Capping off what felt like the worst equity market performance year we have seen since the Great Financial Crisis (GFC), 2022 was a year that we will likely not soon forget. A seemingly atypical year, with market participants having endured a rather unique situation of both equities and bonds falling in unison, an occurrence that has only happened less than a handful of times in the past century.

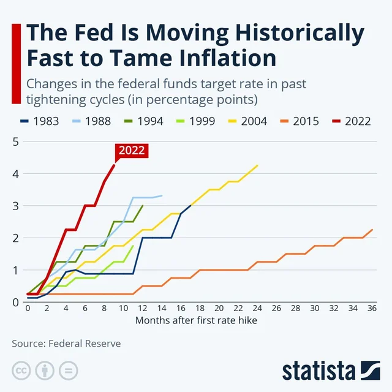

In looking for reasons, one could certainly point to it being an eventful year, with many countries around the world emerging from pandemic lockdowns and the first major land conflict in Europe since WWII capturing our collective attentions. However, if we were to point at a single primary catalyst for the historic volatility endured in the capital markets last year, we would ascribe it to the impact of one of the most aggressive pace of interest rate hikes implemented by North American central banks, within the context of a coordinated move amongst their global peers, in nearly four decades.

To highlight this, we would look at the chart below of the U.S. Federal Reserve’s (Fed) 2022 interest rate tightening cycle, which was very similar to our own Band of Canada’s (BoC) policy pace, against prior cycles since the early 1980s. Not only has the pace been more aggressive than these prior instances, but the terminal level was set to be higher as well, all in North American economies that carry significantly more public and private debt than they have before. In our view, this is a time bomb set last year that will inevitably go off this year, an eventuality that capital markets were beginning to price in with rising open market yields and compressing equity valuations in 2022. We would describe that initial reaction last year as only the first half of an equity Bear Market that shall continue to maul investors into 2023.

This more dire outlook is somewhat at odds with what we had written in our prior January and May commentaries, where we had remained more sanguine about the second half and first half of 2022 and 2023, respectively. What we had frankly not realized at those points in time was that this current Bear Market is likely set to play out in very different fashion than what we had customarily seen in prior cycles in our careers. A different market paradigm if you will.

In previous instances, we would characterize the pattern of prior equity Bear Market cycles in the following manner. As they commence, stock prices are falling mainly due to valuation compression (the multiple of stock price that an investor pays for a company’s earnings or other financial measure), with corporate earnings often holding up initially as the economy remains in late-cycle expansion. We would describe much of the North American equity markets behavior in most of 2022 as following that roadmap.

Then, as the economy would finally decelerate into contraction, dragging down corporate earnings with it, we would see a bottoming of valuations and stabilization of stock prices in the face of this earnings contraction. We would ascribe this manifestation as often the result of Central Banks riding to the rescue of the faltering economy with monetary stimulus, in the form of lowering of interest rates and/or other monetary tools such as Quantitative Easing (QE). This monetary stimulus could be said to encourage investors to step back into the equity market as it increases liquidity and allows them to look through the current decline in corporate earnings to the expected reacceleration of the economy and earnings brought forth by this monetary stimulus.

This order of events can often be seen as appearing chronologically dissonant, with equity markets bottoming and beginning a new Bull Market during an economic recession. What we find is that, generally, valuations often lead earnings, both up and down. This playbook was originally our base case earlier in 2022 for what we expected to happen into late fall/early winter of that year.

The curveball that has been this 2022-23 market episode has been the fact that not only are central banks not riding to rescue of a faltering economy, as we would have expected they were going to do by the end of 2022 in a typical behavior we have seen over the past few decades, but they in fact appear to be intent on weakening the economy instead. With the pursuit of returning inflation back to a stable, low single digit level as their primary focus, the policy tools they have implemented look to be aimed at reducing aggregate demand in the economy to rebalance it better with supply, even at the expense of triggering an economic contraction. Frankly, this was new monetary policy paradigm for us to absorb.

The realization that this cycle was playing out in a way that we had not expected fully crystallized last October after a succession of hotter than expected inflation readings out the U.S.; first the Consumer Price Index (CPI), followed by the Producer Price Index (PPI), and capped off by the University of Michigan Consumer Survey Inflation reading. With all three readings coming worse that expected and at a time that we thought we should start seeing a material moderation of these measures laid bare the need for us to look at this cycle very differently.

Simply put, we came to embrace a new base case that the equity market does not appear to have the policy backstop that it has come to rely on in prior cycles and that the typical expectation of valuation expansion brought by monetary stimulus is not likely to come in time to offset a decline in corporate earnings. It would seem, for the first time in a long while, and certainly in the span of our careers, the equity market is indeed on its own, much as is portrayed quite hilariously in the following cartoon.

In addition to stocks, bonds had also been through a vicious Bear Market through 2022, and in some respects an even more brutal period of volatility in comparison to equities relatively speaking, as they seemed to be the ground zero for volatility in the broader capital markets as aggressive central bank interest rate hikes thrust open market rates higher. This created a situation where it seemed that the bond volatility tail wagged the equity market dog by compressing valuations and creating a positive performance correlation between the two and leaving traditional equity/bond balanced portfolios with seemingly little diversification benefit.

However, at this juncture, with the Fed and the BoC apparently reaching a plateau in their rate hiking cycle and establishing a pause on further increases of their policy rates, we feel that the negative catalyst for bond performance has likely run its course, setting up an interesting risk/reward profile for this asset class, especially over equities over the first half of this year.

It is our assessment that if equity markets were, in fact, in the process of establishing a new durable Bull Market since last October’s low, that would be predicated on an investment thesis that borrows from the prior playbook of an expected pivot in monetary policy stance of the Fed and BoC to cutting interest rates relatively soon. Though this is certainly a possibility and perhaps even the equity market may discount such a move quite a bit earlier than would seem reasonable, we would ask why to take that gamble?

Conversely, if our base case of the Fed and BoC holding their policy rates for higher and longer than they would have done so in the past in the face of economic deterioration comes to fruition, then we have a hard time fathoming a sustained valuation expansion in the face of the concurrent earnings recession. As you can see from the chart below from Macrobond/Nordea, global liquidity, a by-product of monetary policy stimulus, has a significant correlation to equity market earnings with a roughly 18-month lead, with this measure looking to be falling off a cliff.

Moreover, this liquidity-driven drop in earnings is further reinforced by the following chart from Morgan Stanley forecasting a steep drop in S&P500 earnings per their Non PMI leading Earnings Indicator.

Thus, in our minds, bonds provide the bridge over a potential equity market performance chasm that we may see in the first half of this year that is a product of the Fed and BoC not delivering on a policy reorientation that the equity market is hoping for. From our standpoint, bonds will broadly benefit from safe haven flows from the recession trade if our base case is correct and, interestingly, they should also benefit from a monetary policy pivot if our base case is wrong. Either way, this seems to us a safer asset allocation posture to take than riding on equity market hopes.

So with this realization in mind, in the Fall of last year, despite the defensive measures we had taken up until then to fortify the various Models’ portfolios with equity geographic reshoring, market cap and quality upgrading, it dawned on us that we were likely fighting a rearguard action as opposed to getting ahead of market trends. Consequently, we decided to ride North American stock markets with our target equity weightings into what we expected to be end-of-year strength normally seen with longstanding seasonal patterns and coming off mid-term U.S. congressional elections, but with an eye to the exit should the major indices stumble below floating thresholds we had established. In early December, the indices broke below these thresholds and we acted.

Across our five Models, we broadly reduced their public equity exposure by half in the first week of December, then, waiting for the Fed’s upcoming Federal Open Market Committee meeting (the meeting where they decide and announce monetary policy decisions) the following week to see if there would be a change in their stance or rhetoric, we sold out the remaining half upon hearing they were undeterred in their hawkish stance.

With those proceeds, we moved into three major core bond positions, with varying weightings depending on the Model, to diversify across strategies and mandates within this asset class:

TD Fixed Income Pool – A broad, institutionally oriented pool run by the largest bond desk in Canada and a position that should be familiar to clients as we owned it back in 2019-20

Dynamic Tactical Bond Private Pool – A more tactically oriented pool seeking to trade around strategies and trends in the bond market

https://funds.dynamic.ca/fundprofiles/en-US/H7VC/F/CAD

Mackenzie Global Green Bond Fund – A fund that invests with an environmentally focused framework

https://www.mackenzieinvestments.com/en/products/mutual-funds/mackenzie-global-green-bond-fund

Could we be wrong on this asset allocation decision and our base case? Absolutely. There is always a chance that the recent October, 2022 equity markets low was the beginning of new Bull Market cycle, one that could be the market discounting a much softer landing in the economy, an earlier Fed and BoC pivot to cutting interest rates, a weakening USD becoming a sufficiently positive catalyst and/or the tailwind of the Chinese economy re-opening from its harsh COVID-19 pandemic lockdowns lifting up global growth.

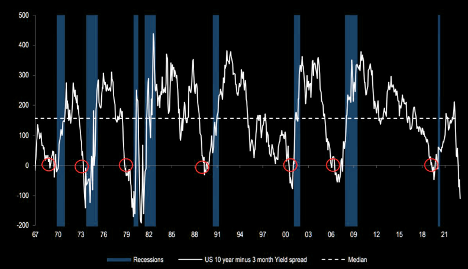

However, if one simply looks at one of the most reliable economic signals we can think of, the shape of the yield curve, a reading that we have often emphasized to clients to pay attention to as a warning of impending recession above all others, its current inversion is flashing economic danger ahead per the chart below from JP Morgan. Not only that, but looking at how deeply inverted the yield curve is at present, more so than at any time since the early 1980s, one could infer that we are likely facing a rather commeasurably severe economic contraction ahead.

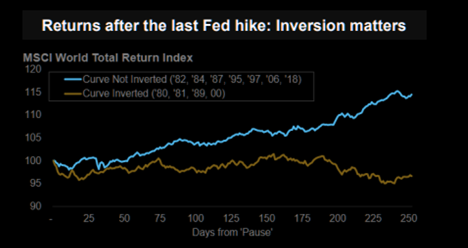

So why risk ignoring this signal? Moreover, per the chart below from Morgan Stanley, broad equity market return profiles after a Fed pause in rate hikes have very different return profiles depending on whether the yield curve is inverted or not. As you can see, historical equity returns are challenged at best in situations of an inverted yield curve, much as we find ourselves in right now. So, again, why chance it?

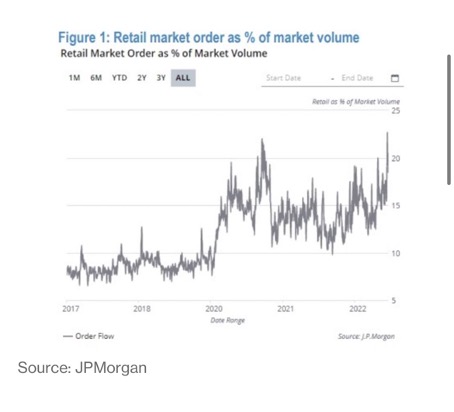

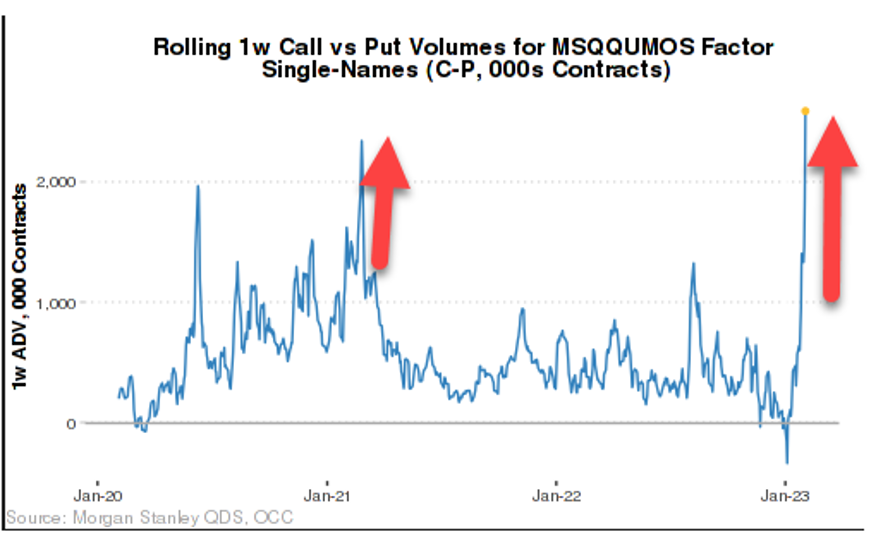

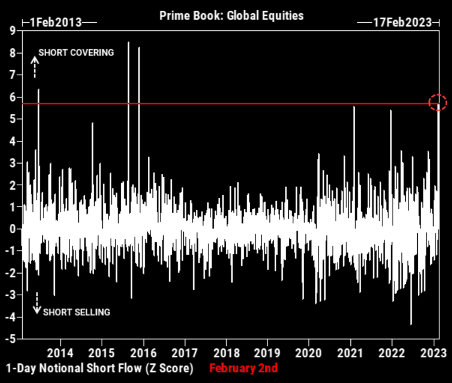

In the two months since we repositioned defensively, we have seen many equity markets recoup their December losses and push to multi-month highs. We have not been caught much offside, as our bonds positions have participated to a certain degree in the rally as well, but one cannot argue against feeling a sense of missing out when seeing bombed-out stocks such as Tesla (TSLA) double in price the span of roughly 5 weeks, albeit still from dramatically lower prices from a year or more ago. This recent rally, with high retail investor participation, record short-dated options trading, short sellers getting squeezed and rushing to cover and distortions caused by fresh capital being deployed in the New Year has many of the hallmarks of a short-term performance chase, dash for trash, and short covering one might find within Bear Market rallies. In fact, many of the largest short-term rallies in the history of markets have occurred within broader Bear Market downtrends.

Chart below from Goldman Sachs:

Rest assured, we will remain nimble and flexible in our thinking, leaving open the door to the reality that fundamentals could always catch up to a market that has already looked through the worst and is beginning to price in the light at the end of the tunnel. But at this juncture, we remain skeptical. Market history has not been kind to investors that have ignored economic warnings signs such as the inverted yield curve, so it is incumbent upon us to embrace our first duty to our clients – to protect their capital.

We are very confident that there will be excellent opportunities down the road to earn robust returns once this storm has passed. The COVID-19 pandemic and invasion of Ukraine have accelerated and laid bare powerful geostrategic and economic tectonic shifts that had been slowly coming to life over the past decade. It is as if the curtain has been drawn on one era only to be reopened to reveal a new one. Trends such as deglobalization, the scramble for commodities, reshoring of manufacturing, fracturing of the world order into multipolar spheres of influence, inexorable demographic decline and aging, automation, the struggles between decentralized networks versus centralizing forces, the push to more environmentally sustainable structures of industrialization, amongst others, will present enormously profitable areas to focus investing on in the equity markets.

We look forward to harnessing these trends for the benefit of our clients when the time is right.

Sincerely,

Omar

Omar Duric, FMA, DMS, BBA, CIM®

Senior Investment Advisor, Senior Portfolio Manager

Shipton Duric & Associates

Wellington-Altus Private Wealth Inc.