The Strange Power of Math in Explaining the Universe

Nobel Prize-winning physicist Eugene Wigner understood the complexities of math but was baffled by its ‘unreasonable’ effectiveness in explaining natural phenomena like motion and electricity. Why would calculus and geometry, created solely in the human mind, so effectively explain the physical world which exists independent of human thought?

The miracle of the appropriateness of the language of mathematics for the formulation of the laws of physics is a wonderful gift which we neither understand nor deserve. Eugene Wigner

C.S. Lewis Offers a Different View

Not everyone was as mystified as Wigner. C.S. Lewis, for instance, considered this alignment between math and physical laws to be completely logical. He believed that this underlying order essentially mirrors a rational Creator’s mind.

Economics: Where the Numbers Don’t Add Up

If Wigner was puzzled by physics, he would’ve been equally bewildered by the realm of economics. Remember last year’s dire predictions of an imminent recession? Quite off the mark, to say the least. One can’t help but think Wigner would’ve found this discrepancy rather amusing. Ironically, he would probably be pleased at the “reasonableness” with which economic math fails to adequately describe the economic world!

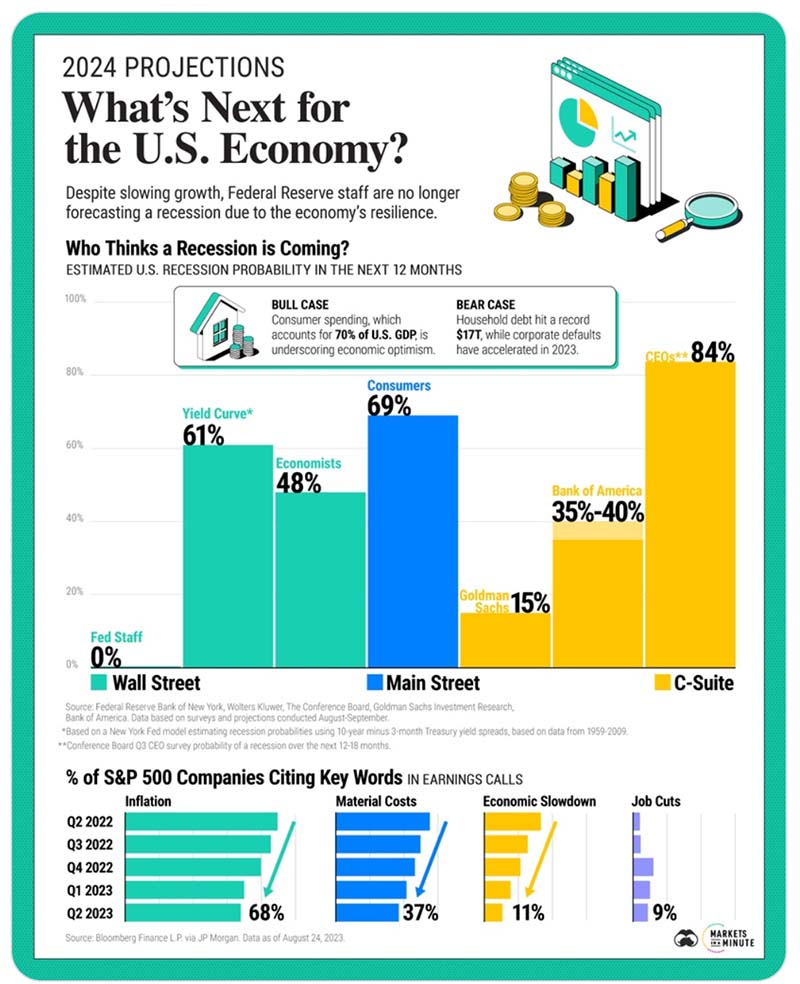

Where Do You Stand on a 2024 Recession?

Have you also been surprised by the economy’s resilience? Many economists have done an about-face, now stating there’s no chance of a recession in the US. However, public opinion remains divided. Take a look at this insightful infographic to see the contrasting views. Where do you stand – are we headed for recession or not?

https://www.visualcapitalist.com/united-states-recession-in-2024-economic-forecasts/

My View: The Real Question Is Pricing, Not Prediction

Personally, I think we’re headed for a recession. Frankly, outside of technology the Canadian and US stock market have been down for the better part of two years. US government bonds have fallen in price the most in history. For me the better question isn’t whether we’ll have a recession, it’s whether the recession has already been priced into assets.

Navigating Financial Uncertainty: An Investor’s Guide

So, what does this mean for investors like you and I? Simply put, uncertainty is a given. If even the brightest minds can’t reliably predict recessions, then our best strategy is to focus on what we can control. Here’s the Good News, we don’t have to predict the future to be successful investors. The nature of investing compensates us for enduring volatility and uncertainty.

When in Doubt, Hold

When faced with uncertainty, the best action is often inaction. Hold your positions. If inaction seems too strenuous, consider it an opportunity to delve into some thoughtful literature, perhaps a C.S. Lewis classic. After all, if experts can’t make sense of the world’s complexities, a little literary escapism might be the next best thing.