Investing in a Corporation

- February 23, 2024

For business owners or incorporated practitioners that generate surplus funds not required to meet personal lifestyle needs or the needs of the business or practice, the question becomes how to maximize the value of these funds? As personal marginal tax rates can be significant, does it make sense to simply invest the surplus funds within the corporation? For the purposes of this article the term “corporation” is used to refer to a Canadian-controlled private corporation (CCPC).

Passive Investment Income

Investment income earned within a corporation that is not directly related to active business operations is considered passive investment income (investment income).

Investment income can be grouped into the following categories:

Tax on Investment Income

Corporations are not subject to graduated tax rates, thus investment income is taxed at a fixed rate depending on the nature of the investment income reported.

Investment income, except for taxable Canadian dividends, is subject to a federal tax rate of 38.67%. A portion of the federal tax (30.67%) is refundable and is added to the corporation’s two respective Refundable Dividend Tax on Hand (RDTOH) accounts.

Taxable Canadian dividends are subject to a 38.33% refundable tax rate and the entire amount is added to the corporation’s RDTOH accounts.

In both instances, the refundable tax is “refunded” when taxable dividends are paid by the corporation to its shareholders and a dividend refund is claimed.

Concept of Integration

The goal of integration is to remove any tax preference between earning income personally, and earning income in a corporation and then paying it out to an individual via salary or dividends.

RDTOH Accounts

The refundable portion of tax paid on passive investment income is added to the corporation’s two RDTOH accounts, namely Eligible RDTOH (ERDTOH) and Non-eligible RDTOH (NERDTOH).

- ERDTOH tracks refundable taxes paid on eligible dividends received from corporations that are not connected (portfolio investments), as well as eligible dividends received from connected corporations to the extent the dividends triggered a dividend refund from the payor corporation’s ERDTOH account. A dividend refund of 38.33% of the taxable dividend can be claimed against a positive ERDTOH account balance upon the payment of eligible dividends to shareholders, and

- NERDTOH tracks refundable taxes generated on all other passive investment income earned. A dividend refund of the NERDTOH can be claimed upon payment of non-eligible dividends at a rate of 38.33% of the dividend amount to the extent there is a positive NERDTOH account balance. In the instance there is an insufficient NERDTOH account balance, but a positive ERDTOH balance exists, the ERDTOH can be utilized to obtain a dividend refund on a non-eligible dividend.

Capital Dividend Account (CDA)

Another corporate tax account that business owners should be acquainted with is the Capital Dividend Account (CDA). The CDA tracks non-taxable receipts, including the 50% portion of capital gains, along with life insurance and capital dividends received. A positive CDA balance can be paid out to shareholders tax-free as a capital dividend. The CDA balance is reduced by 50% of capital losses, and by capital dividends paid out.

Tax Implications by Investment Type

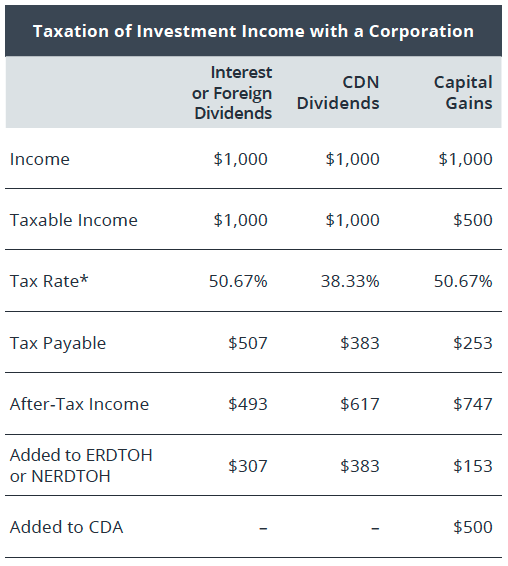

Similar to personal income tax, the tax treatment of investment income varies by type. The table below provides an example of how investment income is taxed in the corporation and recorded in the RDTOH and CDA accounts.

*Assumes provincial/territorial corporate tax rate of 12% applied to interest, dividends and taxable capital gains.

Small Business Deduction Reduction

Active business income (ABI) earned within a corporation is subject to a federal tax of 15%. The small business deduction (SBD) reduces CCPCs’ federal corporate tax rate to 9% on the first $500,000 of ABI.

New rules on investment income earned in the corporation were introduced in 2019. These rules phase-out the SBD for corporations that earn more than $50,000 of passive investment income in the preceding year. The SBD is reduced by $5 for every $1 of passive investment income above $50,000 and is fully eliminated where investment income earned in the preceding year exceeds $150,000.

Business owners who anticipate passive investment income in excess of $50,000 across their corporate structure should discuss strategies to preserve the SBD with their tax and wealth advisors.

Advantage or Disadvantage?

The taxation of investment income within the corporation is designed to eliminate any potential advantage versus investing personally. This aligns with the goal of integration between the corporate and personal income tax regimes.

Integration, however, is rarely perfect. Whether investing in the corporation is advantageous (or disadvantageous) will depend upon several factors, including the personal marginal tax rate of the business owner, corporate tax rates, access to the SBD, net income and the provincial or territorial jurisdiction in which the shareholder and corporation are located.

To see how integration works in your jurisdiction, consult the Wellington-Altus Personal and Corporate Tax Integration Reference Cards.

To discuss whether to invest surplus funds within your corporation or withdraw and invest personally, it is recommended you consult a qualified tax and/or wealth advisor.