Overview

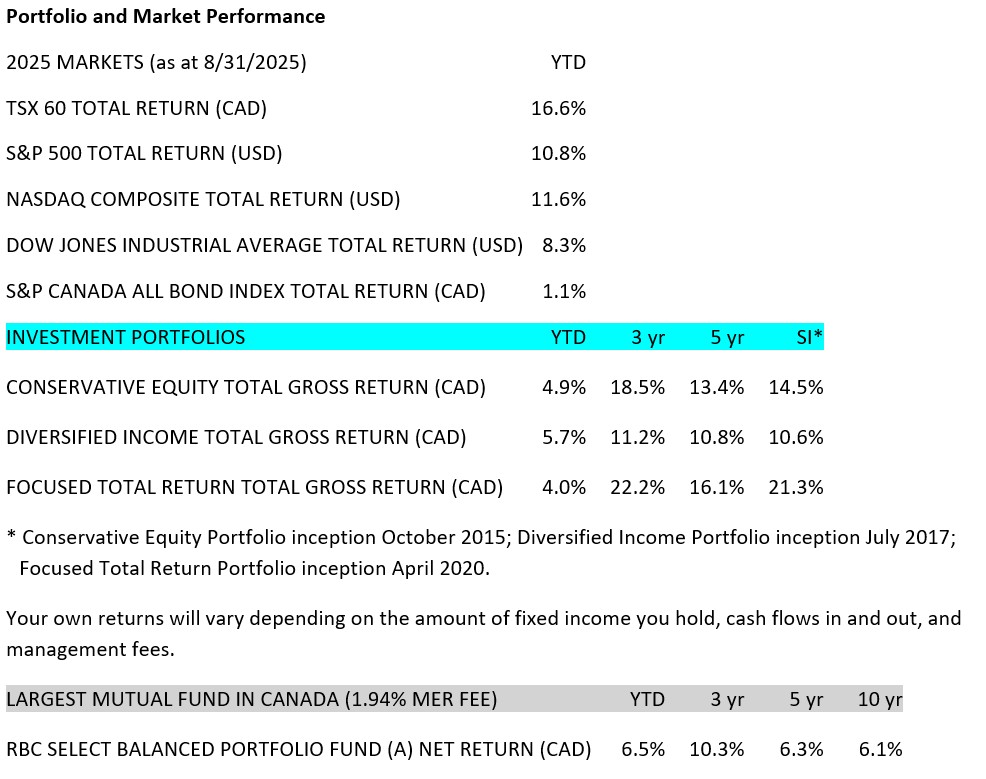

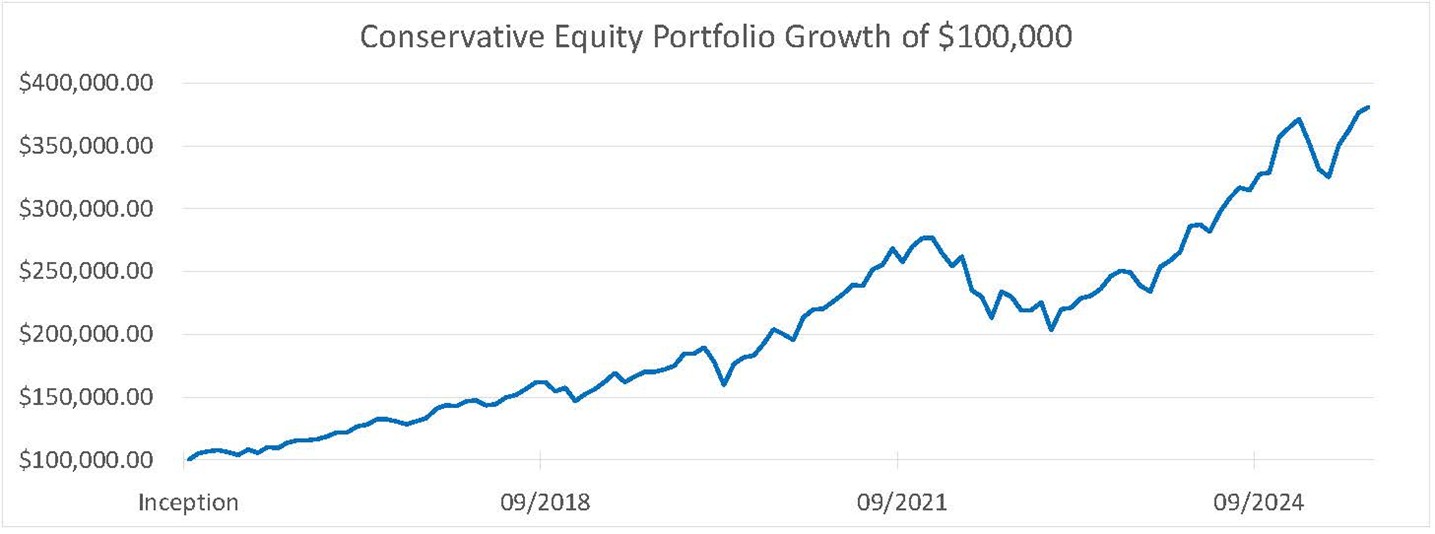

- Portfolio and Market Performance

- Portfolio Update

- Tariffs and Trade

- Interest Rates and Economy

- Rapid-Fire Earnings

- Market Outlook

Portfolio Update

We took some profits on Nvidia as it was becoming too large a position in the portfolio. We still like the company long term but have some discipline in not allowing positions to become too concentrated. Nvidia has a forward P/E of 26 and projected growth rate of over 22% per year, giving it a PEG ratio (PE / Growth) of 1.2, which is not expensive by our analysis.

The issue is that it performed so well over the last few years that it has grown much faster than the overall portfolio. Our job as portfolio managers is to manage risk, hence our trimming some of the profits and moving the proceeds into names that are not as correlated to artificial intelligence (AI) and big tech. We brought the weight down from 13% in the Conservative Equity Portfolio to just under 9% and moved the proceeds to defensive holdings, adding to our position in Canadian National Rail (CNR) and initiating a position in Sunlife (SLF).

Here’s why we are choosing to add the CNR position now.

Canadian National is trading near a 10-year low in terms of valuation, which we feel is cheap for a rail network that will always hold value. Our forward P/E projection is 16, which if the stock stays where it is over the next 12 months would make it the lowest valuation we’ve seen in over 15 years.

Bottom line: We’ve been an investor in CNR on and off over the past 20 years. There are times that it’s loved and other times not so much. We believe that eventually it will return to its historical multiple, once this trade dispute between Canada and the U.S. is sorted out.

That would imply returning to a greater-than-20X multiple within two years. Wall Street’s projections put the stock price at $185–$200 CAD in 24 months or 40%–50% upside from here with much of the downside already baked in.

Meanwhile, we have been investors in SLF for much of the past 20 years. We sold our position at the beginning of the financial crisis in order to reduce life insurance risk and used the proceeds to own companies that would benefit during the government-imposed lockdowns.

Why invest now? SLF trades at 10X forward P/E, which is a roughly 10% discount to historical valuations, has a projected growth rate of 10%, and pays a solid 4.2% Canadian dividend. The company has a history of delivering shareholder value: including dividends, SLF has averaged around a 12% compounded return over the last 5 and 10 years. We are forecasting something of the same over the next 10 years.

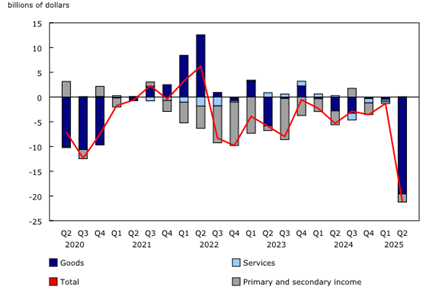

Tariffs and Trade

The two largest factors driving markets through the summer months were tariffs and trade.

Canada is getting hurt far worse than the U.S. with the “elbows up” approach. The reporting from Canadian news media we’ve been reading is that the U.S. is suffering because Canadians are not travelling to the U.S., but what’s not talked about is how Canada is losing out more from Americans not travelling to Canada. In terms of overall dollar value, Canada is losing more than the U.S., and when you put it in terms of overall spending per GDP, it’s much worse, as the U.S. economy is 13X larger than the Canadian economy and their GDP per capita is much higher: Canada GDP per capita is $55,000 versus U.S. GDP per capita at $90,000.

In late July, the U.S. announced a trade deal with the European Union, leaving Canada as the sole major country with no trade deal with the U.S. Thankfully we are still mostly covered under the United States–Mexico–Canada Agreement (USMCA) trade deal from 2018. The most heavily affected are smaller companies and companies targeted by sector-specific tariffs like steel and copper.

Our government continues to try to engage with the U.S. but seems to be taking a slow, drawn-out approach, which we fear may be having a more detrimental impact to our economy.

It is still very difficult to get a clear picture on the longer-term impacts, where things will land, and how the U.S., Canadian, and world economies are being affected. So far, the effects have been less than feared.

The challenge is that many people and businesses had purchased reserves before the tariff deadlines, so we won’t know the full effects for another couple of quarters.

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/250828/cg-a001-eng.htm

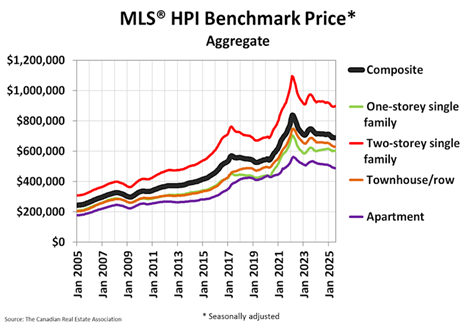

Interest Rates and Economy

Interest rate policy has been in question south of the border and has been having a large effect on markets.

Bond yields and lending rates continue to decline, which is helping to stimulate the weakening economy and support home prices. Cheaper capital also spells higher valuations for growth companies, which is generally positive for our portfolios.

Source: https://stats.crea.ca/en-CA/

There has been considerable debate around U.S. central bank policy and even some contention around whether or not there has been political motivations to their policy. We see a lot of people with strong opinions and little to no economic experience or knowledge. The truth is we never fully see the effects of central bank policy until many years later. No one knows with any amount of certainty where the economy will be 12 months from now.

For now, the bond market’s assumptions of the future continue to push equity valuations up and down. Longer term, we see lower lending rates to be supportive of the market and our economy.

Rapid-Fire Earnings

Nvidia – Revenue is up 56% from last year. They are projecting more growth in graphics processing unit (GPU) sales. This is not a forecast–these are orders on the book. Nvidia’s physical AI and robotics could be an interesting growth area in the coming years.

RY – Royal Bank of Canada showed an unusual 6% increase in stock on their earnings announcement. They had lower loan losses than expected as the economy proved more resilient than anticipated. The quality of their assets is standing out as the economy comes under more stress.

Google – Beat earnings and revenue expectations. Search and ad revenue continues to do well. We were expecting it to fall because of AI large language models (LLMs) but it has not. We were too early on our trim.

Amazon – AWS is thriving. They had another great quarter, beating all estimates. The business is running incrediby well, but the market is concerned over AI cloud growth being slower than smaller competitors. Amazon Web Services slipped from a 31% market share to a 30% market share of a larger pie, which is still a good situation in our eyes.

Brookfield – Brookfield inked the largest clean energy agreement ever in July for US$3 billion to bring hydroelectricity to Pennsylvania for 20 years. The company is doing great in all areas. Shares of the parent Brookfield Corp. split 3 for 2 in early September.

Market Outlook

Wellington-Altus forecasts the S&P 500 at 7,000 by end of year and 15,000 by 2030.

~~~

Have a super month and we’ll see you in October.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager,

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor,

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045