Download this article as a PDF.

Parents, grandparents and other relatives who have achieved financial security often look for wealth transfer planning ideas to leave a legacy for younger relatives — but without incurring a substantial tax liability. The cascading strategy using permanent life insurance is one such planning idea and delivers an effective and tax-efficient way to transfer wealth.

How does the Cascading Strategy work?

While there are several options, the cascading strategy often involves the purchase of a permanent life insurance policy for a child or grandchild. The parent or grandparent remains the owner, payor, and beneficiary of the policy until such time they decide to transfer ownership to the child or grandchild. Funds invested within the policy grow on a tax-sheltered basis and the policy owner has full control over the assets.

Either upon the original owner’s death or at a point in the future, ownership of the policy may be transferred on a tax-free basis to the contingent owner – the adult child or grandchild. Any funds withdrawn from the cash value of the policy after the transfer would be taxed in the new owner’s hands. Upon the death of the life insured, the beneficiary would receive a tax-free payout.

There are several benefits to using life insurance as a wealth transfer tool. Such benefits include:

- Preserving wealth and providing a legacy for future generations.

- Allowing assets to accumulate on a tax-sheltered basis.

- Transferring assets in a tax-efficient manner.

- Access to the accumulated cash value within the policy.

- Insuring the lives of children or grandchildren.

An example of the Cascading Strategy

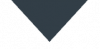

Max and Diane, both in their early 70’s, have accumulated $8 million+ in non-registered investable assets – more than enough to support their current lifestyle and future needs. With a goal to leave a legacy for their immediate family, they set up a cascading wealth strategy to transfer assets to their son Austin, his wife Kate and their two young children, Oliver and Angela, in a tax-efficient manner.

To implement the Cascading Strategy, here are the suggested steps:

- Max and Diane buy individual life insurance policies for their son Austin, his wife Kate, and their grandchildren Oliver and Angela. Each policy has an annual premium of $25,000 for 10 years. Their total investment is 4 x $25,000 x 10 = $1 million.

- Austin is named as the contingent owner on the policies for himself, his wife and his children.

- The named beneficiaries on the policies are:

a. For Austin’s policy, his children, Oliver and Angela.

b. For Kate’s policy, her husband Austin.

c. For both Oliver and Angela’s policies, their father Austin.

The Cascading Strategy: A Tax-Efficient Transfer of Generational Wealth

Benefits of the Cascading Strategy:

For Max and Diane:

- Unlike their non-registered investments, funds invested in the policies grow on a tax-sheltered basis, giving them the opportunity to pass a larger amount of wealth to their heirs/beneficiaries while protecting it from income tax and probate fees.

- Provided Austin, Kate, Oliver and Angela are in good health, the policy premiums will be lower than if Max and Diane insured their own lives.

- They retain control and access to the funds until their death or until such time they transfer ownership of the policies to Austin. Transfer of policy ownership is not a taxable event.1

1 For an ownership rollover to be tax-free, the owner must name one child as the contingent owner of the policy. If no contingent owner is named, ownership will transfer to the policyholder’s estate and a taxable disposition will occur.

For Austin and Kate:

- Life insurance is in place, and they are protected in the future if for some reason their insurability is compromised.

- Once ownership of the policies is transferred to Austin on a tax-free basis, he can access or borrow against the cash value of the policy for lifestyle, health care or other expenses.

For Oliver and Angela:

- In the event of Austin’s death, each grandchild will receive a substantial tax-free death benefit, helping to protect the intended value of Max and Diane’s original gift. Note: additional planning should be contemplated in the event they are minors upon payment of the death benefit.

Conclusion

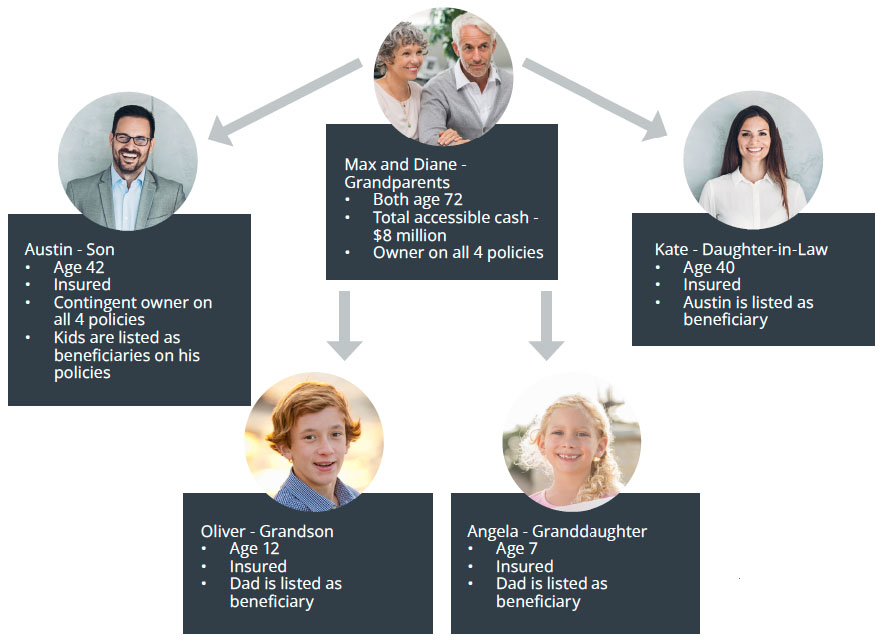

Provided all deposits are made and that each family member lives to their life expectancy, Max and Diane’s initial $1 million investment has the capacity to grow on a tax-sheltered basis to more than $15 million in death benefits, with cash surrender values reaching 7 figures for their grandchildren, as shown in the table below:

*Figures provided by BMO Insurance

Utilizing the cascading wealth strategy using permanent insurance, is one way to transfer wealth efficiently across generations. For more information on this and other insurance matters, please speak to your Wellington-Altus insurance advisor.