January has kicked off 2022 with a ferocious selloff across global markets, with many of them now falling into correction territory from their November highs (normally defined as a greater than -10% drawdown in price). The selling has varied across assets, sectors, and geographies, but has been felt especially hard in growth-oriented stocks where valuations have been cut dramatically.

The brutal market volatility looks to have reflexive characteristics associated with rapid fund flows and repositioning, as opposed to the deeper more structural shifts we often see in advance of an economic and earnings recessions. In other words, we consider this a dip in an otherwise upward bull-market trend and one which we expect will reverse itself in the coming months, as opposed to the beginning of a more protracted downtrend.

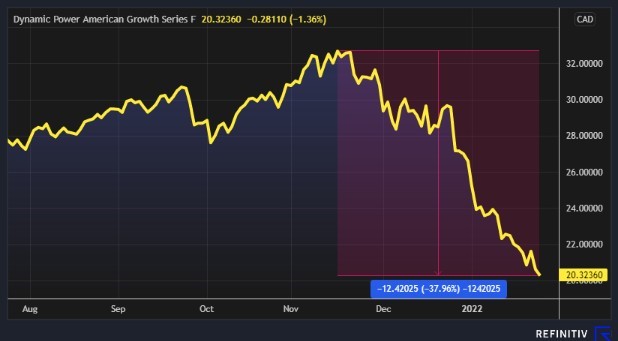

That being said, even if looked at within the context of a shorter-term correction, the ferociousness of the selloff has been near historic in its intensity for the beginning of a calendar year. Case in point, one Canadian mutual fund we often look to as a gold-standard in US growth-style stock investing, the Dynamic Power American Growth fund (5-star Morningstar rating and stellar near 20-year track record), has seen, as of writing, a nearly -38% drop in market value in the past couple months.

Former stalwarts and favorites of this bull market such as Netflix (NFLX) in the US and Shopify (SHOP) in Canada have recently seen their stock prices cut in half, to name a couple examples.

The likely culprit for the selloff? A general shift over the past few months amongst global central banks’ monetary policy stances from highly accommodative and stimulative postures, which they enacted to help combat the economic damage wrought by the pandemic, towards paths to tighten credit conditions in the face of more recent above-trend economic growth and elevated inflation.

Within this monetary policy context, the spark that seemed to have set off this cascade of selling was a seemingly dramatic change in rhetoric over the course of the past couple months from the U.S. Federal Reserve (Fed) with regard to its policy stance. The first hint of change came late last year, when Chairman Jerome Powell communicated in congressional hearings that the Fed no longer perceived inflation as a transitory phenomenon, but it was the release of the Fed’s Federal Open Market Committee (FOMC) December meeting minutes in the first week of this year that seemed to hit markets like a sledgehammer.

The minutes implied that Committee Members were becoming much more concerned about the currently elevated levels of inflation becoming entrenched and were thus countenancing a much more aggressive hawkish approach of accelerating interest rate hikes and tapering Fed asset purchases than markets had previously priced-in.

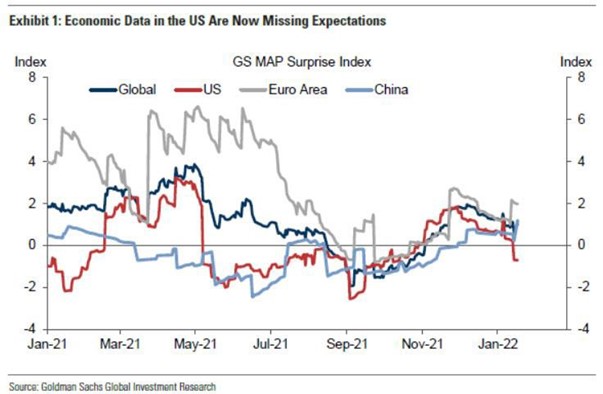

With the January FOMC meeting and press conference of the past week providing some greater clarity, we are of the view that markets seem to be overdoing it by baking in much more aggressive assumptions about upcoming Fed monetary tightening than even policymakers are telegraphing. This reaction now seems hinged on a perception that the Fed will be overly focused on lagging economic data and ignore a myriad of current and leading signals indicating that economic growth looks to be decelerating to more measured rate and that, consequently, inflation will likely come off the boil in the coming months.

With COVID-19 likely now transitioning to an endemic disease, it is our expectation that 2022 will see many of the health authority restrictions recede. This should rebalance consumers’ spending back towards more services from goods and unclog inflation-inducing supply-chain bottlenecks. Moreover, with various business and income support measures from governments having expired or expiring, many economies are likely to start feeling the impact of the drag on growth from fiscal policy being no longer supportive. In fact, Powell even highlighted this fiscal drag being a factor to reduce growth in 2022 in the recent FOMC meeting.

These economic factors, along with the mathematical impact of using elevated 2021 inflation readings as the basis for 2022 year-on-year comparisons for inflation measures this year, will likely have the effect of seeing these readings dissipate as we progress through the year.

With these factors in mind, we are of the position that markets are overdoing this reaction and are now being gripped by downside momentum and knee-jerk selling, with little regard for underlying fundamentals. Economic and earnings growth, though slowing, remain robust. Credit conditions, as in corporate bond spreads and shape of the yield curve, remain constructive. We are not in the midst of a financial or economic crisis, so we believe the current selloff looks to be the moves of markets throwing a tantrum at the prospect of the copious pandemic-response monetary stimulus being unwound and not some seismic shift in the trajectory of capital markets.

The drop in the value of your portfolios is not a reflection of the quality or underlying merits of the securities you hold, but rather our view is this is the product of this broad-based selloff across markets in a convulsive correction in asset prices more generally.

Much like as storm, corrections come and hit markets and then pass. How deep the current storm will drag markets down and for how long is impossible to know with certainty but given the degree of damage already sustained and the fact it is transpiring within the context of reasonably healthy economic conditions that have yet to sustain any meaningful credit tightening, we suspect we may be closer to the end than the beginning.

Given our managed account clients were spared the brutal volatility of the March 2020 market crash (more than -30% drop across many markets) during the onset of the pandemic, many of you have not experienced this sort of volatility since the fall/winter of 2018, so perhaps memories have now faded on how commonplace, and normal, these market events are. Much like the current investing climate, that 2018 correction was seemingly relentless and disconcerting, but ultimately came to end. Markets subsequently recouped their losses in the following few months and went on to new highs thereafter.

Given the generally shorter-term nature of corrections, it is important to not extrapolate out your financial situation and savings sustainability during a period where the market value of your assets is being extraneously and temporarily depressed by conditions we have a little control over. Best to avoid emotion, put the current situation in the appropriate context and avoid making any impulsive changes. Often the recoveries from corrections are as sharp on the upside as the plunges were on the downside, so impairment of long-term performance can be the by-product of any panicked de-risking in the depths of the selloff, thus why we will be staying the course after having made a few defensive adjustments in select models the week prior (which we will outline in a coming follow-up note).

We know how painful and disconcerting these market events can feel and, as always, our team is here for you. We believe this storm, much like the many that have come before, will too also pass, bringing sunny days once more.