It has been said that “successful investing should be more like watching paint dry.”

Yet, for many investors today, the speed of change in the markets may be conditioning us to think otherwise. In fact, a recent Reuters report suggests that investors on one U.S. discount brokerage platform are checking their portfolios at an alarming rate of seven times per day.1 Most would suggest that drying paint should not warrant that much attention.

The rapid rise of equity markets since last year’s lows hasn’t helped to nurture our patience. The S&P/TSX Composite Index (TSX) took only 200 trading days to return to its prior highs.2 The S&P 500 Index rebounded in record time: just 107 trading days. This speed of recovery is unprecedented. Consider that over the past 40 years, it has taken an average of 380 days for the TSX to recover from just a 10 percent drop.3 In similar fashion, this past summer it was reported that the pandemic-related recession was the shortest on record in the U.S., lasting only two months.

History has also shown that, on average, the TSX experiences a correction of at least seven percent per year. Yet, for most of this year, when equity markets have shown any sign of pulling back, retail investors have been quick to buy the dip.

Of course, these are unprecedented times. The extraordinary actions taken to fight the Covid-19 pandemic have helped to distort market and economic cycles.

Our Behavioral Biases Can Get in the Way

For most investors, the objective is to create wealth over the longer term, and not for tomorrow. As such, we shouldn’t abandon the importance of patience within our investing programs. And, actions like constantly checking portfolios can be counterproductive. Why? One of the dangers of frequently checking is that there is a greater chance that we will trigger certain biases.

Viewing a portfolio more often leads to a higher probability of seeing a loss. By checking S&P/TSX Composite Index performance on a daily basis, there is a 48 percent likelihood of seeing negative performance. By checking only once per year, this decreases to just 28 percent. Modern behavioural economists have shown that a loss aversion bias means we may feel the pain of a loss about twice as much as the pleasure of a similar-sized gain. This can prompt us to make decisions that may not be in our best interests. Even seeing positive performance can prompt us to take action, such as selling a well-performing investment too early.

How about you? Are you checking your portfolio too frequently? For most investors, the investing journey will be a long one. Stick to the principles set out in your plan and be aware of the influence that human behaviour can have on investing, remembering the importance of patience in achieving our longer-term goals.

1 www.reuters.com/breakingviews/chancellor-robinhood-is-more-sheriff-than-rebel-2021-07-15/; 2 S&P/TSX Composite Index close, 3/23/20 to 1/7/21; 3 TSX close 10/29/80 to 4/30/21.

Retirement Planning

Age Milestones: Do You Need to Take Action?

Before each year end, we remind our readers that those who reach certain milestones need to consider their options in preparing for retirement. If you are nearing the following ages, take note of these considerations as you look to maximize your retirement savings. Don’t leave money on the table. If you need help, please give us a call.

At Age 60

Consider early Canada Pension Plan (CPP) payments. Although the standard age for starting CPP payments is 65, you have the option to collect your CPP retirement pension as early as age 60. Payments will be permanently reduced if you begin early. You may wish instead to defer CPP payments to receive an increased benefit by starting payments between the ages of 65 and 70.

At Age 65

Don’t forget the federal Pension Income Tax Credit. The Pension Income Tax Credit allows you to claim a tax credit equal to the lesser of your pension income or $2,000. Since this is a non-refundable tax credit, it cannot be carried forward. Note that there are certain exceptions in which the Pension Income Tax Credit can be used before the age of 65, including for those individuals 55 years of age or older who have certain qualifying types of pension income, or widow(er)s, so seek advice on your particular situation. In Quebec, the pension recipient must be age 65 to split all types of pension income.

If you don’t have a pension, you can generate qualifying pension income at age 65 by opening a Registered Retirement Income Fund (RRIF), for example. We are available to assist with this option.

Consider pension income splitting. If your spouse/common-law partner has a lower marginal tax rate and/or available tax credits to provide tax savings, you may consider pension income splitting. An individual can allocate up to 50 percent of their eligible pension income to his or her spouse for tax purposes. (Note: individuals as young as age 55 may have qualifying pension income under certain circumstances.)

At Age 71

Convert your RRSP before year end. You must convert your Registered Retirement Savings Plan (RRSP) before the end of the calendar year in which you turn 71 years of age. The most common choice is to open a RRIF, but there are other options to consider, including purchasing an annuity or distributing funds, which will be taxed as income.

Make final payments to the RRSP before year end. Consider catching up on any unused contribution room from previous years before the end of the year. You won’t be able to contribute until the usual RRSP deadline (which is 60 days after the end of the year) as your plan will need to be collapsed before the year ends.

Consider contributing to a spousal RRSP. If you have reached the age of 71 but have a younger spouse and have unused RRSP contribution room (or are still generating RRSP contribution room if you still have earned income), consider contributing to a spousal RRSP. This has the potential to defer taxes and/or split income.

If we can assist with any of these matters, please call. As always, consult a tax specialist regarding your particular situation.

It’s Back-To-School Time

In Brief: Withdrawing from the RESP

With the return of autumn, many families may be turning their attention to school. If you have a (grand)child who has headed to college or university this fall, congratulations! Now is the time to take action and tap the fruits of your labour: the Registered Education Savings Plan (RESP). Here are some considerations, in brief:

Understand the three components of the RESP.

Track RESP balances according to their source: i) grants, ii) contributions and iii) accumulated income (AI) — income or gains made on contributions and grants. Grants and AI may be paid out to the beneficiary as an Education Assistance Payment (EAP), taxable in the student’s hands. Generally, any unused grants will be clawed back and unused AI may be potentially subject to a penalty tax. Original contributions can be withdrawn, tax free, at any time, or paid tax free to a qualifying beneficiary. When withdrawals are made, you will need to specify how much comes from each bucket.

Give thought to how you will time your withdrawals.

Consider drawing EAPs early when a child’s income is low (depending on summer jobs and co-op programs). It may be beneficial to spread EAPs over several years to make use of tax credits, such as the basic personal amount and tuition tax credit.

Deplete the account while the beneficiary is enrolled in an accredited program.

While you can only withdraw $5,000 of EAPs in the first 13 weeks, there is generally little restriction after that period while enrolled. Be aware that for payments received after a beneficiary is no longer enrolled, unused grants may need to be repaid and AI payments will be subject to additional taxes potentially. There is a six-month grace period after enrolment has ceased that allows for RESP withdrawals to qualify as EAPs.

Explore alternatives if a child does not go to school.

The RESP can remain open until the end of the calendar year that includes the 35th anniversary of its opening. If plans have changed, consider the option to transfer the RESP to a sibling or transfer AI to the parent’s Registered Retirement Savings Plan, both subject to various conditions.

For more information, see: https://canada.ca/en/revenue-agency/services/

tax/individuals/topics/registered-education-savings-plans-resps.html

The Season Of Giving

Do Good, Feel Good & Benefit Taxes

Many Canadians make charitable donations of one sort or another. We are good at giving: according to the latest Statistics Canada data, over 40 percent of taxpayers with income of over $80,000 contributed to a charitable organization.1

There are a variety of ways to make contributions, some of which may benefit you at the same time as the recipient organization. Here are just a handful of options:

Cash Donations — Any donation to a registered charity in good standing results in a tax receipt which will entitle the donor to a tax credit. The federal credit is 15 percent of the first $200 donated per year and 29 percent (or 33 percent*) beyond this threshold. After taking provincial tax into account, the total benefit may exceed 40 to 50 percent, depending on province of residence. This credit can be pooled with your spouse to be claimed by whichever spouse can best use it to their advantage. Moreover, donations can be carried forward for up to five years. Charitable donations are limited to 75 percent of net income in any year except upon death. Donations of up to 100 percent of net income are allowed for tax purposes in the year of death and the year preceding.

Donating Appreciated Securities — If you donate stocks or mutual fund units that have appreciated in value, there is potentially a further benefit. Gifting publicly-traded securities with accrued capital gains to a registered charity not only entitles you to a tax receipt for its fair market value, but also eliminates the associated capital gains tax. If you wish to do this for the 2021 tax year, please let us know well in advance of the year end as charitable donations must be made before December 31st and settlement times may vary.

In-Kind Gifts — You may consider donating personal property which a charity can then convert to cash. For example, by donating a used car to charity, you may be eligible to receive a tax receipt for its appraised value. Similarly, you may be able to donate a legitimate work of art to a public gallery. Special tax rules may apply to in-kind gifts so check with a tax advisor on how to best handle the situation.

Private Foundations — Individuals with more substantial assets may consider establishing a private foundation as a vehicle for charitable activities. Money paid into the foundation may result in an immediate tax benefit while the foundation can direct future gifts as it sees fit. However, the ongoing cost of the foundation may be a disadvantage.

Donor-Advised Funds or Community Foundations — Giving through a donor-advised fund or a community foundation may be a cost-efficient alternative to establishing a private foundation; they can eliminate certain legal and administrative costs, while still allowing you to direct donations and achieve tax benefits. The benefit of a donor-advised fund is that the contribution will be deductible in the year it is made, but funds can be distributed in future years. The donor may also be able to direct how funds are invested by the charity until their distribution.

Get More Information

Charitable giving can be a wonderful way to create a legacy, but the options and their outcomes in estate or tax planning can be complex. There may be other alternatives to consider, than just the ones outlined above, so please get in touch if you are interested in discussing a giving strategy as it relates to your own wealth plan.

Where major gifts are concerned, seek independent professional advice. We would be happy to assist where possible.

*The federal donation tax credit rate for donations over $200 increases to 33 percent to the extent that an individual has taxable income taxed at the federal rate of 33 percent. 1 Based on 2019 tax return data: www150.statcan.gc.ca/n1/daily-quotidien/210308/t004c-eng.htm

Investing Perspectives

The Profound Impact of Time on Investing

“Greatness is not in where we stand, but in what direction we are moving. We must sail sometimes with the wind, and sometimes against it — but sail we must, and not drift, nor lie at anchor.” — Oliver Wendell Holmes

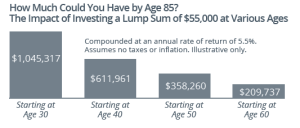

Procrastination can be one of our greatest enemies in the quest for wealth creation and, ironically, it’s one that is within our power to defeat. If you have (grand)children learning about finances, the accompanying chart may be a worthwhile share. It shows the impact that starting early can have in building wealth down the road.

How about you? Do you have funds sitting idle that can be put to work for your future? The latest data suggests that the average unused Tax-Free Savings Account (TFSA) cumulative contribution room is around $34,000 per person. For all Canadians, the total cumulative unused RRSP room was in excess of one trillion dollars! Does any of this unused contribution room belong to you? You can check your available contribution room on your Canada Revenue Agency online account, “My Account,” under “RRSP and TFSA” details.*

The best investment opportunity is valueless unless we actually make use of it. Put time on your side and keep your money working for you.

*CRA data may not be fully updated depending on when it is accessed.

Insurance Planning: It’s Never Too Late

As part of the retirement-planning process, we often suggest that our clients consider the use of life insurance for its many benefits. As life insurance is often more difficult and costly to obtain in the later years, it’s worth considering at a younger age and while an individual is in good health. But, even if you haven’t planned in advance for insurance as part of your wealth plan, it may not be too late. We most often see individuals in their 60s and 70s purchase life insurance as a planning tool and certain insurance companies will even issue life insurance to individuals up to age 85.

Here are four areas where it may prove valuable in your planning:

Complement Investment Returns — Many insurance products blend certain aspects of insurance with investing. Depending on the type of insurance and the policy, there may even be options for how the investment portion is invested, and the potential for a certain amount of growth to be on a tax-sheltered basis. This may be one way to complement investment returns (usually the more conservative portion of a portfolio), especially in situations in which the cost of managing the policy is reasonable. Upon death, the proceeds will pass to beneficiaries on a tax-free basis. While older individuals will be subject to higher premiums, there may still be a benefit gained from the tax-sheltering opportunity and the eventual tax-free benefit payout.

Support Philanthropic Efforts — Insurance may be a way to create a legacy and, in some cases, provide benefits even while you are alive. For example, you could have a charitable organization purchase an insurance policy on your life while you donate the cash annually to pay the premiums. This way, you would receive a tax credit for the annual cash donated. You could own a life insurance policy and name the charity as the beneficiary or donate appreciated shares to fund an insurance policy. There are a variety of tax-efficient ways to use insurance to support your charitable endeavours.

Help to Cover Taxes on Death — Many estates incur a considerable amount of taxes on death and this situation may be complicated by the presence of illiquid assets such as real estate or a family corporation. A life insurance policy may help to effectively cover those taxes, so that your estate isn’t left with a shortage of cash when these taxes come due. For example, there may be a significant capital gains tax liability upon the transfer of a cottage or cabin and the proceeds from an insurance policy can help to cover these taxes and keep the property within the family.

Equalize an Estate — In cases where you wish to leave your estate to multiple beneficiaries and it is important to provide assets of approximately the same value, life insurance may be able to support the equalization. An insurance assessment can determine if this may be an equalization alternative. As well, you may have assets that are better left to certain beneficiaries, rather than being shared, such as a family business. In this instance, the insurance death benefit may potentially be used to help equalize the inheritance for those heirs who may not be the beneficiary of these assets.

We Can Assist

In many cases, it is never too late to explore the opportunities for insurance to play a role in retirement and beyond. There are many products available to support a variety of investment, tax, retirement and succession planning solutions. For a broader discussion, please call the office.