The End of an Era—and to New Beginnings

It is the end of an era: after 60 years at the helm, one of the world’s most closely watched investors has stepped down as CEO.

Very few people stay in one role for six decades. For context, the median tenure with a single employer dropped to 3.9 years in the U.S., while the average working life spans roughly 37 years. This puts into perspective the remarkable length of Warren Buffett’s leadership of Berkshire Hathaway—nearly twice the span of a typical career.

Even if you don’t subscribe to Buffett’s investing philosophy, the scale of his accomplishments is clear. After taking control in 1965, he transformed Berkshire from a struggling textile mill into a multinational conglomerate holding company, growing its share price from about $19 to roughly $745,000—a cumulative gain of nearly 4,000,000 percent! In 2024, Berkshire became the first U.S. non-tech company to surpass a trillion-dollar market capitalization.

Now 95, Buffett shared in November that he was “going quiet” and will no longer write the annual letter or speak at Berkshire’s annual meeting. In his farewell, he offered reflections on both business and life. As we begin a new year, several insights may serve as practical reminders for our own wealth management:

Succession planning takes time. Greg Abel, named as Buffett’s successor in 2021, has been groomed for many years, spending nearly three decades at Berkshire and rising to Vice Chairman in 2018. Even after the transition, Buffett plans to “keep a significant amount” of his shares until shareholders gain confidence in Abel’s leadership.

Estate planning is fluid. Buffett has revised his estate plan many times over the years. His “unexpected longevity has unavoidable consequences” as his three children are now beyond retirement age (72, 70 and 67). He now aims to accelerate lifetime gifts to their foundations so they can fulfill his goal of distributing his entire estate while they’re alive.

Markets go up and down. While market returns have been strong in recent years, Buffett reminds us that markets—and economies—will also see difficult times: “Our stock price will move capriciously, occasionally falling 50 percent or so as has happened three times…under present management. Don’t despair; America will come back, and so will Berkshire shares.”

Our time is limited. “Father Time…is undefeated; for him, everyone ends up on his score card as wins,” Buffett notes. His advice? “Decide what you would like your obituary to say and live the life to deserve it.”

Buffett has long emphasized that money is a tool, not a purpose: “Greatness does not come about through accumulating great amounts of money, great amounts of publicity or great power in government.” Despite his accomplishments, Buffett distills success into something far simpler: “When you help someone in any of thousands of ways, you help the world. Kindness is costless but also priceless.”

Indeed, Buffett’s humility appears to have deepened with age. He acknowledges the role of luck in his successes—and the successes of many others—and admits he’s fallen short of his own ideals many times before: “I have been thoughtless countless times and made many mistakes but became very lucky in learning from some wonderful friends how to behave better.” His reminder: “The cleaning lady is as much a human being as the Chairman.”

And now, as he retires while still retaining the Chairman role, Buffett signs off with a message well-suited for a new year: “Choose your heroes very carefully and then emulate them. You’ll never be perfect, but you can always be better.” As we turn the page to 2026, here’s to a new year that inspires reflection, growth and purpose—and, as in Buffett’s case, new beginnings. Happy New Year!

In This Issue

For 2026: Make Estate Planning a Priority …………………………………………………….. 2

Equity Market Perspectives: Growth Is Expected to Continue ………………………… 2

The RRSP: Why Are We Falling Short? Debunking Two Myths ……………………………. 3

In Brief: What Is the “K-Shaped” Economy? …………………………………………………….. 3

Budget 2025: “Generational Capital Investments To Build Canada Strong” ………… 4

FINANCIAL RESOLUTION TIME

For 2026: Make Estate Planning a Priority

Happy 2026! If improving your financial well-being is on your list of New Year’s resolutions, a great place to start is with your estate plan. A comprehensive plan ensures your assets are distributed according to your wishes, while helping to maximize the legacy you leave behind.

If you already have an estate plan in place, here are five questions to ask that may prompt a review:

- Does my plan promote efficient administration and limit unnecessary expenses?

- Will my plan minimize family effort—or even potential conflict?

- Are my assets protected from potential liabilities, such as former spouses or creditors?

- Do I have safeguards in place to allow my family to make financial and healthcare decisions if I am unable?

- Can my family maintain their current lifestyle if I am no longer able to contribute?

Minimizing Taxes & Fees

A key goal of many estate plans is to reduce taxes and other fees. For Canadian income tax purposes, most assets—including real property and shares—are deemed to be disposed of immediately prior to death and may be subject to tax, except where certain exceptions, such as spousal rollovers, apply. Some provinces also charge probate fees, which can vary significantly. Additionally, Canadians holding U.S. situs assets, such as shares of U.S. corporations or U.S. real estate, may need to plan for potential U.S. estate tax.

While taxes and fees can create a substantial obligation for many estates, careful planning can help reduce or defer them. This may be as simple as arranging bequests differently, using life insurance to help cover tax liabilities or, for business owners, leveraging tools such as an estate freeze or the Lifetime Capital Gains Exemption to ease succession planning.

It’s More Than Just Finances

A comprehensive estate plan goes beyond maximizing the estate value passed to beneficiaries. It can also ensure fairness among heirs or protect those who may need guidance in managing assets. Trusts, for example, can help preserve assets for beneficiaries who cannot manage them independently or prevent access by creditors. By planning ahead, you can create a lasting foundation that reflects your values and helps your legacy endure across generations.

Why Not Make Estate Planning a Priority in 2026?

Like many things in life, estate planning can easily fall down the priority list. For some, the subject feels unsettling, perhaps a reminder of our own mortality. For others, it simply gets lost in the bustle of daily life. Yet establishing a basic plan, and keeping it updated as circumstances change, is one of the greatest gifts you can give to your loved ones. Being familiar with the many aspects of your financial situation, we can provide guidance, counsel or recommendations for experts in the field to assist with your estate plan.

LOOKING BELOW THE SURFACE

Equity Market Perspectives: Growth Is Expected to Continue

After equity markets continued to reach new highs in 2025, there have been renewed concerns about elevated valuations. Are stock prices outpacing underlying fundamentals, or is there still room to run?

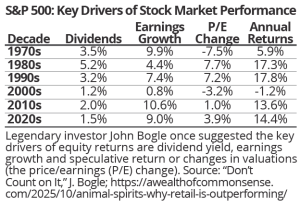

Many factors influence market performance—government policies, geopolitical events, economic growth, inflation, interest rates and even the headlines. Yet over the long run, one of the most powerful drivers is corporate earnings.

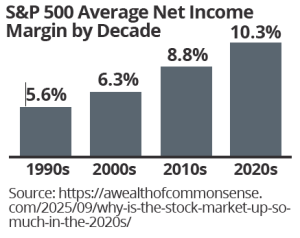

The earnings story, so far, has been strong. U.S. corporate margins have expanded, with the average S&P 500 net income margin climbing above 10 percent this decade, roughly double the level of the 1990s. Canadian corporate profits have followed a similar trajectory, though fluctuations in commodity prices, including a pronounced peak in 2022, have added more volatility to overall profits (graph above).

Looking ahead, several factors suggest that this growth can continue. Companies are benefiting from technological innovation, productivity gains and resilient consumer demand, all of which support sustained earnings growth. Of course, history reminds us that earnings growth alone doesn’t guarantee high market returns. In the 1970s, despite solid earnings growth of 9.9 percent, high inflation and the global energy shocks kept equity markets subdued. Indeed, growth in markets, economies—and even human progress—is rarely linear.

Even so, the current strength in earnings should not be overlooked. Robust corporate profits have been, and remain, a key driver of market strength. As we look ahead to 2026, here’s to continued earnings growth to provide the fuel for markets to keep advancing.

RRSP SEASON IS HERE AGAIN

The RRSP: Why Are We Falling Short? Debunking Two Myths

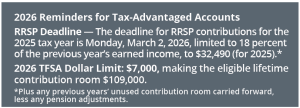

While many of us are unhappy about the high taxes we pay, one way to ease the burden is by fully using tax-advantaged accounts. Yet RRSP participation rates have declined over the past two decades, from 29.1 percent of taxpayers in 2000 to just 21.7 percent in 2022. The good news: high-income earners are more likely to contribute: 66 percent of taxpayers earning between $200,000 and $500,000 contributed in 2023. But younger Canadians are falling short. The introduction of the Tax-Free Savings Account (TFSA) in 2009 may be part of the reason, but persistent misconceptions about the RRSP also play a role. Let’s address two common myths:

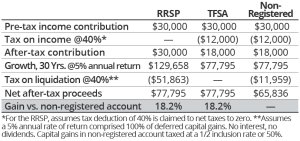

Myth 1: It’s better to invest in a TFSA than an RRSP. In fact, the RRSP generally yields a greater benefit if you expect a lower tax rate in retirement. In practice, many contribute to their RRSP during higher-income working years and withdraw when income is lower in retirement, leading to an advantage for the RRSP. Of course, there may be situations when the TFSA is a better choice, such as if you have a higher tax rate at withdrawal or face recovery tax for income-tested benefits like Old Age Security.

Myth 2: RRSPs aren’t worth it because withdrawals are fully taxed, whereas in non-registered accounts, only income and gains are taxed. A common complaint is that RRSP withdrawals are fully taxed at marginal rates, whereas non-registered accounts only tax income and gains (with favourable tax treatment for dividends and capital gains). While it’s true that RRSP withdrawals (usually from a Registered Retirement Income Fund (RRIF)) are taxed as income, what’s often forgotten is the initial tax deduction at contribution. Remember: a $30,000 RRSP contribution is equivalent to an after-tax contribution of $18,000 at a marginal tax rate of 40 percent. If your tax rate is the same at the time of contribution and withdrawal, you effectively receive a tax-free rate of return on your net after-tax RRSP contribution (chart). In many cases, even if your tax rate is higher at the time of withdrawal, you may be better off compared to a non-registered account due to the effect of tax-free compounding over long time periods.

While the fair market value of the RRSP/RRIF at death is generally included in the terminal tax return and taxed at marginal rates, there may be ways to mitigate the potential tax liability. This includes a tax-deferred rollover to a spouse or financially dependent (grand) child. Another way to manage the potential tax bill is to engage in a “meltdown strategy,” making withdrawals earlier when your tax rate is lower than you expect in the future or at the year of death.

MACROECONOMIC PERSPECTIVES

In Brief: What Is the “K-Shaped” Economy?

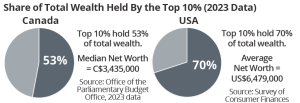

The eleventh letter of the alphabet has taken on new meaning. The letter “K” is now used to describe the bifurcation in today’s economy. Different consumer segments and the businesses that serve them are growing at different rates. Indeed, there’s a divergence: The upward-slanting arm of the “K” represents higher-income households with strong consumer spending, fuelled by healthy income growth and rising wealth. In contrast, the downward-slanting arm represents low- and middle-income households facing rising living costs, stagnant wages and higher debt burdens.

Since consumer spending drives more than two-thirds of total U.S. GDP, this divide carries implications. Higher-income households are now responsible for a disproportionate share of economic activity. In Q2 2025, the top 10 percent of income earners accounted for nearly half of all U.S. consumer spending. This imbalance underscores how economic resilience has become concentrated among wealthier consumers—those benefiting most from asset price appreciation. As a result, the softer labour-market figures observed in 2025 that largely impacted lower-income households attracted less attention as they didn’t materially affect overall consumption.

Where are economies and markets headed in 2026? In 2025, artificial intelligence (AI) was a key driver of market enthusiasm. If AI capital investments deliver productivity gains, markets may look past ongoing labour-market weakness, effectively shrugging off the lower part of the K—although expectations may already be partly reflected in valuations. At the same time, monetary stimulus from interest rate cuts in Canada and the U.S., tariff renegotiations and potential U.S. tax refunds could strengthen labour markets and support more exposed sectors. Yet some argue the same stimulus has exacerbated wealth inequality.

As advisors, we continue to navigate the evolving landscape. The “K-shaped” economy reinforces the value of time-tested principles—diversification, a focus on quality and ongoing risk management—as key to successful long-term wealth management in an increasingly uneven economic environment.

UPDATE ON FISCAL SPENDING, DEBT & TAXES

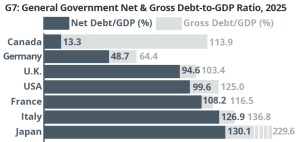

Budget 2025: “Generational Capital Investments To Build Canada Strong”

Canada’s 2025 federal budget, delivered on November 4th instead of the usual spring release, marks a shift toward what Prime Minister Carney calls a “generational” investment in the country’s future. Framed as a plan to rebuild national capacity and competitiveness, the budget commits $450 billion in new spending—primarily on infrastructure, productivity and defense—while projecting a $78.3 billion deficit for 2025–26. This falls to $57.9 billion by 2028–29,but adds around $322 billion to Canada’s debt over that period (2025 to 2030). Total spending cuts are projected to be $60 billion over five years. Public debt charges are expected to rise by $22.7 billion during the same period, meaning that by 2030, Canada will be spending an estimated $1.46 billion per week on interest payments alone.

Carney also introduced a new method of reporting that separates operating expenses from capital investment spending, pledging to balance the operating budget within three years. Opinions are divided: critics call it an accounting manoeuvre to obscure underlying deficits, while supporters see it as a way to distinguish between spending that “sustains” from that which “builds” national capacity.

No changes were made to federal personal or corporate tax rates. The budget confirms the previously announced “middleclass tax cut,” reducing the lowest personal income tax rate (on income up to $57,375, for 2025) from 15 percent to 14.5 percent in 2025, and 14 percent in 2026.

Here are some of the more notable proposed income tax measures that may affect investors:

• Top-Up Tax Credit — A new non-refundable credit to effectively maintain the 15 percent rate for non-refundable tax credits claimed on amounts in excess of the first income tax bracket threshold. This prevents taxpayers—such as those claiming large one-time expenses (e.g., tuition)—from facing higher tax liability under the lowest bracket rate. This would apply for the 2025 to 2030 taxation years.

• Personal Support Workers (PSWs) Tax Credit — A temporary five-year refundable tax credit (2026 to 2030 tax years) for eligible PSWs working in approved health care facilities equal to 5 percent of eligible earnings, up to $1,100 annually. This excludes BC, NWT and NL, where bilateral agreements exist.

• Trusts & the 21-Year Rule — Broadens the anti-avoidance provisions for certain transactions involving trusts that aim to sidestep the 21-year deemed disposition rules.

• Bare Trust Reporting Deferral — Defers the bare trust reporting requirements by one year, applying to taxation years ending on or after December 31, 2026.

• Lifetime Capital Gains Exemption — Confirms the increase to the limit to $1.25 million (and indexed, starting in 2026), announced under Budget 2024.

• Canadian Entrepreneurs’ Incentive: Cancelled — Appears this incentive, originally proposed under Budget 2024, will not proceed.

• Luxury Tax Changes — Proposes to eliminate the luxury tax on aircraft and boats after November 4, 2025, while retaining the tax on automobiles.

• Underused Housing Tax Repealed — Proposes to eliminate this tax effective as of the 2025 calendar year.

• Qualified Investments for Registered Plans: Small Business Investments — Starting 2027, proposes that investments in specified small business corporations,

venture capital corporations and specified cooperative corporations will be extended to RDSPs, aligning with other registered plans. However, investments in shares of eligible corporations and interests in small business investment limited partnerships and small business investment trusts will no longer be qualified investments.

• Home Accessibility Tax Credit — Before Budget 2025, it was possible to claim a tax credit for the same expense incurred under the medical expense tax credit and the home accessibility tax credit. From 2026, expenses claimed under the medical expense tax credit can no longer be claimed under the home accessibility tax credit.

For more information, please see: https://budget.canada.

ca/2025/report-rapport/intro-en.html

Note: At the time of writing, these proposals have not been enacted into law.