Last year, when we began ratcheting down our exposure to stocks throughout our models, despite some resistance from a small handful of clients that wanted us to chase equity markets to ever higher all-time-highs, we did so with the expectation that a cyclical economic deterioration was ahead and that we wanted to adjust our asset allocation in advance to cushion our clients from what we foresaw as inevitable equity market drawdowns.

Our suspicion at the time was that it was likely going to be some oil price surge from tensions in the Middle East, or a surging candidacy of Sen. Bernie Sanders spooking Wall St., or the roll off of the reverse repo and T-Bill purchase operations from the U.S. Federal Reserve in the early spring of this year (operations that we felt were indirectly inflating equity multiples) that were going to be the triggers that would finally tip the global economy into recession and set off a de-risking cycle in investor sentiment and an equity bear market.

We must confess we never would have thought that the shock would have been a global pandemic, one that looks to be not only the nail in the coffin of the past decade’s economic cycle but looking to be delivering an economic shock that might be generational in scope and effect.

The good news for our clients in our models is that we came into this bear market with their portfolios more defensively positioned than they might have been and, as a result, have incurred significantly less damage to the value of their investments relative to what is been experienced by broader equity markets (-30%+ as of writing). This should not only provide our clients some peace of mind in otherwise troubling times, but also should provide them some strategic advantages over other investors out there who may have been more fully exposed to equity volatility and would likely be experiencing double digit losses in their life savings.

Naturally in seeing so many great companies’ stock prices get hit hard over the past month, we are beginning to salivate at some of the bargains out there, but we will hold off for now in opening the purse strings too much as we feel that there are some further shoes to drop both economically and with respect to market sentiment.

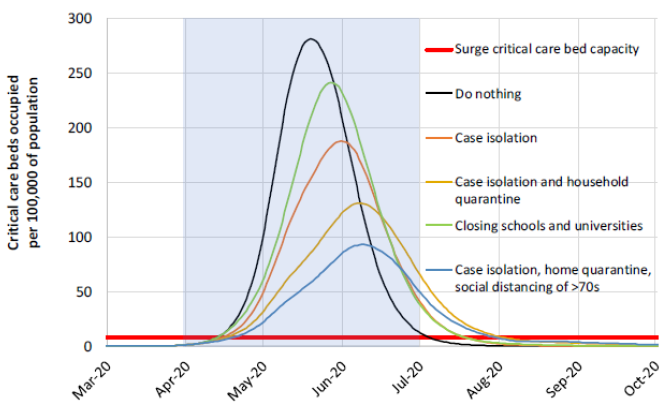

Firstly, there is no way to ascertain in advance the economic impact of shutting large swaths of industries across most of the major economies of the world simultaneously, with the evitable surge in layoffs and unemployment. What will the extent to the impact on consumer spending be? How will the dominoes of small and medium sized business fall, especially those in discretionary and hospitality businesses, and how will that damage percolate through the credit system? If the goal of health authorities is the “flatten the curve” of infection (note chart below), so as to ensure our health care systems do not become overwhelmed, then this should have a proportionally detrimental impact on our economies through the implementation of social distancing for longer.

Source: Imperial College COVID-19 Response Team – Impact of non-pharmaceutical interventions (NPIs) to reduce COVID-19 mortality and healthcare demand – March 16, 2020

Secondly, this shock is happening at the end of an economic cycle that never felt like it truly recovered from the Great Financial Crisis (GFC) a decade ago. For instance, in much of the developed economies of the world, we never quite normalized monetary policy, with policy rates here in North America not far off the zero-bound and Europe and Japan still trying to stimulate their stagnant economies with negative policy rates and continued Quantitative Easing.

We sense that structural issues surrounding excessive debt accumulation, demographic changes, income equality and stagnant wages that had been accumulating for decades and that were unearthed by the GFC but then, in our view, papered over with large sums of liquidity from central banks will now come to the fore and need to be dealt with. There might have to be a reckoning, perhaps a Minsky moment, that will have to be contended with before equities truly find a trough. This was perhaps evident in markets appearing to largely and uncharacteristically shrug off all the massive monetary policy announcements from central banks in the past few weeks. Perhaps, expect a very wide “U” or even “W” shaped recovery and market bottom versus the sharper “V” recovery we have become accustomed to.

As an aside to this point, one thing that has been reassuring to see is the speed at which policymakers have been pushing through fiscal programs in the past month. One can remember the hesitancy and denial lawmakers showed in the GFC towards enacting any fiscal remedies (TARP, automaker bailouts, etc.), which in retrospect seemed to have only exacerbated the situation. Conversely, the relative speed in which authorities have rolled out various stimulus and support plans has been breathtakingly fast and, in our opinion, is badly needed to offset the inevitable suffering this coming recession will impose. Just don’t ask them how they’re going to pay for all this in the end…

Lastly, we feel that a shift in investor’s paradigm with respect to equities (and perhaps to risk-assets more generally) is needed. Through much of the last decade, it has seemed like equity investors had an almost Pavlovian response to every equity market sell-off or correction. Every dip in equity prices was to be bought, as it turned out to be a winning trade because investors seemed to perceive that central banks offered a “Put” (a sort of asset safety net) to shore up markets whenever trouble brewed.

Perhaps the more recent experience of markets now appearing to collectively shrug off major monetary policy announcements that seem to come almost every other day is beginning to reflect a change in market participants’ expectations. Maybe markets are starting to realize that central banks can’t print antibodies or stimulate consumer demand that is forcibly reduced by exogeneous factors. So, though the VIX (a broadly followed measure of volatility) is at nearly 80 as of writing, which is close where it peaked in 2008, we suspect we are yet to reach maximum pessimism. Let’s at least wait until we see what surprises are in store once Q2 earnings start.

With that said, we will get through this and the opportunities to capitalize on bargains from this crisis will be enormous, we just want to see some more economic and corporate data begin to hit the tape that reflects the true damage being wrought by these drastic emergency health measures before we jump in with both feet. We feel that once the equity markets more fully digest and discount the true extent of the economic impact of this crisis, then it will be time to chip away at equities more aggressively. So, we will hold the course on our current asset allocation in our models for now, with some choice tactical rebalancing at the margins.

Let us also say that we are amazed at the calm composure of our clients, with our team fielding significantly less queries than we would have expected. Perhaps it has been the communications we relayed last year that we were reducing exposure to equities or frequent reminders we give to clients to not chase markets and to remember that risk is the other side of the coin to returns. Either way, we appreciate your faith in us and our custodianship of your precious life savings.

Though our physical offices will remain closed until further notice, rest assured that our practice remains open, but operating remotely. All staff are available, and we are keeping our standing business hours.

Thank you and stay healthy.

Omar Duric

Portfolio Manager

Shipton Duric & Associates