Market commentary

With markets ripping higher in August, for the fourth consecutive month, many investors seem awe struck. I’ve heard something like, “it makes no sense” countless times. I’m reminded of the John Maynard Keynes quote, “markets can remain irrational longer than you can remain solvent.” Most use this quote during periods of market turmoil to discourage reckless behaviour. However, in my mind, Keynes is eloquently pointing out the fickleness of markets in the short term, and that it really doesn’t matter if prices “make sense”. Market prices “making sense” implies that an investor has all the facts relevant to pricing investments. That’s simply not realistic. So, if we can accept that every investor is missing something going on in the world, then we should be able to accept that whatever disconnect lies between what we think the market should be doing, and what it is doing, could be attributable to that piece of missing information. Investors can’t sit on the sidelines when they can’t make sense of markets, or they will miss out on too much return.

By no means am I suggesting investors should throw caution to the wind, put their head in the sand and trust all will be fine. What I am suggesting is that over confidence is dangerous. Despite 24-hour news networks, social media and unlimited information pumped to us via our phones, we can’t know everything. So, invest accordingly. I’m reminded of another well-worn quote, this one often attributed to Mark Twain but there seems to be some debate about that, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

From valuations on stocks to credit spreads on high yield bonds, it’s hard to argue that risk appetite isn’t elevated right now. Typically, when riskier assets aren’t paying substantial premiums over safer ones, it’s time to dial down the risk. We have been gradually doing so in portfolios. As Warren Buffett says, “be fearful when others are greedy, and greedy when others are fearful.”

Chart of the month

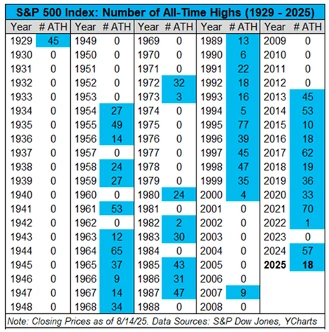

I think it’s important that we all remind ourselves that we have just experienced one of the great equity bull markets of all time. It’s also important to recognize that stock markets can go through long periods where they do not perform well. Of course, those weak periods followed prolonged periods of strength. Now, it’s critical to recognize that owning stocks is risky, but not owning them at all is potentially riskier (because of the relative tax efficiency and historical inflation protection). A properly constructed portfolio owns just enough stocks to keep you invested for the long term, through the good and bad times. It also owns other assets that will pull weight when stocks are not. We could be entering a period where those other assets shine.

Portfolio strategy

Debt

Liquid fixed income

- Credit spreads are near all-time lows, meaning riskier corporate bonds appear expensive with little margin of safety and relatively low expected returns.

- Our fixed income portfolios remain defensive, meaning shorter maturity, higher quality, more liquid.

- Volatility in government bonds and substantial fiscal policy risk means investors should no longer consider government bonds to be “safe”, they have shown substantial volatility and leave investors exposed to inflation and other risks.

Private credit

- Our private credit portfolio continues to chug along, producing healthy income/yield and stable pricing.

- Our managers have continued to increase quality and decrease leverage given the lower risk-premium market we are in.

- We are working on further upgrading managers/strategies in the coming months.

- Opportunities abound in regions like Europe where most lending is still done through traditional banks (plenty of reasons why this is sub-optimal for businesses and economies).

Equity

Public equity (stocks)

- Stocks continue to push higher as the promise of artificial intelligence and that President Donald Trump’s tariffs will be more benign than feared.

- At these valuations, all investors should take a hard look at their exposure, but it’s also costly to be sidelined during runs like this.

- Rebalancing (i.e. taking gains) to target allocations is as important for returns as it is for risk management.

Private equity

- With interest rates coming down and less nervousness about tariffs, we are seeing early signs of increased deal activity, which bodes well for private equity.

- Our ongoing effort to bring the best, institutional-quality private equity to your portfolios is yielding outstanding results. In recent months we have spent considerable time with Apollo Global Management, specifically researching their flagship fund, Apollo Aligned Alternatives. Perhaps the most impressive aspect of this strategy is that Apollo invests its own assets, on a continuous basis, into the same fund. Apollo currently represents about 60 per cent of the total assets. Anytime an investor can align their interests so tightly with a manager, that is a powerful tailwind. The diversification of this portfolio, the impressive capabilities of Apollo and the alignment all lead us to believe this is the best strategy we’ve seen in private markets yet.

Real assets

Real estate

- We have witnessed countless Canadian real estate funds suspend distributions and redemptions.

- Unfortunately, many private asset investments marketed to Canadians over the years have been real estate related (both equity and credit).

- Fortunately, we actively steered clear of these domestic funds that are suffering.

Infrastructure

- We made a long-anticipated and researched investment in KKR’s global infrastructure fund (in eligible portfolios).

- The mix of traditional infrastructure assets (ports, toll roads, pipelines, energy) with new digital assets (cell towers, data centers) provides a compelling balance of stability and growth.

- KKR is a global leader in the sector, they have unparalleled expertise in acquiring, operating and improving infrastructure assets.