Download this article as a PDF.

Canadian residents who routinely fly south to escape the cold winters at home may not be aware that they could face U.S. tax consequences. This article looks at how spending extended periods in the U.S. can subject Canadians who are not otherwise U.S. taxpayers (i.e. U.S. citizens or green card holders) to U.S. taxes and how they can limit their exposure to such.

Like many retired Canadians, Marco and Louise like to spend the winter in a warmer location. When they retired in 2018, the couple bought a condo in Arizona and started flying south for the colder months, arriving on November 15 and flying back home on April 15.

Are Marco and Louise exposed to U.S. taxes? Potentially, yes. Let’s look at some U.S. tax considerations they should be aware of.

Becoming U.S. resident aliens for time spent in the U.S.

Regardless of citizenship and immigration rules, Canadian snowbirds can be considered U.S. resident aliens for income tax purposes if they spend too much time south of the border, requiring them to file U.S. income tax and information returns. To avoid being considered a U.S. resident alien, Canadians must consider two 183-day tests:

- Calendar year test.

183 days or more during the current calendar year, or - Substantial presence test.

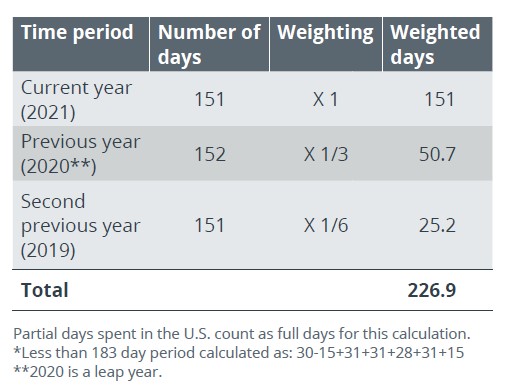

31 days or more in the current calendar year and 183 weighted days or more during the three-year period that includes the current and the immediately preceding two years. Weighted days are calculated as follows:

• All the days you were present in the current year, plus

• 1/3 of the days you were present in the first year before the current year, plus

• 1/6 of the days you were present in the second year before the current year.

For 2021, Marco and Louise don’t meet the calendar year test, having spent less than 183 days* in Arizona. But their lengthy recurrent visits to the U.S. over the past several years meet the substantial presence test as calculated below:

As they have exceeded the substantial presence test, Marco and Louise are, in fact, considered U.S. resident aliens for the 2021 tax year. They will each have to file tax and information returns with the U.S. Internal Revenue Service (“IRS”) as U.S. resident taxpayers, and, if no further steps are taken, they will be subject to U.S. income tax on their worldwide income.

Keep in mind

Given the last 2+ years of COVID-19 travel restrictions, the substantial presence test may not be a concern for the next year or two for clients.

Exemptions for U.S. resident aliens

What can Canadian snowbirds like Marco and Louise do to mitigate their exposure to U.S. taxes?

Two possible exemptions are available, depending on which test is met or exceeded.

01. Closer connection exemption for snowbirds who exceed the 183 weighted day test. Because Marco and Louise have spent fewer than 183 days in the U.S. in the current calendar year, they can apply for relief from filing U.S. tax and information returns under the Closer Connection Exception. By filing Form 8840, Closer Connection Exception Statement for Aliens by June 15 of the following year, Marco and Louise acknowledge the substantial time they have spent in the U.S. but attest that they have stronger residential ties to Canada than the U.S.

The IRS will consider several factors when granting a Closer Connection Exception, not limited to the applicant’s:

• Location of permanent home

• Location of family

• Location of personal belongings

• Driver’s license country of issue

• Where automobile is registered

• Country of residence on official documents

• Country where registered to vote

• Country where most income derived in the

current year

02. Treaty exemption for snowbirds in the U.S. more than 183 days in a given calendar year. If Marco and Louise meet the calendar year test (i.e., they spend 183 days or more in the U.S. in the current year), they cannot claim the Closer Connection Exception. Instead, they may be able claim an exemption under the Canada-U.S. Tax Treaty by filing Form 8833, Treaty-Based Return Position Disclosure along with their U.S. tax returns and applicable information returns on all worldwide assets by June 15 of the following year.

They will need to demonstrate a closer residential attachment to Canada than the U.S. based on the “tiebreaker rules” under the Canada-U.S. Tax Treaty, which successively look at the location of the applicant’s permanent residence, source of vital interests and their nationality.

Helpful Tips for Snowbirds

• As a rule of thumb, spend less than 122 days or four months per calendar year to avoid U.S. resident alien status under the substantial presence test.

• For tracking purposes, the reason for a visit to the U.S. does not matter, whether it be business, personal or leisure. For Canadians living in border towns, going to get gas, groceries, or shopping even for an hour counts as a day.

• There are some exceptions to what must be counted as a day, such as days in the U.S. due to medical reasons or stopovers on an airplane/ship.

Caution! Canada and the U.S. share immigration information. Know that the U.S. can track the number of days spent in that country.

Being aware of U.S. tax rules for visitors can help Canadian snowbirds plan ahead and enjoy their time south of the border without overstaying their welcome. For more information about cross-border taxation planning, consult your Wellington-Altus Advisor.