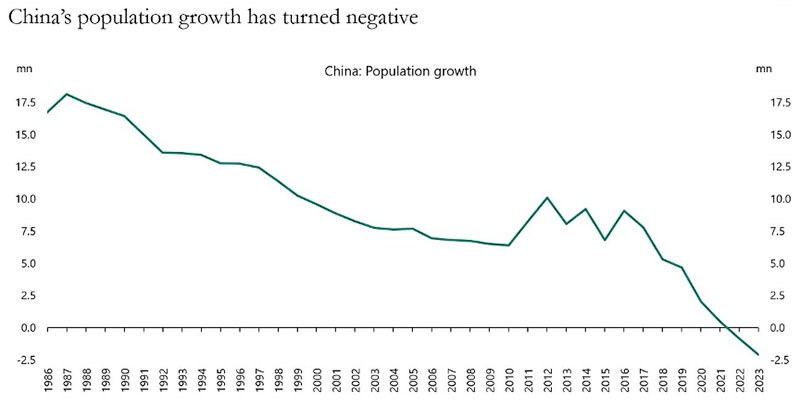

Demographics = Destiny

There is much discussion of the slowdown in China, with many pointing at the overinvestment in the housing market, debt, and a variety of other well documented issues. All economies are multi-faceted, so at the risk of oversimplification, we would highlight population growth as the overarching long-term issue. When your population is declining, you effectively start each year with negative GDP growth that needs to be overcome. That makes showing robust economic performance a tall order.

The End of Fabulous Money Market Rates is Near

We are now three rate cuts deep in Canada, with near certainty that the US follows in September with multiple cuts before the end of the year. The question for many investors is now what to do with funds that were sitting in money market vehicles and GICs. Earning north of 5% without risk sounds like a good deal, even accounting for the harsh tax impact of interest income. When that number starts edging below inflation on an after-tax basis the equation undoubtedly changes. At Gallant MacDonald, we will be keeping a close eye on flows between asset classes as a driver of opportunities.

Stephen Schwarzman, Academy Class of 1999

A very interesting older interview with Stephen Schwarzman. The Blackstone Group had considered starting with a $50M raise, and instead set the audacious goal of raising $1 billion (in 1985!). That early decision set the firm on the path to the behemoth asset manager that exists today.

Neither my partner nor I had done a leveraged buyout, which one might think would be a liability when raising money

Start-up failures rise 60%

The hangover from the massive deal sizes and sky-high valuations in venture through 2020 and 2021 continues apace. Unfortunately, the pace of normalization is proving to be slow given the sheer amount of capital deployed in that period.

Only 9 per cent of venture funds raised in 2021 have returned any capital to their ultimate investors, according to Carta. By comparison, a quarter of 2017 funds had returned capital by the same stage.

Home Insurance is a Really Big Problem

A very interesting piece tackling housing issues from the angle of home insurance. It is less of a problem in Canada at this point, but even here coastal regions are facing the prospect of becoming uninsurable.

Florida, California, and Louisiana all have had home insurers simply leave the market. But the problem is people like those states. California, Florida, Georgia, North Carolina, Texas, and Washington accounted for 53% of the country’s population growth between 2010 and 2020. Insurers don’t want to be there.

Gallant MacDonald designs bespoke investment programs for a select group of institutions and families who have made significant contributions to business, public service, and philanthropy.

If you enjoyed this month’s Insights, please feel free to reach out, subscribe, or share!