Concentrate

See article number two for a deep dive here. The theme of the big getting bigger absolutely dominates the market at the moment. Historically, these types of trends have ended very poorly indeed. That said, while earnings may not be keeping pace with valuations (i.e. the stocks certainly look pricey), today’s tech giants are certainly growing faster than almost anyone imagined companies of that scale ever could.

Acquired: Starbucks

Howard Schultz shares the full story of Starbucks from his lens. This is a business history classic that is well worth a listen. The most interesting take in our view? That the app, which has undoubtedly driven a lot of business, was a huge error for the company.

I would be more than willing to sacrifice economics to go back and find ways to enhance the experience.

Stock Market Concentration

A somewhat technical piece from Morgan Stanley covering the theme of the day, Stock Market Concentration. It underscores a key point we often discuss, that owning the index works really well when concentration is rising, but a whole lot worse when it is falling. Another reason to keep sharp watch on the tech giants.

Fool’s Errand

A deep dive into the fool’s errand which is trying to predict market crashes. You can certainly have a view on future returns from current valuations. There is somewhat simplistic but of often accurate reasoning that the higher valuations are currently, the lower returns will be over the coming years.

That said, predicting the month, or even the year of a market collapse is simply not possible.

Here’s the bottom line: the Black Monday collapse had no definitive (or even clear) trigger. The market dropped by almost a quarter for no apparent reason. So much for the idea that the stock market is efficient.

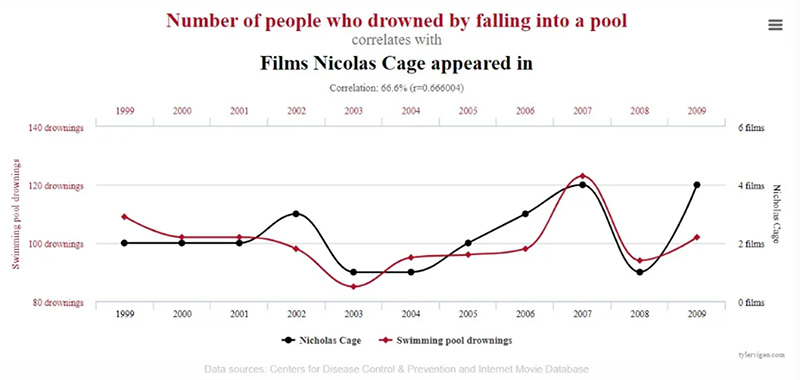

How Not to be Fooled by Viral Charts

This is just so good. If you like data, and specifically pretty pictures that represent that data, and you really don’t like people who ruin those beautiful pictures with misrepresentations, well, this one is for you.

All the classics are included here: not adjusting for inflation, dual axis charts, mean vs. median, spurious correlations…

If you enjoyed this month’s Insights, please feel free to forward and share!