Simon Harry Culture Video

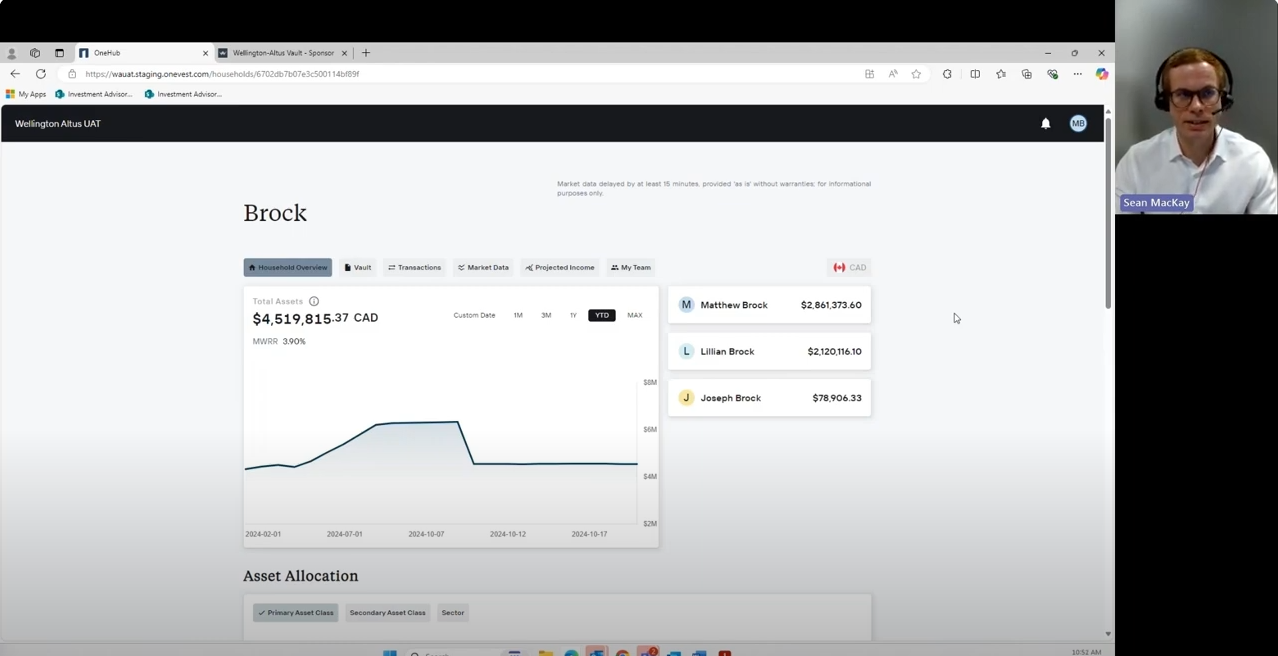

Wellington-Altus has allowed me to build relationships with clients in a way that is completely unanticipated. The financial planning support, which is incredible, and the support that I’ve gotten here to help get to know my clients more deeply and monitor what they have and make sure that we are on plan and on track.