The Inconvenient Truth: An Alternative Narrative

“Something is rotten in the state of Denmark” – William Shakespeare, Hamlet

In the grand theatre of Canadian economic governance, a clandestine struggle is waging, echoing the dramatic narratives of Shakespeare’s Hamlet. Prime Minister Justin Trudeau, once dismissive of monetary policy, now finds himself locked in a power struggle with the enigmatic Bank of Canada. Amidst dwindling popularity at the polls and persistently high interest rates, the stage is set for a secretive battle for control, with both parties striving to shape the nation’s future.

Yet, behind the scenes, the Bank of Canada emerges as a silent player, wielding its monetary tools like concealed weapons. With a cunning reminiscent of Shakespeare’s most captivating characters, the central bank understands its crucial role in this covert war. It knows that by adjusting interest rates and money supply, it can influence the nation’s economy and ultimately dictate the outcome of this hidden struggle.

However, the Bank of Canada’s primary concern is to ensure price stability, not to seek political fortune. Its role is not to play the political game but to maintain economic balance, a task as delicate and critical as any Shakespearean plot. Yet, the objective data suggests a need for rate cuts, a move the Bank of Canada seems to be ignoring. Could it be that “something is rotten in the state of Canada”?

The only reason we introduce this narrative is that an objective evaluation of Canada’s private sector data points to declining inflation pressures, a dramatic contraction in the private economy, and the risk of a potential debt/deflation recessionary episode. To assume the Bank of Canada does not see the same data we see is folly. To blame it on the fear of a wage growth spiral is fatuous.

Perhaps the Bank of Canada is apprehensive about the Trudeau government’s extreme levels of fiscal policy. As Nobel Prize-winning economist Thomas Sargent stated, permanent inflation is always and everywhere a fiscal phenomenon. Could it be that the Bank of Canada is more concerned about the potential inflationary pressures of this fiscal policy than current economic data suggests? Our confidence in policymakers has been shaken. As Shakespeare suggests, “The purest treasure mortal times afford is spotless reputation; that away, men are but gilded loam or painted clay.” A loss of confidence could lead to an economic tragedy.

In this grand theatre of economic governance we ask ourselves, “Whether ’tis nobler in the mind to suffer the slings and arrows of outrageous fortune, or to take arms against a sea of troubles, and by opposing end them?” This renowned quote from Shakespeare’s Hamlet, often seen as a meditation on life and death, seems suited to the current global economic turbulence and the Bank of Canada’s actions. As we explore the potential clandestine conflict between Trudeau and Bank of Canada Governor Tiff Macklem, we must remember that failure to convey one’s true intentions risks undermining economic stability. As the final act of this economic tragedy is yet to unfold, only time will reveal the full extent of its impact.

Act I: The Veiled Conflict

In the realm of economic governance, a Shakespearean tragedy unfolds as policymakers and central bankers, led by Trudeau and Macklem, find themselves entangled in a web of miscommunication. A rift emerges, casting a dark shadow over Canada’s economic landscape as their true intentions remain concealed. Trudeau, driven by his political agenda and societal challenges, failed to grasp the inflationary consequences of his actions. Meanwhile, Macklem, dedicated to monetary stability, struggles to openly challenge the government’s policies without compromising his impartiality. The result is the most aggressive tightening in modern history into the G7’s most levered economy.

Act II: The Clash of Objectives

Behind the scenes, a hidden war brews between Trudeau and Macklem. While maintaining a façade of harmony, their conflicting objectives intensify the struggle. The lack of alignment between fiscal policies and monetary decisions exacerbates the discord, risking economic stability. The timeless words of playwright Tom Stoppard ring true, “We are all tragedians … The bad end unhappily, the good unluckily.”[1] Both protagonists are merely playing their parts. With inflation dramatically falling and the effects of the inflationary exogenous shocks fading away, could Macklem be concerned about a continuation of Trudeau’s inflationary policy but can’t say anything? Why would the Bank of Canada ignore that interest rates have inflationary consequences and are the largest contributor to CPI? [2]

Let us not underestimate the astuteness of Macklem and the Bank of Canada. They know the potential havoc that fiscal policies can wreak upon the Canadian economy. They understand the risks and consequences, yet they must exercise caution in expressing their concerns. Openly challenging the government’s decisions would undermine their impartiality and independence. Instead, they engage in a subtle power struggle, aiming to influence policy outcomes without offending. It is a delicate dance, requiring finesse and tact.

Act III: The Economy’s Demise

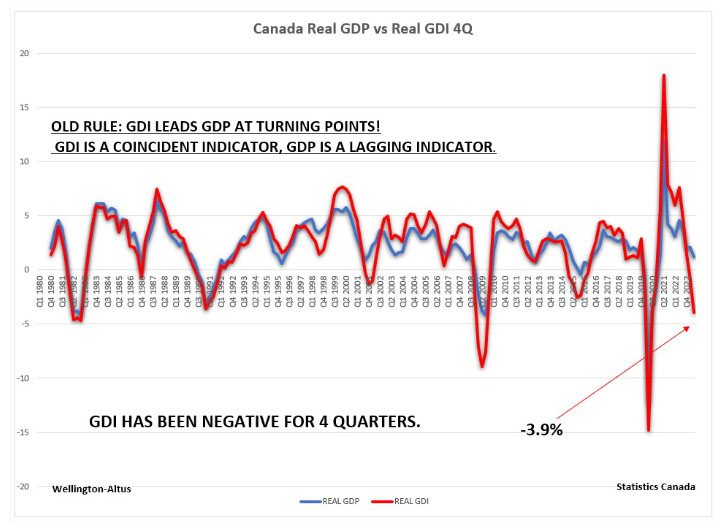

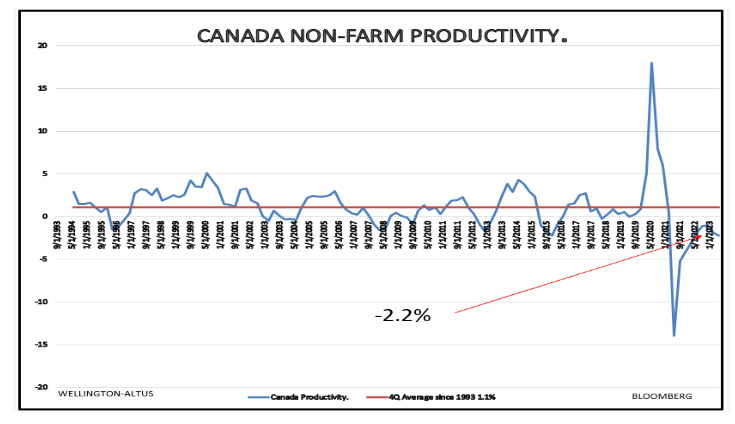

In this tragic tale, the economy, and Canadians themselves could become the ultimate casualty. The inability to openly and honestly communicate true intentions dooms all involved. The lack of alignment, hidden motives, and failure to find common ground leads to tragedy for Canada. Prosperity withers away, productivity continues to decline as the fear of inflation runs rampant, and the economy teeters on the edge of collapse. The once-thriving nation lies in economic tatters, and its citizens bear the burden of this tragic misalignment. As Shakespeare suggests, “All the world’s a stage, and all the men and women merely players.” Moreover, with GDP negative, real GDI -3.9%, and retail sales excluding autos falling 0.8% over the past six months (5.38% below the 20- year average of 4.58%), this data suggests that the economy is not overheating, despite claims from Bay Street and the Bank of Canada. [3]

Act IV: Reflecting on the Lessons Learned

Amidst the tragedy, we must acknowledge the complexities that underlie the roles of Trudeau and Macklem. They are not solely to blame but are victims of their ambitions and circumstances – actors performing their roles dutifully as the tragedy unfolds in slow motion before our eyes. The invisible hand of fate drives them towards their downfall as they grapple with the consequences of their actions. This Shakespearean tragedy of economic governance unveils the perils of communication breakdowns and hidden motives. Let us mourn the loss and hope that future leaders break the cycle, ushering in a brighter economic era – one where in times of crisis, transparency and collaboration prevail, and fiscal and monetary authorities have a level of strategic empathy to avoid future economic tragedies.

Act V: A Glimmer of Hope

Yet, amidst the tragedy, a glimmer of hope emerges. We must not forget the resilience of the Canadian people and the potential for change. While the protagonists of this tragedy may be locked in their conflict, others stand ready to offer solutions. Economists, analysts, and the general public begin to unravel the hidden war, observing the consequences of unchecked fiscal policies and the need for a balanced approach. As the play nears its final act, the stage is set for a resolution. Rating agencies in the U.S. are starting to speak up, Bay Street is waking up to the tragedy that awaits Canada if drastic actions are not taken, the Bank of Canada has paused, and the Trudeau government is reviewing a $15 billion cutback from spending plans.

Act VI: A Comparison of Economies

In this Shakespearean narrative, it is essential to compare the economies of the U.S. and Canada to assess which is better equipped to handle the unfolding tragedy for investors. While both countries face economic challenges, some differences favour the U.S.

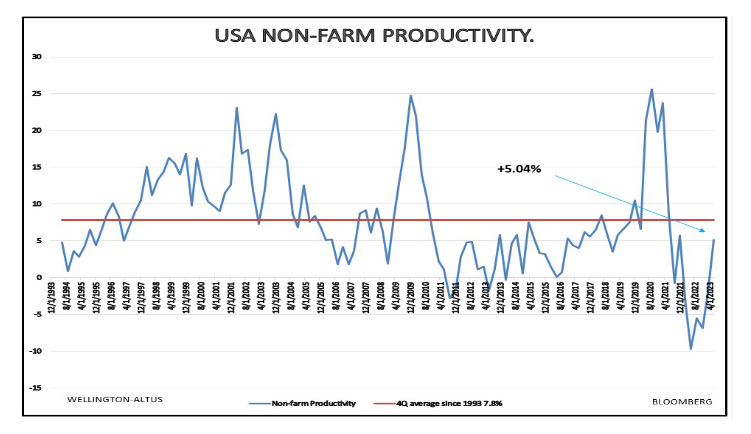

For one, productivity is higher in the U.S. compared to Canada, which implies greater economic strength and growth potential, making it a more attractive destination for investors. Additionally, the U.S. economy is more diversified, reducing its vulnerability to shocks in specific sectors and enhancing its resilience. On the other hand, Canada’s economy relies heavily on real estate and commodities, particularly oil, which exposes it to fluctuations in commodity prices and makes it more susceptible to economic volatility.

In addition, the U.S. has historically demonstrated a stronger ability to handle and recover from economic crises, even in the face of significant challenges. This track record provides confidence to investors, as they know the U.S. has the mechanisms and expertise to navigate turbulent times.

In contrast, Canada’s recent economic performance raises concerns. Even with inflation dramatically falling, a contracting economy, and excessive government spending, the Bank of Canada under Macklem must tread carefully to prevent further damage. The risk of a hard landing looms, and investors are beginning to recognize the potential consequences.

Act VII: Overcoming Home Bias

Amid the unfolding tragedy in Canada’s economic landscape, it is crucial to address the home bias exhibited by Canadian investors. The average Canadian equity portfolio demonstrates a strong inclination towards domestic investments, with a home bias of over 52%. This bias persists even though Canadian equities represent only 3.4% of the global market. While some of this bias may stem from national pride, investors must recognize the potential risks associated with such concentration.

As the Shakespearean drama of economic governance plays out, it becomes increasingly clear that diversifying one’s investment portfolio beyond Canada is imperative. The challenges facing the Canadian economy, coupled with the potential consequences of the hidden battles between Trudeau and Macklem, warrant a closer look at global opportunities.

One such opportunity lies in the U.S. Investing in U.S. equities provides Canadian investors with exposure to a broader range of sectors and industries, reducing their vulnerability to the risks inherent in the Canadian market. Moreover, the U.S. economy’s historical track record of resilience and ability to weather economic storms adds another layer of confidence for investors seeking stability.

To overcome home bias, Canadian investors can consider rebalancing their portfolios, gradually reducing their exposure to Canadian equities, and increasing allocations to U.S. equities. This strategic shift towards a global perspective aligns with the narrative of the unfolding tragedy and allows investors to position themselves more favourably amid economic uncertainties, and potentially seize new opportunities.

Shakespeare himself reminds us, “This above all: to thine own self be true.” In the realm of investment, being true to oneself involves recognizing the need to adapt and evolve, even in the face of a tragic narrative unfolding on the economic stage.

Conclusion: The Final Act

In the grand theatre of global economics, a Shakespearean drama is playing out, with Canada as its stage. The clandestine skirmishes between Prime Minister Trudeau and Governor Macklem, along with the economic challenges faced by Canada and the U.S., are creating a precarious situation for investors. The U.S., with its superior productivity, economic diversity, and a history of resilience, seems better prepared to weather this unfolding economic tempest. Yet, investors are advised to tread carefully, for every tragedy is fraught with unforeseen plot twists. Wise investors must navigate this stage with prudence, diversify their portfolios, and stay abreast of the evolving dynamics between these key players.

Turning to Hamlet, it begs the question, “Is something rotten in the state of Canada?” Our economic governance, much like the state of Denmark in Shakespeare’s time, is under a cloud of uncertainty and potential decay. This bold conclusion is not drawn lightly, but rather from a careful observation of the unfolding drama. Canada’s economic future, and the impact on its investors, hangs in the balance. Only time will reveal how the consequences play out, “the rest is silence.”

[1] Rosencrantz and Guildenstern Are Dead

[2] CPI: Consumer Price Index

[3] GDP: gross domestic product, GDI: gross domestic income