The Future Looks Bright, Indeed!

Download this article as a PDF.

It has been said that millennials — those born from 1980 to 1994 — were the first generation worse off than their parents financially. Skyrocketing housing prices, a higher cost of education and a challenging economy, among others, were to blame. And while things didn’t look so great for the millennials a decade ago, recent studies suggest a different story.

Millennials have caught up to previous generations and are expected to thrive. As they begin turning 43 this year — the average age when we “stop feeling young” — their household income is higher than previous generations at the same age: $9,000 more than the median GenX (1965 to 1979) household income and $10,000 more than the Boomers (1946 to 1964), in 2019 dollars.1 While these are U.S. figures, a recent Canadian study paints a similar picture of a more highly-educated younger population, which has contributed to their success.2

The future may look bright, after all. As they enter their peak earning years, millennials will continue to support the economy, including in investing. Today, millennials hold just 2.3 percent of total U.S. stock and funds,3 a trend that is likely to change as greater wealth is accumulated and assets are invested to meet their future goals.

This narrative isn’t unique; every generation has had its challenges. GenX entered the job market during a recession and was subjected to “dire predictions” about their economic futures. This was just 30 years ago, in 1993, when Joe Carter’s home run would win the Blue Jays their second consecutive World Series. It was a challenging economic period. Canada was emerging from a recession described as “the deepest since the Great Depression.” Unemployment had soared to over 11 percent after interest rates were aggressively raised to fight inflation.4 Then-Prime Minister Mulroney would end up resigning after his popularity fell from imposing the then-seven percent GST two years earlier. Canada’s future economic prospects looked bleak for the near term: An editorial to start 1995 referred to “Bankrupt Canada” as “an honourary member of the Third World.”5 Yet, the years that would follow would be in significant contrast. Canada would post consistent budget surpluses to end the 1990s (a concept foreign to many governments today), and GDP growth would surge.

Indeed, time can be the great equalizer. Economies are cyclical, and the rebound of the 1990s — and the millennials — should remind us not to get too caught up in the present. This, too, may be true in investing. Consider that an investment of $100,000 in the S&P/TSX Composite Index during this seemingly bleak period 30 years ago would have grown to $628,273 today, or $1,318,767 with dividends

reinvested.6 However, participating in this growth required having confidence in the prospect of better days ahead.

While the summer is the season for well-deserved downtime, make sure that your assets are working hard for you — money needs no vacation. Keep time on your side. Continue looking forward and positioning your assets for the brighter days ahead!

[1] www.wsj.com/articles/millennials-turning-40-feeling-old-1df2c83b; www.theatlantic.com/magazine/archive/2023/05/millennial-generation-financial-issues-income-homeowners/673485/; [2] www.desjardins.com/content/dam/pdf/en/personal/savings-investment/economic-studies/canadian-youth-education-employment-17-april-2023.pdf; [3] U.S. Federal Reserve, “Distribution of Household Wealth in the U.S. Since 1989,” at Q4 2022; [4] www.bankofcanada.ca/2001/01/canada-economic-future-what-have-we-learned/; [5] www.reuters.com/article/us-crisis-timeline-idUSTRE7AK0FF20111121; [6] S&P/TSX Composite and Total Return Indices, 01/29/93 to 1/31/23 (3,305.47 to 20,767.40; 6,124.83 to 80,772.20).

PLANNING AHEAD

Has the Hot Housing Market Changed Your Outlook?

After a slowdown that lasted almost a year, largely blamed on rising interest rates, the spring brought a revival to Canada’s housing market. Supply fell to a 20-year low to start the residential sales season, which helped to push prices higher. Will the rebound continue? For many investors, the significant gains in housing prices over the past decade have changed the way we plan for retirement. Here are two challenges:

1. Relying on home equity in retirement. Sometimes a home’s value may be viewed as a potential source of retirement income, but we often suggest exercising caution for a variety of reasons. While your home equity certainly counts as part of your net worth, the main way it can be turned into investable capital is through its sale. Of course, loans such as a home equity line of credit (HELOC) grew in popularity when interest rates were at historical lows, but the significant cost of interest payments as rates have risen should not be overlooked. For those who wish to sell their homes, one pitfall is failing to consider the “true” value of a home. Future real estate values are never guaranteed, and there are often unanticipated costs associated with a sale, such as renovations or maintenance. At the end of the day, you still need a place to live, and this may be more costly than anticipated. Still, others eventually find that selling a lifelong home ends up being too emotionally difficult. There are exceptions: some choose to become renters; others retire abroad to more affordable destinations. However, even in these circumstances, planning for contingencies is important — you may be unable to find a suitable long-term rental property, or perhaps you will eventually decide to move back, such as to access Canada’s healthcare system.

2. Supporting future generations to buy a home. With the cost of home ownership becoming increasingly out of reach, many have been assisting children/grandchildren. By some accounts, the average gift in the two most expensive markets, Toronto and Vancouver, ranged from $130,000 to $180,000, with some gifts in excess of $300,000.1 Given these substantial amounts, it is important to carefully factor in how financial support may affect the gifter’s own retirement plans — a recent survey suggests that 34 percent of parents are using their retirement savings to help adult kids.2

Consider also the different ways to provide support, such as purchasing a property in your name, gifting cash or lending funds to the child. Each comes with various tax and family law issues. For example, if the home is not designated as a principal residence, there may be a future capital gain payable upon its sale or disposition. Or, if the child is married/common-law, what happens if there is a marital breakdown? We recommend seeking the advice of tax and family law professionals.

These are just two of the challenges that may impact retirement planning. For a deeper discussion, please get in touch.

[1] www.theglobeandmail.com/investing/personal-finance/article-parents-gave-their-adult-kidsmore-

than-10-billion-to-buy-houses-in/; [2] www.theglobeandmail.com/investing/personal-finance/

young-money/article-nine-in-10-parents-are-helping-their-adult-kids-financially-heres-how/

The $10-Billion Bank of Mom and Dad

$10 Billion: According to one estimate, that’s how much parents gave kids in 2021 to fund a down payment on a home.1 Back in 2015, the average gift was $52,000; in 2021, it was closer to $82,000, an increase on average of 9.7 percent per year.1 One personal finance expert suggested we may be at a “tipping point for parental obligation.” Is this the new normal, where parents now plan for this expense alongside their own retirement?

BEHAVIOURAL FINANCE & INVESTING

Take a Vacation from Checking Your Portfolio

An article in the Washington Post offered a different perspective to the view that kids these days get too much screen time. There’s another demographic struggling to put down their devices: baby boomers. As one man put it: “My 75-year-old dad’s phone may as well be an implant; he lives with it like a teenager!”1 Of course, this has implications for our investing ways. With easy access at our fingertips, we may all be guilty of checking investment accounts too frequently. This summer, why not take a vacation from checking your portfolio? Here are some reasons why:

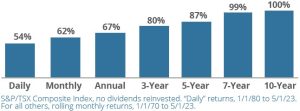

The more you check, the greater likelihood of seeing negative performance. History has shown that by checking the stock market daily, the chances of seeing a negative return are 46 percent. However, this reduces to 0 percent for 10-year rolling monthly returns. As the graph (right) reminds us, the longer you extend your time horizon, the better the chances of seeing positive returns.

Emotions can impact our investing decisions. Behavioural finance suggests that we feel losses twice as acutely as we feel gains of a similar size. “Myopic loss aversion” can occur when we react too hastily to avoid these losses, often making decisions that are not in our longer-term best interests. One important variable for investing success is how long you can stay invested. As Warren Buffett’s business partner Charlie Munger often says: “The big money is not in the buying or selling, but in the waiting.”

Investing often involves patience. When the S&P 500 Index hit a level of 4,200 in May (rising 20 percent from its October trough), some market pundits asked: Is this the start of a new bull market? While the S&P/TSX Composite hasn’t officially entered a bear market, the S&P 500 has been in a bear market since last year. Over the past 50 years, there have been six S&P 500 bear markets that lasted on average 15 months from peak to trough. In order to regain those losses, it took an average of 30 additional months.2 After the last bear market — the shortest ever at a mere 33 days during the pandemic — we may have been conditioned to believe the markets quickly rebound. Yet, enduring bear markets can often take time. The good news? Markets are cyclical: history reminds us that they’ve always recovered to reach new highs.

[1] www.washingtonpost.com/technology/2022/11/12/boomers-screentime/; [2] Based on: awealthofcommonsense.com/2023/03/why-the-stock-market-makes-you-feel-bad-all-the-time/

Chart: How Often is the S&P/TSX Composite Positive?

A POTENTIAL INTERGENERATIONAL WEALTH TRANSFER TOOL

FHSA: Opportunities for High-Net-Worth Investors

The First Home Savings Account (FHSA) is a registered account that offers significant tax-savings and growth opportunities, intended for the purchase of a first home. Eligible Canadian residents ages 18 or older who are first-time home buyers can contribute up to $8,000 per year, to a lifetime maximum of $40,000. Contributions are tax deductible, similar to the Registered Retirement Savings Plan (RRSP), and withdrawals are tax free, similar to the Tax-Free Savings Account (TFSA), if used to purchase a first home. The FHSA can generally stay open for 15 years (or until the year after the first qualifying withdrawal or the holder reaches age 71).

Beyond the opportunity to support those purchasing a first home, the FHSA may provide opportunities for high-net-worth (HNW) investors:

- It may act as a significant intergenerational wealth transfer tool;

- For those who haven’t owned a home in the past four years, it may provide a tax-advantaged way to supplement retirement savings.

Many parents and grandparents gift funds to younger folks to help cover large expenses such as an education or first home purchase. Some HNW investors support a child’s education through the Registered Education Savings Plan but often stop contributions once the Canada Education Savings Grants cease. The opportunity to then gift funds to a child to contribute to their FHSA starting at age 18 may be a great way to transfer wealth to the next generation, keeping in mind the loss of control with gifted funds. If the FHSA is opened at age 18, it must be closed in the calendar year after turning age 33. By some accounts, this is the average age of a first-time home buyer.1

For HNW renters, the FHSA may also provide an opportunity for tax-deductible contributions and tax-deferred growth. The account would need to be closed by age 71 if the 15-year limit isn’t reached, but the holder could transfer amounts to an RRSP/RRIF without affecting existing contribution room.

Since the FHSA can generally remain open for a maximum of 15 years, here are three tips to potentially maximize the growth opportunity.

1. Start early. Since the FHSA must be closed in the year after making the first qualifying withdrawal, if the holder intends to purchase a first home, the account’s life may be shortened. Opening the account

as early as possible may allow for compounded growth over the longest period possible.

2. Maximize contributions from the outset. Making full contributions at the start of each year can maximize the growth potential. Unused portions of the annual limit carry forward, but the carry-forward is limited to a maximum of $8,000 in the following year.

3. Consider the way that funds are invested. Given the substantial tax-advantaged opportunity to grow funds, consider investing in quality securities that provide meaningful growth and return potential.

By maximizing contributions from the outset, the account could grow to over $75,000 in 15 years, assuming a compounded annual rate of return of 5 percent, and this doesn’t include the tax benefit from initial contributions. Alongside the Home Buyers’ Plan under the RRSP, a couple who are both first-time buyers could fund a substantial downpayment. If the holder decides not to purchase a home, the FHSA can be transferred to an RRSP/RRIF without affecting the available contribution room.

Consider also that, generally, contribution amounts not claimed as a deduction on an income tax return in the year made can be claimed in a future year — even beyond the FHSA’s closure. This may provide a substantial tax benefit if saved for future years when the holder’s marginal tax rate may be significantly higher.

To learn more about the FHSA’s potential benefits, please call the office. [1] cdn.nar.realtor/sites/default/files/documents/2021-highlights-from-the-profile-of-home-buyers-and-sellers-11-11-2021.pdf

KEEP YOUR ASSETS WORKING HARD

Billions and Trillions: Unclaimed or Available

It’s the summertime, a time when many of us prefer to be idle. If you are pursuing more relaxing endeavours, make sure your assets keep working hard for you. In brief, here are three considerations:

1. Have you fully maximized tax-advantaged accounts? By now, you have likely received your Notice of Assessment from the Canada Revenue Agency (CRA) for your 2022 taxes. Do you have available RRSP or TFSA contribution room? The latest statistics suggest there is over $1 trillion of unused RRSP contribution room available.1 Similarly, most TFSA holders have not maximized their contribution room.2

2. Do you have unclaimed assets? The number of unclaimed

or forgotten assets continues to grow, serving as a reminder of the benefits of consolidating financial accounts to prevent assets from becoming orphaned over time. The latest reports suggest that $1.1 billion of unclaimed balances are held by the Bank of Canada. The CRA has 8.9 million uncashed cheques equating to over $1.4 billion. Does any belong to you? To search for unclaimed assets, see: www.unclaimedproperties.bankofcanada.ca/app/claim-search. Check your CRA “My Account” for unclaimed cheques at: www.canada.ca/en/revenue-agency/services/uncashed-cheque.htmlactive.

3. Are you keeping in good standing with the CRA? Consider that the CRA’s prescribed rate, which is adjusted quarterly based on prevailing interest rates, currently stands at 5 percent.3 More prominently, the interest charged on insufficient or late instalments, other remittances and penalties, has risen to nine percent! This may be particularly notable for investors who make quarterly instalment payments or remit payroll taxes for a small business: Be on time to avoid costly interest charges!

The CRA continues to crack down on tax mishandling. Recently, it held back tax refunds for those who incorrectly claimed pandemic benefits, recovering $237 million.4 It continues to monitor real

estate transactions to curb non-compliance for property sales and unreported capital gains, completing over 61,000 real estate audits. The Residential Property Flipping Rule that began this year is intended to

support the CRA in clarifying a taxpayer’s obligations, with profits from the sale of a property held for less than 365 days generally treated as business income.

[1] At 2016; Statistics Canada Table 111-0040 “RRSP Room”; [2] www.canada.ca/content/dam/cra-arc/prog-policy/stats/tfsa-celi/2019/table3-en.pdf; [3] www.canada.ca/en/revenue-agency/services/tax/prescribed-interest-rates.html; [4] www.cbc.ca/news/politics/cra-witholding-tax-refunds-pandemic-benefits-1.6829594

A Revolutionary Change?

Welcome to the Age of Artificial Intelligence

“In my lifetime, I’ve seen two demonstrations of technology that struck me as revolutionary…the graphical user interface, the forerunner of every modern (computer) operating system…and artificial intelligence (AI).”- Bill Gates

In the summer of 2022, technology pioneer Bill Gates met with the team that developed the algorithm ChatGPT and left them with a challenge: “Train an artificial intelligence to pass an Advanced Placement biology exam…if you can do that, you’ll have made a true breakthrough.”

Expecting to keep them busy for two or three years, they returned to Gates in less than a few months. ChatGPT would correctly answer 59 of 60 multiple-choice questions in this college-level test and provided outstanding answers to six open-ended questions. Then, to further amplify its capabilities, it masterfully answered a non-scientific question: “What do you say to a father with a sick child?” The experience, according to Gates, was “stunning.”1

Indeed, the age of AI has begun. The remarkable capacity of artificial intelligence is increasingly demonstrating its potential to be a significant disruptor. Quite understandably, it has also ignited a new debate about the threat of our technological advances. Yet, beyond this deeper existential debate, the evolution of AI should remind us of the continued pursuit of humans to constantly advance. Look at how far we’ve come in just two centuries:

- At the start of 1800, life expectancy was around 34 years old. There was no electricity and 90 percent of the population was illiterate.2

- To start 1900, the average family had no indoor plumbing, phone or car, and less than 10 percent of homes had electricity.3

- At the onset of 2000, smartphones didn’t exist. Today, we use these to watch live TV, buy clothes, get driving directions or even file our taxes!

Earlier revolutions, such as those sparked by the development of railroads, electricity and the automobile ignited upwaves of economic growth that lasted for many decades. Consider the impact of the global petroleum industry or the assembly line introduced by Henry Ford — the latter changed global manufacturing processes forever. Will this revolution be any different?

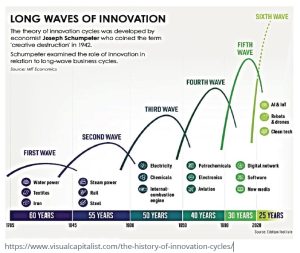

Economist Joseph Schumpeter developed the theory of innovation cycles suggesting that business cycles operate under long waves of innovation (see infographic). These new waves emerge as the markets are disrupted by “creative destruction.” One observation is that as time progresses, these waves are getting shorter — some suggest that this is because there are diminishing marginal returns for innovation.

What does this mean for investing? Innovation will continue to drive economic growth, just as it always has. Taking a step back, let’s not forget that when we invest in the equity markets, we are investing

in the businesses that underlie the economy. Over time, economies have continued to progress and grow because of the motivations of individuals and businesses to innovate and advance, as we are witnessing today.

Of course, in the face of increasingly rapid change, our willingness to adapt also remains important. In the third wave of innovation, Ford and GM had hundreds of competitors that caught the imagination of investors. And do you remember Wang and Commodore? They were the high-tech leaders of the 1980s that have faded from view. Investing involves assessing the changing world, with careful analysis, selectivity and a nimble approach.

Though we may currently be enduring slower economic times, we should expect innovation to support the new growth yet to come — and investors can share meaningfully in the change that lies ahead. Continue looking forward!

[1] https://www.gatesnotes.com/The-Age-of-AI-Has-Begun; [2] en.wikipedia.org/wiki/Life_ expectancy#/media/File:Life_expectancy_in_1800,_1950,_and_2015.png; “Factfulness: Ten Reasons We’re Wrong About the World,“ Hans Rowling, April 2018; [3] www. sciencemuseum.org.uk/objects-and-stories/everyday-wonders/electric-lighting-home