Overview

- Office Update

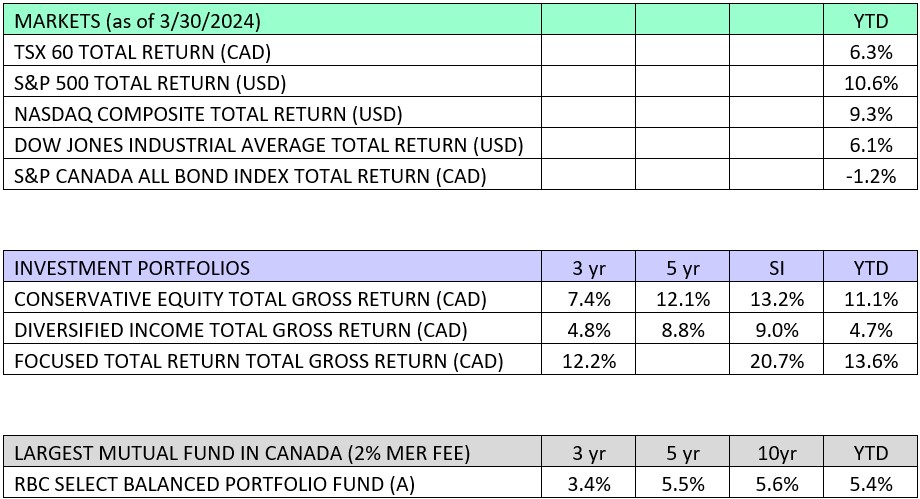

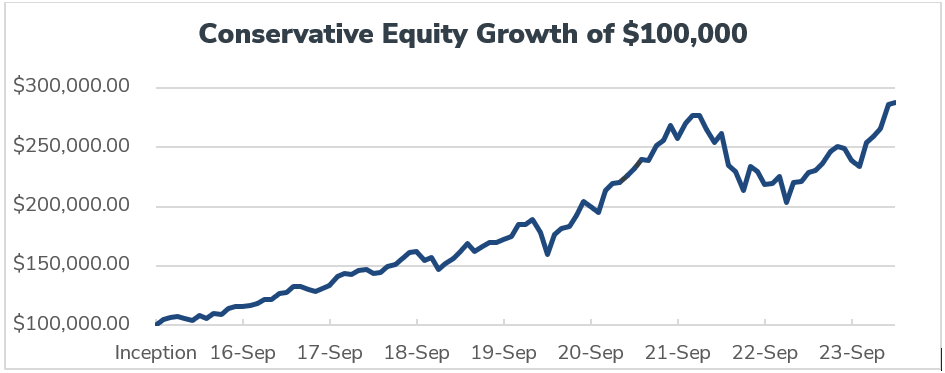

- Portfolio and Market Performance

- Portfolio Update

- Holding Highlight

- Rapid-Fire Earnings

- Market Outlook

Portfolio and Market Performance

Office Update

Mary is spearheading the tax packages. If you need any assistance, please reach out and we will be happy to help.

Just a reminder that we’ll be hosting a client appreciation event on April 18 here at our office. If you have not already RSVP’d, please contact Mary so we know how many people to expect.

Portfolio Update

There were no major changes to the portfolios this month. We are comfortable with the current weights in our models.

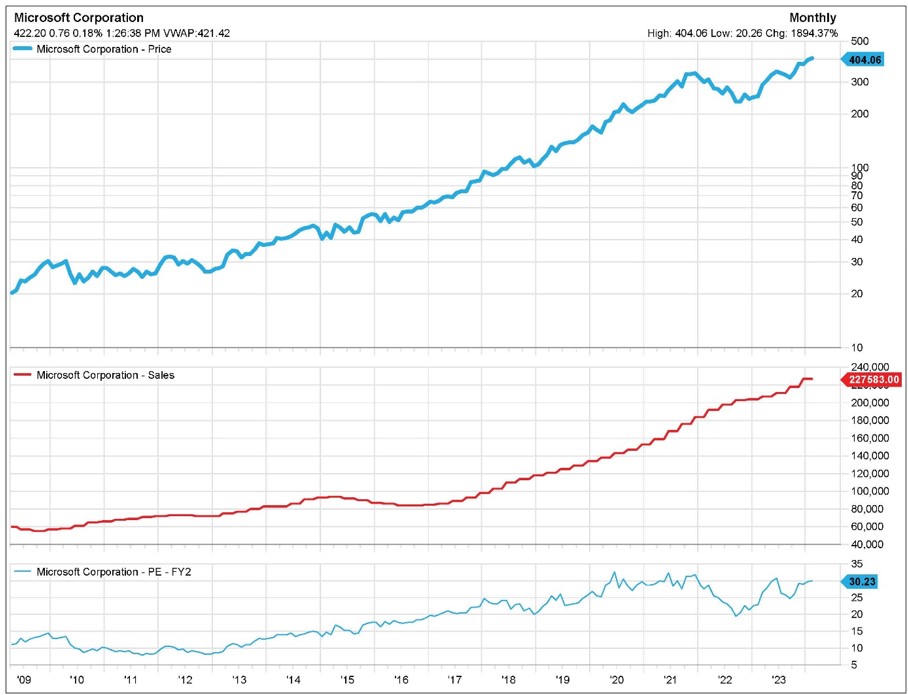

Holding Highlight

Microsoft (MSFT)

We started buying MSFT back in 2011, nearly 12 years ago. At the time, the shares were trading around $25.

History; MSFT peaked in 1999 around $50, then fell by roughly 50% over the next 3 years. For the next 10 years, from 2002 to 2011, the shares traded sideways. In 2011, I read an interesting article in Fortune Magazine that highlighted Steve Ballmer (Microsoft’s CEO at the time) and his horrible track record of acquiring companies and running them to the ground. I believe they used the term “Licking syndrome,” whereby the Windows team that had made the company so successful would interfere in the management of the acquired companies, causing the founders to eventually leave out of frustration. There was nothing they could do – the Windows team were the untouchables. I was curious, so I took some time to look at MSFT’s financials. What I discovered was that their operating software sales had been growing consistently for many years. From 2002 to 2011, they had more than doubled top and bottom line. They had initiated a dividend, then increased it dramatically each year. In 2002, the shares traded for 35X earnings and paid no dividends. By 2011, the shares traded for 10X earnings and paid a dividend of 2.5%.

What we realized was that despite Ballmer and team making a mess of acquisitions, the underlying business was sound, and we could pick it up at a very attractive price. I remember speaking with clients that had been burned in the tech crash. My rationale was that if I was wrong and the stock goes sideways for another 10 years, we would at least collect the growing dividend and the shares would trade for 5X earnings. In any event, I did not see a lot of risk at the time so we started to invest in the company. For the next 3 years, the stock would trade between $20 and $30 based on computer demand and other economic factors. However, the company kept executing from a business perspective, so we continued to hold. In 2014, Sataya Nadella was appointed CEO and the rest is history. Today, the stock trades around $420 per share, almost 20 times what it traded at back in 2011.

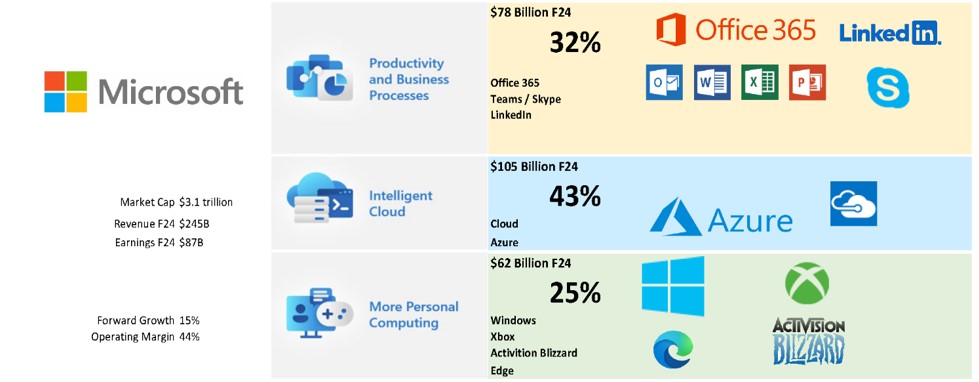

When we bought Microsoft, it sold 2 main products, Windows and Office, each of which were mostly sold along with computers which is fairly cyclical. Today the company sells a very broad range of software as a service with a much more stable subscription revenue model. The company has diversified into a broader range of services where “intelligent cloud” business now represents the largest portion –hosting the files and essentially renting computers to other companies and individuals.

Microsoft recently completed the purchase of Activision Blizzard, which, when combined with their Xbox business, makes them one of the largest video game companies in the world. In short, today Microsoft is far more diversified, has much larger and more predictable revenue and earnings streams, and is probably the best strategically positioned company to profit from advances in Artificial Intelligence (AI).

Rapid-Fire

Apple – A big company is a big target, and Apple will always have people going after how they run their business. Currently, Apple is facing a Department of Justice (DOJ) anti-trust lawsuit. The DOJ complaint makes five major allegations about Apple’s conduct. Prosecutors argue the company blocked “super apps” that could transcend its own applications, suppressed mobile cloud streaming services, excluded cross-platform messaging apps, limited function of third-party smartwatches with Apple devices, and hindered the use of third-party digital wallets.

Adding fuel to the fire: During a 2022 event, Apple’s CEO Tim Cook was asked whether they would make iPhone messaging more compatible with Android. The reporter was complaining that he couldn’t share videos or photos with his mother who was using an Android device. Cook’s response was priceless: buy your mother an iPhone.

Our take: Apple has always been known as a vertically integrated hardware and software company that has a closed architecture. They do this in order to control the user experience and ensure that everything works seamlessly. If you were to open it up and allow outside technologies to run on their platform, it would not be as seamless and would degrade the user experience.

We have to laugh, because we remember when our father was complaining about not receiving videos or pictures from us and we told him to buy an iPhone. He did and now he can see videos of his grandkids.

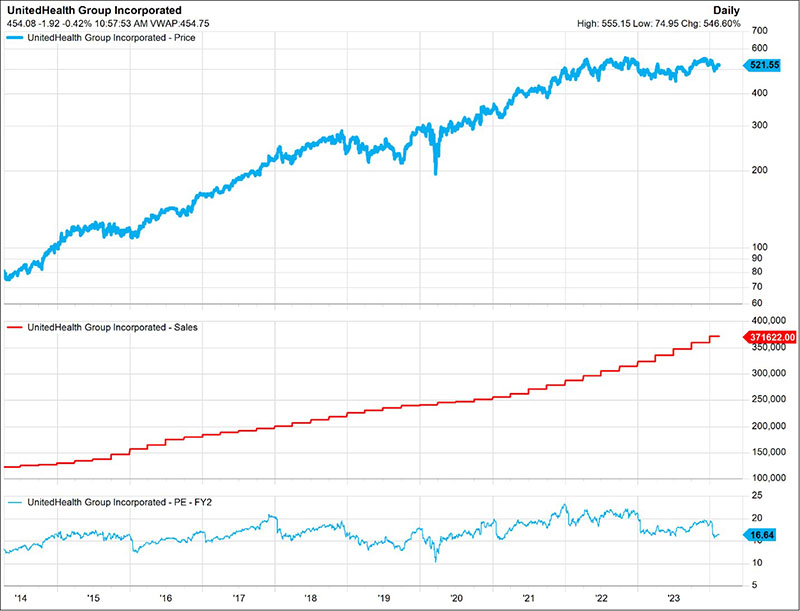

UnitedHealth – UnitedHealth was the victim of a cyberattack. They’re making the news for not only this but as a favourite topic of politicians, who talk about health care costs every election cycle. We pay attention to the numbers, and they look good … some of the best and most consistent revenue growth of any company we’ve ever seen.

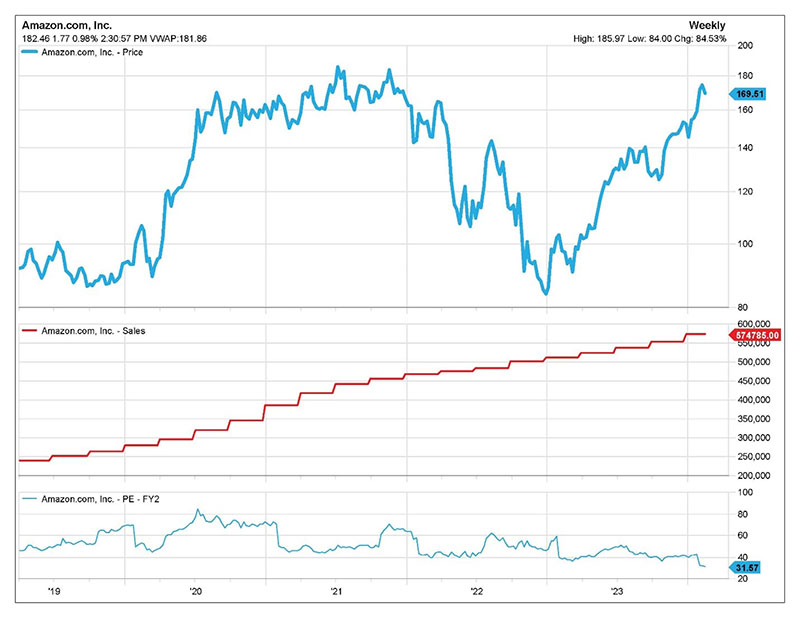

Amazon – Amazon has a stable, conservative business not reflected in the stock price. Amazon is the largest position in our portfolio today at around 8.5%. The stock has been volatile over the past 5 years, trading from $80 per share in early 2019 pre-pandemic to a high of $180 during the pandemic, then falling back to $80 in 2022. Shares are now trading over $180 per share again. But let’s keep it simple. The company has executed very well and their revenue keeps growing. We never sold shares in 2022; we actually added to the position. And now those purchases are starting to pay off.

Here is a simple chart that illustrates the trailing 12-month revenue of Amazon. By looking at the chart, one would never expect the stock price to fluctuate as much as it has. In 2021 we believed that Amazon had pulled forward some future sales and that 2022 would be a flat year, before returning to growth, and it appears that is what has taken place.

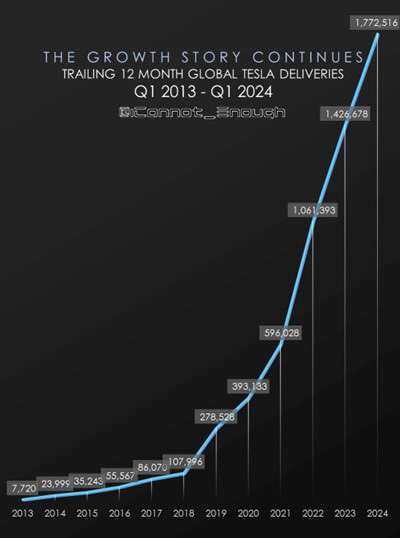

TESLA – Some analysts are missing the forest for the trees – they’re too focused on the short term! True, TESLA’s Q1 delivery numbers were low. They had to temporarily halt most production at their Berlin factory in January due to supply chain issues related to conflicts in the Red Sea. Then last month, an ecoterrorist group took responsibility for setting a local electricity pylon on fire, forcing another shutdown for over 2 weeks. And then there is the tough economic environment in China mixed with high interest rates in North America. Despite all the setbacks, the company is executing extremely well. They are ramping up production of the new model 3 and Cybertruck. FSD V12, which is their latest autonomous software built entirely on Neuro nets, was rolled out to everyone in North America in early April. It is next level, blow-your-mind AI technology! The software was downloaded to my Tesla while my car charged overnight in my garage. The next morning, I demoed it with my kids, driving them to school. Then I had it drive me to the office, where I called down Debbie and Francesco and took them for a drive downtown and through the old port. My car took us there and back flawlessly without interventions.

The speed at which this technology is advancing is phenomenal. My prediction: within 2 years, Tesla will have a fleet of autonomous robotaxis operating in a number of North American cities.

For years we have been hearing the narrative that the competition is coming, and that growth is slowing. The following chart shows otherwise.

Taiwan – A large earthquake recently hit Taiwan and it appears that TSMC has evacuated a few of its manufacturing facilities. Around 90% of the worlds high end chips are currently manufactured in Taiwan so we tracked this story more closely. Currently it looks like there is minimal impact, however this will certainly give even more reason for companies to diversify chip manufacturing going forward, which as we discussed last month should benefit one of our recent portfolio additions ASML.

Market Outlook

We’ve experienced another quarter of continued stable growth, with key themes confirmed. It looks like we’re on track for a soft landing.

We’re still quite bullish on the markets, but we expect a pullback sometime this summer in order to keep the markets healthy. Long term, we feel we are probably in the second inning of this bull market, which should last until the end of the decade. Keep it simple, own quality, and over the next 5-10 years we should do quite well.

~~~

We look forward to seeing many of you at our upcoming office event. Until next time.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Michael Hale, CIM®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045