Overview

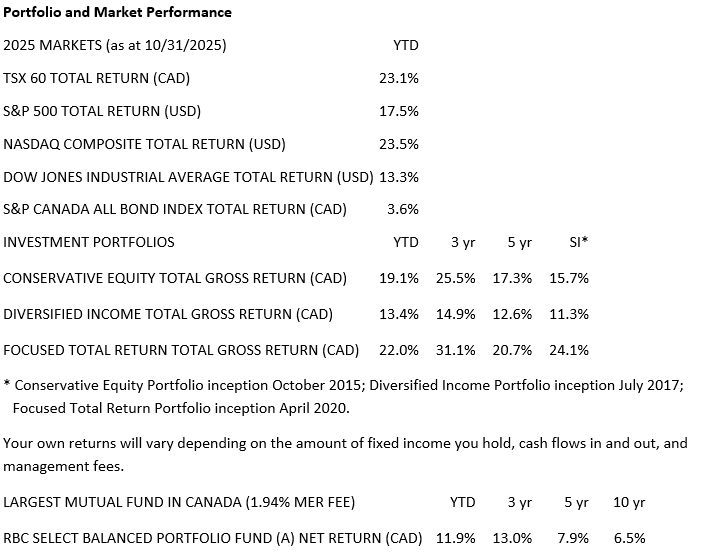

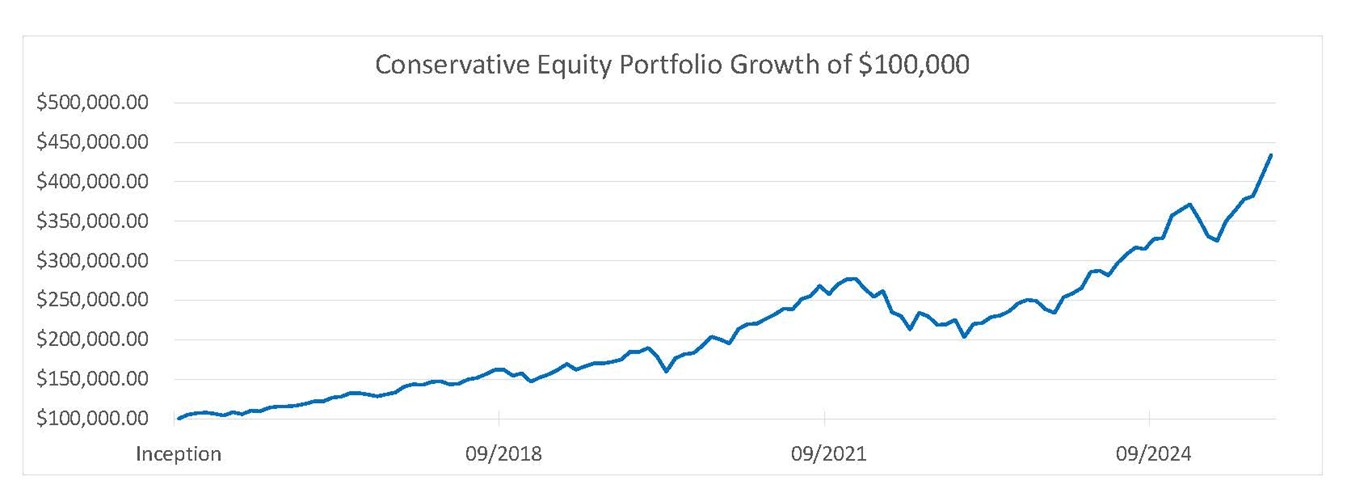

- Portfolio and Market Performance

- Portfolio Update

- Company Updates

- Rapid-Fire Earnings

- Canadian Budget Highlights

- Interest Rates and Economy

- Market Outlook

Portfolio Update

During the month of October, we trimmed our position in Advanced Micro Devices, Inc. (AMD), bringing it down to 4 per cent from 6 per cent. AMD is up over 100 per cent year-to-date and is the best performing equity in our portfolio this year. We still believe it’s a great company, but this enables us to redeploy some of our profits into less volatile names.

With the proceeds, we’ve increased our weighting in Metro, a Quebec grocery chain operator, and Intact Financial, a Quebec-based insurance company. These two companies tend to underperform when markets rise, and perform well when markets decline. These positions add diversification to stabilize the overall portfolio.

We also added slightly to Oracle, taking some profits from Apple, which is trading near all-time highs. We would be willing to add more to our position in Oracle at more favourable prices. Our position is small, now 2 per cent of the portfolio.

Company Updates

Intact Financial

Intact Financial is a Canadian general insurance holding company worth about C$47 billion and has very little debt – about $2 billion. They’ve earned $25 billion this year through their core business and the net income on this is about $2.1 billion.

The stock has a 2 per cent dividend yield. It’s trading at about 15.2x next year’s earnings, which we believe is a fair value, slightly lower than historical.

What’s interesting about Intact is they operate something called a “float.” Basically, they take the money received as premiums and invest it. They have an approximate $27.5 billion float. From the float, some funds are used to insure the insurance (“reinsurance”) against extreme risk such as significant weather events; if done right, even if there was a catastrophic event, Intact and our position in Intact would not suffer abnormally high catastrophic losses.

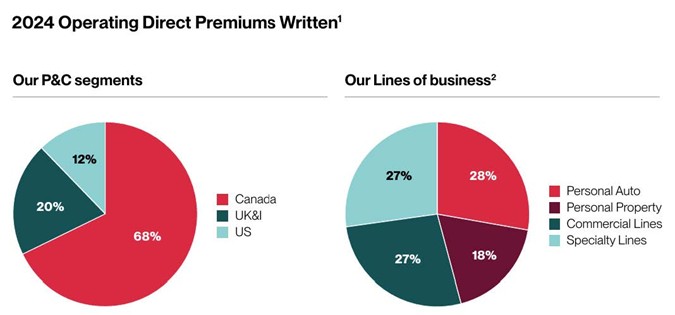

Intact is highly diversified. One-third of the business is outside of Canada, in the form of UK insurance companies and an Australian division. Roughly 28 per cent of their business is personal auto insurance, 18 per cent is home insurance, and 27 per cent is commercial insurance, while other specialty lines comprise another one-quarter of the business. This helps spread the company’s risk.

When we consider a company, we don’t just look for their stock growth; we also look at how and where they earned their income over the last few years and where it’s going to come from in the future. Intact expects 4 per cent growth to come from raising customer premiums, 2 per cent from operating efficiencies, and 4 per cent from strategic capital deployment – buying other insurance companies at a discount, improving them, and increasing operating income.

Over the past 10 years, Intact has proven their ability to execute on their plans. We believe they will continue to do so and that they are likely to generate our desired 10 per cent growth over the next 10 years.

Brookfield Westinghouse Nuclear Deal

On October 28, 2025, the U.S. government announced an $80 billion strategic partnership with Westinghouse Electric Company – owned by Brookfield Asset Management and Cameco Corporation – to accelerate nuclear power development. The deal, led by the Department of Commerce, commits to constructing at least eight new AP1000 reactors across the U.S.

The goals include enhancing energy security, reducing carbon emissions, and creating jobs by deploying mature Westinghouse technology. The reactors will generate reliable base-load power for decades to come.

This is why we’re seeing Brookfield Renewables rallying substantially. It’s the second-best performer in the Conservative Equity Portfolio, behind only AMD.

If because of the contract the value of Westinghouse exceeds $30 billion, the U.S. government, by 2029, would have an option to IPO their portion of shares, which we believe will happen. The next few years should be very interesting.

Rapid-Fire Earnings

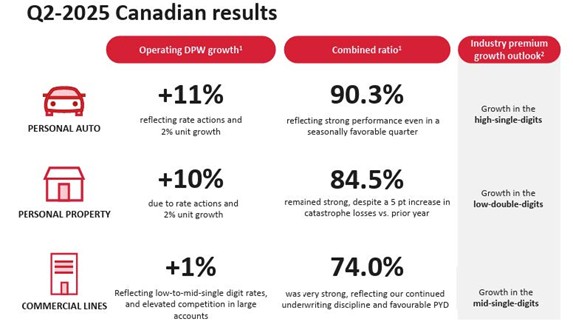

Intact Financial – Premiums increased 6 per cent while underwriting performance was good growing their profit margin by about 10 per cent on policies in the quarter.

Apple – CEO Tim Cook said their new iPhone 17 sales were “off the chart,” reporting 12 per cent revenue growth year–over–year and increasing their forward sales guidance into December.

AMD – Secured huge orders from Oracle and OpenAI this quarter. OpenAI’s purchase of chips alone will double AMD’s total revenue.

Amazon – Amazon Web Services growth is picking up again to 20 per cent and on pace with their growth in 2022. Everyone has been talking about their announcement of 14,000 layoffs but they forget to mention Amazon has 1.5 million employees, so this is less than 1 per cent of their workforce. Amazon’s core business will be enhanced by their investment in AI and robotics and should expand their margins.

CP Rail – Freight volumes improving, carloads up 4 per cent, earnings up 11 per cent. The stock is down because people are concerned about the trade war, but we believe the trade war has bottomed and the stock is starting to trade up.

Google – Over US$100 billion in quarterly revenue – great numbers thanks to AI supercharging everything from search to business tools. They’re ramping up spending to $93 billion next year on data centres, while a $155 billion backlog means customers are planning to use Google’s AI smarts, which could power the next wave of smart apps.

Eli Lilly – Beat expectations with 54 per cent revenue growth since the same quarter last year. Launched weight loss drugs in China, Brazil, and India. Rumours today are that there soon will be an announcement that Medicaid and Medicare will cover GLP-1 drugs for weight loss, with an agreement on a less expensive version.

Microsoft – Microsoft’s cloud hit a whopping US$42 billion, up 22 per cent, with AI tools growing 60 per cent. Microsoft handed back $9.7 billion to shareholders in dividends and buybacks – rewarding investors like a thank-you bonus after strong growth.

Meta (Facebook/Instagram) – 3.5 billion people log in daily across Meta’s apps – that’s nearly half the world scrolling, chatting, or sharing – underscoring Meta’s grip on social life. They’re spending big (US$70+ billion) on AI and the metaverse, like building virtual worlds – CEO Mark Zuckerberg sees it as the next internet revolution, but it’s pricey short term. Stock was punished down 10 per cent the day after Meta announced the increased spending.

Tesla – Record vehicle deliveries worldwide, with sales up 12 per cent. China and Europe sales surged 33 per cent and 25 per cent, respectively. 81 per cent growth in energy storage deployment. Production ready robot prototype to be revealed at the start of 2026 with plans to have a production line capable of making 1 million robots a year by the end of 2026.

Canadian Budget Highlights

The Good

- No surprise tax increases.

- The federal workforce was reduced by 2.6 per cent per year going forward (it has increased by 5 per cent per year for the past 5 years). This will be more attrition than layoffs.

- Reductions in both immigration and temporary resident admissions, reducing strain on housing, healthcare, and education. Reached 6 per cent per year, down to 2 per cent.

- Accelerated depreciation and capital cost expensing – 100 per cent in the first year to match U.S. policy.

- Shadow corporate tax cuts with $60+ billion set aside to give tax breaks to companies that move here or keep factories here.

The Bad

- $80 billion deficit, the largest ever outside of COVID years.

- $1 trillion in “investment” spending over 5 years.

- Manufactured figures and math, quoting of items like the “world uncertainty index” chart, puzling figures.

- Budget using a new figure called “net” debt-to-GDP ratio, saying we have the best in the Group of Seven major economies (G7). By net debt they are counting the Canada Pension Plan and Quebec Pension Plan assets of C$717 billion against our debts but not subtracting the actual pension obligations. No one uses this figure; everyone uses debt-to-GDP.

The Interesting

- $660 million over 5 years to the “Women and Gender Equality” department.

- $533 million over 3 years to maintain and repair small fishing harbours.

- $183 million over 3 years to the Department of Defense to “establish sovereign space launch capability.”

- $150 million additional spending to the CBC to “serve the public and reflect Canadian diversity.”

- $635 million over 3 years to “connect students with work experiences in high-demand sectors.”

Bottom line, if I saw a budget like this for any public company I would be very upset as a shareholder. Spending looks scattershot with no real focus or direction, the executive team is not transparent with the facts, the figures are cooked, and the capital plan has a total lack of discipline. Unfortunately this has become all to comon when it comes to developed countries and so with the bar being extremely low most will not be so critical.

Interest Rates and Economy

Rates have been coming down in the U.S and Canada. Both the U.S. Federal Reserve and the Bank of Canada are saying they’re going to wait and see before making further reductions, and for the U.S. we expect that to happen. However, we believe rates are way too high for the current environment in Canada and hence we are still forecasting another 50 to 100 basis points of rate cuts over the coming year. Canada’s economy is in a bad spot and getting worse. It’s not improving from an economic perspective. In Ontario alone, unemployment is 7.6 per cent.

Market Outlook

Our outlook is bullish. We see the S&P hitting 7,000 this year and 8,500 by the end of next year. While we do expect corrections, we don’t believe there will be one before Christmas. We will maintain our focus on what the investments in our companies will be worth in the next 3 to 5 years, and much less on their worth in the next 12 to 18 months.

~~~

Winter is coming and with that, a lot of snow is expected. We hope you get out and enjoy it!

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager,

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor,

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045