Although winter is in full swing up here in Collingwood, the stock market is red hot as another rate cut from The Fed pushed markets towards all-time highs.

Following the fantastic run from stocks, we’ve been actively rebalancing portfolios, executing on some exciting new investments after months of due diligence. Our portfolios now offer unmatched quality and diversification. We believe we’ve built the ultimate “sleep-at-night” solution—designed to capture upside and compound returns while cushioning short-term volatility and minimizing the most significant long-term risks.

Our full collection of Monthly Portfolio Memos since May is now available on our website, Newsroom – Constellation Wealth Management. Follow us on LinkedIn, Instagram and Facebook for more frequent market observations and educational content (links at bottom).

Happy Holidays,

Tom, Galit & Victor

Market Commentary

Volatility returned to markets in November, with nearly 70% of the trading days experiencing a move greater than 0.5%. Typically, we see moves of that magnitude only about 30-50% of the time. With no real geo-political or macro-economic developments, the blame was directed at concerns over high valuations, concentration and capital expenditures in artificial intelligence (AI). Amongst all these big swings, the S&P 500 eked out a slight gain for the month of 0.25%, matching the return for global bonds.

Few investors should be surprised by the volatility experienced in November. When stocks trade at lofty valuations based on future growth potential and growth expectations are increasingly focused on one narrative (AI), it’s reasonable that anything less than stellar news can cause market angst. Discipline and diversification are more important now than ever. Our allocations to private assets accomplish both effectively.

On private assets, one thing that is becoming clear is that the “deal dam” is breaking. We are seeing a surge in merger and acquisitions and planned initial public offerings (2025 Mid-Year Market Update | Hamilton Lane). Deal activity could be a tailwind for our expanding private asset portfolio.

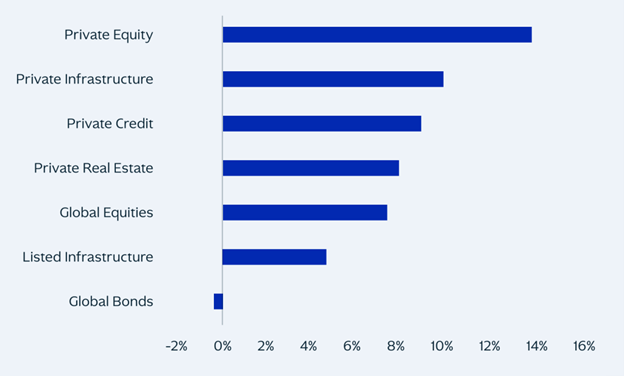

Chart of the month: 10 Year Annual Returns from Major Asset Classes

It’s hard to imagine that anything has outperformed the stock market in the past ten years, but that is in fact the case according to this chart from KKR. Infrastructure has provided a unique benefit to portfolios – excellent total returns while delivering yield, lower volatility and inflation protection. Hence our investment in KKR’s private infrastructure strategy.

Note: Analysis using quarterly returns from 2Q14-2Q24. Private Equity, Private Infrastructure, Private Credit, and Private Real Estate refer to the respective Cambridge Associates Benchmark Index and are quoted in net return. Global Equities refers to the MSCI World Index. Listed Infrastructure refers to the S&P Global Infrastructure Index. Global Bonds refers to the Bloomberg Global Agg Index. Global Equities, Listed Infrastructure, and Global Bonds are gross returns. Source: Bloomberg, MSCI, Cambridge Associates, KKR GBR analysis.

Private Infrastructure: An Asset Class for All Economic Conditions | KKR

Content Recommendation

Sorry for a repeat performance from Blackstone, but Jon Gray does a superb job at addressing bubble concerns in AI and private credit, Blackstone’s positioning, plus a solid long-term investment outlook.

Is Everything a Bubble w Jon Gray

Portfolio Strategy

Debt

Liquid fixed income

- Despite short term rates dropping (another 25bps Fed cut on December 10th), yields on longer term US Treasuries are moving higher. This is not good for bond investors and is sending an odd signal as under normal circumstances they would be falling with short rates. We are happy to have minimal exposure to government bonds.

- Corporate bond spreads (investment grade and high yield) remain near record lows; thus our portfolio has moved to perhaps its most conservative positioning.

Private credit

- Although private credit remains attractive, we believe the opportunity is less compelling than in the past few years when we were earning double-digit yields.

- Yields have come down materially and the market has become more competitive, compressing spreads further.

- New opportunities in private assets (equity and infrastructure) could provide better return profiles.

Equity

Public equity (stocks)

- Data shows forward price earnings multiples are the same as a year ago (~24x), suggesting returns this year have been driven by earnings, not multiple expansion. This is fundamentally a positive signal.

- I’ll keep my last two bullet points from last month for emphasis:

- Never underestimate the stock market’s ability to surprise to the upside, but also be prepared for volatility and some disappointments at these elevated valuations.

- We are actively monitoring and adjusting exposure to the most volatile sectors and stocks.

Private equity

- Deal activity of all forms is picking up, already at levels not seen in years (up 50-100% since last year).

- Interest rates continue to fall.

- Less regulatory burden from Trump administration.

- Valuations in our portfolios appear low versus public market comparisons (one manager marks their portfolio at a 43% discount to public peers).

- We believe all this points to a promising outlook for private equity, just as our opportunity set and allocation has grown substantially.

Real Assets

Real estate

- Valuations in commercial real estate seem to have bottomed.

- We believe there is a case building for diversified real estate exposure in the most conservative portfolios as bond yields fall and equity valuations peak.

Infrastructure

- AI, national defence, transportation, energy…these all require substantial capital to develop and/or modernize. Governments do not have the money, so increasingly partnering with private investors like KKR to fund projects.

- Combining long-term contracts and competitive advantages with secular growth industries/companies is a winning formula.

Excellent returns out of the gate from our KKR infrastructure investment.