Since March 2009, in the depths of the financial crisis to February 2020, the US enjoyed an unprecedented bull market. Everything went up in an almost straight line. There were hiccups to be sure – Trump’s shut down, some concerns over Brexit – but despite those relatively short periods of time, volatility felt like a bad childhood dream. A dream that might come back from time to time but was easily forgotten.

Until the dream returns – as a nightmare – with a vengeance.

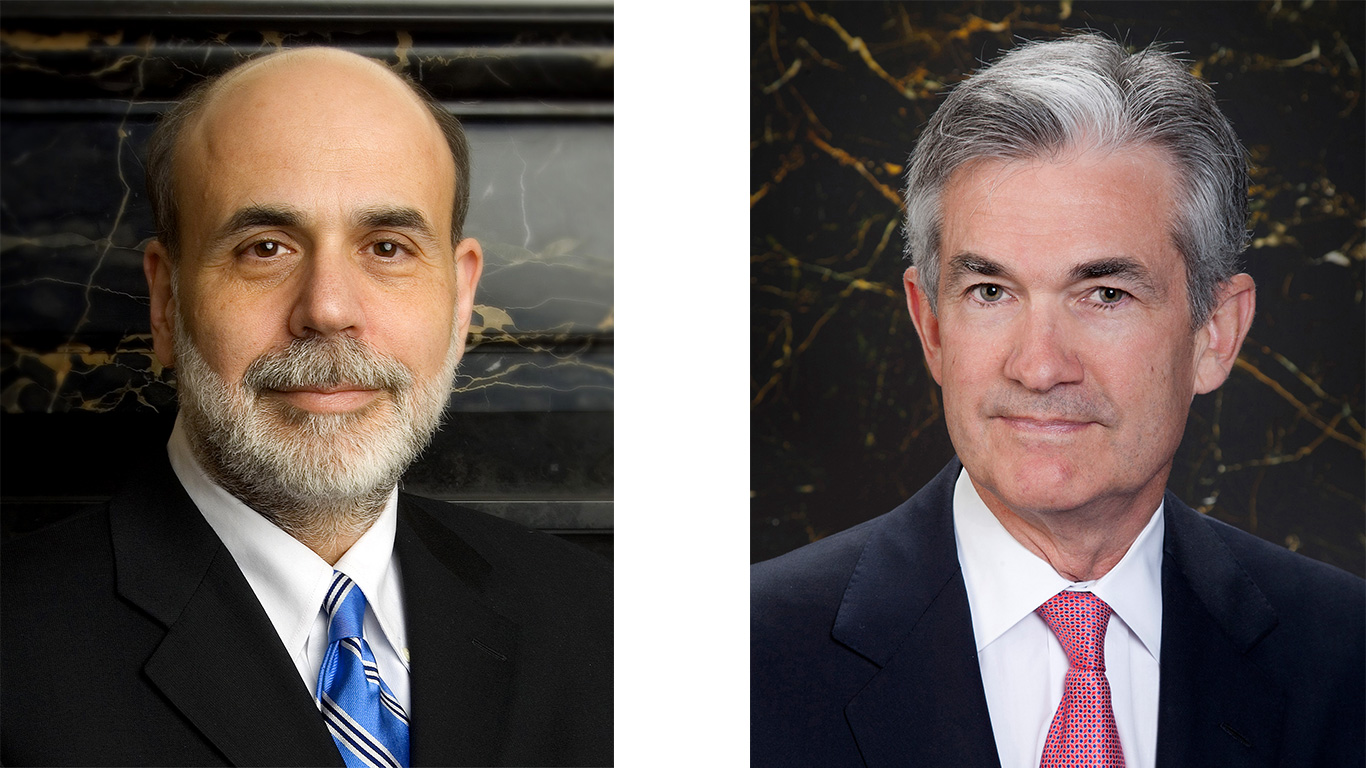

I would like to share my experiences with you, to tell you why this incredibly difficult time isn’t concerning me like it is many investors today. I have seen this movie before. I had a front seat ticket to the last two major selloffs being the Tech Wreck and the Financial Crisis. The Tech Wreck scared me because I hadn’t seen a major meltdown before. The Financial Crisis terrified me however, because life as we knew it almost came to an end. We were on the brink of destruction and the response of the Fed, in particular Chairman Ben Bernanke, changed the way that I viewed investing permanently.

On Sunday March 15th, 2009 I watched the following 60 minutes episode from my home. Little did I know that this one episode would change the way I looked at investing, and the way I would advise others to invest, forever. I have copied the interview here for you to watch, I encourage you to watch it as well.

At 8:05 Chairman Bernanke says: “So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed…. It’s much more akin to printing money than it is to borrowing.”

The host asks: “You’ve been printing money?”

Chairman Bernanke replies: “Well, effectively…[yes]”

When I heard the Chairman of the Federal Reserve state that they were using the computer to print money, I never looked back. The Fed was backstopping the market and made a precedent that I never forgot. Since that day, I felt that if there were ever a true crisis, an act of God that we couldn’t foresee, that the government of the United States wouldn’t stand aside, but intervene, in ever bigger ways.

Now this has played out many times over the years. In the industry we called it the “Bernanke Put”. This meant that anytime there was a problem with the markets, the Federal Reserve would come and save it… and time and again it has.

And then we got COVID-19. I don’t need to describe what this has been like for investment markets because we’re living it, but we have had a rally of unprecedented size over the last few days. Between Tuesday and the time of writing, 1:30 pm on Thursday, we have seen the markets rally 20%. We are now in a bull market if you measure that by a 20% rise or more… If you have been reading my blog posts, or talking to me on the phone or on social media, I have been saying for a while now that the market is giving us an opportunity to invest like we haven’t seen in ages, because the “Bernanke Put” has transformed into the “Powell Put”.

This morning there was an interview on the Today show. If you have the time, and have watched the 60 minutes interview linked above, I now encourage you to watch this one with Federal Reserve Chairman Jerome Powell.

The parallels in this interview to the one from 10 years ago, almost to the day, are incredible. The one soundbite that I would quote here comes at the very beginning of the interview, where the host asks: “…’you have the ability to conjure money out of thin air.’… Is there any limit to the amount of money the Fed is willing to put in this economy to keep it afloat…” and Chairman’s Powell’s response is: “…no…”.

Now, this is not surprising to me. Read my past posts about how this is an incredible buying opportunity and know the reason why I have been as optimistic as can be about why it’s important to own assets through these periods of distress.

When things get tough and the risk of the economy collapsing is real, the Federal Reserve of the United States has a history of not standing still. They would rather ‘conjure money out of thin air’ than let companies fail and the economy collapse.

This is why it is so important to own good, high quality assets over the long run – be they stocks or bonds, real estate or art – at the end of the day, when trouble comes the Fed has responded by printing money, and just as more water added to a pool makes water levels rise, so too will more money being added to the pool make prices rise. Be they stocks or bonds, real estate or art – and over time, the prices of food, clothing, health care and shelter will be sure to rise as well. If you own high quality assets, there is no surer way to protect yourself against those risks that are scarier to me than what we are currently going through.

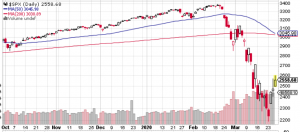

I leave you with the tale of two charts. The first is of the S&P 500 during the Financial Crisis and Ben Bernanke’s interview. The second is the S&P 500 and the Coronavirus meltdown. I don’t know what the second chart will look like tomorrow, and there is so much more pain and suffering to come with the Coronavirus, but I can say that I have faith that we will overcome, and that though we will likely see more volatility, the light at the end of the tunnel is shining ever more brightly.

S&P 500 2008 – 2010

S&P 500 2019 – 2020