Overview

- Office Update

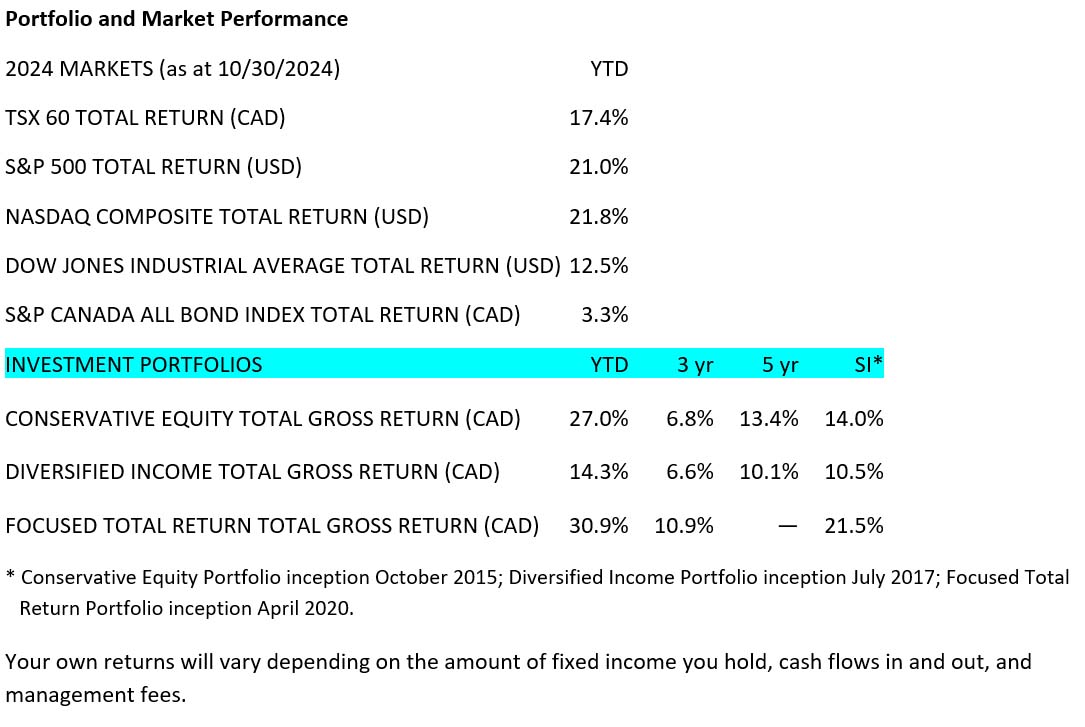

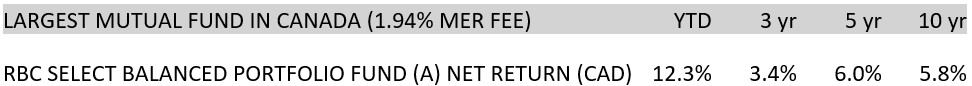

- Portfolio and Market Performance

- Portfolio Update

- Rapid-Fire Earnings

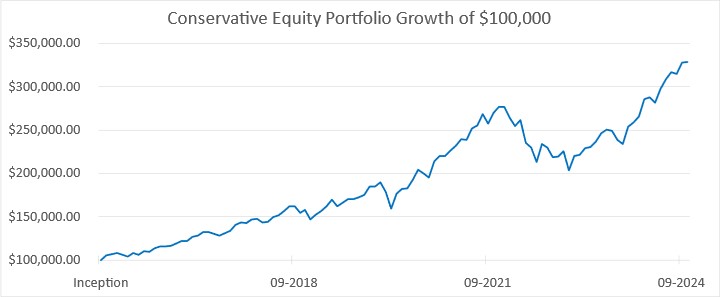

- S. Election Results

- Currency and Rates

- Market Outlook

Office Update

We are starting to roll out our new client portal and will have everyone connected over the next month or so. We think you’ll be pleased with its ease of use and functionality and look forward to your feedback.

Portfolio Update

We took a tax loss on Nutrien and after 30 days we decided against buying it back, as we thought we found an opportunity in BCE. We purchased a 0.8% weighting in BCE in the last week of October, only to watch BCE go out and make a $5 billion acquisition a few days later. We had reliable information that they would not cut their dividend and that a large institutional value manager was loading up on the shares. The thesis was that as interest rates come down and the market realizes that BCE would not be cutting its dividend, the share price could easily appreciate by 20%. BCE’s dividend was yielding over 9%. This tells us that either the dividend needs to be cut, or the market or the stock needs to move higher. Like we mentioned, we had it on good information that the dividend was safe.

Needless to say, we got blindsided with new information when BCE went out and made the large acquisition. This move tells us that management is still not serious about bringing down its debt and shoring up its balance sheet. They also overpaid for the asset, in our opinion.

We cut our losses by selling BCE one week after purchasing and moved the proceeds of the sale into Canadian National Railway. All that work for a 0.8% position!

We took a tax loss on Walt Disney and decided after 30 days not to get back in the name. We feel Disney has lost its way, and the quality of its content has been in decline. There has been too much focus on short-term profits and social commentary and not enough focus on the writing and quality of entertainment. In the longer term, the quality of the content is what drives all its business units, and so until we see improvement we will remain on the sidelines.

We used the proceeds to increase our position in Apple on this latest pullback.

Rapid-Fire Earnings

Advanced Micro Devices – AMD reported Q3 earnings last week. The numbers were exactly what we were expecting, but the stock traded down 9%. We feel many investors were expecting some kind of crazy NVIDIA-like earnings beat. We feel that a portion of the market doesn’t fully understand the company. Many were disappointed by forward guidance on artificial intelligence (AI) chips, which AMD raised slightly to $5 billion for 2024. There were also lower than expected numbers in PlayStation chips sales and video cards, but these numbers tend to be bumpy from quarter to quarter.

To give a clear picture, when you invest $1 in AMD, about 25 cents is invested in AI and the rest is invested in traditional semiconductor stuff, mostly central processing units (CPUs).

With NVIDIA, when you invest $1, about 90 cents is invested in artificial intelligence. That brings us to another update: NVIDIA has joined the Dow Jones Industrial Average, replacing Intel, which has been another positive on the stock.

Apple – AAPL reported Q4 earnings last week as well. The big headline was that their services division passed the $100 billion annual run rate this quarter, most of which is recurring revenue and subscriptions. What we don’t see in the numbers are their new AI tools, which were launched in the last three days of the quarter through IOS 18. Next quarter we should begin to find out if their new phones with AI features are affecting sales. Another big outstanding question is if all the stimulus in China is going to increase sales for them or if the political turmoil in the U.S. could have some blowback in China, which represents about 16% of their revenue and is where they manufacture a lot of their products. As a reminder, the last time President Trump was in office, Tim Cook was able to make the argument that tariffs and manufacturing requirements would hurt them globally as they would not be able to compete against Samsung and others going forward. We think this may well be the case again. Tim Cook is a master at navigating geopolitics.

Amazon – There was a large jump in the Amazon stock price following their earnings report. The operating leverage story continues to play out as we have been talking about since last year. Operating income over the last 12 months is up 130% from the previous 12-month period, at $60.6 billion versus $26.4 billion. Amazon continues to be incredibly efficient and drives down costs while growing its top line at the same time. The stock is still cheap at 13 x forward EBITDA. Historically it trades at 20-25 x.

Remember that $100 billion services business from Apple? Who do you think is providing it along with all the AI services Apple has launched? Those computers belong to Amazon Web Services. They are the AI landlord for companies and governments who want to work in the AI space, and business is booming.

Berkshire Hathaway – Cash went up to $325 billion in the quarter, after selling another 25% of their Apple stake. Earnings and operating income were lower than expected, largely from their largest business, which is insurance. Total catastrophe losses for the quarter were $720 million, attributed to Hurricane Helene. In the big picture, insurance has been a huge contributor to net income, but it was a bad quarter.

Eli Lilly – The company reported their third quarter and shares sold off 6%, mostly attributable to missing earnings expectations and not beating sales expectations.

One major item that stood out to us as a contributor to the earnings miss was the finalizing of the $3.2 billion purchase of a drug for bowel diseases that would further diversify their revenue. A second item was that during the quarter their sales were constrained as they were telling doctors they were in shortage so they should not prescribe their GLP-1 drugs. They are now coming off constraints, which should accelerate growth going forward. Some messiness around quarterly sales while you are supply constrained is to be expected; some of the miss is just on the difficulty of execution around balancing the shortage in sales channels.

Google – Google announced monster numbers. The company had its best quarter ever, with $88 billion in revenue and $38 billion in EBITDA. Cloud is very strong. Search is a concern as there is increasing competition from AI search tools and AI agents going forward. They have been under investigation by the Department of Justice who are looking to break up their business into pieces as they feel Google holds too much power.

Tesla – TSLA unveiled the Cybercab, which the market did not understand, and the stock sold off. A week later they had their Q3 earning call, which answered a lot of questions. Tesla is back to growth mode, with Tesla Energy, EVs, autonomous driving, and robotaxis rolling out next year, and Optimus rolling out the following year. Tesla is a leading AI play and is starting their next leg of growth, which will continue into the next decade. Wall Street was caught offside and is only now trying to catch up with their valuation models.

Visa – Visa’s earnings showed a stable economy with a 10% growth in revenue and 14.6% year-over-year earnings growth. Payment volumes reflect a healthy economy.

U.S. Election Results

It looks like the Republicans are taking the presidency, the Senate, and the House of Representatives, along with the existing control of the Supreme Court—a straight run. This gives a lot of power to one side and will certainly reduce legislative gridlock.

This Republican group is more of a coalition and has many lifelong Democrats, so we believe we will see a more centrist policy going forward. Examples would be Robert F. Kennedy Jr. and Tulsi Gabbard, both of whom previously ran as Democrats, as well as Elon Musk, who has been a lifelong Democrat.

That’s not to say we will not see sweeping changes—they could be big.

How are markets reacting to the news? Very positively. Lower corporate tax rates mean more profits. A big part is de-regulation as well. Financials are on a tear on our call day, with Goldman Sachs up 10%. The FTC under Lina Khan and President Joe Biden was aggressively blocking all large mergers and acquisitions over the last four years, and that will likely end under Trump. The Justice Department under Biden had aggressively gone after every major corporation to break them up or prevent them from expanding or even operating, and we expect this to be drastically reduced.

Another major point has been de-regulation and efficiency. We expect the reduction in red tape and regulation to be hugely positive for markets as a whole, especially in financials, construction, and energy.

What is negative? Government handouts and tax credits. This will be negative to the renewable energy industry, especially those who were benefiting from federal money. We don’t believe the CHIPS and Science Act will be reversed. Robert F Kennedy Jr. has said he will go after big food and big pharma in a big way and we expect to see some pressure there.

Again, it’s early, but this is generally where things stand today.

Currency and Interest Rates

Currency

The Canadian dollar is very weak, at 71 cents to the U.S. dollar. Our economy is weak and there is little innovation—unless you consider what the Trudeau/Freeland government has done to our deficit and balance sheet innovation.

All these recent moves in the bond market have affected not only mortgages and lending rates, but currencies as well. The U.S. dollar is the risk-off currency; in times of uncertainty capital floods into U.S. treasury bonds, which causes a rally in the U.S. dollar. This, combined with a weakening economy, has caused the Canadian dollar to shift all the way to 1.4 Canadian to U.S. dollar leading up to the election—the weakest dollar since the height of pandemic fears in March 2020.

As risks subside, we may see a move back in the other direction, but with a widening differential in bond yields, we don’t see this changing meaningfully in the near term.

Interest Rates

Interest rates in Canada have peaked and are coming down fast. We continue to expect much lower rates by the end of next year. Our prediction is that we’ll get to 3% mortgage rates by this time next year. U.S. rates will be stickier as the economy does well under a Trump administration and AI buildout.

The Bank of Canada made a larger 0.5% rate cut last month, after 3 quarter-point cuts, lowering the rate from 5% at the beginning of June to 3.75% today. The general consensus is that it will drop further to 2.75% next year with the next cut coming in December; we think it could be lower by the end of next year.

South of the border, the U.S. Federal Reserve has been cutting later and at a slower pace, with just a single 0.5% cut in September, and a 0.25% cut on November 7.

While this has led to a rally in bonds the last six months as rates come down, over the last month there was a move in the opposite direction with yields going back up. The markets point to two factors: first, the U.S. economy remains strong, reducing the chance of a recession that could force central banks to drop yields close to zero to stimulate the economy, and second, there remain concerns over inflation and U.S. fiscal policy through overspending.

Economy and Market Outlook

We are calling for the S&P 500 to hit 6,200 by year-end and 7,000 by the end of 2025. So yes, we’re still quite bullish. We expect 15,000 by 2029.

~~~

Remembrance Day was on the second Monday of this month.

One of our investing idols, Warren Buffett, has stated that any American who felt their success was solely of their own making need visit the rows and rows of white crosses in Normandy. Buffett has repeatedly attributed much of his success to being born in the United States after the war, which created one of the greatest economies in history.

We remain grateful to those that sacrificed so much for the peace, prosperity, and freedoms we enjoy today.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager,

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor,

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045