Investment Insight – Spring 2022

Download this article as a PDF.

Time: The Investor’s Great Ally

It has been said that “history is just one damned thing after another.” This may be particularly fitting today. For many of us, there has been little respite from the challenges of the past two years. Looking forward, it seems as though there is no shortage of new challenges. As we try to navigate the return to normal from the pandemic, we are now confronted with new uncertainties arising from the Russia/Ukraine conflict.

Financial markets are often quick to respond to uncertainties and the volatility we have seen as of late is no exception. It may feel particularly unsettling since the markets were largely immune to sustained periods of volatility for much of last year. However, we shouldn’t forget that volatility plays a common role in the equity markets — market drops of at least five percent occur every seven months, on average.1

The escalating geopolitical tensions emerging from the Russia/Ukraine conflict have added to current worries, as the world responds to this new crisis. This has created new market headwinds and put upward pressure on the price of oil and other commodities. We continue to monitor the evolving situation and the potential effects on the financial markets.

At home, as we move forward from the pandemic, we are faced with new challenges. Central banks now have the unenviable task of normalizing the accommodative policies put in place to support economies through the pandemic: increasing interest rates and reducing the size of their balance sheets, while addressing high levels of inflation.

There are positive factors that may help to balance this change. Household wealth, across all income levels, is higher than it has ever been.2 Improving labour market conditions are expected to support households. And, many analysts suggest that the central banks can increase rates quite a bit without adversely affecting credit conditions.

With heightened volatility, keeping expectations on an even keel is not an easy task. During these times, it may be helpful to remember that we have faced many challenges throughout history that have made it difficult to assess future prospects. Yet, the equity markets have shown remarkable resilience over the longer term.

Consider that over the past 30 years, we have experienced credit and debt crises, recessions, many changing central bank policies — and even war. And, yet, the markets, as measured by the S&P/TSX Composite Index, returned an average of over six percent annually during this time, not including reinvested dividends.3

Having a longer-term view reminds us that the markets have continued to persist and advance, despite the many challenges. Indeed, time can be one of the investor’s great allies.

As the current headlines continue to test our resolve, don’t lose sight of your own wealth goals: patience, alongside careful monitoring and prudent adjustments through our support, should stand you in good stead. Continue to have confidence in your plan and allow your assets to keep working hard for you.

Please call if you have any concerns — we are here to help.

1. Based on S&P/TSX Composite Index over 30 years, 1/3/92 to 1/5/22;

2. www. reuters.com/business/finance/us-household-wealth-rose-record-1417-trillion-q2-fed-says-2021-09-23/

3. Index close, 1/3/92 – 3,495.60; 1/5/22 – 21,335.60.

NAVIGATING UNCERTAINTY

Keeping Perspective During Volatile Times

Recent market volatility has prompted some investors to rethink their perspective on risk. However, reacting to short-term market fluctuations is not usually advised. Instead, we continue to focus on the importance of having a plan in place with a view for the longer term, making prudent adjustments and rebalancing a portfolio where required. Here are some things to consider to help keep perspective during volatile times:

Why we rebalance portfolios: helping to avoid market timing — Rebalancing an investment portfolio involves adjusting the proportion of asset types to ensure it reflects your continuing goals. This is done because, over time, the value of the securities that make up your portfolio can rise and fall at different rates. This will change the asset allocation, which has been established to reflect your personal risk profile, goals and time horizon.

Often, rebalancing involves trimming winners to get back to the target asset allocation level. One of the virtues of rebalancing is that it helps to take the emotion out of the investing decision-making process. The rebalancing decision should occur when the portfolio’s balance is not in check, and not in response to the markets being under pressure. This can allow investors to better achieve the objective of selling high.

Don’t discount diversification — Diversification continues to remain an important tool in an investor’s portfolio, helping to manage risks and allow for more consistent longer-term results. Consider that a well-diversified portfolio often means that, by nature, the value of some components of the portfolio may fall when others may rise.

Cash continues to have a cost — Periods of volatility are not a time to run and hide. For investors, while having some cash on hand to take advantage of new investment opportunities is wise, holding too much may not make sense in these days of low interest rates and higher inflation. The low returns achieved through savings accounts or Guaranteed Investment Certificates are offset by just moderate inflation levels, so sitting on cash is likely to yield a negative real rate of return.

Volatility may bring opportunity — Alongside the earnings recovery and growth of many companies, volatility has helped to temper valuations. Consider also that high uncertainty can sometimes be the buyer’s ally. Periods of downward volatility may offer the opportunity to purchase investments at relatively lower prices. In the words of renowned investor John Templeton: “invest at the point of maximum pessimism.”

Don’t overlook your time horizon — It may be easy to become impatient with investments that perform below expectations in the short term, especially after last year’s equity market performance in which many investments continued their upward advance with little interruption. Returning volatility reminds us that patience can be one of the longer-term investor’s great virtues. History has shown that over shorter time frames the markets can often be unpredictable, yet over the longer term they have continued to advance. Don’t overlook the profound impact of time in the markets.

Have confidence in your plan — Volatility should be a reminder that growth does not occur at a steady rate. Your plan has been put in place with the objective of creating a portfolio that can weather the inevitable short-term storms to deliver longer-term returns. We continue to monitor your investments during these volatile times, making prudent adjustments where necessary to account for changes in the marketplace. Have confidence in your plan and allow your assets to keep working hard for you.

DID YOU KNOW?

The RRIF: Four Things You May Not Know

If you have yet to reach the retirement age, consider the opportunity to think ahead to the time when you will eventually access retirement funds. Here are four things you may not know about the Registered Retirement Income Fund (RRIF).

1. You can convert the RRSP to the RRIF earlier than age 71. The RRSP matures by the end of the calendar year in which the holder turns age 71 and is often converted to the RRIF at that time. However, you are able to open the RRIF earlier than this age. Minimum withdrawal payments will still be required, but not until the calendar year following the year that the RRIF account is opened.

2. You can hold the RRSP and RRIF at the same time. While the RRIF is usually used by an investor to transfer funds once the RRSP matures, there may be instances in which you may want both. If you need to generate pension income to take advantage of the federal pension income tax credit, you could open a small RRIF at the age of 65. At the same time, you can still continue operating the RRSP to capture ongoing tax deductions from your contributions. Consider also that you can notionally split up to 50 percent of eligible pension income (which includes RRIF income from age 65) with a spouse (common-law partner).

3. You are able to convert the RRIF back to the RRSP. If you’ve converted funds to the RRIF earlier than age 71 and realize that it’s no longer to your benefit, you are able to convert it back. You may decide to do an early conversion if you retire early, take a sabbatical or have an extended leave from work, since the loss of income means you may be in a lower tax bracket or you may need funds. However, if you return to work, it may be beneficial to resume the RRSP.

4. You can base RRIF withdrawals on a spouse’s age. If you have a younger spouse, it may be useful to use their age to result in a lower minimum withdrawal rate for your RRIF. Be aware that this must be done when first setting up the RRIF and before you have received any payments, so plan ahead.

If you have any RRIF questions please get in touch. If you’re turning 71 in 2022, let’s discuss options for the maturing RRSP before year end.

TAX SEASON IS HERE ONCE AGAIN

Consider These Ways to Be Tax Savvy

Spring is here again and with it brings personal income tax season. Many of us feel we pay too much tax and there may be actions we can take to help minimize these liabilities. This may be especially important in these times of high inflation. Here are some ideas:

Consider professional tax support — The support of tax professionals can help to ensure your tax planning takes into consideration current and proposed rules. This support can also help to prevent costly mistakes, such as incorrectly completing tax returns or neglecting to claim tax credits. It can be particularly beneficial if your situation is more complicated, such as where a divorce is involved or if you hold a significant portfolio of foreign assets. As we grow older, a professional advisor can provide continuity from year to year, which may become important if individuals experience health issues, incapacitation or the death of a spouse. Many accountants are well placed to assist with estate planning activities, including the transfer of assets upon death.

Be aware of the evolving tax rules — Make sure that your tax planning accounts for the latest tax rules. Remember that these rules continue to evolve. Since the start of 2022, the Canada Revenue Agency (CRA) has announced some of the following changes that may impact certain tax positions. While these changes may not apply to personal income tax season, they are examples of the evolving landscape:

- Work-from-Home Tax Credit — Those who worked from home due to the pandemic are entitled to claim up to $500 of home expenses. As with the 2020 tax year, the CRA has issued a simplified Form T2200. However, the temporary flat-rate option remains available to taxpayers for both the 2021 and 2022 tax years.

- Automobile Expenses — For 2022, the limit on the deduction of tax-exempt allowances paid to employees who use personal vehicles for business purposes has increased by two cents, to 61cents per kilometre (km) for the first 5,000 km driven and 55 cents thereafter for all provinces. Mileage rates were last raised in 2020.

- Expanded Trust Reporting — Expanded annual reporting requirements for trusts, including beneficial ownership information, were anticipated for the 2021 tax year based on the last federal budget. In the first quarter of 2022, the government confirmed that this would no longer apply for 2021. However, draft legislation was introduced in February, which is expected to be passed and will apply to trusts with taxation years ending after Dec. 30, 2022.

- A Pending Luxury Tax — The 2021 federal budget proposed a luxury tax expected to be introduced

at the start of 2022 and retroactive to April 2021. In March, draft legislative proposals were released

and the tax is now expected to come into effect on September 1, 2022.1 The proposed levy is either 10 percent of the value of the purchase above a certain threshold ($100,000 for new cars/aircraft; $250,000 for boats) or 20 percent of the full value, whichever is less. - Cryptocurrencies — The CRA continues to conduct audits on cryptocurrencies to crack down on tax non-compliance. Last year, the CRA won an order which allows it to collect personal and transactional information about the largest users from Canada’s largest cryptocurrency exchange.2 Owning cryptocurrency itself is not taxable; however, be aware that there may be tax consequences for trading or exchanging cryptocurrency, including disposing of one cryptocurrency to obtain another.

Make tax planning a year-round exercise —Year-round tax planning can start with maximizing tax-advantaged accounts like Tax-Free Savings Accounts (TFSAs) or Registered Retirement Savings Plans (RRSPs). It may include adjusting asset location as investment returns, i.e., bond interest, Canadian and foreign stock dividends, capital gains, may be taxed differently depending upon where they are held, i.e., RRSP, TFSA or non-registered accounts. When it comes to your wealth plan, we’re here to discuss tax-planning opportunities to help you keep more of your hard-earned dollars.

A tax refund? Put it to work! — If you receive a tax refund, what will you do with it? Last year, 19 million Canadians received a refund averaging $1,801.3 Yet, only 18 percent planned on investing it in a TFSA, RRSP or RESP.4 Consider the potential upside: investing this amount each year for the next 25 years at an annual rate of return of 5.5 percent would yield almost $100,000 in that time.5

For assistance with tax-related investing matters, please call the office.

1. www.canada.ca/en/department-finance/news/2022/03/government-releases-draft-legislative-proposals-to-implement-luxury-tax.html;

2. www.forbes.com/sites/taxnotes/2021/04/29/cryptocurrency-tax-data-requests-its-easier-to-go-fishing-in-canada/;

3. “Canadians Are Stalling on their Taxes,” J. Golombek, Financial Post,

April 1, 2021;

4. www.newswire.ca/news-releases/confusion-dread-and-fear-of-owing-money-fuel-tax-filing-procrastination-in-canada-860977490.html; 5. Compounded annually at 5.5%, assuming no fees or taxes.

AN ADDED LAYER OF PROTECTION FOR INVESTORS

Nominate Your Trusted Contact Person

With a rise in sophisticated cybercrimes and with increasing concerns over the financial well-being of investors, especially as we age, the “trusted contact person” (TCP) has been introduced to help provide an extra layer of protection. The TCP is someone you appoint and for which we have your written consent to contact if we have concerns about the decision-making on your accounts or if we are unable to contact you. The TCP has no legal authority to make any financial decisions or direct transactions on your account. They do not replace a trading authority or power of attorney appointed to act on your behalf.

While you may not feel that there is a current need for a TCP, implementing this safeguard now may help to provide protection down the road. As such, it is recommended to select someone who is trusted, mature and knowledgeable about your personal situation and support network. This individual should be capable of speaking with you, and to us, about your well-being and potentially sensitive topics such as your physical or mental health status. It may be beneficial to select someone who is familiar with $1,045,317you on a consistent basis and has no potential authority now or in the future. You are able to change who you designate or revoke designations at any time.

For more information, or to nominate a TCP for your existing accounts, please get in touch.

A Rising Rate Environment:

Five Reasons for Investors to Keep Perspective

As we move forward towards a return to “normal” from the pandemic, the central banks will be raising rates to more “normal” levels. For many months, the media has been hyping concerns over rising interest rates. As investors, should we be concerned?

While the highly accommodative central bank policies have helped to support the financial markets to see us through the past two years, here are five reasons why investors should keep perspective in a rising rate environment:

1. Expectations of interest rate hikes have been built into the markets. Today, we’ve been given ample warning by the central banks that rates will be rising, so much of this expectation continues to be built into the markets. While we have become accustomed to the forward guidance given by the central banks today, consider that it hasn’t always been this way. In the past, decisions made by central bankers were often a surprise that could rattle the markets. In the 1990s, investors used to guess what the Fed would do based on the size of then-Chair Alan Greenspan’s briefcase!1 The theory: if the Fed was going to change rates, Greenspan would be carrying a lot of documents so his briefcase would be wider.

2. Even with multiple rate increases, interest rates will still continue to be low. Even before the central banks implemented these highly accommodative policies, interest rates have been kept at low levels for quite some time. As we learn to manage the pandemic and return to normal, a natural unwinding needs to take place, which includes allowing rates to rise. However, let’s not forget that even with multiple rate increases, interest rates will still continue to be very low by historical levels.

3. Businesses and consumers are expected to be able to withstand these rate hikes. Many analysts continue to suggest that central banks can hike rates quite a bit without affecting credit conditions, especially given the excess liquidity in the markets. Many businesses continue to be in good shape financially, with solid balance sheets and excess cash reserves, so defaults on business loans are expected to be low. Household wealth also increased at all income levels during the pandemic, and delinquency levels on consumer loans still remain at record lows, suggesting the potential for resilience as interest rates rise.2

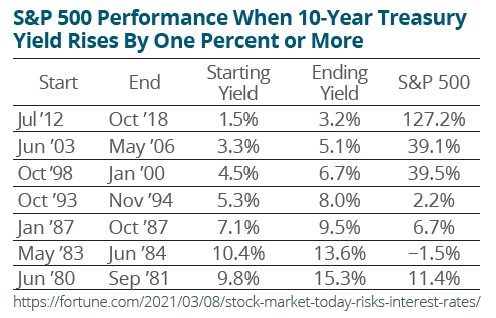

4. Equity markets have performed well in past rising rate environments. Investing theory suggests that interest rates and stock prices move in opposite directions, as stock prices reflect the present value of future earnings: the higher the interest rate, the less future money is worth today. However, history has shown that markets can perform well during rising rates3. One market strategist determined that the S&P 500 Index returned five percent in the six months following the first rate hike of past recent cycles, despite initial volatility.4 Other studies support positive equity market performance during rising interest rate environments (chart).

5. More recent data points to slower economic growth, which may slow the pace of hikes. Recent economic data has been mixed to start the year, painting a slowing economic picture. With the challenge of slower economic growth, and with emerging uncertainties from the geopolitical situation in Europe, it is likely that central bankers will be cautious in the pace of tightening, which may help to temper potential market volatility and may allow time for financial markets and economies to adjust.

1. www.money.cnn.com/1998/09/29/bizbuzz/briefcase/;

2. www.wsj.com/articles/u-s-households-took-on-1-trillion-in-new-debt-in-2021-11644342925;

3. www. bloomberg.com/news/articles/2022-01-23/u-s-stocks-historically-deliver-strong-gains-in-fed-hike-cycles;

4. www.ca.finance.yahoo.com/news/what-happens-to-the-stock-market-when-interest-rates-rise-115245445.html; www.forbes.com/sites/kristinmckenna/2022/01/24/how-do-stocks-perform-when-interest-rates-rise/

The information contained herein has been provided for information purposes only. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information has been provided by J. Hirasawa & Associates and is drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) and the authors do not guarantee the accuracy or completeness of the information contained herein, nor does WAPW, nor the authors, assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact me for individual financial advice based on your personal circumstances. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

© 2022, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca