Starting Point

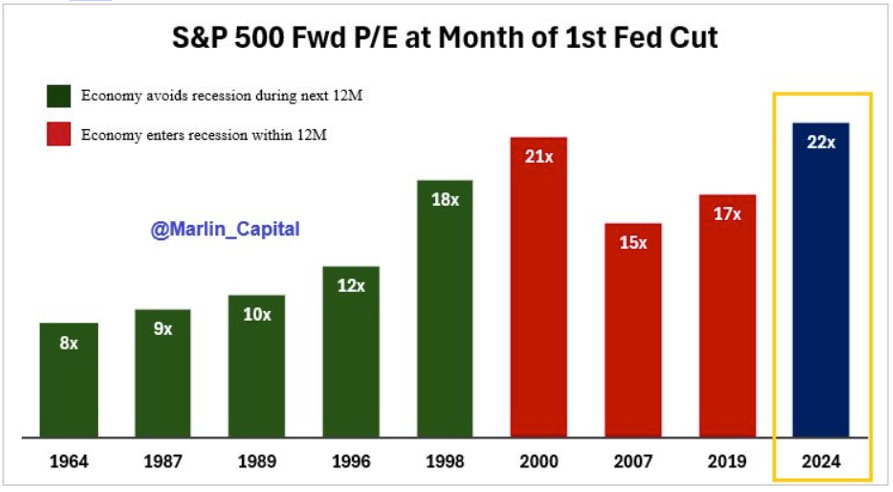

Source: @Marlin_Capital

We have previously discussed the sea change in markets, with rates now declining across most developed markets. This particular topic is, in our opinion, the most important thing for investors to focus on at the moment.

Given the highest starting valuations in modern history, the potential downside risk is material should economic data disappoint. If a recession can be avoided, markets generally perform very well into a cutting cycle. Unfortunately, the inverse is also true.

Founder Mode

An excellent talk by Brian Chesky made the rounds last month, and Paul Graham’s dissection is well worth reading. We can personally attest to the thesis, as we have seen it play out with many founders and entrepreneurs over the years.

Hire good people and give them room to do their jobs. Sounds great when it’s described that way, doesn’t it? Except in practice, judging from the report of founder after founder, what this often turns out to mean is: hire professional fakers and let them drive the company into the ground.

Shall We Repeal the Laws of Economics?

In our opinion, this is one of the best pieces ever released by Howard Marks. This exploration of second order impacts from government policies is well worth a listen. It is a fair and balanced take on the intersection between political promises and economic reality.

There is no free lunch in economics, despite candidates’ assertions to the contrary.

Runnin’ Down a Dream

A 2018 talk by Bill Gurly that has stood the test of time.

Everybody has the will to win, people don’t have the will to practice

Are We Too Impatient to Be Intelligent?

This is a wide-ranging piece exploring the costs of efficiency and our perception of time. The fundamental question being posed is whether some things are better when they move just a bit slower.

There are things in life where the value is precisely in the inefficiency, in the time spent, in the pain endured, in the effort you have to invest.

John Bragg: The Blueberry Billionaire

It was most definitely a necessity to highlight the typically-low-profile John Bragg. The most successful Canadian you may not have heard of, a Maritime legend, and businessman we can all learn from.

Stick to your knitting, do what you can do, and try and grow it…don’t try and do everything, so many people fail by getting successful and then thinking they can do anything.

Gallant MacDonald designs bespoke investment programs for a select group of institutions and families who have made significant contributions to business, public service, and philanthropy.

If you enjoyed this month’s Insights, please feel free to reach out, subscribe, or share!