Overview

- Office Update

- Portfolio and Market Performance

- Portfolio Update

- Holdings Highlight

- Rapid-Fire Earnings

- Economy and Market Outlook

Office Update

We had our first annual Wellington-Altus summer staff party last month. Held at the Lake, there were approximately 40 people including family members and other Wellington-Altus employees in Montreal. Everyone had a fabulous time!

Last month, Simon attended the Tesla annual shareholder meeting in Austin, Texas . He had the chance to tour the over one-mile long Gigafactory and walked the Cybertruck production line. It’s amazing to see. He also got to see the construction site of Tesla’s new liquid-cooled AI data centre. It’s now almost complete, and it’s impressive. Once complete, Tesla could have more AI compute power than anyone else in the world.

Tesla Giga Texas drone footage showing AI computer cluster construction with massive cooling fans

Mike is expecting the birth of a baby boy next month, so he’ll be off for a couple of weeks—I’m sure you’ll join us in wishing him and his growing family all the best.

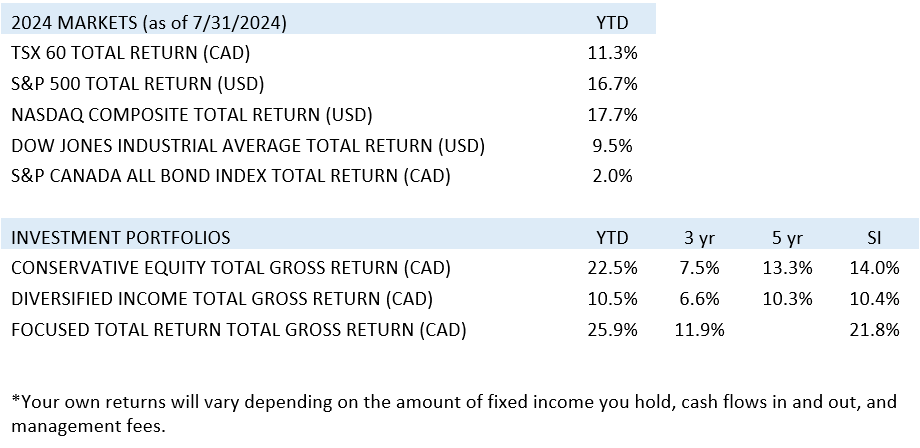

Portfolio and Market Performance

Portfolio Update

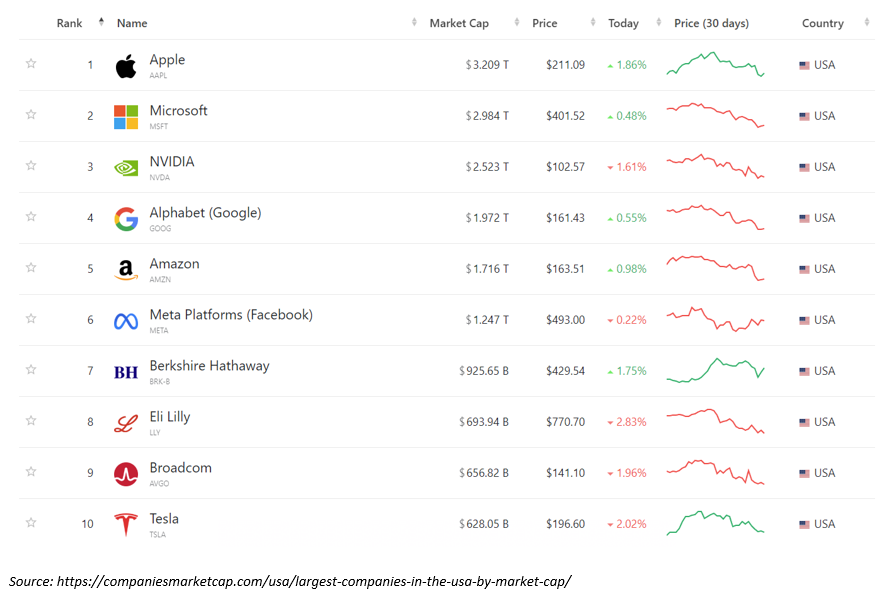

In June we trimmed NVIDIA and used the proceeds to increase our position in Tesla and closed our position in Johnson & Johnson and used the proceeds to increase our position in Eli Lilly. So far, the trades have worked out well.

Company Highlight

Berkshire Hathaway

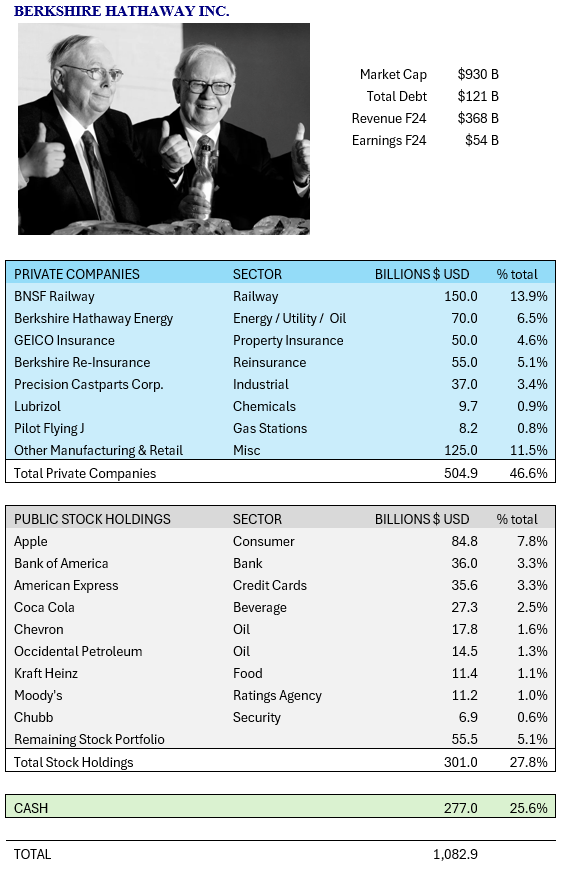

Weighing in at US$930 billion market cap, Berkshire Hathaway (BRK.B) is the seventh largest company in the S&P 500. Interesting to note that we own eight of the top 10 largest and most successful companies in S&P 500.

If you didn’t know any better, you would think that Berkshire Hathaway was just another company/stock in our portfolio of 30 companies. However, Berkshire is actually a holding company for many great American businesses … over 100 in total. Many of these businesses they own outright, and some they take a fractional ownership through shares. However, Warren Buffett, the founder and CEO, would always say that whether Berkshire owns the entire business outright, or fractional shares through the stock market, there is little to no difference in his opinion. A great business is a great business.

Most would credit Warren Buffett for his brilliant investment acumen, however, Warren always gave credit to his former business partner, Charlie Munger, for his brilliant financial architectural skills. Charlie was responsible for the significant growth that Berkshire achieved in its early years by structuring Berkshire as an insurance holding company and using the float to acquire other businesses.

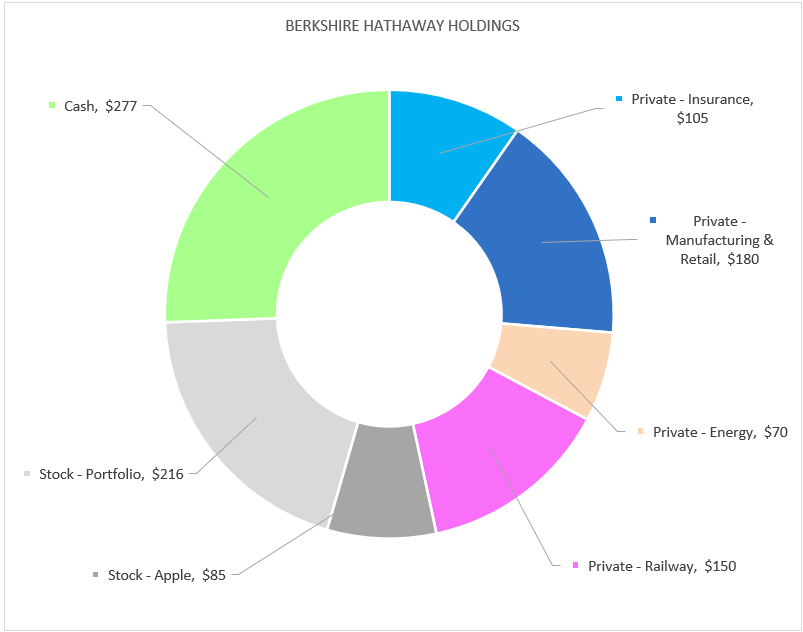

So, let’s take a look under the hood and see what drives profits at Berkshire Hathaway. The following is a very rough estimate of the size of its many different parts;

How has Warren Buffett affected the way we manage investments? No other person has had more influence than Warren, we would say.

Warren’s annual letter has had a profound impact on us. We try to read it each year and for many of the past years we keep a copy of The Essays of Warren Buffet by Lawrence Cunningham close by for casual reading. Great book.

The idea of writing annual letters to our clients actually came from him, and now we try to do it every month.

We also try to be as transparent as possible, to not only discuss what we get right, but also what we got wrong, and to try to always own up to our mistakes. This is a trait we learned from Warren in his annual letters.

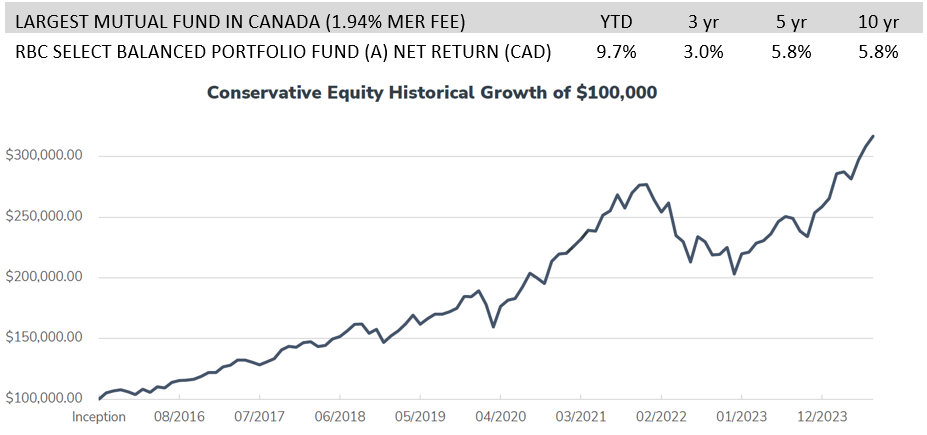

We also post our results with each letter along with the results of the overall market, something Berkshire does every year as well.

You can take a look at it here: https://www.berkshirehathaway.com/letters/2023ltr.pdf.

It’s interesting to see that most of the company’s significant gains were made in the early years, and as Warren would say, the law of large numbers prevents Berkshire from achieving these kinds of results in the future. We are fine with that, as we also know Warren and company will never put Berkshire at risk and will always carry a Fort Knox balance sheet.

In the news—Berkshire Hathaway has been selling its shares in Apple and some in Bank of America. Its stake in Apple went down from US$174 billion at the beginning of the year to around US$84 billion today, having sold around half its position. The company has raised its cash position by about US$100 billion in the last seven months to US$277 billion.

Rapid-Fire Earnings

NFI – A small weight in our portfolio at 1%, NFI is a turnaround story that appears to be on track. We just saw NFI’s first positive earnings quarter in three years, up about 17% since we purchased in May. Operating leverage should be interesting going forward. Bus orders continue to roll in.

Disney – Revenue, earnings, and margins are going up, while debt is going down. Disney beat estimates, entertainment and streaming revenues were better than expected, and the streaming business is finally profitable. We underestimated how competitive the streaming business would be.

Apple – Again, Apple beat expectations and shares were flat. Retail items like iPads sold better than expected. CEO Tim Cook commented that half of iPad buyers were first-time buyers. This points to a growing market, and good retail environment. China was weak. Services provided 45% of profits this quarter. It’s all about installed base.

Amazon – Sales are up US$14 billion from the same quarter last year. Consumer sentiment, however, was low and could be slowing. Great Amazon Web Services numbers including 19% sales growth as was expected. Nothing on AI yet. 43% increase in free cash flow over the same quarter last year as Amazon continues to demonstrate tremendous operating leverage.

Tesla – Tesla Energy did almost a billion dollars in profits. And Tesla has a new mega pack factory in China coming online next year that could produce two to three times as much as their U.S. factory. So that’s potentially US$4 billion in profits from U.S. Mega pack operations, and another US$8-12 billion in China over the next few years. By our estimates, Tesla could do US$12-16 billion in profit just from their energy business by 2027. That’s the total earnings of the entire company over the last 12 months.

Microsoft – Good numbers; annual revenue is up 15% year-over-year and Intelligent Cloud, which is what everyone is looking at, was up 19%. US$34 billion in gross earnings this quarter. OEM growth for Windows of 4% from last year shows that the computer sales cycle may be restarting after the pandemic purchases. The company is trading to perfection: 32x forward price/earnings (P/E) with a 16% growth rate. In our opinion, that’s where it should trade.

ASML Holdings – Beat expectations on both sales and earnings. We are in the early stages of the AI revolution. AI companies are in an arms race for compute power, and ASML has a monopoly on the equipment that makes the AI chips.

Economy and Market Outlook

Upcoming U.S. elections

Remember not to get too emotional over who wins the election. What matters most from an investment perspective is the long-term economic impact of the businesses we own. What was more important to Apple or Berkshire Hathaway over the last 15-20 years—their underlying business, or who was in the White House? Let’s keep that in mind as we enter the U.S. election season. The businesses in our portfolios should continue to grow and be significantly more profitable three to five years from now regardless of who sits in the Oval Office.

Market correction

We see cracks in the economy, especially here in Canada. However, we are very light on Canada and those businesses we do own are not as affected by the Canadian economy.

In the U.S., we believe the effects of high interest rates will have a negative effect in late 2025. The U.S. Federal Reserve is later than many had expected in lowering rates. We remain invested in areas we feel will be less affected by these forces.

Market pullbacks are always blamed on something; however, we view them as normal and simply a process of price discovery. We’ve been calling for a pullback in August and September, and historically these next two months are the most volatile for equities as there isn’t a lot of liquidity in the markets with people off on summer vacation. As usual, we hold through the correction and expect new market highs by year-end.

Again, we reiterate, we believe we are early stages of an AI-driven bull market that should last into the next decade. Expect 5-15% pullbacks every year and even major corrections every couple of years. The mainstream media will continue to hype up fear and doubt, selling a narrative of widespread global market instability. We on the other hand will do our best to stay the course and block out the noise.

For some context, the S&P 500 today is at 5,300; could it drop to 5,000 before going higher? Of course. However, we are targeting 5,800 by year-end and 15,000 by 2030.

~~~

Thanks for reading this month’s report. Have a great end of summer!

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Michael Hale, CIM®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045