Dear Clients and Friends,

It’s been a busy start to the year here at Hale Investment Group. As we look back on the first month of 2026, we find ourselves navigating a world that feels increasingly like a science fiction novel, yet our focus remains rooted in the same common-sense principles we’ve always held.

.

A Little “Legacy” Self-Driving

Michael started the month up north testing some “legacy” self-driving technology. While we spend a lot of time thinking about the effects of artificial intelligence (AI) and autonomous vehicles, this system was fueled entirely by renewable resources and was remarkably autonomous, though he did have to take control a few times.

You can see the system in action in the photo below. That lead dog is Spirit, a highly trained “Central Processing Dog.” If you look closely, you can see the networking cables connecting the nine tertiary processing dogs behind him.

It was a good reminder that whether you are navigating a snowy trail or a complex stock market, success usually comes down to having a clear lead and a team that pulls in the same direction.

.

.

Performance Update

| 2026 MARKETS (as of 1/31/2026) | YTD | |||

| TSX 60 TOTAL RETURN (CAD) | -0.2% | |||

| S&P 500 TOTAL RETURN (USD) | 1.5% | |||

| NASDAQ COMPOSITE TOTAL RETURN (USD) | 1.0% | |||

| DOW JONES INDUSTRIAL AVERAGE TOTAL RETURN (USD) | 1.8% | |||

| S&P CANADA ALL BOND INDEX TOTAL RETURN (CAD) | 0.6% | |||

| US DOLLAR VS CANADIAN DOLLAR | -1.5% | |||

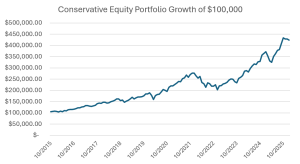

| INVESTMENT PORTFOLIOS | YTD | 3 yr | 5 yr | SI |

| CONSERVATIVE EQUITY TOTAL GROSS RETURN (CAD) | -1.2% | 24.4% | 14.0% | 15.0% |

| DIVERSIFIED INCOME TOTAL GROSS RETURN (CAD) | -1.5% | 13.2% | 9.7% | 10.7% |

| FOCUSED TOTAL RETURN TOTAL GROSS RETURN (CAD) | 1.4% | 30.2% | 18.1% | 22.8% |

| *Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees. | ||||

| LARGEST MUTUAL FUND IN CANADA (1.94% MER FEE) | YTD | 3 yr | 5 yr | 10 yr |

| RBC SELECT BALANCED PORTFOLIO FUND (A) NET RETURN (CAD) | 1.4% | 10.8% | 6.6% | 6.8% |

Our performance for the year has remained relatively flat, largely due to a 1.5% pullback in the U.S. dollar against the Canadian dollar.

Here is the common-sense explanation: Roughly 70% of our portfolio is in U.S.-denominated assets. When the U.S. dollar drops in value, the Canadian value of those holdings drops on paper, even if the companies themselves are doing fine. Conversely, when the U.S. dollar strengthens, it provides a tailwind. We don’t lose sleep over currency fluctuation; it’s just part of the weather.

Portfolio Changes: We did a deep dive into the portfolio this month. To be frank, we couldn’t find anything we wanted to trim or add. We are very happy with our current allocations.

.

Housekeeping

A few quick reminders for the season:

.

The Largest Merger in History

One of the biggest stories this month is the largest merger in history between SpaceX and xAI. The deal puts a US$1 trillion valuation on SpaceX and US$250 billion on xAI, creating a combined giant worth US$1.25 trillion.

Why does a rocket company need an AI company? It sounds crazy until you look at the physics.

If they pull this off, they become the phone carrier, the internet provider, and the AI computer at the same time. It’s a “sci-fi” concept which requires further advances in many fields at the same time and is incredibly ambitious.

Space X currently has an estimated 10,000 communications satellites in orbit and filed an authorization to the Federal Communications Commission for a maximum of 1 million satellites to be launched in the future.

They have already reduced the cost to launch 1 kilogram (kg) to space from about US$50,000 to about US$1,500 since their founding. In the coming years, Space X hopes to reduce the cost even further to between US$200 to $1,000 per kg using their larger Starship reusable rockets, which are the largest rockets ever built at around 7,000 tonnes and the height of a 40-story building.

Along with being the largest it certainly seems like the most ambitious merger in history as well.

.

Rapid Fire Updates

We had a flurry of earnings reports this week. Here is the “Coles Notes” version:

.

Macro Outlook: The Tale of Two Economies

We are currently seeing a divergence between Canada and the U.S., and it reminds us why we diversify.

The “Strict Parent” at the Fed President Trump has nominated Kevin Warsh as the next Federal Reserve chair. Think of him as a “fiscal hawk” or a strict parent. He has historically criticized money printing (which is good for the value of the U.S. dollar) but has stated he believes AI will cause deflation, meaning he might actually cut rates to keep the economy balanced. The markets liked this pick.

Warsh’s nomination was notable this month as it caused a crash in gold and silver prices as well as a strengthening of the U.S. dollar. The bond market is now calling for three more rate cuts from the Fed in 2026 and this may also carry over to bond prices in Canada. Mortgage rates in Canada and the U.S. will likely continue to fall.

Canada vs. the USA Preliminary data suggests Canada may have had negative GDP growth in the fourth quarter of 2025. Our economy is softening, particularly in manufacturing and wholesale trade. Meanwhile, the U.S. economy is chugging along, potentially hitting 5%+ growth in 2026 according to the St. Louis Fed. Official Q4 GDP numbers will be released for both Canada and the U.S. at the end of February. Until then this is all speculation.

While we naturally cheer for our home team, a booming U.S. economy is actually the best thing that could happen to Canada right now. They are our biggest customer. If they are buying, it eventually helps us.

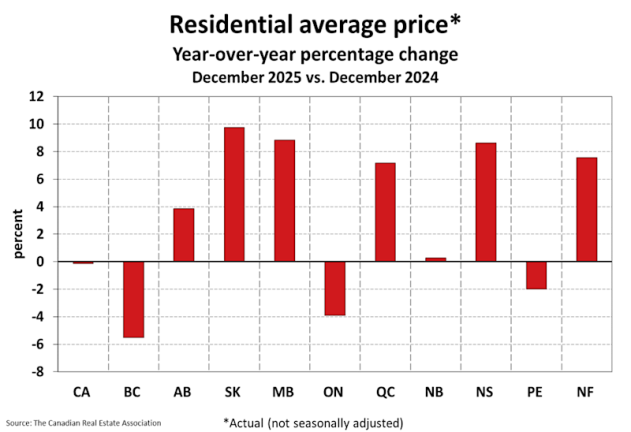

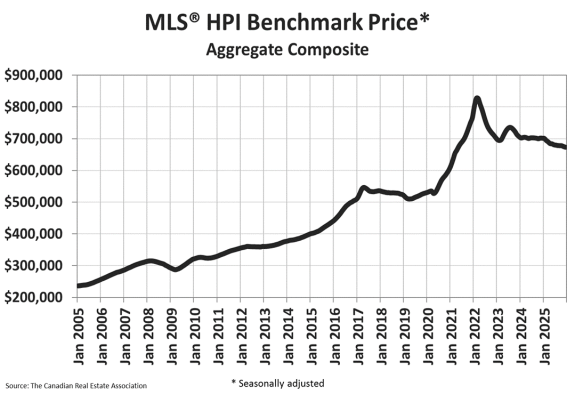

Housing We are seeing a split market. Prices in Ontario and B.C.—the areas that ran up the most—are softening. Meanwhile, markets like Québec and the Maritimes remain stable.

.

.

Looking Ahead

Despite the noise, our outlook remains optimistic. The S&P 500 is flirting with the 7,000 level, and we see a path to 8,000 by year-end.

We have a rare combination of double-digit corporate earnings growth (driven by efficiency and AI) and the potential for falling interest rates. History tells us that is a powerful recipe for returns.

There will be volatility—ups and downs are the price of admission for a healthy market. But as we say back home, there’s no such thing as poor weather, just poor clothing. Our portfolios are dressed for the elements.

Stay warm out there.

.

Sincerely,

The Hale Investment Group