There is an old saying in the investment industry: “Don’t confuse brains with a bull market.” The inference, of course, is that it’s easy to pick winners when markets are rising. The difficulties come when uncertainties arise, as they always do. With the tremendous proliferation of investment information available through the internet and other sources, a modern corollary might be: “Information is not the same as advice.”

Technology continues to make information more widely and instantaneously available. This has provided the opportunity for investors to make more informed decisions. However, this also comes with pitfalls. The difficulty usually arises in interpretation, as prudent evaluation often requires specialized skills.

Sometimes, information can be misleading or wrong. The internet has provided an easy way for individuals to promote investment “advice” for their own purposes. It’s not always easy to spot the differences between fact and near-fact or fiction. Quite alarmingly, a recent Wall Street Journal article suggested that in upwards of 41 percent of Gen Zers are receiving financial advice from the app Tik-Tok.1

Equally important is being able to cut through the noise when making investment decisions. In buoyant markets, there can be significant noise. In May, the cryptocurrency Dogecoin, started as a joke and named after a “doge meme,”2 became the fourth most valuable digital currency after gaining 14,000 percent to start the year. SPAC issuances have surged, prompting regulators to warn investors not to be “lured into participating in a risky investment.”3 SPACs sell shares with the objective of buying a private company to take public. They are known as “blank cheque” companies for a reason: they have no operating business and often no stated acquisition targets.

During rising markets, it’s easy to get caught up in the excitement — we’d all like to ride the next superstar investment to financial freedom. We may also feel that we aren’t successful investors unless we are in the middle of the action. But when there is too much enthusiasm for what appears to be a good opportunity, it can prove unsustainable; the warning signs sometimes only apparent to the astute.

Despite the risks, some investors choose to make their own security selections. This can be a successful undertaking when markets climb, yet challenges can emerge when markets decline. For most investors, the objective is to create wealth over the longer term. This involves investing over many cycles, which will inevitably see both ups and downs, to maximize asset values for the future and not tomorrow.

As we look ahead, the investing landscape looks a lot different than just a year ago with divergent global recovery, strengthening commodities prices and increasing inflationary pressures. The changing times are precisely when trusted advisors can provide thoughtful evaluation and scrutiny in investment choices, shifting gears where necessary to position for change.

We are here to provide sound advice to keep your hard-earned funds working for you. Continue to look forward and use our resources to help you reach your own investment goals.

1 wsj.com/articles/tiktok-financial-advice-11619822409;

2 en.wikipedia.org/wiki/Doge_(meme);

3 sec.gov/oiea/investor-alerts-and-bulletins/celebrity-involvement-spacs-investor-alert

Avoid Penalties

Contribution Errors? Review Your TFSA

Over recent years, the Canada Revenue Agency (CRA) has increased its review of the Tax-Free Savings Account (TFSA), auditing holders it believes to have over-contributed. If an individual exceeds their TFSA contribution limit for the first time, they are sent a warning letter and/or Form RC243-P, Proposed TFSA Return. This form assesses an amount of penalty tax due. If the excess TFSA amount has been removed prior to receiving the letter, generally no further action is required. As such, if you may have inadvertently over-contributed, it may be worthwhile to review your TFSA now to make corrections before a penalty tax is assessed. Here are two areas where mistakes are often made:

TFSA funds are withdrawn and recontributed within the same year.

Remember that TFSA withdrawals made in a certain year do not create contribution room until the following calendar year. If you do not have contribution room available in a particular year, any recontributed funds would be considered to be an over-contribution for that year.

TFSA funds are withdrawn and transferred to another TFSA at a different financial institution.

This can be done without penalty, but it must be done through a direct transfer that is completed by the financial institution. If funds were instead withdrawn from one TFSA as cash and moved to another TFSA held at a different institution, this would be considered to be a withdrawal followed by a contribution. In this case, contribution room for the withdrawal would not be created until the next calendar year.

What is the penalty?

A TFSA penalty is assessed at one percent of the over-contribution amount per month until the excess amount has been removed from the TFSA (or additional contribution room becomes available). For example, an indirect transfer of $5,000 from one TFSA to another that is considered an over-contribution would be assessed a penalty of $50 per month, or $600 per year. Over time, these penalties can add up.

How can you determine your contribution room?

TFSA contribution room information is available on your CRA online account: “My Account”. You can also contact the CRA to request a TFSA Room Statement or TFSA Transaction Summary showing your contribution and withdrawal information. Please note that the contribution room reported on the CRA website may not be up-to-date depending upon when you access your account. Sometimes, the previous year’s information is not fully accounted for. In other cases, there have been instances in which information is incorrect and the CRA should be contacted to ensure records are updated.

If you have multiple TFSA accounts at different financial institutions, consider consolidating them to simplify their administration and avoid contribution errors. This may also improve management of your asset allocation or ease the future settlement of an estate.

Reminder: The 2021 TFSA dollar contribution amount is $6,000, bringing the eligible lifetime contribution amount to $75,500. Have you fully contributed?

Forward Planning With Spouses

A Spousal Rollover May Not Always Make Sense

Having a surviving spouse* may provide flexibility for capital property or property held in a registered plan upon your death. This is because the Income Tax Act permits the use of a spousal rollover.1 A spousal rollover allows such property to be transferred to a surviving spouse and any associated capital gains or registered plan income will be deferred until the spouse disposes of, or is deemed to have disposed of, those assets (or withdraws the assets, in the case of a registered plan).

Using the spousal rollover has become an almost automatic strategy for many estate plans. However, in some cases, there may be reasons why it may not make sense. Why? While deferring taxes is often beneficial, it can also result in unintended consequences. Take, for example, a surviving spouse who ends up with a very high income due to the rollover of their deceased spouse’s Registered Retirement Income Fund (RRIF), increasing their minimum annual withdrawal requirements. With this higher income, the spouse is now subject to the Old Age Security (OAS) clawback and a higher marginal rate of tax.

Given the reduced OAS benefit and higher annual taxes, some forward planning could potentially have reduced the overall lifetime tax-related burden. It may have been better for the deceased spouse to bleed down their RRIF in the years of having a lower marginal tax rate. Or, perhaps the RRIF could have been partially converted to cash upon death, with a portion transferred to the surviving spouse.

Electing to Not Use the Spousal Rollover

Be aware that an automatic rollover of capital property, for tax purposes, occurs upon the death of the first spouse. However, an election can be made to not use the spousal rollover on a property-by-property basis. Here are some other situations in which electing to not use the spousal rollover may make sense:

- The deceased’s marginal tax rate is low on the date-of-death return.

- The deceased has capital losses carried forward from previous years that can be used to offset some of the realized capital gains.

- The deceased owns qualified small business corporation shares with unrealized capital gains and an unused lifetime capital gains exemption (LCGE).

- The deceased has property with an accrued loss, which may be used to offset accrued capital gains on other properties.

Having flexibility in tax planning by using — or not using — the spousal rollover may have its benefits. Please seek the advice of a tax planning expert as it relates to your particular situation.

*Or common-law partner;

1 For tax purposes, a person is generally deemed to have disposed of their capital property at fair market value immediately before death. Even though there may not have been an actual sale, there may be associated gains or losses realized for tax purposes. Also, unless a rollover is available, the fair market value of a registered plan is included in the deceased’s income in the year of death. A spousal rollover is available where property is transferred to a surviving spouse or common-law partner.

Upcoming Federal Government Changes

Federal Budget 2021: How It May Impact You

In April, the federal government released its first budget in more than two years. It was largely focused on supporting economic recovery as we continue the fight against Covid-19. It offered extensions to various Covid-19-related benefits, resulting in a record deficit and significantly higher projected debt for the foreseeable future. While there were no changes to personal or corporate income tax rates, here are five ways you may be impacted:*

Seniors — If you are age 75 years or older as of June, 2022, a one-time Old Age Security (OAS) payment of $500 will be made by this August. For this same age group, monthly OAS payments will be increased by 10 percent, beginning in July, 2022. If you aren’t in need of these funds, consider investing them.

Investors — Over the next five years, $8.8 billion has been pledged to support green initiatives, including the intent to raise $5 billion through a green bond launch planned for the 2021-2022 fiscal year. Proceeds will be used to finance a variety of green projects. According to the budget, these government-backed bonds may support more mature investors who are “looking for a green portfolio but also need to manage their investment risk.”1 With a continuing focus on responsible investing, have you considered this as part of your own portfolio?

High-Net-Worth Spenders — If you’re lucky enough to be purchasing a luxury vehicle in the near future, consider making a purchase by Dec. 31, 2021. As of January 1, 2022, sales of luxury cars and personal aircraft with a retail sales price of over $100,000, as well as boats over $250,000, will incur a new tax. It will be calculated at the lesser of 20 percent of the value above those thresholds, or 10 percent of the full value of the vehicle.

Students — If you have a (grand)child with student loans in the form of Canada Student Loans or Canada

Apprentice Loans, the budget extends the waiver of interest accruing on these loans to March 31, 2023. The budget also increased the threshold for this assistance from those earning $25,000 per year to a level of $40,000 per year. Remember: students may claim a tax credit for interest on qualifying student loans.

Business Owners — If you operate a Canadian-controlled private corporation, you will now be able to purchase up to $1.5 million of certain capital assets and fully expense them in the year they become available for use. This includes eligible assets purchased on or after April 19, 2021 and before 2024. There may be tax benefits achieved by immediately expensing assets versus capitalizing a purchase; however, seek the advice of a tax professional relating to your situation.

For greater detail on all initiatives proposed, see the Government of Canada website: budget.gc.ca/2021/home-accueil-en.html

1 Budget 2021: A Recovery Plan for Jobs, Growth and Resilience, Government of Canada,

page 166. *At the time of writing, the budget proposals had not been passed into law.

Macroeconomic Perspectives

Inflation: How Has Purchasing Power Changed?

The year was 1987: Brian Mulroney was prime minister, the new “loonie” was starting to line our pockets, “La Bamba” was the top 100 single in Canada and Gretzky and Lemieux would lead us to a win against the Soviet Union in the Canada Cup hockey finals. Back then, a Big Mac hamburger would put you back around $2.

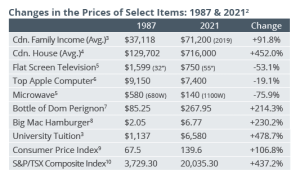

Fast forward to today and that same Big Mac costs over three times the price at almost $7, an increase of around 3.6 percent annually in just under 35 years. During that time, average family income has only risen by 91.8 percent* and according to the Bank of Canada, the Consumer Price Index (CPI), its measure of inflation, has increased by 107 percent, which represents a year-over-year increase of just 2.2 percent.

Today, one of the most pressing questions in financial circles is whether inflation will become a problem, or if current inflationary pressures are temporary in nature as the central banks would like us to believe. If we were to consider the increasing price of commodities, which is feeding into consumer prices, as well as rising food prices, many would argue that the CPI is not very telling. Those who believe inflation may become a greater force cite a variety of factors that signal a potential shift: significant government stimulus, aging demographics in low-cost manufacturing geographies and empowered labour that puts upward pressure on wages and prices. Others suggest that inflation won’t be able to maintain its recent pace after struggling to climb for many years, largely attributing it to pandemic-depressed prices.

Regardless of the path forward, how has purchasing power really changed? The chart shows the prices for select items back in 1987 and today. While prices for many things have gone up, technological amenities have become more affordable: TVs are not only larger and thinner, but cheaper! Regardless, the good news is that since 1987, investors have seen the S&P/TSX Composite Index gain over 430 percent, an annualized rate of around 5 percent (not including dividends reinvested). If history is any indicator, the equity markets continue to be a great way to grow funds for the future.

*Average family income is slightly higher when adjusted for inflation.

1 CANSIM Table 027-0015; 2 1988 data: Report on Business Magazine, April 2012, pg. 13; 3 Statistics Canada T-1110019101; Undergrad tuition https://www150.statcan.gc.ca/n1/daily-quotidien/200921/dq200921b-eng. htm; 4 CREA; 5 Sony HD TV at bestbuy.ca; 6 MacPro on apple.ca; 7 LCBO; 8 economist.com; 9 https://www. bankofcanada.ca/rates/related/inflation-calculator/ for March 1987 and 2021; 10 Close on June 7.

Retirement Planning: How Much Do You Need?

Worried about retirement? Specifically about the cost of retirement and whether you will have enough money? If so, you’re not alone.

According to recent surveys, more than half of Canadians are concerned about their retirement savings and, for many, the pandemic has only made the situation worse.1

Worrying Too Much?

Some studies have shown that perhaps we worry too much about our funds in retirement. One retirement expert estimated that a couple could live on around $44,000 per year.2 Government safety nets may help to supplement this amount if personal assets were exhausted. Many of us would dispute this assessment — and most would like retirement to go beyond subsistence! However, while the pandemic has created income issues for some, it has shown many of us how much discretionary spending could be reduced — though few would want retirement to mirror pandemic life.

If you are fortunate enough to have a defined-benefit pension plan at work, you will have at least some idea of your retirement income. However, as the world continues to change, these pension plans have become increasingly rare.

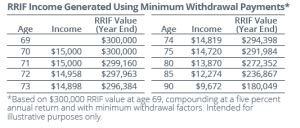

Registered Retirement Savings Plans (RRSPs) are typically the other major component of retirement savings for many Canadians. If you convert your RRSP to a Registered Retirement Income Fund (RRIF), you must eventually withdraw at least the prescribed minimum amount from the RRIF each year. How much can a RRIF provide? For an individual who prudently contributes to their RRIF over time, it may play a substantial role. The table shows the payments that would be received by the RRIF annuitant based on current minimum withdrawal requirements for a plan value of $300,000 at age 70. Assuming a five percent annual return on investments, changes in the RRIF value are shown. For those worried about outliving assets, the numbers provide some comfort. At age 90, 60 percent of the original asset value is still available, and this doesn’t consider other sources of retirement income.

Need More Income?

If income beyond a RRIF will be needed, planning ahead can ensure that other sources will be available. A RRIF is flexible in the amount of income you can draw, so some retirees will withdraw more than the minimum during years when needed. A Tax-Free Savings Account (TFSA) has also become a significant investment vehicle that can help fund retirement. And, in many cases, people do not stop working at age 65. While they may leave lifelong jobs, they may end up doing something else productive and perhaps even profitable!

For those concerned about longevity risk, the Canada Pension Plan (CPP) has the potential to provide a greater benefit payout if payments are deferred to the age of 70. The current annual maximum benefit is $14,445 for an individual starting payments at age 65, but this rises by 42 percent at age 70. Yet, fewer than one percent of retirees delay CPP benefits until age 70, despite studies continuing to show that it can be one of the more financially prudent decisions should you live beyond the average life expectancy of 82 years old.3

We Are Here to Assist

One of our roles is to provide assistance as our clients prepare for a comfortable retirement. We can assist with worksheets and tools to help estimate your requirements as you plan for the future. Continue to look forward with confidence!

1 https://hoopp.com/docs/default-source/about-hoopp-library/advocacy/abacus_executive_ summary_2020.pdf; 2 https://thestar.com/business/personal_finance/opinion/2020/02/10/a-fulfilling-retirement-may-be-cheaper-than-you-think-heres-why.html ; 3 https://www. theglobeandmail.com/investing/personal-finance/retirement/article-less-than-1-of-canadians-choose-to-delay-cpp-heres-why-the-rest-are/