I like to consider myself ‘well read’…. Though I must admit that I am becoming ‘well watched’ as I seem to spend more and more time watching Netflix rather than sitting quietly with a good book. So I guess it’s no surprise that I first came across the word hubris while watching an episode of HBO’s ‘Rome’ – a drama from 2005 so shocking at times that its disappointingly short 2 season run unnerves me still, even after having lived through 8 seasons of HBO’s other shock and awe drama: ‘Game of Thrones’. In the clip I have added here we see Mark Antony conversing with Julius Caesar and his educated slave Posca. Caesar is going to invade Egypt with only half a legion of men. Egypt’s 100,000 men makes Antony accuse Caesar of hubris, to which Caesar replies: ‘it’s only hubris if I fail’. This made me reach for a dictionary (remember this is 2005) to find out what this word ‘hubris’ meant.

Hubris (/ˈhjuːbrɪs/, from ancient Greek ὕβρις) describes a personality quality of extreme or foolish pride or dangerous overconfidence, often in combination with (or synonymous with) arrogance. In its ancient Greek context, it typically describes behavior that defies the norms or challenges the gods which, in turn, brings about the downfall or nemesis of the perpetrator of hubris.

Hubris immediately became one of my favorite words, the investment industry is rampant with it. When helping people and institutions to allocate capital we are often positioning those people and entities for success and/or failure. I am a big fan of market watchers and investment professionals who are able to stay humble even amidst their genius.

However, I believe that we are now seeing the opposite of hubris take hold of the investment community. If hubris is dangerous overconfidence, we need a word for dangerous pessimism. We see this each day, with people making alarmist statements and thinking that their nightmares are about to come true. My late stepfather told me something once that has always stuck with me. People have been walking around with signs on their shoulders that say: “The end of the world is near” since signs were able to be made. When times are good, they are easy to ignore, but when pessimism becomes widespread and people get caught up in it, they have the tendency to make rash decisions. Taking action makes us feel better than inaction when faced with danger that is either out of our control or that we don’t understand.

I would like to share a few articles that I think are important to read. These don’t get the attention that they should while too many of us are focused on the apocalypse du-jour. The best and most thorough is first, written by Catherine Wood of ARK Invest. If you have the time to get through it, I highly recommend it. The others are soundbites that will hopefully give you a quick dose of optimism… which is exactly what doctors should be ordering.

The Coronavirus: Innovation Gains Traction During Tumultuous Times https://ark-invest.com/research/coronavirus

- What have global responses meant to equity markets in past crisis?

- What sort of economic recovery might we expect?

- How will this crisis affect innovation and the stocks associated with innovation?

Bill Miller calls this market one of the best buying opportunities of his lifetime https://www.cnbc.com/2020/03/18/investor-bill-miller-one-of-the-best-buying-opportunities-of-his-life.html

The Dow Is Rallying as Warren Buffett Buys the Stock Market Dip https://www.ccn.com/the-dow-is-rallying-as-warren-buffett-buys-the-stock-market-dip/

- Warren Buffett and Carl Icahn are buying the dip. It takes time to know exactly what these billionaires are doing but early regulatory filings are showing they are buying as other investors stampede for the exits.

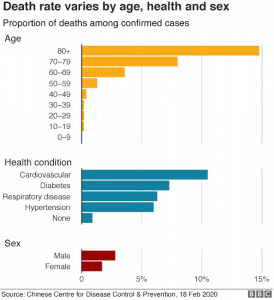

Coronavirus death rate: What are the chances of dying? https://www.bbc.com/news/health-51674743

- This should be reported as: What are the chances of living…. Spoiler alert: 99.1% (though BBC is focusing on the chances of dying, not the chances of living. Bad news makes good copy doesn’t it?)