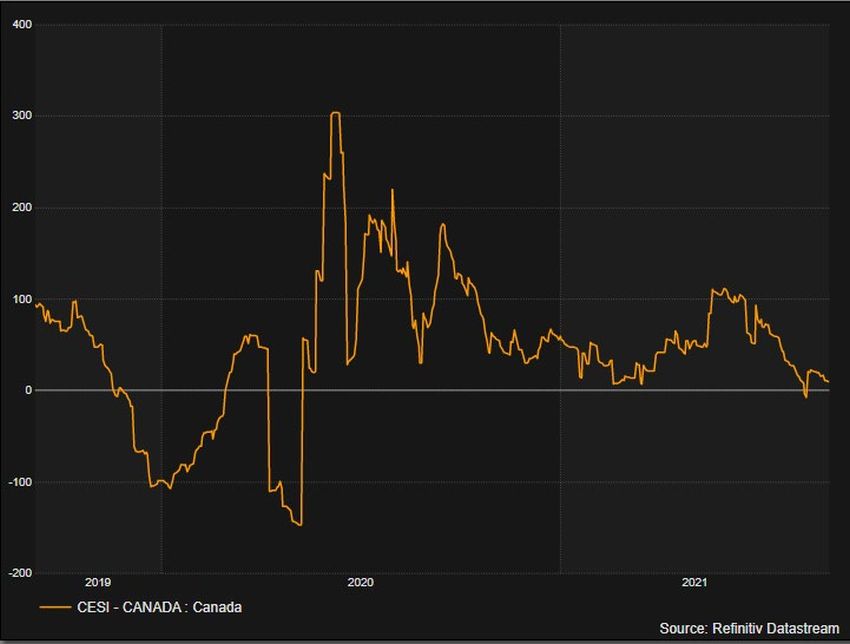

Today’s Bank of Canada (BOC) decision to maintain the overnight rate at 0.25% and the pace of Quantitative Easing to $2b of assets purchased a week is not overly surprising given the context of an economic backdrop that looks to be decelerating, when looking at the following chart for Canada of the Citi Economic Surprise Index (CESI – Canada). Question is, should the CESI – Canada decidedly push into the negative, be it due to continued economic headwinds from the Delta variant or otherwise, will the BOC keep to an apparent path of continuing to reduce their Quantitative Easing as they have since Spring?