“It ain’t what you don’t know, it’s what you know that just ain’t so.” – Mark Twain

If political hot air could heat homes and power electricity grids, coal might already be relegated to a footnote in history.

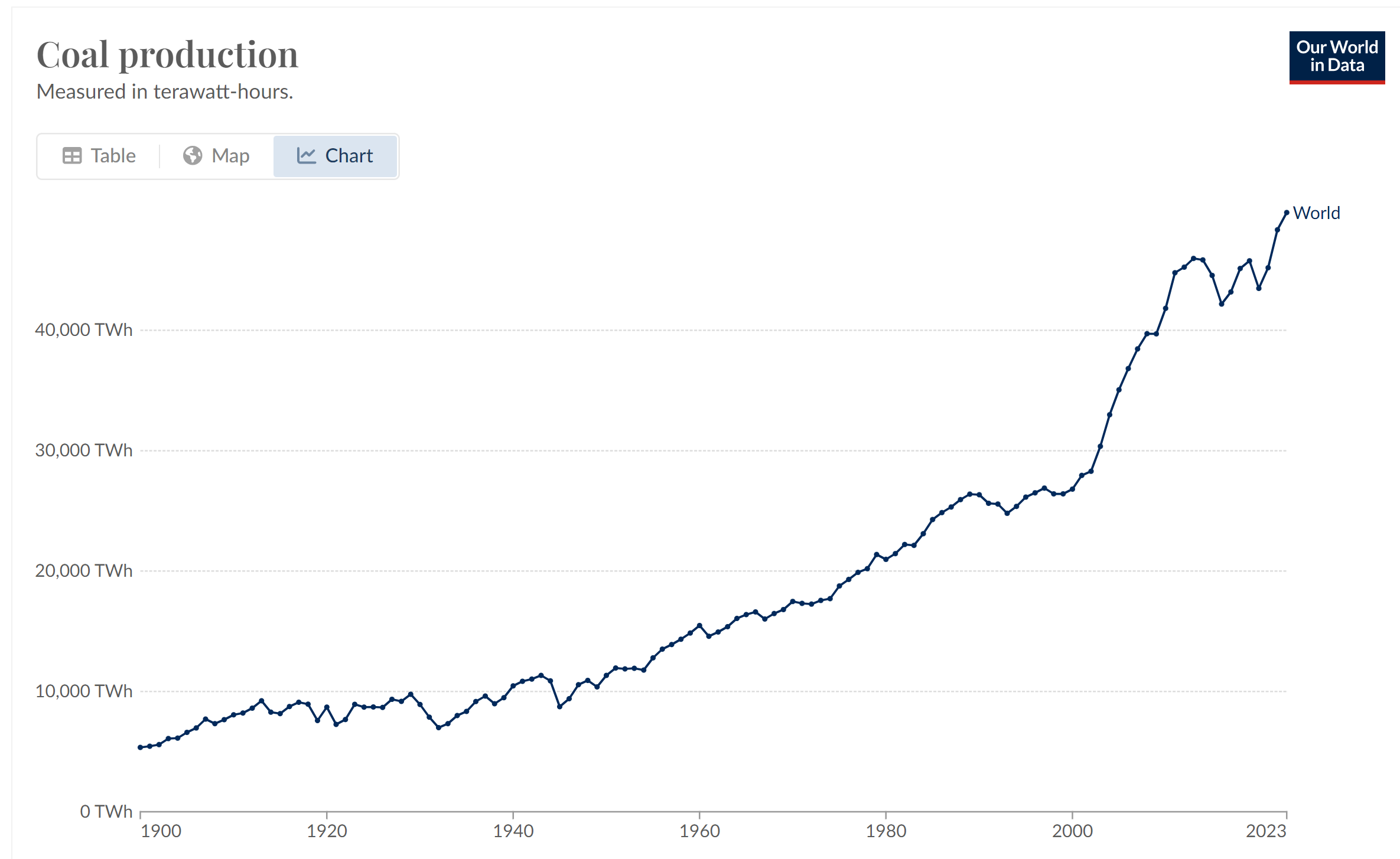

In 2020, the CEO of the largest asset management firm on earth announced their firm would divest from coal, urging others to follow suit in a bold embrace of green energy and the Environmental, Social, and Governance (ESG) movement—source. This was meant to signal leadership, pushing for a future driven by renewables and sustainability. As we approach the fifth anniversary of this high-profile announcement, it’s more than a little puzzling to see that coal usage continues to climb. Despite all the hand-wringing, virtue signaling, photo ops and carbon taxes, demand for coal has not only persisted—it’s reached new all-time highs.

Baffled? You’re not alone.

The Investor’s Dilemma: Green Energy vs. Coal

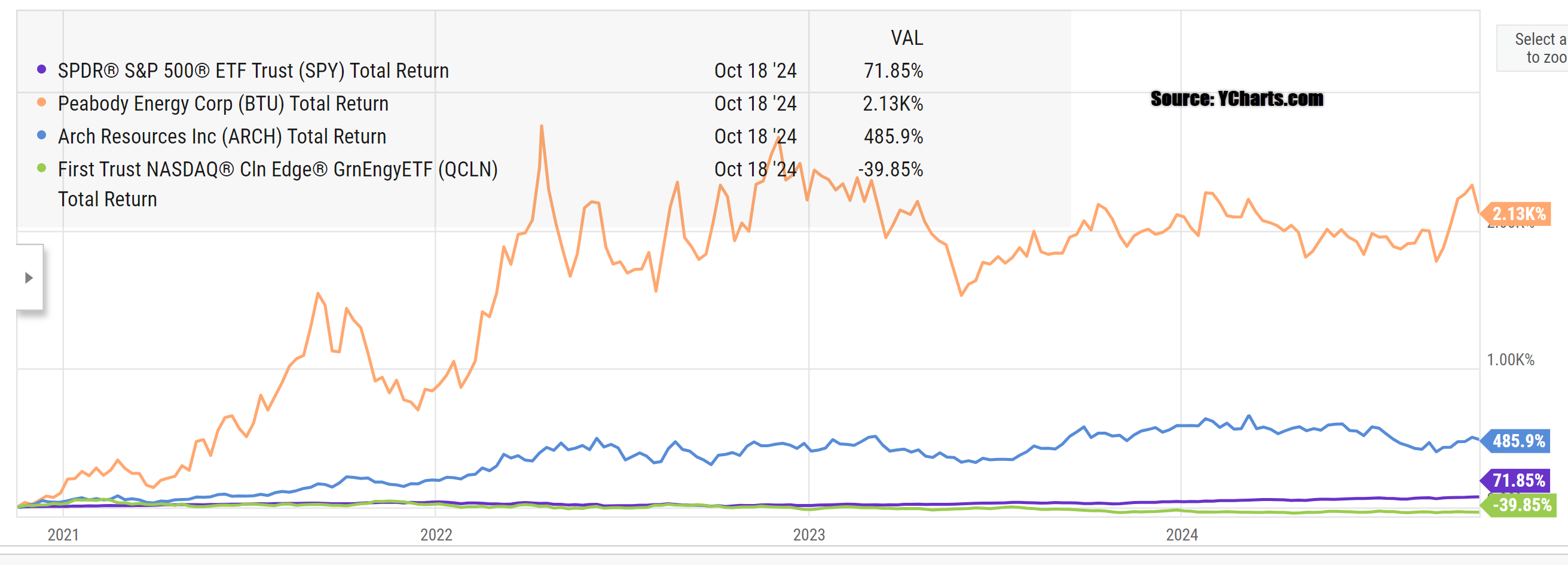

For investors, the news gets even worse. Remember the push for green energy investments? The Biden administration’s ironically named Inflation Reduction Act channeled billions into the sector, promising a new era of energy transformation. To date, they might as well have lit that money on fire. Not only has the Green Energy theme been a bust, but compared to coal, it has been an outright embarrassment.

YCharts.com © 2024 YCharts, Inc. All rights reserved

I was reminded of this history while reading about the new poster child of the energy transition—nuclear energy.

The Nuclear Renaissance: Breaking Step

I’ve written before about the nuclear renaissance we appear to be moving toward. Here’s a passage from my earlier reflections on this ‘breaking step’ moment in energy policy:

“Amidst AI hype and tech glamour stocks, savvy investors are looking beyond semiconductors to companies building and powering data centers. I track about 25 companies benefiting from this new spending, including Canadian names like Cameco, WSP Global, Brookfield Infrastructure, Hammond Power Solutions, and Atkinsrealis Group.”

I’ve already taken positions in some of these names, and it seems new announcements about nuclear energy projects are springing up like mushrooms. But this got me thinking—are we falling into the same trap of overhyped expectations as we did with green energy in 2020?

Even if nuclear power plants are permitted and fast-tracked, it will take many years for them to be built and to start contributing significantly to the grid. So, what will power the explosive growth of artificial intelligence (AI) driven demand until then? It won’t be solar or wind—AI needs baseload energy, and intermittent renewables just can’t provide that stability. Coal seems out of the question, especially with ESG sentiment still strong. That leaves us with natural gas, specifically cogeneration power plants, as the most likely bridge fuel.

Natural Gas: The Bridge Fuel for the AI Era

Just as coal was pushed down in price in 2020, natural gas prices have tumbled in recent years. A decade of fracking has turned the U.S. into a gas powerhouse, with ample supply to meet growing demand. Meanwhile, Canada’s Montney Formation holds tremendous long-term reserves of natural gas, positioning North America as a critical player in the global energy market.

YCharts.com © 2024 YCharts, Inc. All rights reserved

Despite this potential, Prime Minister Justin Trudeau famously downplayed the prospect of liquefied natural gas (LNG) exports when German Chancellor Olaf Scholz visited in 2022, dismissing the opportunity as not economically viable at the time. But reality paints a different picture. LNG continues to see massive global growth, driven by countries seeking to secure energy stability as they transition away from coal and prepare for the future. Now, with AI and data centres demanding more energy, the need for scalable, reliable fuel sources like LNG is set to expand even further.

Opportunities for Investors: Nuclear for the Long-Term, Natural Gas for the Short-Term

Investors actually have two opportunities: a long-term solution in nuclear power and a short-term solution in natural gas. Unlike the current hype surrounding nuclear names, natural gas stocks continue to trade at relatively depressed prices, offering a compelling value proposition. If coal is to see a peak in demand within the next five years, it’s more likely to be driven by the expansion of LNG than by nuclear energy projects still years away from completion.

For investors with steady hands, holding onto Canadian natural gas producers could prove to be as rewarding as coal was for those who didn’t follow the herd in 2020. With growing demand from AI-driven data centers and global energy needs, natural gas might just be the bridge fuel that powers this transition period—and delivers outsized returns to those patient enough to ride the wave.

Lessons Learned

One of the benefits of our 26 years in the industry brings is a refined pattern recognition that helps us navigate both opportunity and hype. While I don’t believe the nuclear renaissance is just another hype cycle, that doesn’t mean we should pursue it to the exclusion of cheaper, more immediate alternatives. Both the long-term case for nuclear and the short-term case for gas-fired cogeneration are clear—but, as with most things in life, timing will be key to success. We’re on it.

Watch the Video: Coal, Natural Gas, and Nuclear Power’s Renaissance

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen