Market Commentary

Despite persistent geo-political, trade and fiscal policy headline risks, markets have been strong. Most markets are edging up against the all-time highs set in February and posting healthy multi-year returns. Our strategies have delivered excellent returns through the past few months of volatility, posting outperformance from March to May relative to our preferred benchmarks (Vanguard asset allocation ETFs). Periods of sharp selloffs and sharp recoveries are an excellent test for portfolio’s ability to cushion downside but capture upside. Once again, our strategy has shined.

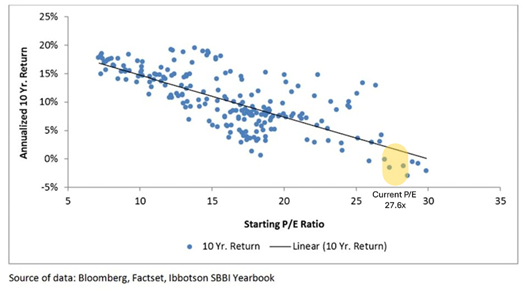

Taking a step back and looking at the past year, considering all that is going on in the world, it’s remarkable that returns are double digits for both Growth and Balanced portfolios. Three-year rolling returns are now approaching the top of the range we’ve seen in recent history. Coupling strong multi-year returns with frothy stock market valuations has us increasingly cautious. Our chart this month shows the subsequent 10-year returns of the S&P500 based on the starting price to earnings (PE) multiple. This tells us that, historically, the higher the multiple paid for stocks, the lower the returns earned in the subsequent 10 years. The current P/E multiple of nearly 28x indicates that future returns from stocks could be quite low. It’s critical to note that this shows 10-year returns, a lot can happen inside a decade (including fantastic returns) and P/E multiples are a notoriously bad market-timing tool. But we like to look at investment opportunities through a probabilistic lens and in that context, history suggests it is highly unlikely that stocks will produce great returns from here. Thus, we are motivated to look for other assets that provide better odds of success.

S&P500 price/earnings multiples and subsequent 10-year returns

Fortunately, we have the most compelling opportunities in private markets we’ve ever seen, just as public markets (stocks and bonds) look increasingly over-valued. We have reduced exposure to the most volatile group of stocks in portfolios, which will lock in significant gains, further insulate portfolios from potential drawdowns and allow us to allocate to what we believe are better opportunities in private markets and more probable returns from high-quality fixed income.

Portfolio Strategy

Debt

Liquid Fixed Income

- Credit spreads remain very tight, meaning riskier corporate bonds appear expensive with little margin of safety and relatively low expected returns.

- Our fixed income portfolios remain defensive, meaning shorter maturity, higher quality, more liquid.

- Volatility in government bonds and substantial fiscal policy risk means investors should no longer consider government bonds to be “safe” – they have shown substantial volatility and leave investors exposed to inflation and other risks.

Private Credit

- Has provided excellent, consistent returns throughout recent bouts of volatility.

- Rates remain high in the US, preserving healthy yields.

- Europe’s debt market is still heavily bank financed, a substantial opportunity for private credit investors.

- We remain bullish on private credit and we are pivoting to even higher quality strategies.

Equity

Public Equity (stocks)

- Solid Q2 earnings from US banks did not produce a meaningful equity market upward move.

- Valuations are elevated, particularly in North America.

- Risks abound yet valuations reflect robust growth and stability. We see little evidence of either and prefer a more reliable path to returns.

- We remain confident in our recent decision to reduce exposure to the most volatile stocks.

Private Equity

- Our ongoing effort to bring the best, institutional-quality private equity to your portfolios is yielding outstanding results. In recent months we have spent considerable time with Apollo Global Management, specifically researching their flagship fund, Apollo Aligned Alternatives. Perhaps the most impressive aspect of this strategy is that Apollo invests its own assets, on a continuous basis, into the same fund. Apollo currently represents about 60% of the total assets. Anytime an investor can align their interests so tightly with a manager, that is a powerful tailwind. The diversification of this portfolio, the impressive capabilities of Apollo and the alignment all lead us to believe this is the best strategy we’ve seen in private markets yet.

Real Assets

Real Estate

- Certain segments should continue to experience growth, however several factors could weigh on returns more broadly (i.e. building costs, modernization of old buildings, higher financing costs). We have reduced exposure over time in favour of more attractive sectors.

Infrastructure

- Infrastructure tends to offer inflation protection, steady cash flow backed by real assets that are difficult to replicate, have rising demand and investors can earn modest capital appreciation as the replacement costs rise.

- Infrastructure has multiple tailwinds right now (pent up demand, shifting definition of infrastructure to include things like data centers, increased energy demand, lack of public funding to finance projects). The opportunity set in infrastructure has finally opened up to individuals and we intend to capitalize in the coming weeks.