Il Gigante, twice discarded due to its flaws and awkward shape, lay like a washed up carcass on a beach – a 19 meter Carrara marble whale. Quarried in 1464, and transported to Florence, Il Gigante (the Giant), stymied the best efforts of early sculptors. While massive, it tapered to the top and was shallow, thwarting the design intents of artists. For forty years Il Gigante lay in the work yard of the Florence Cathedral – the marble problem child – the washed up whale.

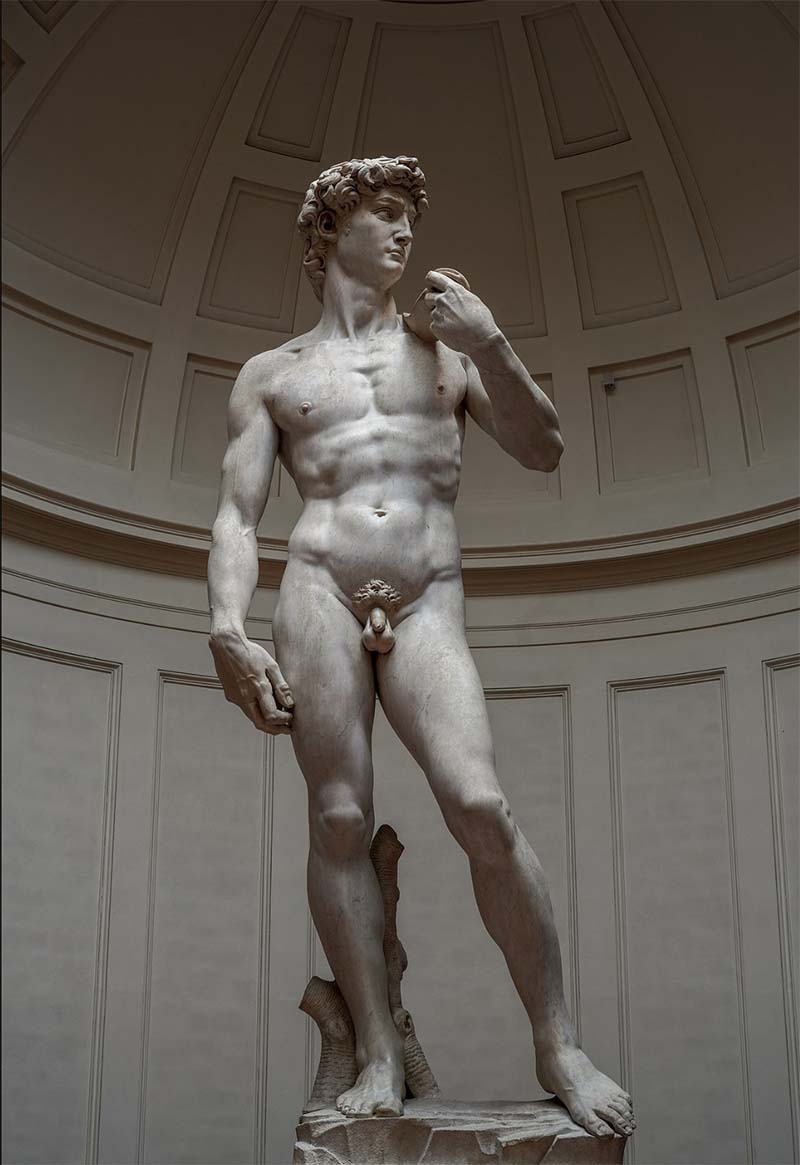

In 1501, the guild responsible for the construction of the Florence Cathedral, decided to commission a series of statues for the buttresses of the Duomo. The most important was to be David and it was to be constructed from Il Gigante. Michelangelo, who had recently completed the astonishing Pieta in Rome’s St. Peter’s Basilica was granted the commission at the tender age of 26. Two years later, like Jonah, his masterpiece David was freed from the whale.

Michelangelo’s Pieta source: https://en.wikipedia.org/wiki/Piet%C3%A0_(Michelangelo)#/media/File:Pieta_de_Michelangelo_-_Vaticano.jpg

He approached the work differently from artists of the day – working with the stone rather than forcing his vision upon it. By turning David’s head to the side, he overcame the shallowness of the Il Gigante. By posing David with his weight on his right leg, he was able to maximize what the marble whale offered. According to Giorgio Vasari, a contemporary and his first biographer, Michelangelo claimed that he saw David within the block and merely needed to free him.

Michelangelo’s David source: https://en.wikipedia.org/wiki/David_(Michelangelo)#/media/File:Michelangelo’s_David_-_right_view_2.jpg

Investors Don’t Get to Pick the Stone

To free David, Michelangelo had to work within the limits imposed by the reality of Il Gigante. He wasn’t working with a “blank sheet”. The stone was imperfect, previously worked and awkwardly shaped. His genius was working within its limits. That seems like an apt metaphor for life and for investing. You and I aren’t given a blank sheet in life or investing. The investment world your parents had success in has changed. To succeed, we’ll have to work within the limitations of the block of marble we’re chipping away at.

For instance, for the past 40 years interest rates have trended lower. That has created a benign investment landscape that has favoured a “buy and hold” strategy and rewarded dividend paying investors. Now that interest rates appear to have bottomed, that strategy may not work as well. Think of this as a deep crack in the marble the next generation is sculpting into their retirement plan masterpiece. Like Michelangelo, investors are going to have to change their plans to accommodate this reality.

Portfolio Managers and Investors Have to See What Others Miss

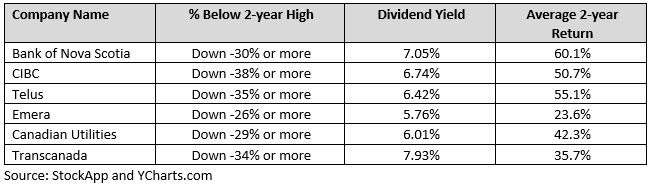

It’s no secret that rising interest rates have negatively impacted utilities, banks and telecom companies in Canada. We’ve catalogued in prior issues just how far some of these giants have fallen. Instead of recounting the losses, let’s consider how these Il Gigantes have responded to prior periods of steep losses. To do that, I used software that I’ve had custom built to examine how the share prices have performed in the two years following prior periods of weakness. These Average 2-year Returns exclude the high current dividends these securities are paying. To be clear, we can’t be certain that history will repeat – but we can hope it rhymes.

I’m no Michelangelo, but when I look at these “Il Gigantes” I see substantial opportunity buried inside. True, the change in the trend of interest rates is likely to cap some of the upside in these securities compared to historical precedents and we can’t assume that past performance will inform future performance, but step back and look! Take it in from multiple angles. This block, discarded by today’s investors, has value inside.

Risks continue to abound – there could be flaws beneath the surface that we can’t see right now. Recession could be a deep crack – but our job hasn’t changed – as investors our task is to pick up our hammer and chisel and to “free” our David.

Glen