Planning

Investment Planning

Investment Planning

Based on your goals and risk tolerance, a financial plan includes an investment strategy that outlines how assets should be allocated among different asset classes (e.g., Cash, Fixed Income, Equities, and Alts) to achieve growth and diversification.

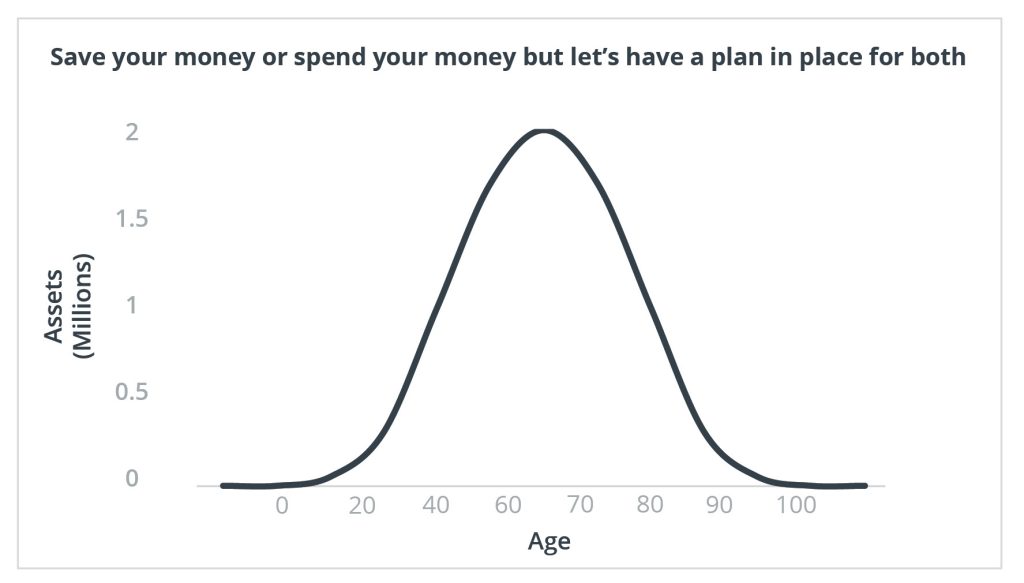

Retirement Planning

Retirement Planning

We help you plan for a comfortable retirement by estimating how much you need to save, recommending retirement

accounts (e.g., RRSP, TSA, RESP, RRIF/LIF), and creating income distribution strategies when you take the next step in life into retirement.

Estate Planning

Estate Planning

Addressing the distribution of assets and the minimization of estate taxes upon the client's passing. It includes the creation of trusts and the designation of beneficiaries.

Tax Planning

Tax Planning

Efficient tax planning is an integral part of financial planning. It involves strategies to minimize tax liabilities while maximizing after-tax returns.

Insurance Planning

Insurance Planning

Assessing the client's insurance needs, including life insurance, health insurance, disability

insurance, and long-term care insurance to ensure adequate coverage and protection.

Cash-Flow Planning

Cash-Flow Planning

Maintaining a balanced cash flow is essential for meeting both short-term and long-term financial goals.

We help clients budget and manage their cash flow effectively.