Path Dependant

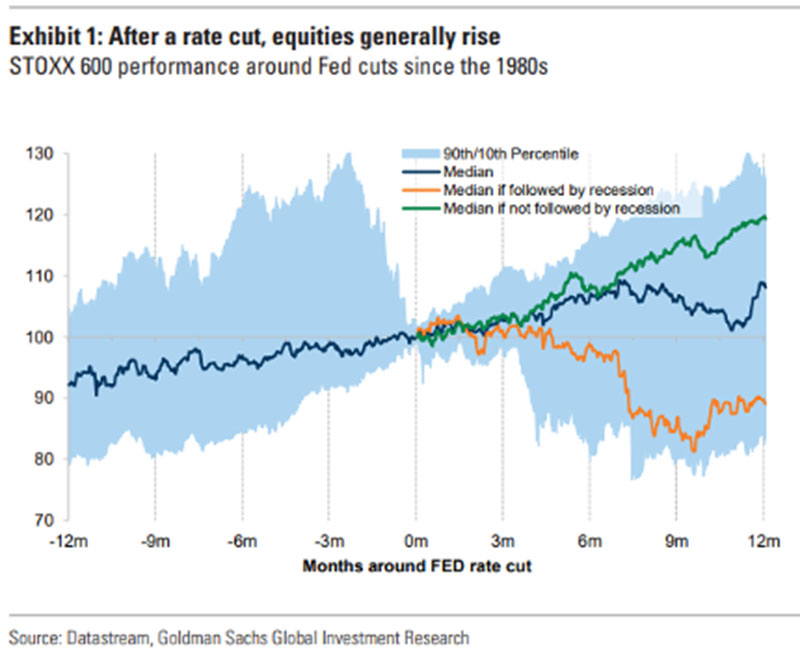

The volatility of the past few weeks marks the return of bad news actually being treated as such by the markets. For a long time, any indication economic malaise was viewed positively as it increased the odds of near-term rate cuts. Now that a Fed cut in September is virtually assured, history would suggest that increasing odds of a recession would not be treated kindly.

As the chart above shows, if we do get a soft-landing post the initial rate cut then markets should behave nicely (at least from a historical perspective). The alternative is more painful, but would also create substantial long-term opportunity along a more volatile path.

Recent price action gives us some level of validation in pushing the risks in overall valuation and concentration in recent months, but more evidence will be needed to claim the era of returns being dominated by a small number of companies has come to a close.

AI’s $600B Question | Sequoia Capital

An article that is more interesting due to the author. Sequoia Capital, a highly reputable (and hard to access) venture firm, is sounding the alarm on AI valuations.

The thesis is one we subscribe to. There will be amazing companies built in the AI boom that will have transformative impact on the world, but (there is always a but) there will be many more losers than winners along the way. The issue is that the market is currently having a very hard time distinguishing the winners from the losers, and ascribing any business loosely associated with AI a premium valuation.

Speculative frenzies are part of technology, and so they are not something to be afraid of. Those who remain level-headed through this moment have the chance to build extremely important companies. But we need to make sure not to believe in the delusion that has now spread from Silicon Valley to the rest of the country, and indeed the world. That delusion says that we’re all going to get rich quick, because AGI is coming tomorrow, and we all need to stockpile the only valuable resource, which is GPUs.

The Roundup: Top Takeaways from Oaktree Conference 2024

We are highly focused on the evolving dynamics of credit markets as the rates appear to be on the verge of their long-discussed decline. There is still a lot to do in these markets, though the window of opportunity feels a lot more narrow than at the beginning of 2022.

Liquid credit instruments currently offer yields in the high single digits, and the yields on private credit are in the low double digits. These yields are highly competitive with the excellent historical returns on equities. These yields also exceed most investors’ required returns and are considerably less uncertain than the returns on equity and other ownership strategies. In other words, they have a high probability of delivering what they promise.

To Hike Prices, Companies Are Refreshing Old Products For New Uses – Bloomberg

Beware the upflation. Shrinkflation seems to have entered most people’s vocabulary at this point, but less are aware of upflation despite likely intuitively recognizing it. This is creating a new use/formula for an old product and charging a material premium. In many cases, the difference from the original just comes down to marketing.

In some cases, shoppers are trading down to cheaper options, like Amazon’s in-house brand, Amazon Basics. Others are buying fewer essential items altogether. To win those people back, companies have come up with a fresh tactic: ‘upflation,’ an attempt to create new applications for things consumers have decided they no longer need as much of — and upcharging for them.

Cause and Effect on a Global Scale

This podcast is filled with anecdotes which highlight how minor and very random events have had unbelievable impact on the current world.

We ignore the invisible pivots. The moments we will never realize were consequential. The near misses and near hits that are unknown to us because we have never seen, and will never see, our alternative possible lives

If you enjoyed this month’s Insights, please feel free to forward and share!