NAVIGATING CHINA, FED TIGHTENING, FINANCIAL INSTABILITY AND RATE CUTS

“A national debt, if it is not excessive, will be to us a national blessing.” – Alexander Hamilton

It’s All About Timing. Navigating macro investing poses the challenge of not only identifying key events but also timing their occurrence. The hardest part is indeed getting the timing right. With Japan and the United Kingdom in recession, and Germany likely to follow, the global economic landscape is increasingly fraught with challenges. The downturn in these major economies, coupled with China’s dramatic slowdown and deflationary trends, points to a broader malaise across global markets.

Alexander Hamilton once remarked that a national debt, if managed wisely, can be a national blessing. This idea underscores the delicate balance between leveraging debt for economic growth and the perils of becoming overburdened by it. Today’s global economy, saddled with excessive debt, appears to be ignoring Hamilton’s sage advice.

As global central banks, including the U.S. Federal Reserve, grapple with inflation rates that seem to be normalizing toward targets, there’s a palpable shift in monetary policy focus. Central bankers are now confronting the possibility that their war against inflation may be misdirected, with the real threat being financial instability and a looming credit crisis.

Historically, after periods of high inflation and aggressive interest rate hikes, economies have faced significant risks to financial stability. We see echoes of this today, as the Federal Reserve and its international counterparts begin to acknowledge the unsustainability of fiscal pressures, such as U.S. government debt interest payments now outstripping its defense budget.

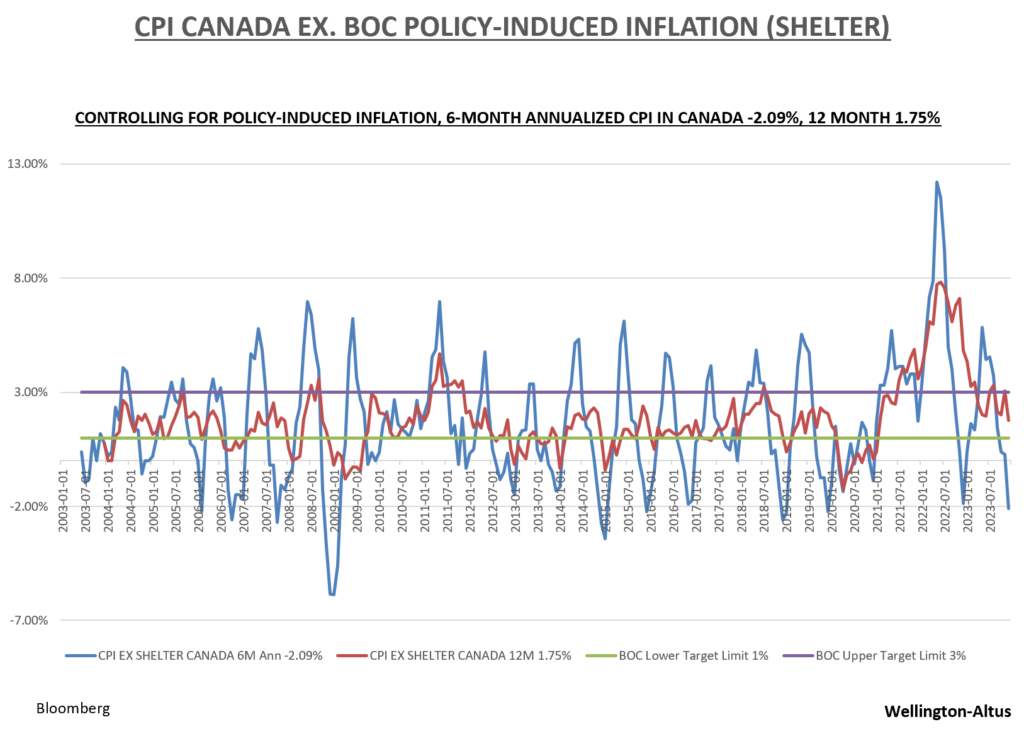

The monetary policy narrative is undergoing a paradigm shift. The conventional central bank playbook of raising interest rates to quell inflation is now seen as potentially too myopic, especially considering supply-side shocks. For example, the Bank of Canada’s struggle with policy-induced inflation and deflationary pressures shows that high interest rates alone cannot resolve complex, supply-driven economic challenges. When one controls for policy-induced inflation, the Consumer Price Index (CPI) in Canada over 12 months is firmly in the 1-3% target range. Yet more concerning is the six-month annualized reading at -2.09%—deflation.

The Federal Reserve, traditionally at the forefront of inflation targeting, now recognizes the emergence of a non-inflationary environment conducive to job growth. However, there remains a concern that the U.S. central bank’s aggressive stance on rate hikes, intended to temper inflation, could inadvertently precipitate a financial destabilization. The narrative is changing. The real monster may not be inflation, but the spectre of a credit crisis.

The Federal Reserve’s recent signaling of readiness to cut rates reflects a new awareness of the financial stability risks that overshadow the relief of controlled inflation. The current economic condition, marked by high real interest rates and towering debt levels, teeters on the brink of a financial event that could echo past crises.

Unfolding Crisis: China’s Echo of the Late 1990s Hong Kong Turmoil

Emerging markets offer a prime example of the fallout from the Federal Reserve’s aggressive rate hikes. Harvard Kennedy School Professor Carmen Reinhart’s analysis in Capital Flows Bonanza: An Encompassing View of the Past and Present, highlights how the Federal Reserve’s monetary policies have global implications. Previous bouts of tightening have led to capital flight, currency devaluation, and financial instability in these economies. Moreover, when the Federal Reserve aggressively tightens, any ensuing financial crisis starts outside the U.S. Particularly, China’s economic slowdown, with its troubled property sector and ballooning debt, is a stark reminder of financial stability risks with global implications.

American economist Paul Krugman’s skepticism of debt-fueled growth in Asia during the 1990s resonates today as China’s growth miracle teeters on the edge of a potential credit crisis. Beijing’s reluctance to bail out local governments and developers is a precarious game of financial confidence that could have worldwide repercussions.

Policymakers in China and around the world are now faced with the challenge of implementing structural reforms to mitigate these risks. Reflation efforts in China have already begun, but entrenched interests, demographic challenges, and the sheer magnitude of the debt problem present formidable obstacles. China must learn from Japan’s stagnation and financial crises in places like Hong Kong to avoid a similar fate.

The transition China aims to make—from investment-led growth to a model focused on domestic consumption and innovation—is fraught with risks. Yet, the consequences of not making this shift could lead to a severe financial crisis with profound implications for the global economy.

The deflationary signals emerging from China, with slight drops in consumer prices and wages, are troubling. The country’s failing property developers highlight the fragility of the economy. With producer prices falling for over a year and industrial profits on the decline, China is demonstrating real-time evidence of American economist and statistician Irving Fisher’s debt deflation cycle in action.

As the Federal Reserve considers its upcoming monetary policy moves, it must monitor China’s financial health closely. The interconnectedness of the global economy mandates a more nuanced approach, one that accounts for the potential international consequences of domestic policy decisions.

Financial Stability Takes Centre Stage

The current economic backdrop hints at a broader reconsideration of monetary policy frameworks. Namely, the evolution of monetary policy from a singular focus on inflation to a dual mandate that includes financial stability, could signal a new chapter in central banking. This shift would require central banks to navigate uncharted waters as they balance these dual objectives.

The Federal Reserve’s inconsistent communication has been a source of criticism, but if economic data confirms a sustained trend toward the 2% inflation target, a policy shift may be justified. Such a move would signal a recognition of the potential for financial instability and the need to prioritize financial stability alongside inflation control.

The decisions made by the Federal Reserve and its peers in the near future will be critical, with potential long-term impacts on global economic stability and growth. Employing a dual mandate will be essential for managing the uncertain economic landscape ahead. The world’s financial markets await the actions of central banks with bated breath, hoping for a steady hand to maintain the delicate balance between inflation control and financial stability.

In this context, the role of central banks becomes even more complex. They must acknowledge the limitations of their traditional tools when it comes to addressing structural issues in the economy and the financial system. Interest rate adjustments alone may not suffice to stave off a credit crisis or ensure financial stability, particularly when highly leveraged sectors of the economy are vulnerable to shocks.

Instead, central banks may need to incorporate financial stability indicators into their policy-setting calculus, expanding their purview beyond inflation and unemployment rates. This could include monitoring levels of corporate and household debt, real estate market dynamics, and the health of the banking sector, among other factors.

In the U.S., the Federal Reserve may have to reassess the balance between tightening financial conditions to combat inflation and the need to support an economy that could be destabilized by a rapid unwinding of debt. Similarly, the European Central Bank, the Bank of England, and other central banks are finding themselves at a crossroads, where the pursuit of price stability could potentially undermine the very financial stability they seek to protect.

This reassessment of priorities comes at a time when the global economy is already facing numerous headwinds, including geopolitical tensions, supply chain disruptions, and the ongoing impacts of the COVID-19 pandemic. These challenges only compound the difficulty of central banks’ task to foster a stable and healthy financial environment.

Investors and policymakers must therefore remain attuned to the potential for a shift in central bank policy emphasis from inflation to financial stability. It is this balance—or perhaps a new synthesis of objectives—that will define the next era of central banking. The potential for a credit crisis, if left unaddressed, could overshadow the gains made in controlling inflation, derailing economic recovery and growth. In this environment, capital flows into the U.S.

Ultimately, the actions taken by the Federal Reserve and its international counterparts in the coming months will be pivotal. They will need to demonstrate flexibility, adaptability, and a willingness to consider a wider array of economic indicators in their decision-making processes. The goal is a stable, resilient financial system that supports sustainable economic growth without succumbing to the excesses that lead to crisis. As the central banks navigate these uncharted waters, their success or failure will have profound effects not just on the markets, but on the global economic landscape for years to come.

What Should Investors Do?

In conclusion, investors should prepare for a shift in focus towards financial stability concerns in coming months. Historical patterns indicate that during periods of significant tightening by the Federal Reserve, capital tends to gravitate towards U.S. capital markets. Should a crisis arise, it is more likely to be triggered outside of the U.S., with attention particularly drawn to the potential for a repeat of the late 1990s Hong Kong crisis in China.

As Core Personal Consumption Expenditure (PCE) data continues to indicate that inflation is not the primary risk, the extreme tightness in the federal funds rate and the growing cloud of financial instability may prompt the U.S. central bank to implement rate cuts. It is plausible that these cuts could be more substantial but less frequent, with a strategy of three 50 basis point rate cuts commencing in May. Furthermore, while economic growth propelled by excessive fiscal policy may reach its limits, I maintain my recommendation for secular growth, foreseeing a rally leading into the end of the second quarter, followed by a downturn preceding the presidential election—aligning with historical trends. With an unchanged S&P 500 target of 5400, my preference for the NASDAQ-100 remains unwavering.