It is the immutable market cycle. Stock market valuations can swing back and forth from one extreme to the other, sometimes being depressed and offering high value, and at other times appearing overvalued and speculative. Somewhere in the middle of this swing may be the fair value of any particular equity.

Over the past year, we have seen how quickly the market’s pendulum can swing. After last spring’s significant drop in the markets, in the midst of the greatest economic and public health crisis of our time, the pendulum swung to the other side. To start 2021, the S&P/TSX Composite (TSX) and S&P 500 indices posted record highs, with many stock valuations appearing stretched.

Of course, the equity markets are a discounting mechanism and are forward looking in nature: economies will eventually reopen and pent-up demand is expected to be released. However, other factors have helped to push equity markets higher. With central banks pledging to keep interest rates low for the near term, investors turned to equity markets as there is no alternative (TINA). Continuing stimulus measures have also helped to inflate asset prices. A rise in low-commission trading platforms has enticed many new investors to enter the markets, often trading based on momentum.

More recently, the market narrative has shifted. Long-term bond rates have risen, increasing inflation expectations. Rising yields are often seen when economic expectations strengthen, and the positive news from vaccination programs is supporting the path to economic reopening — the light at the end of the tunnel that we have long awaited! Volatility has also returned to certain areas of the markets. Yet, after many months of market advances, this can be expected and it may provide opportunities to put capital to work as we continue to build portfolios for the future.

Will the markets continue their climb? For many investors, there is limited value in trying to predict the direction of the markets — after all, the overall success of your wealth plan isn’t dependent on calling the top (or bottom) of any cycle. Consider, too, that markets can sometimes advance further than many believe. In 1996, during the dot-com years, then-Federal Reserve Chairman Alan Greenspan delivered his infamous “irrational exuberance” speech. Yet, the markets continued to advance for more than three years. Today, while there is a considerable amount of excess, some suggest that there isn’t the same magnitude of financial leverage that has accompanied past exuberance. And, certain areas of the markets are expected to benefit from continued economic recovery as things return to normal.

For most investors, the investing journey will be a long one. If we have a sound wealth plan to guide us, with a portfolio based on quality, diversification, and focused on the longer-term, it should serve us well no matter where the day-to-day markets take us. Continue to look forward and have confidence in that plan, regardless of where the market pendulum may swing.

Wealth Transfer Planning & Your Family

The Importance of Talking to Adult Children

In our work with clients, it isn’t uncommon for us to find parents who haven’t had any discussions with their adult children about their wealth transfer plans. Such planning may be a difficult topic to approach: not many people like to talk about death, and the intensely private subject of finances can further complicate matters.

However, excessive secrecy can make a potentially difficult situation even worse. How will anyone know how to deal with your assets in the case of death? Or, in the situation where you are alive but unable to act for yourself, how can those appointed to act on your behalf ensure your wishes are carried out as intended?

The health-related consequences of Covid-19 have been a stark reminder of the value in having wealth transfer planning discussions with family members. It isn’t necessary to divulge any detailed information about your finances or your Will in advance, but it may make sense to inform family members of your intentions.

In some cases, parents have appointed adult children as executors but haven’t made them aware. Others may be aware, but have not been provided with information on where Power of Attorney (POA), Will and other important documentation is stored. It is important for an attorney (the person appointed under a POA document*) or next-of-kin to know where to find these documents in an emergency situation. This can help prevent a needless search or avoid other complications, such as incorrectly assuming a Will does not exist.

Communicating what is important to you, how you would like to be remembered and your desired legacy may also be important to family members. Without any instruction, survivors may struggle with doubt

about whether they made the right decisions. This can be especially difficult during a time of grief. Some individuals plan their funeral arrangements in advance; others may wish to make loved ones aware of causes or charities important to them. Having a dialogue with adult children may also provide an opportunity to pass along family values.

If you own a business and wish to see it continue within the family, it is important to have discussions with family members in advance. Planning today can not only provide clarity over your intention for the business’ succession, but it can also help provide tax and other financial benefits down the road.

While these discussions can be difficult, having them while you are alive and well may provide comfort to you and your adult children that you continue to support them, even after you are gone.

*The name, terms and conditions of the POA document vary by province (e.g. known as a mandatary in Quebec).

Macroeconomic Perspectives

Working From Home: Remember to Claim Expenses

For those old enough to remember, the late 1970s and early 1980s were periods rife with high inflation and interest rates. In 1981, inflation rates reached over 12 percent and the now defunct Canada Savings Bond returned 19.5 percent interest.1 While high interest rates meant great returns on low-risk assets like guaranteed investment certificates, it also meant unaffordable mortgages!

Since that time, it has been widely recognized that the central banks are responsible for keeping inflation in check as part of their policy objectives. For many years, the Bank of Canada and U.S. Federal Reserve (Fed) have targeted a two percent core inflation rate. Over the last decade, inflation has generally hovered close to this target, due to monetary policy actions as well as persistently low price and wage increases. It should be noted that the measure of core inflation doesn’t include some of the more volatile components of our goods and services, such as food and gas — everyday costs incurred by most individuals. Many Canadians would argue that food costs have largely outpaced core inflation rates!

Today’s Realities: Low Interest Rates, Low Inflation

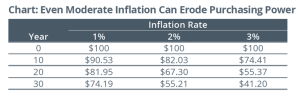

Of course, it is unlikely that we will see the return of the inflation rates experienced in the 1970s. However, even moderate inflation can have a significant impact over time. The chart shows the erosion of purchasing power of $100 with just moderate inflation rates.

This should also remind us of the value in investing funds for the future. With interest rates at near-zero levels, many savings accounts yield paltry returns. Add in the subtle effects of inflation and doing nothing with your money can have its own risks.

There are differing views on the longer-term path for inflation. With central banks pledging to keep interest rates low for the foreseeable future, there is the potential for rising inflation — traditional economics suggests that when rates are low and the economy grows, inflation generally increases. As well, last year the Fed signaled a major shift in its approach to managing inflation, allowing it to run above the previous two percent target. This significant change in policy stance was undertaken to try and stimulate growth and tackle unemployment as a result of the ongoing pandemic.

1. Bank of Canada monthly historical CSB rates and CPI. www.bankofcanada.ca

Planning For Retirement

Don’t Need Excess Funds? RRIF Withdrawal Planning

While Registered Retirement Savings Plan (RRSP) season may be over, if you are nearing the age in which you will be converting your plan to a Registered Retirement Income Fund (RRIF), you may wish to start thinking ahead. Equally important as contributing to your RRSP is planning for the eventual withdrawal of funds from your RRIF.

As you think about retirement, maximizing your retirement income is an important part of this exciting transition. Ultimately, it’s your after-tax income that counts: paying the least amount of tax on your income can help you keep more of your hard-earned dollars.

Carefully consider and plan for all sources of income, including pension income, non-registered assets, and Tax-Free Savings Accounts (TFSA). If you have sufficient funds through pension income and non-registered assets to meet your retirement expenses, it may make sense to only withdraw the mandatory minimum amount from your RRIF or locked-in plans such as a Locked-in Fund (LIF), Locked-in Retirement Income Fund (LRIF) or Prescribed Retirement Income Fund (PRIF) each year. This allows for continued tax-deferred growth within the plan. Here are some additional strategies to help keep funds invested for longer:

Base the withdrawal rate on a younger spouse’s age — If you have a younger spouse, consider basing your withdrawal rate on their age in order to lower the amount of the required annual withdrawal, thereby helping to keep more assets to potentially grow within the plan on a tax-deferred basis.1

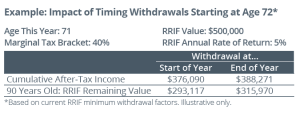

Make your first withdrawal at the end of the year in which you turn 72 — You are required to convert your RRSP or Locked-in Retirement Account (LIRA) into a RRIF/LIF/LRIF/PRIF by the end of the year in which you turn age 71, but don’t need to make the first withdrawal until the end of the year in which you turn age 72.

Time annual withdrawals at the end of each year — The timing of withdrawals can make a difference over time. If you take your withdrawal at the end of each year, instead of the beginning, you allow for greater time and potential compounding of funds within the plan.

For example, consider a 71-year-old with a marginal tax bracket of 40 percent and a RRIF worth $500,000 that has an annual rate of return of five percent. If this individual withdraws the minimum from the RRIF at the end of the year in which they turn 72, the after-tax income from age 72 to age 90 will be higher than if payments were made at the start of the year. As well, by the age of 90, $315,970 would be remaining in the RRIF, as opposed to $293,177, if payments were made at the start of every year.2

Plan Ahead

While these strategies involve minimum withdrawals from your RRIF, consider that, in some cases, withdrawing more than the minimum amount can improve an overall lifetime tax bill. Every situation is different. As such, please get in touch if you require support as you think ahead.

1 Provincial locked-in plan legislation for LIF/LRIF/PRIF allows for the use of a younger spouse’s age, with the exception of New Brunswick;

2. Based on current prescribed RRIF withdrawal factors.

Personal Income Tax Season

Working From Home: Remember to Claim Expenses

It’s personal income tax season once again. If you worked from home as a result of the pandemic, the Canada Revenue Agency (CRA) has introduced two simplified methods for claiming the home office expense deduction on your 2020 personal income tax return:

New Temporary Flat Rate Method — If you worked more than 50 percent of the time from home, for at least four consecutive weeks in 2020 due to Covid-19, you may claim $2 for each day worked from home, to a maximum of $400 per individual.

Simplified Detailed Method — For home office expense claims exceeding the temporary flat rate maximum of $400, the CRA requires individuals to use a “detailed method,” where a worker must calculate the employment use of their home workspace. The CRA has now created a simplified form for the detailed method, Form T2200S. While this form does not have to be attached to the tax return, it should be saved for auditing purposes. The CRA has also provided an online calculator to help perform workspace calculations.

In both simplified processes, employees must complete and attach Form T777S, Statement of Employment Expenses from Working at Home Due to Covid-19, to their tax return. Due to the pandemic, the CRA will accept an electronic employer signature on Form T2200S.

Changes to Eligible Expenses — The CRA has also expanded the list of claimable expenses. As a result, reasonable home internet access fees may now be claimed. Detailed information regarding allowable expenses and claims can be found at the Government of Canada website: canada.ca/cra-home-workspace-expenses

Investment Perspectives: During Market Advances — Think Longer Term

In the first six weeks of 2021, the S&P/TSX Composite Index hit six new all-time highs. Despite being a year in which a pandemic made economic conditions some of the worst in history, the S&P 500 Index hit 30 new all-time highs in 2020.

For some, buoyant market times may be cause for discomfort: while markets can climb, they can also fall. But here are a handful of considerations that may help to keep perspective:

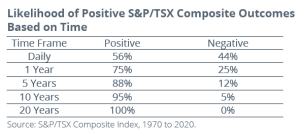

Don’t forget your time horizon — With many of us spending extended periods of time at home, it may be easy to pay greater attention to daily market movements. Yet, most of us are longer-term investors with a time horizon extending beyond today. Longer-term investors will see numerous peaks — and troughs — across market cycles. But, history has shown that the longer your time horizon, the greater the possibility of positive outcomes.

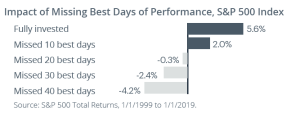

Timing the markets is difficult — While avoiding a drop in the markets is good in theory, accurately timing the markets is a difficult, if not impossible, task. And, it’s not just about protecting your investments from market drops — equally important is benefiting from market gains. After the market lows last spring, many were surprised at the speed in which markets reversed their course. Consider the consequences of missing the best days of performance in the markets.

Consider rebalancing — If gains in your portfolio make you want to take action, consider making adjustments to your asset allocation or portfolio diversification. When we think about the process of reallocation, we often look for opportunities to adjust into areas that stand to benefit in changing environments or pare back positions that have exposure to negative dynamics. Rebalancing, to get your asset allocation or portfolio diversification back to its target, may be one way to take some gains while keeping invested for the future.

Rely on professional support — The high valuations of current markets may make it difficult to see opportunity. Yet, thereare areas of the markets that haven’t experienced the same acceleration in performance. For example, at the time of writing, value stocks have had a sharp run over the past seven months, but not the extended gains of growth stocks. One of our roles is to critically assess the potential opportunities that may exist, or are to come, while managing risks in a challenging landscape.

Continue to look forward, enjoy the advancements of the markets and leave the day-to-day worries of your portfolio to the professionals who are here to manage it.