Navigating a Complex Economic Moment

There are real challenges in today’s economic environment—tariffs, retaliatory measures, and signs of a global slowdown. But it’s important to stay grounded: this is not the 1930s, and it’s not 2008.

The Great Depression was driven by catastrophic monetary deflation and a failed policy response. In contrast, today’s environment is marked by active central banks, ongoing liquidity support, and no signs of systemic financial collapse. Similarly, this is not 2008, when a fragile, overleveraged banking system crumbled under the weight of unchecked risk. While there is pressure in credit markets today, the financial system is far stronger and more resilient than it was pre-Great Financial Crisis.

That said, the road ahead may still be uneven. Policymakers face uncertainty—both from within the White House and from the U.S. Federal Reserve—as they navigate a delicate balance between supporting growth and managing inflation expectations. But the world is better prepared to respond than it was in past crises. China, for example, is already easing policy and stepping up stimulus efforts. And around the globe, governments appear increasingly willing to act.

Recent data confirms that the global economy is slowing. Specifically, the world began to slow down before the latest escalation in trade tensions. The world has already slipped into a mild recession, and U.S. bond markets are responding.

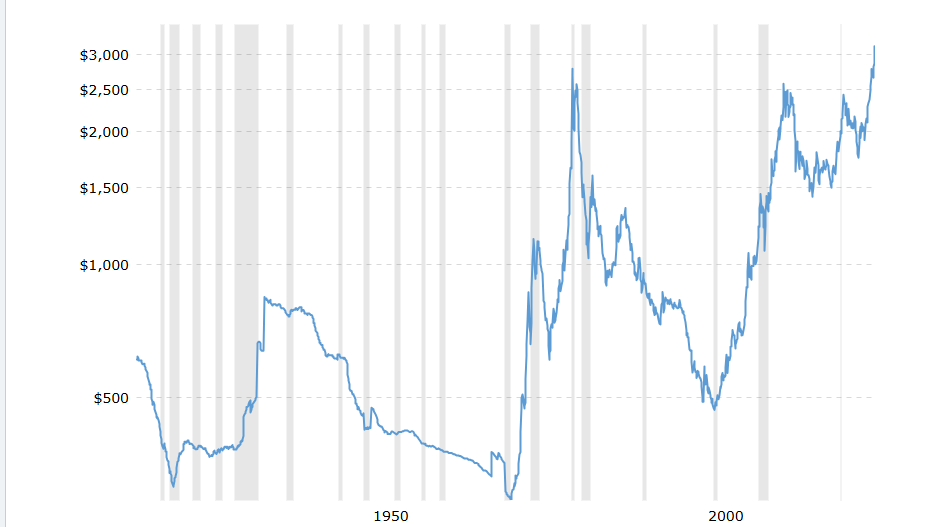

Before turning to bonds, it’s worth noting what the gold market is telling us. Gold’s recent strength isn’t a sign of deflation or panic. Instead, it reflects long-term expectations for monetary inflation. Investors appear to be preparing for an environment where central banks stay accommodative and paper currencies gradually lose purchasing power. That’s not a 1930s-style contraction—it’s a different kind of challenge.

Chart: Gold Prices Surge, Adjusted for Inflation

Chart: Gold Prices Surge, Adjusted for Inflation

What the Bond Market is Telling Us

We are seeing the benchmark 10-year U.S. Treasury yield continue to trend lower. A key reason is that bond market participants are betting that lower rates will come faster and deeper than previously expected. Investors now foresee larger rate cuts from the U.S. Federal Reserve that appears focused on supporting employment and treating recent inflationary pressures as largely transitory.

Put another way, bond market participants are investing as if rate cuts are on the way, and that is a positive for equity markets.

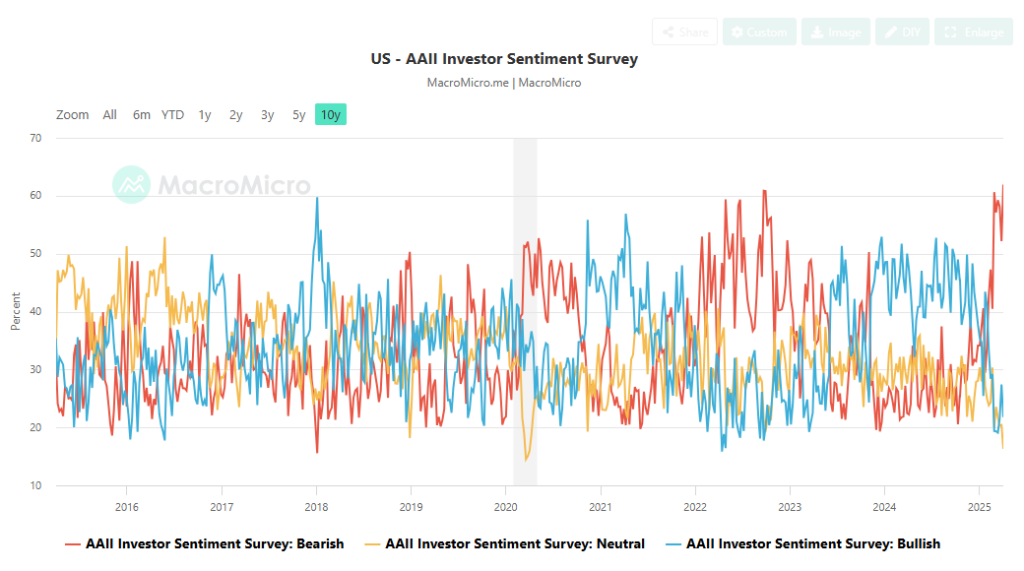

Investor Sentiment: Defensive but Stabilizing

Investor sentiment is reflecting extreme fear. While there is cause for concern, the media—as usual—is amplifying that fear beyond what the moment demands. If it feels like up is down and left is right, it’s worth remembering what we can still count on. One of those things is this: watching too much news will almost always leave you more anxious than informed.

“If it bleeds, it leads,” as they say, and the louder the headlines, the easier it becomes to tune out your own instincts. But this is exactly when we should be listening to them. As Warren Buffett has reminded us time and time again: “Be greedy when others are fearful.”

Historical data supports that view. Our models show that current positioning among U.S. investors is among the most defensive we’ve seen since 1978. Moves this extreme don’t typically reverse overnight, but they do tend to stabilize and, over time, present opportunities.

Relative to global peers, U.S. investors appear especially cautious. That sentiment can be painful in the short run, but it may be creating the conditions for long-term entry points. At the very least, it’s a moment to stay alert, stay disciplined, and avoid being swept up in the noise.

Chart: Investor Sentiment Survey

Chart: Investor Sentiment Survey

Positioning for What Comes Next

For now, this remains a trader’s market—choppy and tactical. This is where I would expect active managers to outperform passive ETFs. If ever there is a time to be invested with a high-quality portfolio manager, it is at this time.

We expect a bounce in equities and see potential in mid-duration government bonds, both for income and modest capital gains. Strategically, we continue to favour gold as a longer-term store of value in a world of growing policy uncertainty. We’re not fully committed yet, but we are watching closely.

Opportunities will emerge for those who stay patient and disciplined.