Overview

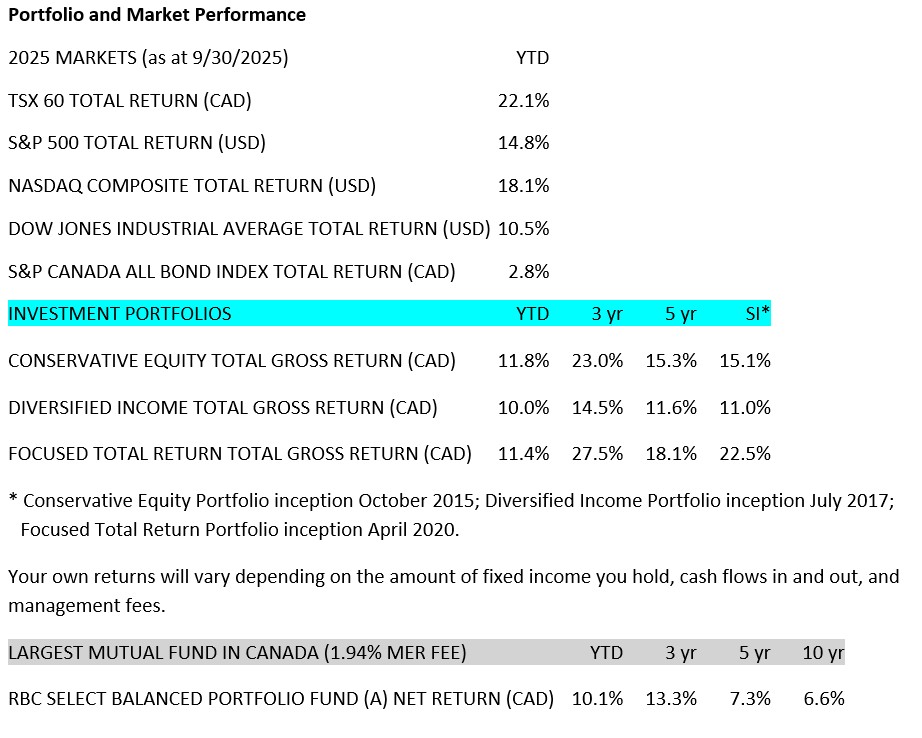

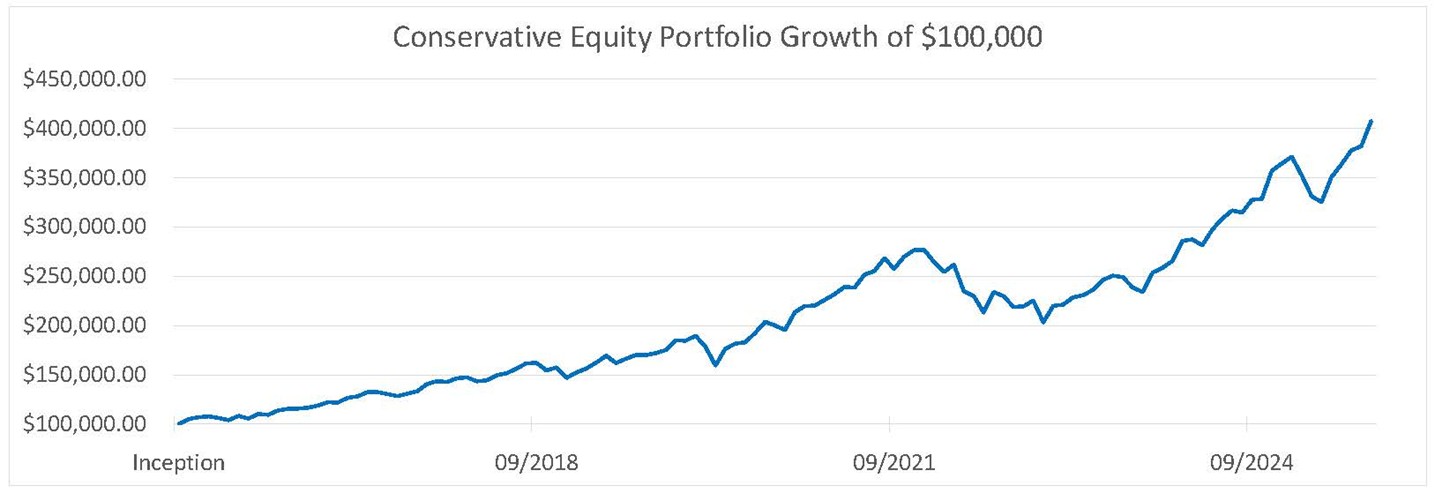

- Portfolio and Market Performance

- Portfolio Update

- Company Updates

- State of the Economy

- Market Outlook

Portfolio Update

In the month of September, we again trimmed a small amount of our Tesla position, at $440 USD, as the position was over 10 per cent of the overall portfolio. We reinvested the capital into Eli Lilly and started a small position in Oracle.

We continue to have high conviction long term in Tesla, but we must maintain a disciplined approach to our asset allocation and will sometimes need to trim when a name breaches 10 per cent of the overall portfolio. We did the same with Nvidia last month, and remain positive on that name as well. We think there is a very large runway for these companies over the next five years. We really think the market is underestimating their growth trajectory.

Eli Lilly sidestepped some of risks we were worried about in the pharma segment as their $50 billion USD commitment to build U.S. manufacturing facilities has exempted them from pharmaceutical tariffs as well as some price pressures. We also have more certainty in the name because of recent concessions from drug companies on pricing. Case in point: U.S. President Donald Trump and Pfizer made concessions recently that affect the entire big pharma landscape. Pfizer committed to bringing their U.S. pricing in line with the rest of the world, ending a long-term policy whereby the U.S. paid the highest drug prices in the world while smaller economies received lower pricing. These are both positive developments for Eli Lilly.

We initiated a small position in Oracle. We’ve been discussing a purchase of Oracle for almost two years now. The company’s movement into artificial intelligence (AI) infrastructure has become more and more significant in terms of investment value. We think that the growth of this company will be much higher over the next five to 10 years than the previous 10 years.

Company Updates

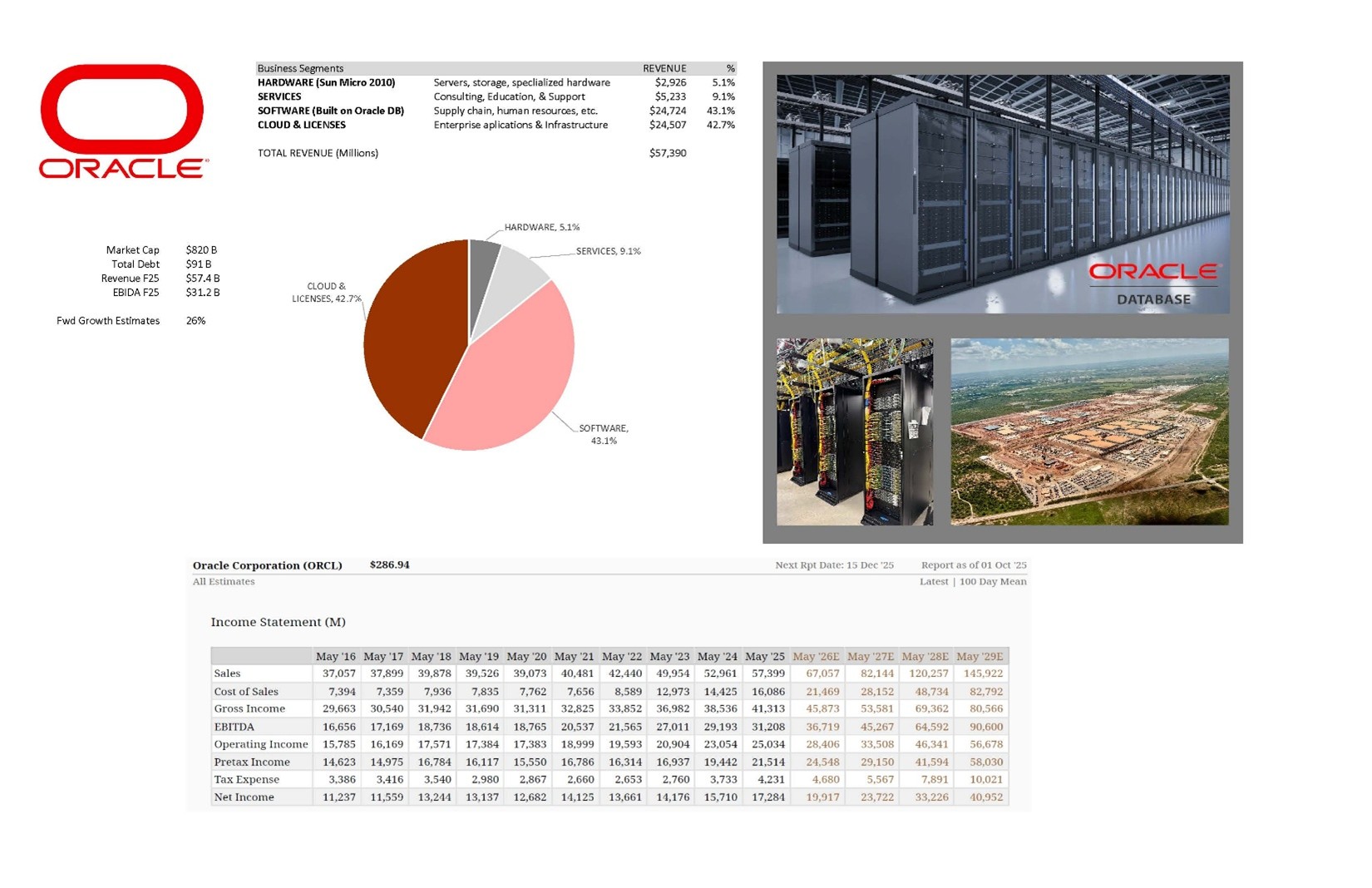

Oracle

So, let us give you a picture of Oracle’s overall business. The current market cap of the company is about $820 billion USD and they have about $91 USD billion in debt. Their revenue for this past year is about $57 billion USD and they did about $31 billion USD in Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). Analysts predict a 26 per cent growth rate per year over the next four years.

Oracle divides their revenue into four segments: Hardware, through their purchase of Sun Microsystems; Services, including consulting, education, and support; Software, through software systems built on the Oracle database, including supply chain management, human resources, and inventory management; and Cloud & Licenses, including AI servers operating their database systems and the licensing of the same. This last segment is the area that represents tremendous growth going forward.

Here are four reasons we decided to invest in Oracle.

- Explosive AI-fueled cloud growth: Oracle Cloud Infrastructure (OCI) is projected to grow 77 per cent to $18 billion USD in fiscal 2026, up from 50 per cent in 2025, with total cloud revenue expected to exceed 40 per cent growth. This positions Oracle as a key player in the AI boom, potentially reaching $144 billion USD in OCI revenue by fiscal 2030 which, if compared to Amazon AWS or Microsoft Azure at 15-20x revenue, could value OCI business at over $2 trillion USD.

- High-profile AI partnerships: Recent mega-deals, including a $30 billion USD cloud agreement with OpenAI for AI data centres and a major expansion with Meta Platforms, highlight Oracle’s role in powering next-generation AI workloads. These partnerships not only boost backlog visibility but also enable cross-selling to enterprises.

- Unique multi-cloud strategy: Unlike competitors locked into single ecosystems, Oracle embeds its high-performance database services natively into AWS, Azure, and Google Cloud, offering flexible, low-latency solutions for AI. Analysts predict this will make OCI the top AI cloud by 2031.

- Strategic TikTok investment: Oracle is a lead investor in TikTok’s U.S. operations under a new framework deal preserving its existing cloud partnership, providing stable revenue from one of the world’s largest social platforms while mitigating geopolitical risks.

https://openai.com/index/stargate-advances-with-partnership-with-oracle/

Nvidia

Nvidia announced their intention to invest $100 billion USD in OpenAI, and invested $5 billion USD in Intel. While there is a lot of talk on the street about circular revenue and comparisons to activity back in 1990/2000 between Cisco and Nortel, when both sought bigger sales numbers by providing financing to buy their products, we believe the Nvidia situation is different. There’s actually a shortage of Nvidia’s goods and with massive cash flow, investing in infrastructure to build what they need makes sense.

Nvidia founder Jensen Wong did a great interview with Bill Gurley and Brad Gerstner on the BG2 podcast where he explains his reasoning for the investment.

https://youtu.be/pE6sw_E9Gh0?si=MPfmJsb1UVO6BaX1*

* The information contained herein includes the opinions of representatives of third-party companies or organizations and does not necessarily reflect that of Wellington-Altus (WA) or its representatives.

They have the cash and believe that OpenAI will be a $10 trillion USD company one day, and that Intel is crucial to U.S. sovereignty and AI independence. Nvidia will be helping Intel become better at making chips through their expertise in supply chain consulting.

State of the Economy

Canadian dollar weakness: The Canada economy is weak. Jobs are leaving to the more business-friendly U.S. where red tape and regulation are easing. Corporate tax rates are also much lower south of the border. Canada needs to take aggressive action now, or else risk further economic loss.

Unemployment in headlines: “Difficult uncertain times, today more than ever, trade uncertainties.” Our governments are preparing us, giving them a good reason to spend spend spend.

Massive deficit: C$68.5B billion this year, says Parliamentary Budget Office.

https://www.youtube.com/shorts/xl5znrWOTtM

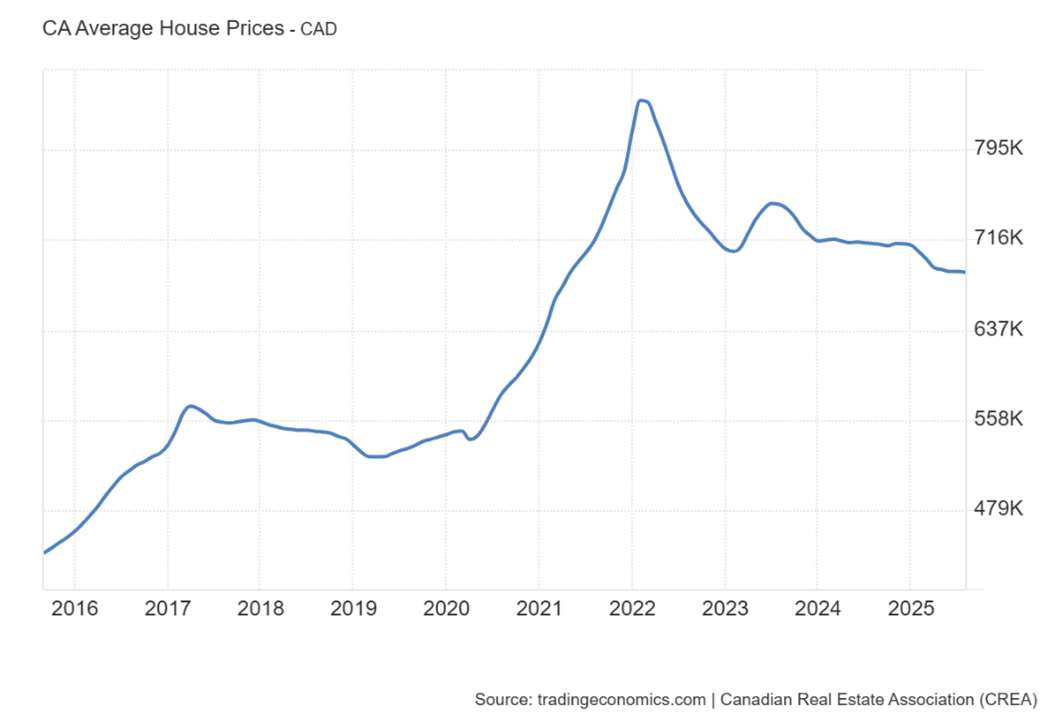

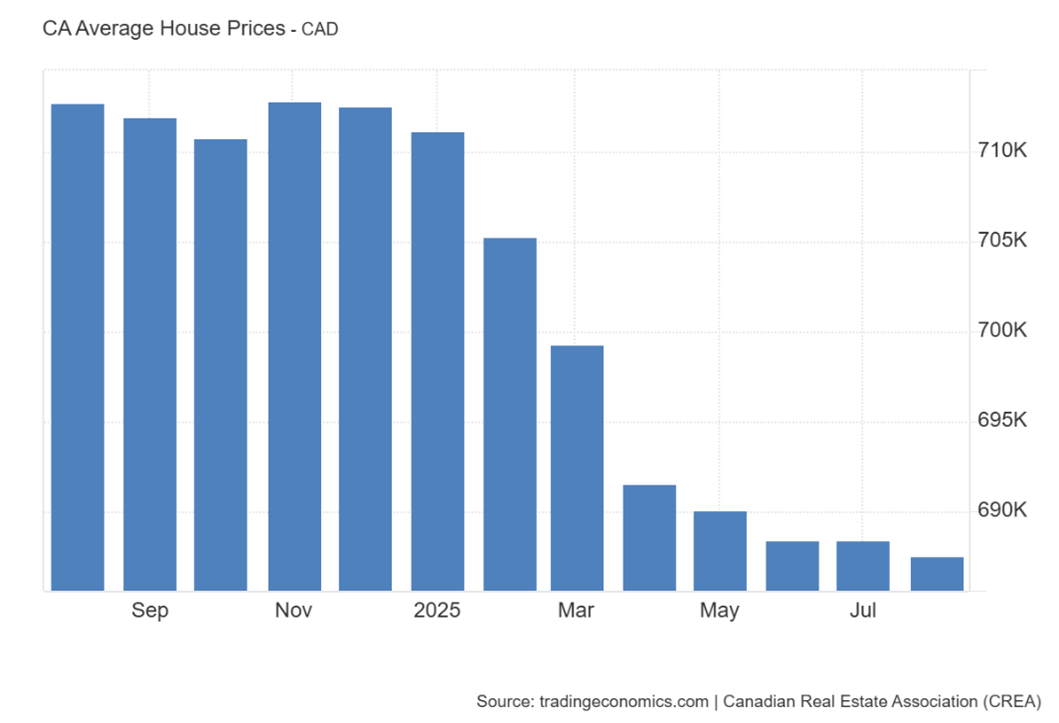

Housing prices versus interest rates: We believe housing prices will continue to be under pressure over the next 12-18 months.

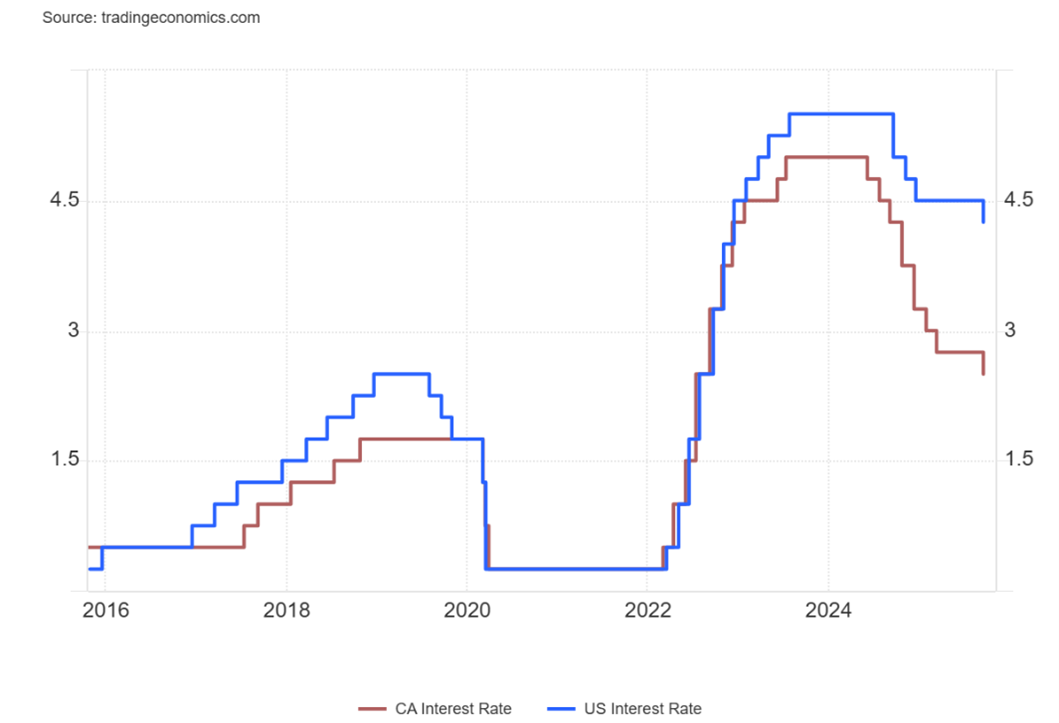

Interest rates: Both Canada and the U.S. have reduced rates a quarter-point, and we expect this to continue, especially in Canada where our economy is weakening fast.

Market Outlook

Our long term outlook on markets has not changed. We are extremely bullish over the next 5-10 years. On the near term, we believe we are in a goldilocks environment with interest rates going down and business activity picking up thanks to increased AI infrastructure spending. Market corrections will come and go on a regular basis. We try to stay focused on what matters long term, owning great businesses with strong economic prospects. Over time, this is how lasting wealth is created.

Ignore the noise.

Happy thanksgiving folks,

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager,

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor,

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045