Download PDF here

The Golden Years: More Golden

Chances are “you might live longer than you think.” This was the longevity message of a Wall Street Journal article earlier this year.1 Indeed, we are living longer and healthier lives — half of those born today are expected to live to the centenarian age of 100.2 And, though the average Canadian’s life expectancy is around 82, if you reach the age of 75, you’re likely to live until age 87. Our life expectancy increases as we get older.3

Notably, this points to the importance of wealth planning to ensure that our funds have similar longevity. This is challenged by the ongoing trends of declining workplace pensions, the growing costs of dependents, the potential high costs of health care later in life and ambiguous government support — though actions like the CPP reforms, with more changes set to begin in 2024, are expected to make a marked difference to future retirees, especially those who haven’t been able to make wealth planning a priority.

The good news? Retirees today appear to be doing a pretty good job. A study from Statistics Canada suggests that recent retirees have experienced greater income growth and maintained more of this income in retirement than ever before. Their conclusion: The “golden years of retirement have become more golden.”4

As wealth advisors, preparing our clients financially for the future — including an extended one — remains a key focus. Whatever your plans for the golden years, the ability to make choices for the activities you wish to pursue is important. You may choose to continue working, but wouldn’t it be nice to do so on your own terms, not by financial need. Or you may wish retirement to resemble an extended vacation. The common thread should be to have the financial wherewithal to allow you to decide.

The $1.7 Million Head Start

According to many Canadians, this is the amount of savings we feel is needed to retire.5 Consider that a 20-year-old investing $125 per week for 25 years, at a rate of return of 6 percent, would have around $378,000 by the age of 45. But, leaving this amount to compound at the same rate would yield $1.7 million by age 70. This is our way of pointing out that even a modest investment program can result in significant outcomes over time. Just imagine the head start a young person would have in retirement with an “extra” nest egg of $1.7 million. A bit of discipline, consistent savings and an investing program that relies on relatively modest contributions each year could steadily progress towards this goal over time.

For those of us further down the road, the principles remain the same: having a sound plan, contributing consistently and having the determination to follow through. The tactics may occasionally need to change to meet the prevailing market conditions, or we may need to fine-tune your plan, but don’t overlook the importance of a commitment to your plan. It has been built to return dividends down the road. And even if you are living through retirement, it is a good reminder that the road ahead may still be a long one.

As we enter the final months of the year, autumn ,the season of change, is a reminder that time changes all things — perhaps even our financial obligations or goals. If a review is in order, or if there are investing actions you need to take before year end, please get in touch.

1. https://www.wsj.com/articles/death-finances-and-how-many-of-us-get-ourmoney-

needs-wrong-51a660a2

2.https://www.reuters.com/article/us-ageingpopulations-

idINTRE5907DM20091002

3. https://www150.statcan.gc.ca/t1/tbl1/en/

tv.action?pid=1310013401

4. https://www.statcan.gc.ca/o1/en/plus/3693-goldenyears-

retirement-have-become-more-golden

5. https://www.advisor.ca/retirement/

retirement-news/canadians-now-expect-to-need-1-7m-in-order-to-retire-survey/

U.S. CREDITRATING : RECENTLY DOWNGRADED

Credit Scores: When Was the Last Time You Checked?

It has been said that “there are two things you should never be without: your reputation and your credit rating. You can destroy them both in an instant and spend the rest of your life trying to get them back.”

Over the summer, the long-term credit rating of the world’s largest economy was downgraded for only the second time in history. Fitch downgraded the U.S. rating from AAA to AA+. A country’s credit rating is an independent assessment of the country’s creditworthiness ,which can give investors insight into the level of risk associated with a nation’s debt, as expressed by a letter system. Canada maintains a similar credit

rating to the U.S. of AA+ (Fitch). A downgrade is generally seen as a signal of concern about a nation’s creditworthiness. However, given the suggested political “dysfunction” over the spring debt ceiling debate, the recent downgrade may be less related to the U.S.’s ability to pay its debt and more related to its Willingness to do so.

This is a good reminder that, as individuals, we also have “credit ratings,” as expressed through our credit score — a numerical range between 300 and 900, with a score of over 700 considered as good. The two main Canadian credit bureaus, Equifax and TransUnion, keep track of your credit through public records of lenders like banks, collection agencies and credit card companies and assign a score based only our credit history and your ability to pay bills on time and in full.

When was the last time you checked your score? There may be reasons to make this a priority, especially if you haven’t checked lately.

Establishing good credit can take time. One common issue seen with older couples is that one spouse

may have a good credit rating, but the other will have none. If the spouse with the good credit rating passes away, the other often has difficulty qualifying for a loan or obtaining a credit card. Building a good credit score takes time.

You may uncover or protect against fraud. Periodically accessing a credit report may be valuable not just to check your credit score, but also to help guard against identity theft. A credit report may list accounts that you haven’t opened, which may uncover possible fraud. The credit bureaus also offer monitoring services that can notify you if there are changes to your credit position. You can also add security measures, such as a fraud alert, when financial providers issue new credit in your name. Some of these services incur fees, but the cost may be worthwhile as fraudulent activity becomes increasingly sophisticated.

Your credit score matters. Many young people may have limited experience with credit and do not realize that having a good credit history can make life easier. It is important because your score determines how lenders assess your credit capacity — the higher the score, the greater the likelihood that you’ll be approved for mortgages, loans or credit. It is also often checked when applying to rent a property and is sometimes checked during the job application process.

Dollars and Sense

Consider Making Investments More Tax Efficient

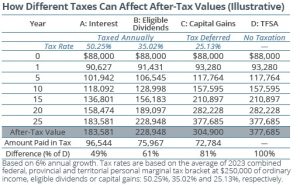

Just as investments benefit from compounded growth over time, the associated taxes on income and gains can accumulate to become significant. Recall the different ways that investment income ist axed in

non-registered accounts. Interest income is fully taxable at the investor’s marginal rate. Capital gains are taxed at half of this rate, snice only half of the capital gain is taxable. Eligible dividend income from Canadian corporations generally attracts a tax rate somewhere in between the two.

How much of a difference can this make? The table illustrates four scenarios (A to D), each involving an investment of $88,000 in Year 0 and a rate of return of 6 percent annually compounded over 25 years. In A and B, tax is paid each year at different rates based on the type of income earned: interest and dividends. In C, taxes are deferred so there is no annual tax, but tax is paid at year 25 when capita gains are realized. In D, there is no tax; funds grow in a Tax-Free Savings Account (TFSA). After 25 years, the difference in the after-tax value is significant.

As such, it is prudent to consider making investments more tax efficient, where possible. In brief, here are a handful of ideas:

1. Fully maximize tax-efficient accounts. Don’t overlook the benefits of tax-free and tax-deferred growth through TFSAs and RRSPs.

2. Optimize asset location. Different types of income may be taxed differently based on the type of account the income is generated from. By consolidating assets, a comprehensive view can help to better optimize asset location across all accounts while maintaining a balanced allocation.

3. Consider tax-efficient investing alternatives. Some types of investments have tax-advantaged attributes. Mutual funds, REITs, limited partnerships and others may provide return of capital R(OC)

distributions that are not a taxable receipt. With increased interest in Guaranteed Investment Certificates (GICs), some investors have considered high-quality bonds trading at a discount, which have both

an income and more favorably taxed capital gains component.

4. Explore other tools. There may be other tools that can help defer tax, such as an individual pension plan (IPP) that allows business owners/executives tax-deferred contributions to build retirement income. Those looking to pass a company to the next generation may use an estate freeze to lock in the tax liability at death based on today’s business value.

For a deeper discussion, or for more ideas, please contact the office.

Kids are Back in School

You Asked: Should I Open the RESP for a Grandchild?

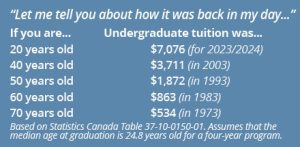

How has the cost of an education grown over time? A look back at the historical cost of undergraduate tuition provides some insight. For those who went to university in the 70s and 80s, tuition was largely

in the hundreds of dollars. Today, average undergraduate tuition has exceeded $7,000, and once room and board, as well as other supplies, are factored in, the cost can be upwards of $30,000 per year.

It is, therefore, not surprising that many grandparents are now considering supporting the cost of a grandchild’s education through the use of the Registered Education Savings Plan (RESP). The RESP offers many benefits: tax-deferred growth within the plan, earnings taxed at the child’s tax rate when eventually withdrawn and, of course, the Canada Education Savings Grant (CESG) — funds paid into the plan by the federal government, potentially adding an additional $7,200 per qualified beneficiary.

While grandparents can open the RESP as the “subscriber” for the benefit of a grandchild, there may be unintended consequences in certain situations. Here are three, along with some potential mitigating alternatives:

What if the child opts not to pursue higher education? If the RESP will not be used for qualifying educational purposes, it may be possible to transfer up to $50,000 of the RESP’s accumulated income to the subscriber’s RRSP, if contribution room is available. However, grandparents over 71 years old will not hold the RRSP and there are likely to be tax implications. Alternative: One approach might involve grandparents setting up a family plan with multiple beneficiaries (such as the grandchild’s siblings or cousins). If one beneficiary chooses not to pursue a qualifying education, the plan’s funds can benefit other beneficiaries. Another alternative would be for the parents to set up the RESP and have grandparents gift funds as contributions.

What if you relocate from Canada? If the RESP subscriber decides to retire outside of Canada, there may be tax repercussions. For instance, in the U.S., the IRS doesn’t recognize the RESP’s tax-deferred status and views it as a foreign trust. Consequently, the annual income and grants earned within the RESP would be subject to U.S. taxation for the subscriber. Alternative: Before leaving Canada, transferring the RESP to a new one with a Canadian-resident subscriber but the same beneficiary

may be a prudent move.

What occurs in the event of death? Many incorrectly assume that, upon death, RESPs are treated in the same manner as RRSPs and bypass the subscriber’s estate. However, generally, if there’s no surviving joint subscriber or alternate arrangement, the RESP assets become part of the deceased

subscriber’s estate. This means that the plan will be collapsed, triggering tax implications for received income and grants, and the value will become part of the estate property, to be distributed to the estate’s beneficiaries. These beneficiaries may not be the same as the RESP beneficiary. Alternative: To ensure the RESP’s original intent, instructions for the RESP can be directed within the last will, such as naming a replacement subscriber.

Have you made estate planning a priority?

The Greatest Wealth Transfer in History is Here

As some of the youngest Baby Boomers turn 60 this year, and the oldest approach 80, the greatest intergenerational wealth transfer is now in motion. It is expected that over $1 trillion of wealth will be transferred to Canadians — a number that has grown with the price growth in the financial and housing markets.1 Consider that the S&P/TSX Composite Index Total Return is up by over 3,000 percent since the start of 1983! 2

Mirroring the distribution of wealth, this transfer is expected to disproportionately affect higher-income households. In Canada, the top 20 percent of households hold more than two-thirds of all net worth,

compared to the bottom 40 percent, which hold just 2.8 percent3.

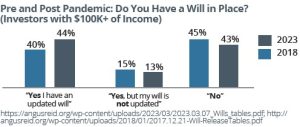

Have you prepared for your own wealth transfer? Back in 2017, a survey suggested that only 22 percent of high-net-worth Canadians had a detailed plan to pass along assets, though nearly 60 percent

were not confident in their children’s ability to preserve or grow their inheritance.4 One of the more positive outcomes of the pandemic appeared to be that more Canadians were influenced to put a greater

focus on estate planning, at least when it came to the basics of preparing a will.5 However, a recent Angus Reid poll suggests this may not be the case: the statistics about wills haven’t significantly changed.

As the costs of living, housing and raising families continue to surge, for many investors the tactics of estate planning may also be evolving. Some are pursuing a “giving while living” strategy. Others are using insurance or trusts to help support future generations and create a lasting legacy. If you have yet to give your estate plan the thought it deserves, why not make this a priority before year end? It has the potential to enhance your overall wealth management and can be one of the greatest gifts you leave for your loved ones. For ideas on where to start, please call.

1. https://financialpost.com/personal-finance/retirement/canadian-inheritances-could-hit-1-trillion-over-the-next-decade-and-both-bequeathers-and-beneficiaries-need-to-be-ready

2. S&P/TSX Composite Total Return Index 12/31/82 – 2,562.85; 8/1/23 – 81,166.08

3.https://www150.statcan.gc.ca/n1/daily-quotidien/221003/dq221003a-eng.htm

4. https://financialpost.com/personal-finance/family-finance/high-net-worth-families/most-high-networth-

individuals-lack-inheritance-plan-despite-largest-transfer-of-wealth-coming-study

5. www.newswire.ca/news-releases/panmic-influenced-canadians-to-prepare-estateplanning-

documents-832378633.html

Actions to Consider:

Your Year-End Financial Planning Checklist

With the arrival of cooler and shorter days, it is a reminder that there are only a few months remaining in the calendar year. Are there actions that you can take before year end to impact your financial

position? Here is a checklist of ideas:

Realize capital losses to offset capital gains. For tax purposes, 50 percent of a capital loss can be used to offset taxable capital gains realized during the year. If you do not have sufficient capital gains to offset the losses, you can carry the net capital loss back for three tax years to recover taxes paid on taxable capital gains or carry it forward to use against future capital gains. Be aware of the superficial loss rules, which defer or deny the capital loss if you or anyone affiliated with you acquired the same

security within the period 30 days before or after the date of the loss transaction. There may also be opportunities to transfer capital losses between spouses. This should be done well before year end

as it can take time for transactions to settle.

Split income, save tax. There are a variety of ways to split income. For example, you may elect to split eligible pension income with your spouse (partner) on your tax return. Spouses may also apply for CPP pension sharing. There may be an opportunity to open a spousal RRSP. Business owners may consider paying reasonable salaries to spouses/children for services provided to a self-employed business or private company. For greater details, contact the office.

Contribute to your RRSP. You don’t have to wait for the February 29, 2024 deadline to make contributions. Contributing as early as possible can allow for greater tax-deferred growth.

Consider also that deferring the deduction may provide tax planning opportunities. For instance, if you make a contribution, you can choose to delay the RRSP deduction to a future year, perhaps one

in which you have a relatively higher income to offset the higher potential tax.

Make RESP contributions. If you hold a Registered Education Savings Plan (RESP), consider contributing before year end to benefit from the Canada Education Savings Grant (CESG) for 2023.

Don’t forget the pension income tax credit. If you are 65 years of age or older and do not have eligible pension income, you can purchase an annuity or open a small Registered Retirement Income Fund (RRIF) before year end to enable you to claim the federal pension income tax credit.

Convert your RRSP if you turned 71 in 2023. If you have turned 71 this year, you have until December 31st to make any final contributions to your RRSP, and not the regular February 29, 2024 deadline, before converting it into the RRIF or registered annuity.

Review asset location. If you have earned some highly taxed interest income in a non-registered account, there may be an opportunity to review asset location. Or, consider whether a different type of fixed-income asset can reduce your tax bill while still meeting your risk tolerance and personal

objectives. We can help.

Withdraw from a TFSA before year end. If you need to access funds and are looking to withdraw from the TFSA, consider doing so before year end. Contribution room resets itself at the start of the calendar year, so waiting until January 2024 would mean that this contribution room will not be available until the start of 2025.

Consider charitable donations. Make eligible charitable donations before December 31st to benefit your 2023 taxes. Gifting publicly-traded securities with accrued capital gains to a registered charity not only entitles you to a tax receipt for their fair market value, but also eliminates the associated capital gains tax. However, the shares must be donated “in kind” — do not sell them first and donate the proceeds or part of the tax benefit will be lost. For securities that have depreciated, consider selling them and

donating cash. You will be entitled to the capital loss, as well as a donation tax credit.