As an investor, wouldn’t it be great to travel back in time 30 years to alter the course of the future? Knowing what you know now, would you choose to do things differently?1

It may be surprising to recall how the world has changed in three decades. Back in 1995, the “World Wide Web” was still largely unknown. Released in the public domain two years earlier, only 3 percent of us had logged on. Inventions like the PalmPilot and Windows 95 (with no internet browser!) were considered “landmark.”2 That same year, a young Jeff Bezos sold his first book from his online bookstore, Cadabra, which he ran out of his garage. This venture would eventually become Amazon. Would you have had the foresight to join him on this journey? In hindsight: Of course. In reality: Probably not.

The economic landscape back then had some interesting parallels to today. While the U.S. enjoyed some of the highest GDP growth and lowest inflation to end 1994, Canada’s future appeared uncertain. Unemployment hovered above 8 percent and the Bank of Canada began aggressively lowering its policy rate to help boost growth. The Wall Street Journal referred to our dollar as the “northern peso,” and Canada as an “honorary member of the Third World.”3

This look back over time may offer valuable perspective as we enter a new year. Despite a notable year in the markets, it may be easy for investors to focus on short-term challenges. Canada’s declining productivity and lagging economic growth remain top of mind, as do new concerns about how far equity markets have advanced. Yet, we shouldn’t overlook how much change can happen, even in short periods. In 2024 alone, we entered an easing rate environment, expectations of a hard landing gave way to a soft landing, inflation largely moderated and, despite many challenges, markets continued to advance.

While the double-digit market returns of 2024 should be embraced, they highlight a key principle: market (and economic) growth is rarely linear. Meaningful progress is often measured over decades. Reflecting on the past also reminds us that unexpected shifts can transform economic conditions. In 1995, then-Prime Minister Jean Chrétien and Finance Minister Paul Martin orchestrated one of the most dramatic fiscal turnarounds in history. Canadian debt shrank from 68 percent of GDP in 1995/96 to 29 percent by 2008/09, with budget surpluses for 11 consecutive years. Our fiscal position in the G7 went from second-worst to first. We reaped a “payoff decade,” outperforming in growth, job creation and inward investment.3 Notably, the S&P/TSX Composite Index opened at 4,192.90 to start 1995, a time of substantial uncertainty; today, it has surpassed a level of 25,000. While we may not have had the foresight to join Bezos in his garage, investing $200,000 in the market could have grown to nearly $1.2 million today, without reinvested dividends — a reminder that broad opportunities often exist alongside big ideas.

Indeed, investors don’t need a time machine to make sound choices. Just as in the past, future success is likely to favour those who recognize today’s opportunities and commit to them. While there’s never any guarantee of what tomorrow will bring, the only way to miss out on the growth potential is to sit on the sidelines. Here’s to a new year ahead — and the next 30 years to come!

1. Of course, this is the narrative of the iconic movie Back to the Future, celebrating its 40th anniversary; 2. https://fastcompany.com/3053055/1995-the-year-everything-changed; 3. https://financialpost.

com/uncategorized/lessons-from-canadas-basket-case-moment

PORTFOLIO MANAGEMENT

Portfolio Rebalancing: Four Additional Benefits

Rebalancing a portfolio involves adjusting the allocation of assets to bring it back in line with your original investment strategy, ensuring it remains consistent with your risk and return profile. Why is this important? Over time, certain assets or sectors in your portfolio may grow faster than others, causing your overall asset allocation to shift. Rebalancing helps prevent any single investment or asset class from becoming too dominant, ultimately helping to manage and control risk. No matter how promising a particular company, industry or asset class might appear, maintaining an appropriate balance according to your risk profile can help to protect your investments from excessive downside exposure.

Regular portfolio reviews and adjustments are essential for effective diversification and asset allocation. However, consider that rebalancing can offer benefits beyond just managing risk, and here are four:

- Helps to Keep Emotions in Check — Rebalancing can help remove emotion from buy-and-sell decisions by basing them on objective criteria, like asset allocation, rather than on market sentiment. While the principle of “buy low and sell high” seems straightforward, it may be challenging to follow in practice. Often, stocks are priced low during market downturns when sentiment is at lows and investors are focused on selling, not buying. Conversely, in times of market euphoria, investors may hesitate to sell.

- Enables Strategic Capital Deployment — Rebalancing doesn’t always mean selling assets. At times, simply redirecting new cashflow to underweighted asset classes can help to bring a portfolio back into balance. This approach offers the added discipline of focusing on potentially undervalued asset classes or sectors, supporting the “buy low” principle by positioning new investments in areas that need more weight in the portfolio.

- Balances Gains with Losses — If rebalancing requires selling part of an overweight position, keep in mind that gains realized outside of registered plans are subject to capital gains tax. To reduce this tax liability, consider offsetting gains by selling positions with losses. Alternatively, if you want to hold the position, you could buy it back after a 30-day waiting period under the superficial loss rules. Or, a previous net capital loss can be carried forward to the current tax year to offset gains. Within registered plans, there will be no tax implications if securities are traded and funds remain in the plan, making asset location an additional consideration when rebalancing.

- Manages a Potentially Higher Capital Gains Inclusion Rate —With potential increases to the capital gains inclusion rate,* an approach to rebalancing can help spread out the realization of gains over multiple years rather than all at once. This strategy could allow investors to take advantage of the lower inclusion rate for realized gains up to $250,000 each year (for individuals).

Beyond asset allocation, rebalancing offers additional potential benefits that can strengthen your overall portfolio and wealth management. If you’d like to discuss rebalancing, or any other aspect of your portfolio strategy, please feel free to reach out.

*At the time of writing, the implementation bill has not achieved royal assent.

NEED IDEAS ON WHERE TO START?

Your New Year’s Financial Checklist

The beginning of a new year is an opportune time to revisit certain aspects of your wealth management. If you don’t know where to start, here are a handful of ideas. For more information, please call the office.

- Contribute to the RRSP. The Registered Retirement Savings Plan (RRSP) deadline for the 2024 tax year is March 3, 2025, limited to 18 percent of 2023 earned income to a maximum of $31,560. Don’t forget: you can make a contribution, but can defer the deduction to a future year if you believe your marginal tax rate will be substantially higher.

- Fund your TFSA. The 2025 Tax-Free Savings Account (TFSA) annual dollar amount is $7,000, bringing the eligible lifetime contribution limit to $102,000. Have you fully contributed?

- Revisit account beneficiaries. This is especially important

if you’ve left a job or had changing life circumstances. If you need assistance with investment accounts, let’s connect. - Review your estate plan. Do you have updated documents

in place, including a will & estate plan, power of attorney (or related documents, i.e., healthcare mandate) or trusts to support beneficiaries? - Review your insurance. Even if you have the right insurance in place, rates can change over time or new discounts or programs may be available. Consider the opportunity to negotiate better rates, such as by bundling multiple policies like auto and home.

- Evaluate your savings. Even for high-net-worth investors, a rising cost of living underscores the value of a budget to identify spending patterns. Effective saving remains one of the few aspects of wealth management that is fully within our control.

- Manage debt. An estimated 1.2 million mortgages in Canada are up for renewal at higher rates in 2025 alone. Despite easing interest rates in 2024, borrowers are still seeing some of the highest mortgage rates in recent times. If you have a renewing mortgage, it may be an opportune time to explore options. Start early to allow time to negotiate better terms or potentially switch lenders. If you have high-interest debt, consider prioritizing repayment or refinancing as rates change.

- Account for changes in health status. In our work as advisors, many are seeing clients overlook the impact of health changes in wealth planning. If you or your family members experience longer-term changes, from diabetes to dementia, valuable support may be available. At a basic level, one overlooked benefit is the disability tax credit.

- Organize financial documents. With tax season just around the corner, consider organizing both digital and paper financial documents, ensuring secure storage for sensitive documents.

- Holding a bare trust? Note that CRA will not require bare trusts to file a tax return for the 2024 tax year. Draft legislation has been introduced that, if passed, will exempt trusts with a fair market value of $50,000 or less throughout the year. If all parties to the trust are related individuals, the exemption will rise to $250,000 if only certain assets are held (i.e., GICs, stocks, bonds, mutual funds or ETFs). This will apply to bare trusts with years ending December 31, 2025, and later.

SEEKING INCOME-SPLITTING OPPORTUNITIES?

RRSP Season: Don’t Overlook the Spousal RRSP

It’s RRSP season once again! Over the decades, the federal government has eliminated many income-splitting opportunities available to taxpayers. However, if you have a spouse/common-law partner, don’t overlook the spousal Registered Retirement Savings Plan (RRSP) — a valuable opportunity to split income at retirement if your spouse will be in a lower tax bracket at that time.

A Tax Break Now…A Tax Break Later

A spousal RRSP is a plan to which you contribute on behalf of your spouse and receive a tax deduction based on your own available RRSP deduction limit. With a spousal RRSP, your spouse is the annuitant, so any funds withdrawn are considered to be the spouse’s income and must be included in their income tax return. As such, withdrawn funds will be taxed at a lower rate should your spouse pay tax at a lower rate than you. Be aware that income attribution rules may apply to a spousal RRSP: In general, if you contribute to a spousal RRSP in the current year, or two of the preceding years, some or all of any RRSP withdrawal may be taxed in your hands.

More Flexibility Than Pension Income Splitting?

A spousal RRSP may provide an enhanced income-splitting opportunity when compared to pension income splitting. Pension income splitting can only be done after reaching the age of 65 and is limited to 50 percent of eligible pension income. A spousal RRSP can begin before get 65 and the full amount of RRSP withdrawals may be included in the spouse’s tax return. However, RRSP contributions can only be made until the end of the year the taxpayer turns age 71. If you have a younger spouse, you can contribute to the spousal RRSP until the end of the year the spouse turns age 71.

For any RRSP matters, please call.

Consider the “Four Cs” of RRSP Season

Contribute — The deadline for RRSP contributions for the 2024 tax year is Monday, March 3, 2025. Consider an automatic monthly contribution plan to avoid missing the deadline.

Consolidate — If you hold multiple accounts across different financial institutions, consolidation may provide convenience, comprehensive asset oversight and potential cost savings.

Collapse — If you are turning 71 years old in 2025, please get in touch to discuss options to convert your RRSP.

Confirm (Beneficiaries) — Ensure your plan beneficiaries are updated to avoid complications when settling your estate.

DEBUNKING THE MYTHS

Investing After Periods of Strong Market Returns

“The strongest of all warriors are these two: Time and Patience.”

— Leo Tolstoy

Following the notable gains in both Canadian and U.S. equity markets in 2024, some investors may feel hesitant about the prospect of continuing to put money to work. Here are a few myths, debunked, about investing after periods of strong market performance:

Myth: Investing at all-time highs means substantially lower returns. While investing benefits from the practice of buying low and selling high, sometimes perceived highs still allow for growth. Consider the situation to start 2024 — many were asking if U.S. markets ad

peaked. Yet, investing only at market highs may not be as unfavourable as many believe. Since 1950, the returns from investing in the S&P 500 only at all-time highs wouldn’t be far from the average index when

investing at all other dates for one-, three- and five-year periods.

Myth: Market corrections often follow market highs. In reality, corrections are not common after markets reach all-time highs. The chart (top) shows just how often the S&P 500 has finished down more than 10 percent (often defined as a market correction) over various periods, following any of the over 1,250+ all-time highs since 1950.

Myth: High U.S. market concentration will lead to a prolonged bear market. While strong performance driven by the tech sector has led some market pundits to warn of a potential “lost decade”

for U.S. stocks, historical analysis suggests otherwise. An interesting study of over 200 years of U.S. stock market history concluded that significant increases in market concentration did not typically lead to dramatic bear markets; instead, bull markets often continued following periods of rising concentration associated with the onset of a bull market. Certain sectors, reflecting the prevailing innovation at the time, such as technology today, were responsible for high concentration and this dominance often persisted for extended periods — in many cases multiple decades.2 Another analysis of the S&P 500 over 90 years shows that rolling 10-year returns below 3 percent are rare, largely occurring in the worst economic periods in history: the Great Depression, the stagflation of the 1970s and the Great Financial Crisis.3

This isn’t to suggest that recent rapid gains are expected to continue at a similar pace. Indeed, we may find ourselves in a period where strategic security selection is even more important — and this is where our work as advisors shines through. These perspectives are intended to provide a more balanced view of market concentration and high valuations. Enjoy the gains we’ve recently seen, but don’t overlook the importance of time and patience in building wealth for the future.

1. https://www.rbcgam.com/en/ca/learn-plan/investment-basics/investing-at-all-time-highs/detail; 2. https://globalfinancialdata.com/200-years-of-market-concentration; 3. https://awealthofcommonsense.com/2024/10/3-stock-market-returns-for-the-next-decade/

Investing Resolutions: Resolve to Review Your Will

If you are looking for a financial resolution to start the year, why not make estate planning a priority?

Every so often we hear stories about the consequences of not having a valid will. To die without one, known as dying “intestate,” can have significant and perhaps unintended effects as assets will be distributed according to the rules set out by your province of residence. This can result in additional costs to the estate, such as a large tax bill that could have been reduced if better planned for. It can also lead to conflicts between loved ones who are left behind to sort out matters without direction. In addition, other tax-planning or succession plans may be compromised as a result. This would be unfortunate, as a valid will is comparatively inexpensive to put in place. Even if you do have a valid will in place, consider the importance of it reflecting your current circumstances, which points to the need for periodic reviews.

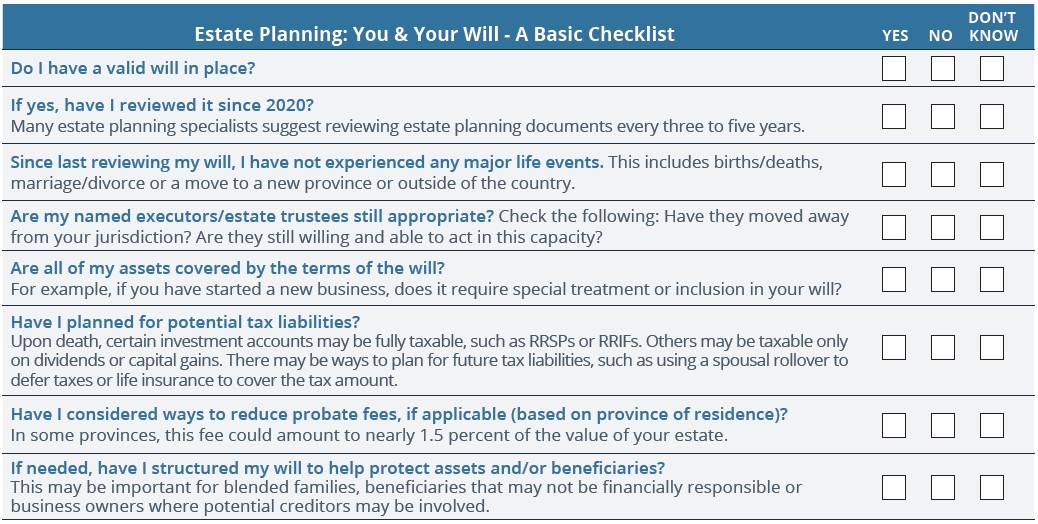

As we begin another year, take a look at the checklist below to see if any adjustments are needed to your final instructions. This isn’t meant to be a comprehensive list, but is intended to act as a starting point to determine whether a review might be useful. If you answer “no” or “don’t know” to any of the questions, perhaps a review is in order. It’s time well spent to take steps to ensure the validity of your will for the sake of your beneficiaries. It may also bea great time to review the beneficiary designations for accounts or assets that do not pass through your will, which may include registered accounts (not applicable in QC) or insurance.

Seven (Not-So-Serious) Reasons to Skip Estate Planning

These tongue-in-cheek “reasons” may serve as a lighthearted reminder of why it may be wise not to put off estate planning:

- You enjoy paying taxes.

- Your family has never had a dispute.

- You feel the government deserves more of your money.

- You’re convinced you’ll get plenty of warning before anything happens.

- You believe lawyers need extra work for probate disputes.

- Your pet can fend for itself.

- You’re planning to live forever.

Having a solid estate plan is essential for protecting your loved ones and your assets. Don’t leave it to chance.

Why not resolve to make your estate plan a priority for 2025? If you need assistance, please call.