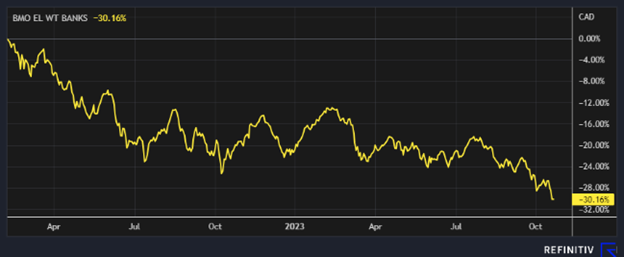

For anyone who may not have been paying attention, it may come as a shock to hear that Canadian bank stocks are collectively down more than -30%, as of writing, since their highs in February 2022 (using the BMO Equal Weight Banks ETF (ZEB) as a measure).

Given the size and importance of our banking sector on the Canadian economy and stock market, it makes ample sense that the sector’s negative performance has been a major contributor to the S&P/TSX Composite Index, our main Canadian stock market, enduring a second consecutive year of losses year-to-date.

One only has to read or watch the news to hear of daily announcements of the relentless increase in amortization periods and proportion of negative amortization mortgages at the Canadian banks (explainer on negative amortization mortgages) or the brutal payment increases faced by mortgage holders renewing (great example found on X of what a $1m Toronto homebuyer might face) to appreciate the economic storm that is approaching on our domestic horizon.

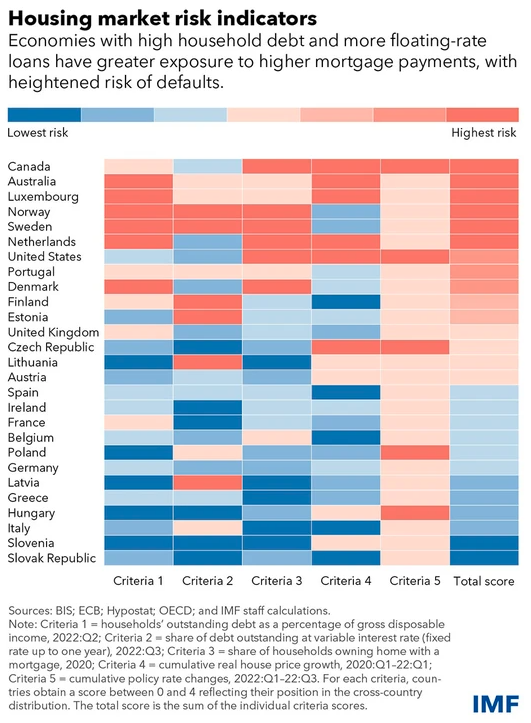

Given many of the factors that our Chief Market Strategist, Dr. Jim Thorne, highlighted in his October Market Insight, we have trouble envisioning a 2024 macroeconomic landscape in Canada that results in anything other than a sharp domestic recession, punctuated by loan defaults and material pullbacks in consumer and corporate spending. Never mind what these catalysts might have in store for our national housing market (local market fundamentals notwithstanding), if the following IMF Housing Market Risk Indicators chart is to be believed, which rates our economy as having the highest risk of defaults amongst OECD major economies.

This is the core reason why we have largely avoided any direct Canadian equity allocation across the models over the past year and a half, looking to the U.S.’ relative advantages in terms of longer mortgage terms held by homeowners (30-year terms are very common), overall private and corporate balance sheets that are less leveraged, and equity markets that are more sector diversified and exposed to growth sectors such as a technology, amongst others. All in all, it appears, thus far, that the American economy is far more interest rate immune than ours, thus offering better odds of a “soft” economic landing (milder or no recession after a period of interest rate hikes) and, consequently, more likely to see positive equity market returns.

The dramatic underperformance of Canadian bank stocks has likely been quite painful to most Canadian investors given their ubiquitousness in portfolios held domestically. Though we have largely avoided any direct exposure to the Canadian banks for the past couple years, we do not think there is any risk to their businesses as ongoing concerns, but that does not imply that their stock prices cannot get further wrecked as loan loss provisions are steadily ratcheted up in response to deteriorating credit quality and the drying up of loan demand in their respective franchises.

That said, the storm will eventually pass, and given their oligopolistic control of the domestic banking market, robust dividend growth and yields, and immense institutional presence in our economy, we are salivating at the opportunity within the next, say, 12 months to add Canadian bank stocks to our model portfolios aggressively … just not yet.

Sincerely,

Omar

Omar Duric, FMA, DMS, BBA, CIM®

Senior Investment Advisor, Senior Portfolio Manager

Shipton Duric & Associates

Wellington-Altus Private Wealth Inc.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPW assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

© 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. http://www.wellington-altus.ca” www.wellington-altus.ca