A Rougher Start than Most

What a year 2022 has proven to be so far, with war, a lingering pandemic and asset markets in turmoil, to name just few risks weighing on investors. Since our last commentary earlier this year, equity and bond markets have continued to exhibit, apart from a brief relief rally in March, some of the most relentless and disconcerting volatility we have seen in years.

To use just a few examples to highlight the extent of the asset price drawdowns we have seen over the past six months, note the chart below providing total returns as of writing for a number of major benchmarks:

iShares Canadian Core Bond Universe (broad measure of Canadian bonds – blue) – Down nearly -9%

iShares Core US Aggregate Bond (broad measure of US bonds – red) – Down nearly -9%

MSCI All Countries World Index (a measure of the world’s equity markets – yellow) – Down nearly -17%

Nasdaq Composite Index (a good barometer of growth stocks – purple) – Down nearly -28%

Though we remain of the view that we are experiencing a mid-cycle correction, much like we saw in 2011/15/16/18 that transpired in the prior economic expansion, the length and brutal nature of the price action of this drawdown feels very much like a bear market. What seems particularly dissonant about this bout of volatility is that it is occurring against a backdrop of a still seemingly healthy economic environment and solid corporate fundamentals, so the specific drop in equity prices appears largely to be due to valuation compression more than anything.

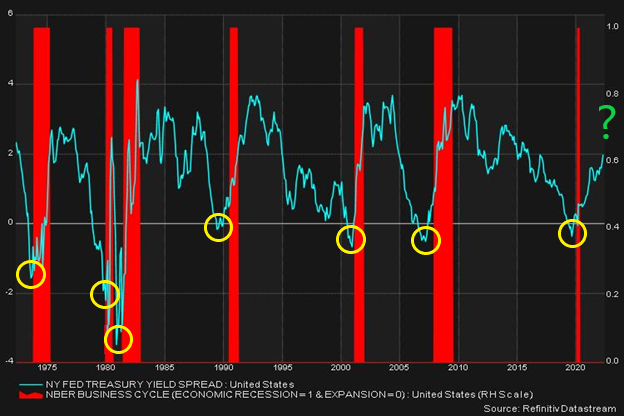

To wit, one of our favorite economic recession indicators, the spread between the 3-month U.S. T-Bill and the U.S. 10-year Treasury Note yields, as shown in the chart below, which has boasted a pretty solid track record of predicting every U.S. recession over the past 50 years whenever it inverts, is not signaling an inversion of the yield curve that would flash a similar warning to us now.

Moreover, per the chart below, you can see with the Refinitiv FY1 Earnings Per Share (EPS) Smart Estimate for the S&P500 in yellow, corporate earnings are similarly not indicating warning signs either.

So, with fundamentals seemingly not demonstrating any major basis for concern, what is causing so much apparent consternation in markets? Well, the answer may lay in the fact that somewhat unlike prior periods of market turmoil, the pain we are currently experiencing in stocks has also been felt very much in bonds as well, normally considered a safer asset class that investors look to allocate to. In fact, it has seemed to us as if the bond market has been the ground zero for investor concerns and has served to be the tail wagging the proverbial equity market dog for much of this market volatility.

Deflating Inflation

Though investors have been bombarded with a steady stream of concerning headlines, especially the first major land war in Europe involving a great power since World War II, the backdrop for this market volatility has remained, in our view, one primarily driven by the factors we outlined in our January Commentary (https://advisor.wellington-altus.ca/shipton-duric/2022/02/02/january-2022-commentary/).

Much as we suggested in that note, persistent inflation impacting much of the globe, but particularly in the United States, has fueled concerns amongst investors that the American central bank, the Federal Reserve (Fed), will embark upon an aggressive credit tightening cycle, involving both their interest policy rate and a reduction of their balance sheet, in a process termed Quantitative Tightening (QT), the combination of which is feared will tip the global economy into a recession. This hawkish monetary policy (central bank jargon for constricting credit and reducing financial liquidity) has the impact of tightening financial conditions which is often reflected rapidly in the bond and equity markets.

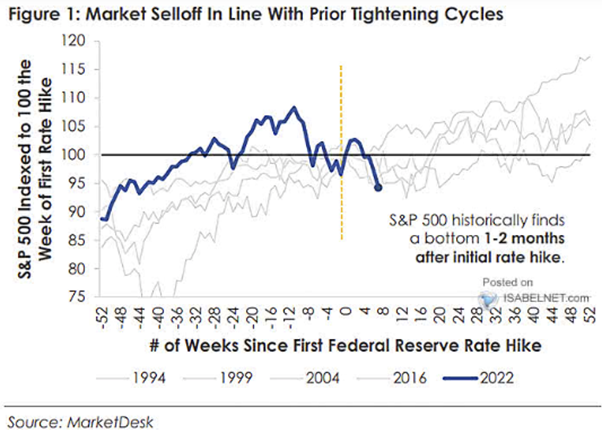

Certainly, some market volatility has historically been experienced around the commencement of an interest rate hiking cycle previously, but as you can see from the chart below, the current volatility feels orders of magnitude greater than what has been experienced in the prior four historical examples.

Despite these investors’ fears of inflation and monetary policy, we continue to feel that these concerns are overblown and that markets are overreacting, pushing bond and equity prices down beyond what should be reasonable given the global economy’s underlying strength and the resilience of corporate earnings profiles in many countries, but particularly here in North America, where practically all our Models’ geographic exposure resides.

To that point, we do not feel that the fears around inflation becoming entrenched in North American economies and thus forcing every tighter monetary and financial conditions shall be realized. We see the multi-decade high levels of inflation we have been experiencing since 2021 as the product of a unique collision of COVID-19 pandemic-related effects on constrained supply-chains that were already very lean due to just-in-time manufacturing, governments’ emergency income supports turbocharging economic demand and savings, and lockdown-induced distortions in the spending mix of goods versus services normally exhibited by consumers.

Markets may be convulsing right now due to investors’ taking their fears about inflationary forces to a darker endpoint that sees the resurrection of the structural inflation that plagued many economies throughout the 1970s and that proved the bane of bond and equity markets for much of that decade. That persistent and entrenched bout of inflation seemed to have only been overcome after a brutal application of monetary medicine in the form of a dramatic cycle of interest rate increases in the late 1970s/early 1980s that wrought havoc on North American economies and asset markets, including housing prices.

We feel that these fears are unfounded given the data pointing to long term inflation expectations remaining well anchored at lower levels than current readings (note chart below), which is particularly important as fending off elevated long term inflation expectations is seen as one of the primary concerns that drives central bankers’ policy measures.

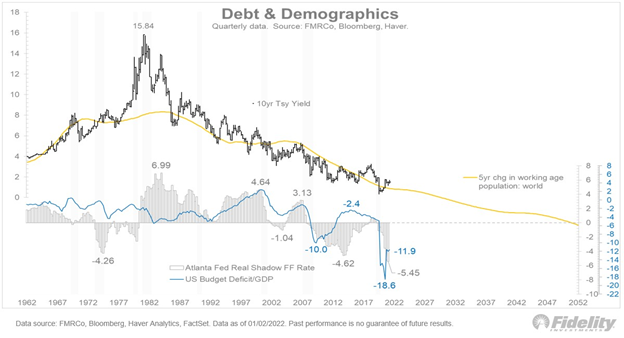

Moreover, as we discussed in a prior note from last year (https://advisor.wellington-altus.ca/shipton-duric/2021/07/07/omars-quick-take-d-is-for-demographics/), we are confident in that the powerful long term disinflationary forces affecting global economies will eventually tamp down these current pandemic-induced inflationary distortions, with or without a robust monetary response from central banks.

To highlight the point, note below a great chart from Fidelity showing how long-term interest rates have fallen in tight correlation to the ever-decreasing rate of world working age population growth. The implication would seem to be that the trend points to an inexorable downtrend in interest rates in the years and decades to come, notwithstanding the recent pop in rates due to inflation fears.

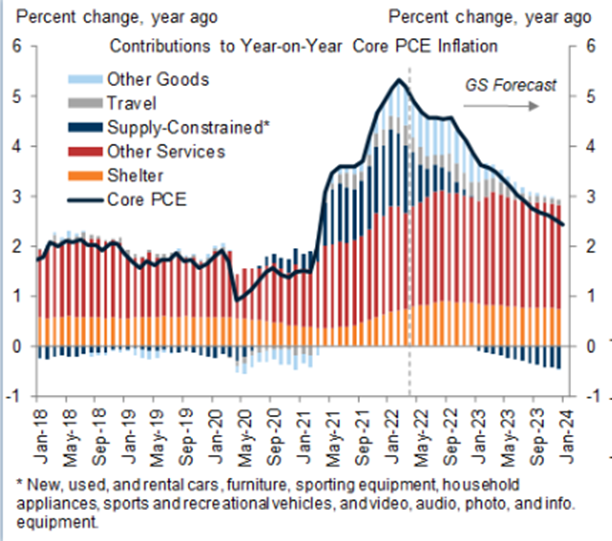

Setting aside these broader considerations, the underlying data may be beginning to indicate that inflation is indeed cresting already, especially in the U.S. The past two U.S. Consumer Price Index (CPI) prints have shown sequential deceleration and a tapering of goods specific inflation as consumers rebalance spending more towards services as the COVID-19 pandemic appears to recede in the developed world. This rebalancing of spending should help relieve pressure on goods supply chains and let inventories catch up. The following chart from Goldman Sachs highlights the view that we may have indeed passed peak inflation.

Source: Goldman Sachs

So, with the prospect of inflation having peaked, one would think that this would adjust assumptions to central bank policy that would prompt them to temper the aggressive hawkish policy path they seem to be communicating. With this narrative change, one would expect rate markets would likely ease off, providing support to bond markets and, in turn, equity markets.

In fact, we may be even seeing this already, as the Fed Chairman, Jerome Powell, seemed to have taken rate increases of greater than 50bps per Federal Open Market Committee (FOMC) meeting off the table at his May FOMC press conference.

Moreover, we have seen some recent firming in bond markets with open market rates easing off multi-year highs, much as we might expect. Note chart below highlighting an apparent topping out of the U.S. 10-year Treasury Note yield in blue (as listed with the CBOE 10-year Treasury Yield Index (TNX)) in conjunction with a similar topping of a measure of inflation expectations in red (as listed with Proshares Inflation Expectations ETF (RINF)).

Batten Down the Hatches, but no Evasive Maneuvers

Some clients have asked about what tactical moves we have employed in the past six months to try and navigate these perilous market waters and mitigate the impact to the Models. Our general reply has been that since we have remained of the view that the painful moves we have seen in the bond and equity markets are not the product of a sustained downtrend in economic or corporate fundamentals, we have not seen a need to slam on the brakes and get as radically defensive like we did in 2019.

As painful as this investing climate feels right now, we do feel that it will prove to be temporary and that we need to stay the course until we reach steadier waters to ensure that we capture a subsequent rebound in markets, which are often the most powerful in gains as they pull out of the trough of a drawdown. We will likely rebalance to Model target weightings within the next month or so, but to do anything materially defensive beyond that at these levels will likely result in nothing more than the proverbial shooting of one’s foot.

That said, we have not simply been bystanders, as we did make a significant change in the Balanced/Growth/Aggressive Growth Models back in the third week of January, when we switched nearly a quarter of each those Models’ weightings by shifting from the Dynamic Global Growth Private Pool to the Dynamic North American Dividend Private Pool. Note in the following chart their relative performance since the switch in the chart below, highlighting the benefit of the trades.

The rationale for the switch at the time was the growing concern we had with the rapid shift in Fed rhetoric that was having a concomitant effect of pushing up the value of the U.S. Dollar (USD), which we suspected would have a constricting effect on the Eurodollar market resulting in a headwind to international equities’ performance. So, to reduce that risk, our switch re-shored practically all our geographic equity exposure back to North America, with an added dividend/value tilt to provide some buffer to the increasing market volatility we were starting to experience. In hindsight, the switch proved to be even more beneficial, as it reduced our European equity exposure a month ahead of the Ukrainian invasion.

Additionally, we should point out a more structural benefit enjoyed by our Models in navigating this year’s market turmoil that was the product of our decision a number of years ago to strategically forego a direct allocation to traditional bonds in our Models (outside of balanced mandates and pools sometimes held within our Defensive/Conservative Models) and rely mainly on residential mortgage (Antrim), commercial mortgage (Trez) and private debt (NextEdge) assets for our fixed income allocation.

What prompted this approach was the concept of “Convexity” in the relationship between bond prices and interest rates where, all things being equal, the lower the interest coupons paid by bonds and the resultant longer duration of their cash flows, the greater the risk for bond price volatility. These concerns were made manifest this year with multi-decade high levels of negative bond price performance we have been experiencing, so we are reassured to have largely skirted this pain in our fixed income allocations for clients.

What’s Next

Though it is impossible to know the direction of markets in the near term, our suspicion is that they will grind through a bottoming pattern into summer, at which point they will find their footing into the fall in a resumption of a bullish trend to reflect stable and growing economic growth and corporate earnings.

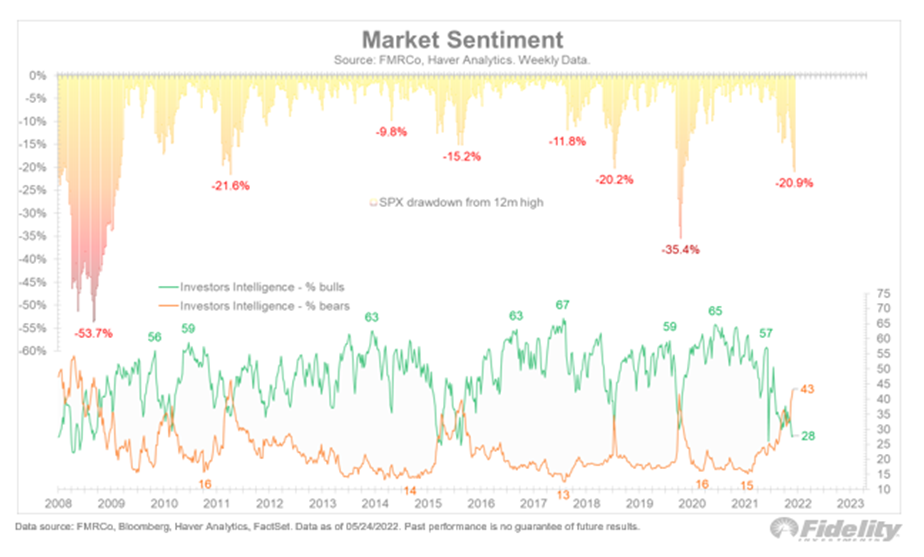

To our eyes, signs abound in terms of excessive pessimism that can be seen as good contrarian signals of fertile ground for a market recovery. Per the chart below, investor sentiment surveys are indicating levels of low investor bullishness and high bearishness associated with prior market bottoms.

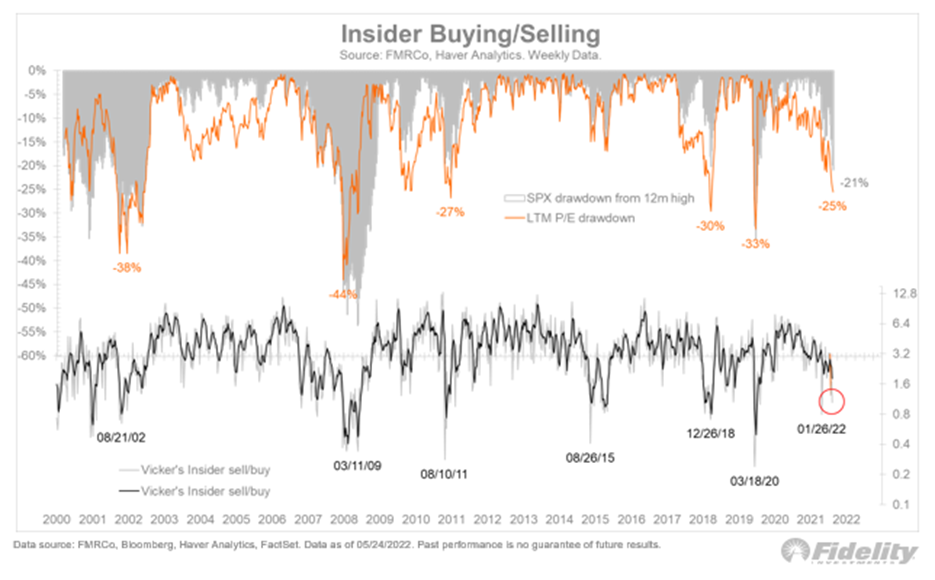

Moreover, another good contrarian indicator, the ratio of insider buying/selling is showing a net propensity for corporate insiders to buy their own companies’ stock which similarly at levels since at other market bottoms. A recent Bloomberg article highlights this recent trend (https://www.bloomberg.com/news/articles/2022-05-23/insiders-put-recession-angst-aside-to-binge-on-their-own-stocks).

With the Fed having tightened financial conditions considerably in the last six months (note chart below showing tightest conditions since the 2020 recession), one could remark that the current market environment may have been, in fact, intentionally engineered by the Fed to tighten financial conditions through hawkish rhetoric as a policy response to inflation outside of their usual tools of the policy rates and balance sheet management.

Remember, they have only raised the Fed Funds Rate (FFR) by 0.75% so far, but the 2-year Treasury Note (which is often a strong predictor of where this rate will be in 2 years hence) is showing roughly 2.5% yield as of writing, so the bond market turmoil may have done a fair amount of heavy lifting for the Fed in tightening credit without them having to employ their policy rate as much as investors fear they will.

Lastly, stepping back for a moment, we would reflect that after the vicious recessions encountered by North American economies during the early 1980s, partly if not mainly induced by hawkish monetary policy, we suspect that central bankers have institutional hesitancy to impose a monetary cure that would bring more economic damage than the inflation disease.

As such, we have suspicions that the very rapid apparent policy pivot that the Federal Reserve exhibited late last year was possibly the product of political considerations of the Biden Administration around voters’ concerns around surging inflation. Though the Fed is nominally an apolitical institution, given that its Chairman and Vice-Chair positions were up for reappointment at the time, we wonder if the Biden Administration was pushing for the Fed to embrace hawkish rhetoric, thus why we saw such a rapid change in posture from the institution.

Similarly, now that the Fed has, in our view, made significant market waves with its subsequent hawkish jawboning, we are confident that Democrats would be less than enthused at seeing voter’s investment savings accounts enduring continued pain right before this year’s upcoming November Mid-Term Congressional elections, so we would not be surprised to see some of those same political calculations work now in reverse.

So, in summary, as long as inflation continues to abate and temper aggressive monetary policy posture, the tightening of financial conditions brought by central bank policies do not excessively harm economic and corporate fundamentals, and political considerations do not influence policy prescriptions too detrimentally, we are confident of an outlook for market recovery in the back end of the year. At this juncture, it may seem to be a path through a needle eye, but we are confident it is one that can be ultimately thread.

As always, we appreciate your feedback and questions. Take care.

Omar Duric, FMA, DMS, BBA, CIM®

Senior Investment Advisor, Senior Portfolio Manager

Shipton Duric & Associates

Wellington-Altus Private Wealth Inc.