As governments around the world have unleashed massive deficit spending to offset the devastating economic impacts that their public health policies have engendered, many economists and market participants have begun to wonder what future fiscal policy measures will be needed to tackle these deficits and increased government debt. One of the first things that come to mind is that increased taxation and fiscal austerity will be inevitable post-pandemic, but I find it hard to believe that governments will rush to impose such restrictive policies during a nascent recovery, not only because these options are almost always sufficiently politically unpalatable to enact but also because I can envision developed world economies settling back down to Secular Stagnation growth rates once the post-pandemic growth bounce in 2021/2022 subsides. Should growth go back to low single digits, similar to what we experienced for the past decade since the Global Financial Crisis (GFC), governments would likely be loath to hit the growth brakes with tax hikes or curtailed spending.

If anything, now that large swaths of the developed economies’ populations have gotten a taste of variants of Universal Basic Income (UBI), much like the CERB program here in Canada, these income assistance programs are probably more likely to be added to various governments’ policy toolkits going forward and most probably in the promises of competing political parties vying for power. So caught between the vice grip of demands for increased deficit social spending coupled with record-sized legacy debts and the inability to raise revenues or reduce costs to pay for them, this predicament could likely lead governments to rely ever more on an option that they seem to have slowly become more enamored with since the GFC: print money to pay for it!

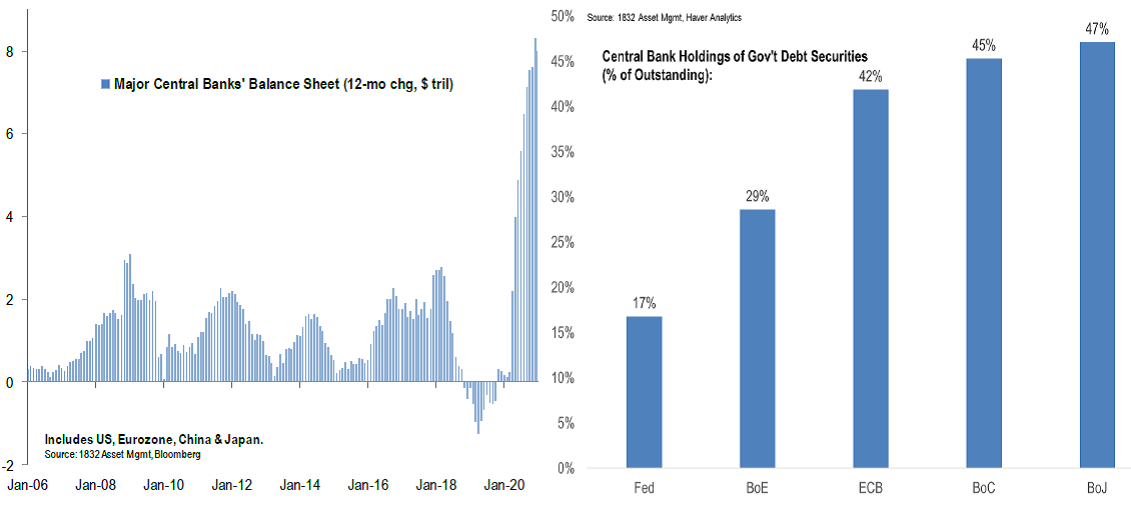

As you can see from the following charts, over the past decade and a half, global central banks have been busy running the printing presses to provide monetary accommodation in a lower-bound and negative interest rate world. With the pandemic, this policy has slowly mutated into outright monetization of portions of governments’ bond issuance (or in the case of Japan, all of the government’s bond issuance) to make deficit spending less of a concern. This approach is one that seems inspired from a new school of economic thought being introduced by proponents of Modern Monetary Theory (MMT), where deficits do not matter as long as the central bank can print money to pay for them.

Apparently, balancing a fiscal budget is irrelevant when a government’s budget is only limited by the amount of money creation that does not stoke too much inflation

Sound like something right out of the Weimar Republic? Well, it’s probably closer to becoming a reality than we might think. In fact, here at home, where Canada avoided embarking on the same Quantitative Easing sprees that were seen in other developed economies during and after the GFC, looking at the second chart below, the Bank of Canada has been rapidly making up for lost time this past year by gobbling up large quantities of outstanding sovereign bonds (and corporate bonds too), so that its percentage holdings are on par with Europe and Japan. So, I would not be surprised if outright debt monetization of new issuance is next.