Market Summary

September delivered another month of blockbuster returns for investors. Returns were healthy across most assets. The global stock index returned 3.53% (Vanguard Total World Stock ETF, VT) and the global bond index rose an impressive 0.83% (Vanguard Total World Bond ETF, BNDW). The “anti-fiat currency” trade gained steam as investors grew increasingly skeptical that politicians will ever be able to rein in government spending, Gold rose 11.55% and Bitcoin was up 5.19%. I’m reminded of The Economist cover from 2017, “The Bull Market in Everything”.

Perhaps The Bank of Canada and The US Federal Reserve both cutting rates by 25bps in September is contributing to investor’s euphoria? It’s worth noting that inflation in the US is still running well above the 2% target, with September’s CPI coming in at 2.9% and the rate is accelerating versus August’s rate of 2.7%. Although economists forecast that the probably of a recession is decreasing, the likelihood of stagflation (slow economic growth with above target inflation) seems to be increasing.

With spreads on corporate bonds near record lows, equity valuations, gold and Bitcoin near record highs, it’s hard to find an obvious safe haven. Even cash yields less than inflation thanks to Bank of Canada rate cuts. Note, all these conditions have persisted for months and yet prices continue to move higher. Investors pay a steep price for being overly cautious in times like these. Finding the appropriate balance between risk and reward is a compromise. It is an approximation. As they say, “the sign of a good compromise is when both parties are equally disappointed.” You can’t have all the return with no risk and vice versa. Our job is to find that balance. I like to say, “keep the car between the lines and out of the ditch”.

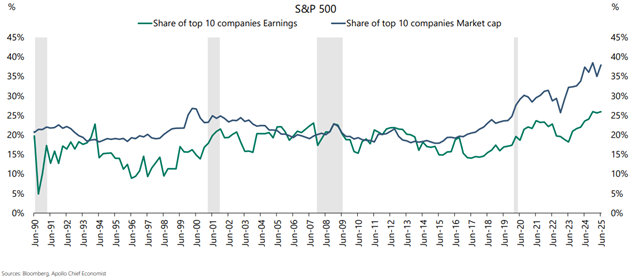

Chart of the month

The current composition of the stock market looks more like a high conviction hedge fund than a diversified index. With 10 companies representing about 40% of the S&P500 (and over a quarter of earnings), this is an unprecedented level of concentration. It has been a profitable investment, one we have participated in, but investors need to recognize this phenomenon and consider that their portfolios may not be nearly as diversified as they think or as they should be.

Portfolio strategy

Debt

Liquid fixed income

- Thanks to lower yields and ultra-tight spreads, future return outlook is muted. Best not to chase yield and stay high quality.

- Government bonds look increasingly unattractive – low yields, high volatility, broken political systems overseeing massive deficits.

Private credit

- The exceptional growth in private credit has no doubt spawned some lower quality firms making low quality loans to low quality businesses. We may be seeing the early signs of the negative consequences.

- We exclusively partnered with the largest, highest quality firms to manage private credit. These loan portfolios remain robust, tilting toward less risk while still delivering yields well above traditional fixed income.

Equity

Public equity (stocks)

- Remember the saying, “the stock market is not the economy”.

- There is often a substantial disconnect between what we expect the economy to do and what the stock market does. This year has been a perfect example – don’t overweight the news.

- Valuations continue to stretch higher – there has been money to be made but be sure to have a chair when the music stops.

Private equity

- Deal activity continues to ramp up, underscored by the largest ever buyout announced, $55 billion for the video game producer, EA Sports.

- Lower rates are good for mergers and acquisitions (and generally for private equity).

Real assets

Real estate

- Back to office seems to be in full swing and there’s some excitement over office-focused REITS.

- The real estate investment paybook has changed – occupant expectations are higher, construction and maintenance cost are higher, energy efficiency standards are higher, interest rates are higher…all this means returns are likely to be lower than what many investors want/need/expect.

Infrastructure

- As inflation continues to run above target, infrastructure maintains its alure.

- Combining long-term contracts and competitive advantages with secular growth industries/companies is a winning formula.

- We are pleased with our recent infrastructure investment with KKR, we expect it to deliver stability, diversification, inflation protection and healthy returns.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPW assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

NOTICE: This email and any attachments are for the sole use of the intended recipients and may be privileged or confidential. Any distribution, printing or other use by anyone else is prohibited. If you are not an intended recipient, please contact the sender immediately, and permanently delete this email and attachments. If you no longer wish to receive commercial electronic messages from Wellington-Altus Private Wealth Inc., please send an email to unsubscribe@wellington-altus.ca or click here to unsubscribe.

Please note that we may still send messages for which we do not require consent. © 2025, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION