The Power of Economic Sentiment

“Have we all just become economic snowflakes?”

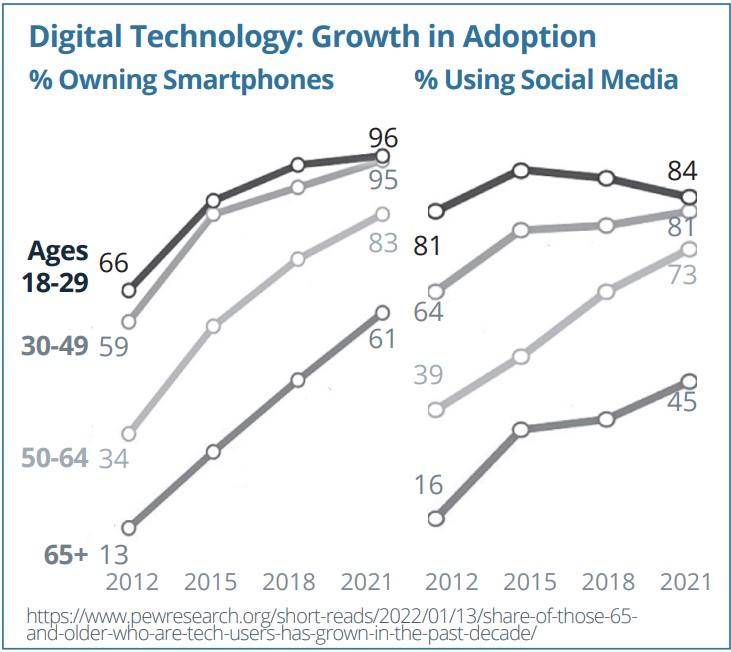

This question emerged from a recent study analyzing the text of 200 million newspapers spanning almost two centuries. It concluded that both economic and non-economic sentiment have substantially declined over the past 50 years, despite far fewer economic setbacks.2

In the not-so-distant past, recessions were seen as natural business cycle occurrences. Some market observers suggest this view shifted after the Global Financial Crisis, with policymakers now striving for the aversion of economic pain as a top priority.

Indeed, it appears that the long-feared recession in the U.S. may be far from arriving. While Canada’s economic output has been lacklustre, our economy has remained relatively resilient. Labour markets have been one reason for this resilience, with unemployment continuing at relative lows. This has largely supported GDP growth south of the border, where Americans have lower debt obligations and continue to spend; consumer spending comprises over two-thirds of U.S. GDP. We’ve needed a boost in Canada with our higher indebtedness and declining labour productivity rates. Yet, consider that wealth, wages and employment are higher today than they were before the pandemic began.

Still, for many, optimism continues to be in short supply. However, there are benefits to being more positive about the economy. One interesting observation from the same study that questioned our collective resilience suggested that positive economic sentiment can drive economic growth.2

It’s a view that merits perspective. Perhaps we’d be better off focusing on positive sentiment. We are living through a pivotal time, where advances in the availability of big data, high-powered computing and artificial intelligence (AI) are expected to lift productivity. While recent U.S. equity market gains have been driven by the handsomely-rewarded tech stocks, AI is in its early innings and its productivity and growth potential is far reaching — well beyond the tech sector.

Canada’s stock market has trailed due to its more cyclical nature, but is poised to benefit from interest rate stability and declining long-term rates. Corporate earnings may be driven by higher margins through efficiency gains and lower input costs, particularly as inflation moderates. While Canadian economic output has been sluggish, the strength of our largest trading partner should help provide near-term momentum. And, the potential for interest rate cuts may provide further tailwinds to equity markets.

This is not to suggest that short-term setbacks won’t occur. There are continuing signs of slowing economic growth closer to home and abroad; the latest GDP data for the UK, Japan and Germany has been negative or close to zero. Yet, slower growth is part of the cycle and sometimes necessary for economies to cleanse excesses or reset — or even spark innovation and new growth.

Seasoned investors accept that both financial markets and economies will ebb and flow. This feature comes with progress of any sort. It is also one reason to support diversification in portfolio management and a good reminder of why we continue to invest with a view to the longer term. Looking forward, continue to focus on the many positives. Here’s to the warmer and longer spring days ahead. Please let me know if I can be of assistance with any investing matters.

- https://www.ft.com/content/af78f86d-13d2-429d-ad55-a11947989c8f;

- https://www.nber.org/system/files/working_papers/w32026/w32026.pdf;

FACTORS IMPACTING THE CPP TIMING DECISION

More Perspectives on When To Start CPP Benefits

When it comes to the decision of when to start Canada Pension Plan (CPP) benefits, actuarial studies show that many are better off delaying benefits since the break-even age* commonly falls below our average life expectancy. Living beyond the break-even age means that waiting will yield a larger total lifetime payment. Recall that starting CPP before age 65 (as early as age 60) decreases payments by 0.6 percent per month; yet, delaying CPP beyond 65 (up to age 70) increases payments by 0.7 percent per month, to as much as 42 percent.

Of course, it’s not just expected longevity that should influence the decision. Factors such as the need for income, the impact on incometested benefits and others may be considerations. And now, as more Canadians continue to work past age 65, another factor that should be accounted for is how retiring early — or late — can affect CPP benefits.

Consider the situation in which an individual works past age 65 and also delays CPP benefits. This can lead to a potentially greater benefit. CPP benefits are generally calculated using the best 40 years of income, usually between ages 18 and 65. Since lower-earning years tend to be at younger ages when first starting a career, if you extend your working years past age 65, you may be adding higher-earning years to the calculation and increasing the benefit. The good news? It doesn’t work the other way: Any low-earnings years due to employment past the age of 65 will have no effect on the benefit calculation.1

CPP Timing Tool: This tool may help to calculate and decide whether you should start collecting CPP earlier or consider deferring payments until later: https://www.theglobeandmail. com/investing/personal-finance/tools/cpp-benefits/

Conversely, if you retire before 65 but wait to take benefits, the zeroearnings years have the potential to negatively affect your CPP benefit. For example, retiring at age 60 and waiting to collect CPP at age 65 can potentially add five zero-earning years to the calculation of the benefit.

Regrets, We’ve Had a Few…

Indeed, Frank Sinatra’s words may be a fitting reminder to carefully consider the decision. Since most Canadians opt for early benefits, there has been a recent increase in media coverage discussing reasons to consider a delay. Here are some perspectives from those who wished they had waited:2

A potential reduction of survivor benefits — A widow receiving CPP survivor benefits from her deceased spouse was unaware that the decision to begin her CPP might jeopardize the maximum entitlement. She didn’t consider that survivor benefits would change at age 65, or the impact of deferring her own CPP benefits until after the age of 65.

Leaving more for beneficiaries — Since he wasn’t in need of funds, one man wishes he waited after realizing how much more he could have left for his beneficiaries. One study suggests that taking CPP at age 60 instead of 70 could forgo $100,000 worth of lifetime benefits.3

Inflation indexing — Living on a fixed income in retirement is difficult, especially as inflation has increased the cost of living. One retiree recognizes that had she waited, she would have had a larger benefit that, after indexing for inflation, would have been even greater.

A return to the workforce — One man started CPP at age 60 and retired at age 63, but then decided to go back to work. He regrets starting early due to the taxes paid on the CPP after returning to work.

*The age at which the total benefits received by delaying CPP payments exceed the total benefits received by starting CPP payments earlier.

1. https://www.theglobeandmail.com/investing/personal- finance/article-retiring-early-or-late-heres-how-your-cpp-benefits-could-be-affected/;

2. https://www. theglobeandmail.com/investing/globe-advisor/advisor-news/article-these-canadians-wish-they-hadwaited-to-take-their-cpp-benefits-heres/;

3. https://www.theglobeandmail.com/investing/personal- finance/article-taking-cpp-early-can-cost-you-100000-and-limit-your-long-term/

BE AWARE OF NEW REPORTING RULES

Are You Associated With a “Bare Trust” Arrangement?

Are you a legal owner of an asset where someone else is a beneficial owner and has a beneficial interest and oversight of the asset? If so, you may be holding a “bare trust” and have a filing requirement where you previously did not.

Here are some examples where a bare trust arrangement may exist:

- You have been added to the title of an adult child’s home in order to help your child qualify for a mortgage.

- You have been added to the title of an elderly parent’s home for the sole purpose of facilitating estate planning.

In Brief: What Is a Bare Trust?

According to the CRA, a bare trust “exists where a person, the trustee, is merely vested with the legal title to property and has no other duty to perform or responsibilities to carry out as trustee, in relation to the property vested in the trust.”1

New Reporting Requirements Why is this important?

Starting in 2023, even if there is no income or activity to report, all trusts and trust-like relationships must file a T3 Trust Income Tax and Information Return within 90 days of the trust’s tax year end. The reporting requirements have been expanded to include bare trusts.

However, there is good news. Given that bare trust arrangements are new to these rules, the CRA will provide relief for penalties if the T3 return has not been filed by the deadline. This relief is only applicable to bare trusts for the 2023 tax year. Certain trusts are excluded from the reporting requirements, including those less than three months old at year end, and trusts holding certain assets with a fair market value of $50,000, as examples.

Seek Assistance

Since the intent of the arrangement can impact whether or not it is considered a bare trust, if you hold an arrangement that has a separate legal and beneficial owner, it is best to consult tax and legal experts. For more information: https://www.canada.ca/en/revenue-agency/services/ tax/trust-administrators/t3-return/new-trust-reporting-requirementst3-filed-tax-years-ending-december-2023.html

1. https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/p-015/ treatment-bare-trusts-under-excise-tax-act.html

This is not intended to be a legal discussion of bare trusts. Please seek professional advice.

ESTATE PLANNING FOR DIGITAL ASSETS

Your Digital Footprint: Don’t Overlook Its Value

In estate planning, many of us tend to focus on assets with tangible value, such as investments and real estate. Yet, frequently disregarded are many digital assets due to their perceived lack of monetary value. However, a Wall Street Journal article reminds us that these assets may possess substantial sentimental value, and overlooking their transfer can have distressing outcomes. For instance, one widow was unable to retrieve thousands of photos stored on her partner’s cloud account. Another wasn’t able to access her late husband’s Facebook profile.1

It is becoming increasingly important for loved ones to know how to access digital accounts to safeguard important information. Canada doesn’t have consistent legislation giving the executor/attorney automatic authority to deal with digital assets. Rules vary by province, if they exist at all.2 Yet, even if laws do allow for authority, the reality is that access can be difficult if no provisions have been made by the deceased. Customer support for online accounts is often limited, creating challenges and undue stress during an already emotional time.

As such, here are a few steps we can all take today to help safeguard our digital assets and provide future access:

Update your inventory — Just as we should keep an inventory of physical assets for estate planning, it is equally important for digital assets with no perceived monetary value. This includes records for digital assets (computers, phones, tablets, etc.) and online accounts (usernames and passwords for each). The list should be updated regularly and securely stored. This not only helps loved ones with access, but also with security to manage, protect or close accounts and destroy sensitive material or information.

Safeguard data — Protect your data by regularly backing up important files, contacts, photographs and other information stored on your devices. Consider encrypting sensitive data for added security.

Consider the use of a password manager — If keeping an updated list of accounts/passwords is difficult, consider a password manager. These software programs maintain access information for digital accounts, including account numbers, passwords and other important data you might need to leave behind.

Establish a legacy contact or plan — Many platforms offer options to designate a legacy contact or create a legacy plan for your accounts. For Apple devices, go to “Settings” and then tap your name. Under “Password & Security” go to the “Legacy Contact” option. The system will generate an access key for your contact, which will need to be presented alongside a death certificate to access data. Google users can access this feature by visiting “myaccount.google.com” and selecting “Data & Privacy,” then “More Options” and “Make a plan for your digital legacy.” You can then decide when Google should consider your account inactive and what will be done with your data.

Revisit your estate plan — Ensure your will, power of attorney or any other relevant directives include language addressing digital assets. Grant representatives the authority to access, manage, distribute and dispose of these assets accordingly.

1. https://www.wsj.com/articles/a-plan-for-your-digital-life-after-death-177b065e;

2. https://dig.watch/updates/saskatchewan-ca-introduces-fiduciaries-access-digital- information-act

TAX SEASON IS HERE AGAIN

A Reminder of How Interest Income Is Taxed

With rising rates, there has been increasing interest in guaranteed investment certificates (GICs). Now that tax season has arrived, here is a reminder of their tax treatment, as well as the taxation of bonds.

The taxation of GICs — GICs are often “locked in” and cannot be cashed in until their maturity date. As an example, for a five-year GIC purchased on July 1, 2023, the invested capital must remain in place until July 1, 2028, in order to receive the interest earned. However, this doesn’t mean that there isn’t a tax liability. For non-registered accounts, any accrued interest must be reported on an annual basis, even if it has yet to be received.

Accrued interest is reported based on the anniversary date of the GIC’s issue. So, for the five-year GIC noted above, the interest accrued during 2023 would be the equivalent of six months: July 1 to Dec. 31, 2023. For 2024, a full year of accrued interest would be reported. The exact amount would depend on when interest is calculated and compounded; in most cases, interest is calculated every six months, though some products may compound interest daily or monthly. A T5 information slip will be issued for interest amounts of $50 or more. This interest income is fully taxed at your marginal rate in the year it is earned.

The taxation of bonds — Interest income is also generated from bonds. Interest earned in nonregistered accounts, often paid semiannually, must be reported each year on a tax return.

The rapid rise in bond yields has resulted in many “discounted bonds” that may offer greater tax efficiency when compared to a GIC. When purchased on the open market, a bond’s price can fluctuate based on changes to its stated interest rate. If the bond is purchased at a lower price and sold at maturity, a portion of the return will be a capital gain, taxed at a lower rate than interest income. Also notable, when accrued interest is paid at the time of purchase, it is deductible as an investment expense on a tax return for the year in which you bought the bond.

Spring Cleaning Your Finances?

Five Questions To Ask & Related “Rules of Thumb”

Now that ‘spring has sprung’ and many of us are in spring cleaning mode, perhaps you are looking for a bit of motivation when it comes to your finances. Here are five wealth planning questions that may be answered by simple “rules of thumb.”

These may spark meaningful discussions about wealth management, budgeting or family and estate planning — or perhaps even help to motivate better financial decisions for you or others. Consider sharing these rules of thumb with younger adults who are just starting their wealth-planning journey to help inspire their own financial thinking:

1. How long will it take for my investments to grow?

The Rule of 72: In the investing world, we often use the Rule of 72 as a simple way to estimate the time it takes to double an investment based on a constant rate of return. Dividing the number 72 by this rate of return determines the approximate number of years it would take to double. For example, with a 6 percent rate of return, it would take approximately 72÷6, or 12 years. The Rule of 72 can be a good reminder of the power of compounding and the importance of staying invested over the longer term. Indeed, the opportunity to build significant wealth is within reach for both young and old investors alike. Consider that at a rate of return of 6 percent, even if you’ve reached the respected age of 70, based on the average life expectancy, you are likely to see your funds double — and twice still if you become a centenarian!

2. Am I on track with my wealth accumulation?

The Net-Worth Indicator: This rule of thumb can be used to gauge your current wealth accumulation progress based on your household income, as developed by the authors of the book “The Millionaire Next Door.” Multiply your age by your realized pre-tax annual household income from all sources except inheritances. Divide by ten. The answer is your expected net worth. If your actual net worth is more than twice this figure, you are considered a “prodigious accumulator” of wealth. If it is below this figure, you are considered an “under-accumulator” of wealth.

3. What portion of my budget should go toward saving?

If you are an under-accumulator of wealth, perhaps there may be merits to engaging in budgeting to improve savings, control expenses, manage debt or instill discipline.

The 50-30-20 Budgeting Rule: This simple budgeting rule involves dividing after-tax income into three buckets: 50 percent to “needs,” 30 percent to “wants” and 20 percent to “savings.” Needs include housing, utilities, food, transportation, healthcare and childcare. Wants are non-essential, including memberships, entertainment and fashion. Savings include investment and debt repayment; however, if you hold debt, it may be prudent to consider allocating a greater proportion to paying it down, given the higher costs of holding debt.

4. How much of my income should be put toward a house?

The Rule of 30 for Home Purchases: In the past, there was a general rule of thumb that suggested the price of your home should be no more than three times your annual gross income. However, over the past decade, housing prices have skyrocketed in many metropolitan cities making this rule of thumb largely outdated. Instead, the Rule of 30 may be a more practical replacement, suggesting that we should limit total annual housing costs, including mortgage payments, insurance, property taxes and maintenance, to 30 percent of gross income. This rule may be especially important to help younger folks frame a purchase decision. Overspending on a house can leave individuals vulnerable to financial instability, especially in the event of unforeseen circumstances such as job loss or economic downturns.

5. When should I be having discussions with elderly parents?

The 40/70 Rule for Aging: This simple rule of thumb encourages discussions about aging-related matters, suggesting that these conversations should happen between adult children and their aging parents once the child reaches the age of 40 or the parents turn 70. The rule is based on the premise that it is best to start these discussions when parents are still healthy and capable — well before any potential crisis forces decisions to be made. These discussions may include difficult topics such as future care, living arrangements, decision-making support, finances and end-of-life decisions.

Call for Support — Or Ideas!

Of course, these rules of thumb are meant to be informal guidelines — they are oversimplified and general in nature. They do not consider individual circumstances and may not apply to everyone’s particular situation.

However, they may provide high-level guidance and motivation, or inspire new thinking, when it comes to managing finances and wealth. If any of these rules of thumb prompt further questions or the need for wealth management or estate planning support, please call the office.