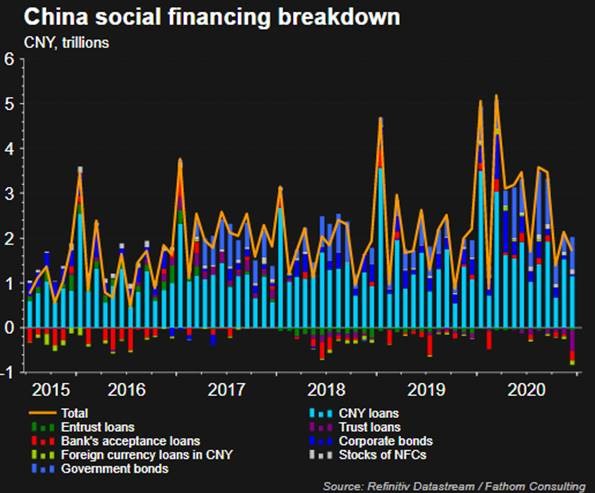

Due to the sheer size of the Chinese economy and its corollary impact on global markets, many market participants have paid close attention to the social financing policies of Chinese authorities and the ensuing credit impulses they have generated. As seen from the following chart, you can see the last major impulse was initiated at the beginning of 2020, not surprisingly during the initial stages of the pandemic when Hebei province, and Wuhan city in particular, were under complete lockdown.

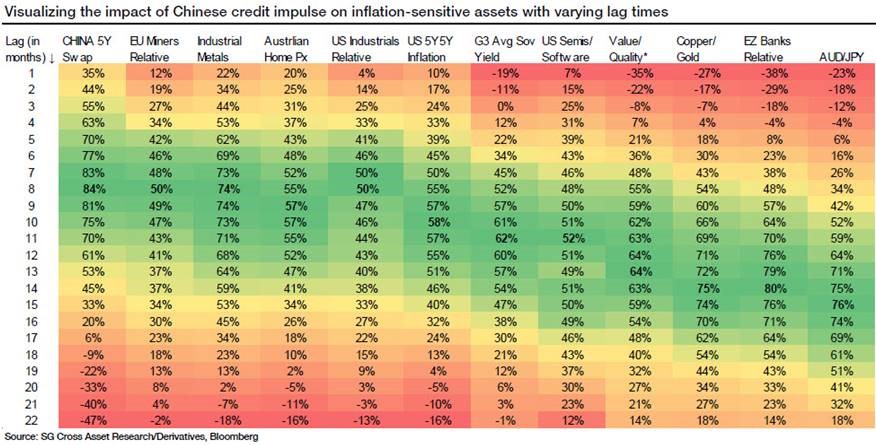

More interestingly in the following second chart, is a cross-asset time series table demonstrating apparent correlations of these Chinese credit impulses to various assets’ subsequent performance with their corresponding time lags.

Notwithstanding all the noise that would affect the performance of these various assets classes due to other factors, such as the rest of global economy recovering from the pandemic, if one were to posit that the last major Chinese credit impulse peaked around 10 months ago, that would imply that we have just passed the peak impact this impulse would have on industrial metals and miners, it is about to have peak impact on US 5Y5Y breakeven yields, and one could expect the effect to next migrate to G3 sovereign bond yields, US semiconductors, value stocks, and copper/gold.

Interesting stuff, especially as we have seen the predicted assets react so far as would be expected. However, with all the noise around fiscal and monetary stimuli from so many economies, one has to wonder whether this signal can be as reliably parsed in 2020/2021 as it would in more subdued economic conditions.