a fixed exchange rate pegging the Chinese renminbi (RMB) to the U.S. dollar (USD), which still exist today, the Chinese economy was largely protected from the forces of the global capital markets. This helped to keep interest rates lower than they otherwise would have been, attracting investment from the rest of the world. The Chinese economy exported deflation, over capacity and savings.

As a result, manufacturing and investment shifted out of the west, slowing economic growth, stagnating wages, collapsing private sector unions, increasing inequality within countries while reducing inequality between countries, and creating declining real interest rates — catalysts for a new cold war between the U.S. and China.

This is now slowly reversing. A reduction in excess saving from China will be felt globally; the global savings glut is over!3 Most emphatically, the demographic sweet spot provided by China is disappearing. Global supply chains will be altered. The world must be prepared for this shift in the demographics underpinning the global economy: inflation is coming.

Central Banks Are Playing a New Game and It Is Inflationary

In dealing with low economic growth and a deflationary environment, the desired solution is to create an inflationary growth environment. How this is done has been the center of debates for decades. In some circles, the implementation of quantitative easing (QE) has been a failure. Ten years of Mario Draghi’s “we will do whatever it takes” has not generated growth: deflation still exists and negative interest rates are causing economic damage. Stagnant wages, the rise of inequality, and a recognition that central banks have played a role in the rise of populism have set the stage for a profound generational change. It started quietly last year when Chairman Powell, Mark Carney4, Stephen Poloz and Christine Lagarde all communicated a need to be open-minded and recognize the limitations of past fixations: wage growth and the 2% inflation target.

Then, Covid-19 happened. The U.S. responded with unprecedented stimulus, invoking emergency lending authority under Section 13-3 of the Federal Reserve Act and implementing the CARES act. But it didn’t stop there. To support the economy, a new monetary and fiscal regime was introduced: helicopter money or MMT-lite, which will result in inflation.

To be clear, helicopter money is not QE. Helicopter money explicitly creates demand by giving money directly to Main Street using chartered banks. What is not well-known is that approximately 97% of the growth in the money supply is created by chartered banks, with only 3% by central banks.5 Because of this, in the 1980s the Bank of Japan,6 through a policy referred to as “window guidance,” directed banks to create a specific amount of loans to put money directly in the hands of spenders.

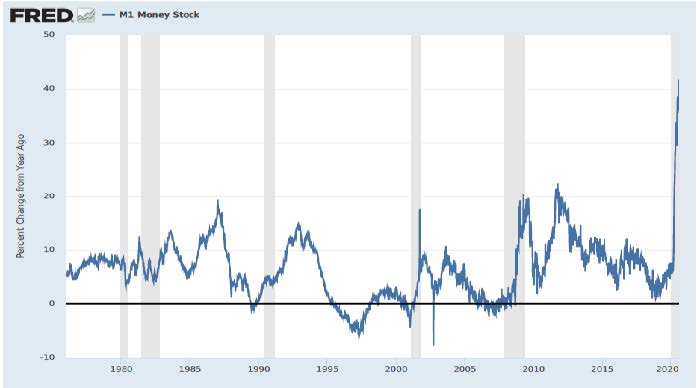

Today, the Federal Reserve and the Department of Treasury have mirrored this program to flow funds into the economy. Chartered banks have been told to make loans to small businesses, with the government guaranteeing these loans. The result is that the broad-based money supply has grown dramatically, as seen in the chart below.

Change in M1 Money Supply, 1975 to 2020

Source: Board of Governors of Federal Reserve System

Broad money supply growth of over 40% cannot be ignored. Moreover, these bank credit guarantees, which are contingent liabilities on the government balance sheet, do not even increase the level of government debt — all they do is motivate banks to lend to Main Street. Balancing budgets is no longer important to policymakers as central banks are trying something new, and it’s called MMT-Lite.

The key question is how permanent is this policy — if inflation ensues, will this become a continuing part of central bank tool kits? How will financial markets respond to a higher level of inflation, say 4%, with interest rates being suppressed? Can the Federal Reserve control the slope of the yield curve? We just don’t know. We are entering a new era of financial repression, and there may be no turning back.

Passive Investing Dominates Capital Markets

Epictetus once said: “it’s not what happens to you, but how you react to it that matters.” When we look at how the markets today react to real and emotional events, compared with decades ago, we can attribute these price movements to the domination of passive investing instruments. Capital market dynamics have intrinsically changed.

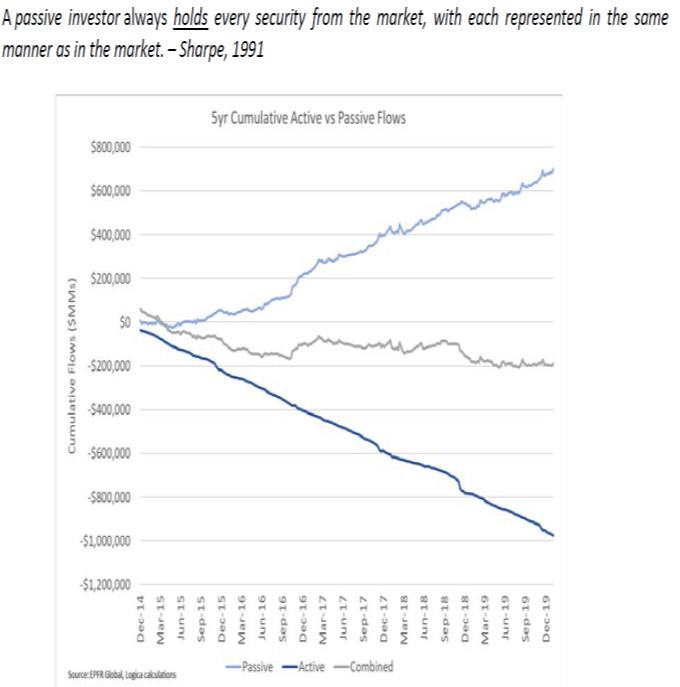

Passive investing can be characterized as dumb algorithmic investing. It just buys a basket of assets and sells a basket of assets, with no consideration of valuation, technical analysis, dividend yield, company fundamentals or market liquidity. This means that fundamentals and valuations are now of less importance — a major contextual change that many investors have yet to realize.

As seen in the chart below,7 capital continues to flow out of active and into passive funds.

5-Year Cumulative Fund Flows: Active vs. Passive, 2014-20

Source: EPFR Global; Logica

As more and more investors sell actively-managed mutual funds and replace them with passive ETFs, the market becomes dominated by groupthink, implying that growth and momentum characteristics rule the day. This dynamic did not exist 10 years ago; company fundamentals and valuation underpinned capital flows.

The growth in passive flows is expected to continue. With close to $5 trillion in money market funds sitting on the sidelines waiting to be deployed, investors need to recognize that most of this capital will flow into passive funds, allocated to the next hot theme. One such near-term event — the eventual recognition by investors that a successful Covid-19 vaccine is close to being approved — will drive capital into the markets, likely into areas that we refer to as Covid-19 “ground zero” or epicenter stocks.8 A violent rally could materialize.

How Should Investors Respond?

With any long-term secular trend, there will be instances where short-term cyclical forces will dominate, pacifying the strong proponents of the deflationary thesis that has stood well for three decades. But deflationary pressures are set to go away in the coming years. Until then, investors should favor stocks over bonds, gold, silver, bitcoin and commodities with favorable supply demand dynamics, and companies well-positioned for accelerating growth in the post-Covid-19 digital world. Here are some thoughts:

- Invest in assets that benefit from a long-term secular inflationary environment: gold, silver, digital assets, commodities, and growth stocks should be a core holding in portfolios.

- Invest in an environment dominated by passive investing. Expect long periods where growth and momentum outperform. However, prepare for intense short periods where value will outperform. For example, once a Covid-19 vaccine is close to being developed, expect the Covid-19 epicenter stocks (i.e., airlines, hotels, restaurants) to experience extreme outperformance driven by capital flow into value ETFs.

- Expect central bankers to be slow in responding to rising inflation by increasing interest rates. This should allow economic growth to accelerate and risk assets to appreciate.

- Periods of cyclical deflation should be expected. We are in the early innings of this new secular regime. However, we could now be experiencing a generational low in interest rates. Investors should prefer stocks over bonds in the long term but realize that an actively-managed bond portfolio that can take advantage of counter-cyclical trend rallies should be present in their portfolio.

It is no secret that change (as always) is imminent.

James E. Thorne, Ph.D.

1 In 1968, economist Milton Friedman introduced the concept of helicopter money to the world when he famously stated: “Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky.”

2 MMT stands for Modern Monetary Theory, heterodox economics that theorizes that it is acceptable to create money out of thin air to finance fiscal policy. MMT suggests that it is a mistake to force governments to try to balance their budgets; instead, spending should be determined by need and deficit levels should not be a concern.

3 Bank of International Settlement Working Paper No. 656, “Demographic trends will reverse three multi-decade global trends,” Charles Goodhart and Manoj Pradhan.

4 Mark Carney, August 2019 Jackson Hole Symposium speech: “In the longer term, we need to change the game.”

5 Professor Dirk Bezemer, University of Groningen, and Michael Kumhof, IMF Economist, explain where money comes from: https://positivemoney.org/how-money-%20works/how-banks-%20create-money/

6 Princes of the Yen: Japan’s Central Bankers and the Transformation of the Economy, Richard Werner.

7 Policy in a World of Pandemics, Social Media and Passive Investing. Logica March 2020.

8 Ground zero or epicenter stocks: airlines, hotels, banks, cruise lines, hardline retailers, restaurants and other value stocks that have lagged.