After equity markets continued to reach new highs in 2025, there have been renewed concerns about elevated valuations. Are stock prices outpacing underlying fundamentals, or is there still room to run?

Many factors influence market performance—government policies, geopolitical events, economic growth, inflation, interest rates and even the headlines. Yet over the long run, one of the most powerful drivers is corporate earnings.

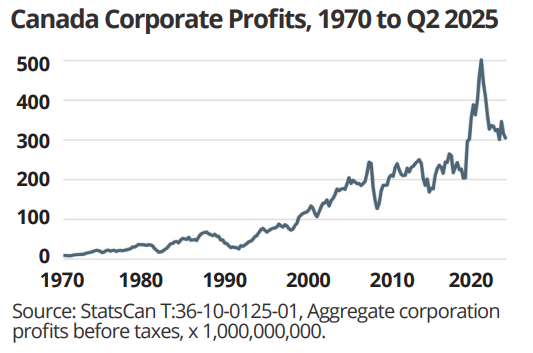

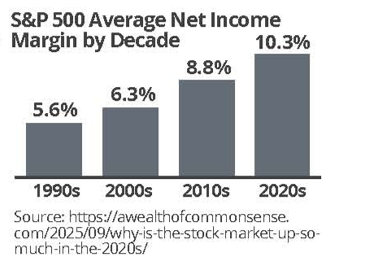

The earnings story, so far, has been strong. U.S. corporate margins have expanded, with the average S&P 500 net income margin climbing above 10 percent this decade, roughly double the level of the 1990s. Canadian corporate profits have followed a similar trajectory, though fluctuations in commodity prices, including a pronounced peak in 2022, have added more volatility to overall profits (graph, bottom).

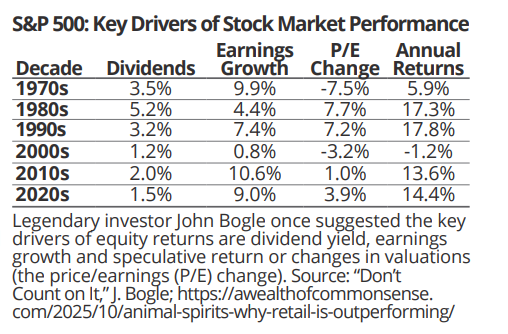

Looking ahead, several factors suggest that this growth can continue. Companies are benefiting from technological innovation, productivity gains and resilient consumer demand, all of which support sustained earnings growth. Of course, history reminds us that earnings growth alone doesn’t guarantee high market returns. In the 1970s, despite solid earnings growth of 9.9 percent, high inflation and the global energy shocks kept equity markets subdued. Indeed, growth in markets, economies—and even human progress—is rarely linear.

Even so, the current strength in earnings should not be overlooked. Robust corporate profits have been, and remain, a key driver of market strength. As we look ahead to 2026, here’s to continued earnings growth to provide the fuel for markets to keep advancing.